-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD/JPY Clears Y150 As Relative Yield Dynamics Underpin Bullish Environment

The yen weakened past Y150 against the greenback for the first time since August 1990, moving along the path of least resistance determined by familiar fundamental forces. Intervention chatter was rife as another key psychological threshold gave way.

- Hawkish Fedspeak continued to do the rounds and the terminal fed funds rate pricing toped 5% for the first time this cycle. This exerted upward pressure on U.S. yields, driving a bigger wedge with Japan. The spread on 2-year yields widened by 4.4bp, while 10-year gap expanded 9.7bp, with both touching multi-year wides. Meanwhile, the BoJ defended its YCC target via unscheduled bond-purchase operations.

- Japan's top FX diplomat ramped up his rhetoric, noting that excessive moves in currency markets are becoming even more intolerable, while resources for intervention are limitless. Still, officials stopped short of clarifying whether they stepped in, albeit they had earlier signalled that stealth interventions are on the table.

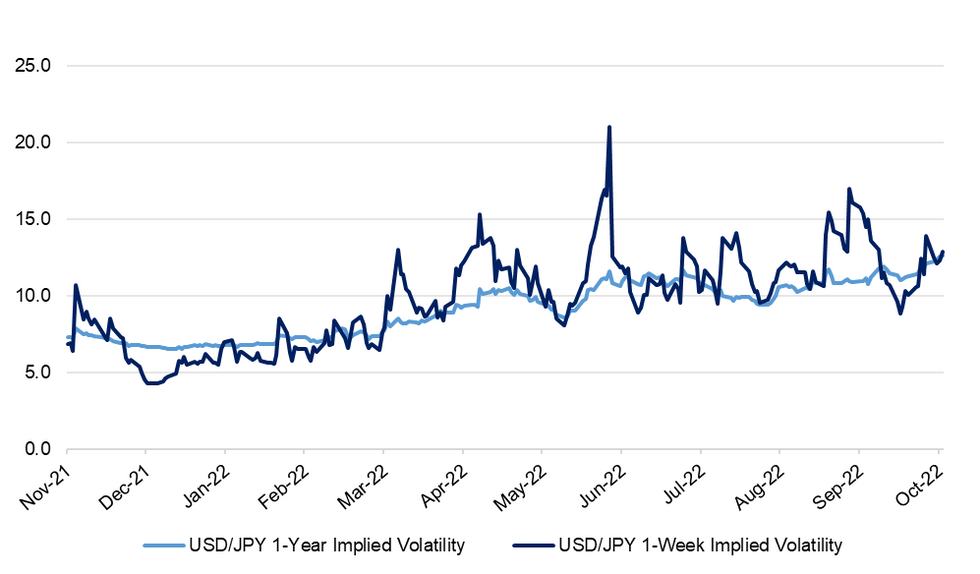

- Implied volatilities were trending higher, with 1-year tenor lodging new cyclical highs.

- Spot USD/JPY last sits at Y150.12, barely changed on the day. The next topside target is the 3.618 proj of the Aug 2 - 8 - 11 price swing at Y150.45. Bears look for a pullback towards Oct 5 low of Y143.53.

- Japan's inflation data will cross the wires today, with the confluence of reliance on imported goods and rapid currency depreciation expected to fuel price growth. Core CPI may have accelerated to +3.0% Y/Y, according to a Bloomberg survey.

Fig. 1: USD/JPY 1-Week/1-Year Implied Volatility

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.