-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD/JPY Clings Onto Post-U.S. CPI Losses Despite Recovery In U.S. Tsy Yields

Spot USD/JPY plunged Wednesday as U.S. CPI inflation slowed more than forecast, prompting participants to dial back Fed rate-hike bets.

- U.S. Tsy yields tumbled in reaction to the inflation report but gradually trimmed losses as the day progressed, with Fed's Kashkari & Evans noting that they still expect rate hikes to continue into next year.

- USD/JPY remained at depressed levels, with the area near Y133.00 capping recovery attempts, despite aforesaid recovery in U.S. Tsy yields. By contrast, as the spot rate retreated, risk reversals pulled back from multi-week highs, with 1-year skews returning below par after a brief foray above zero.

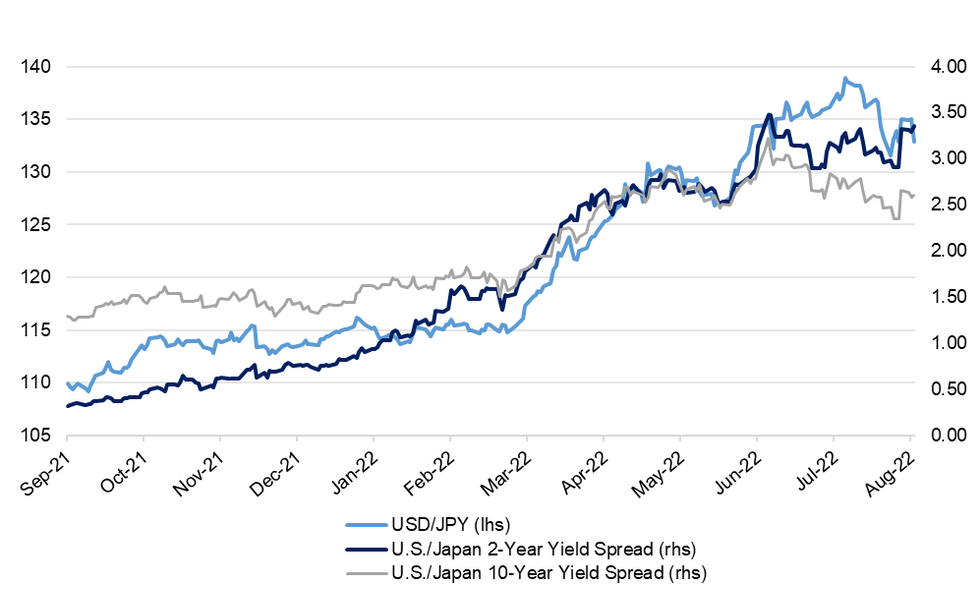

- Note that U.S./Japan yield gaps have served as a key driver of USD/JPY price action this year, with participants monitoring growing policy divergence between the tightening Fed and the ultra-dovish BoJ.

- We would suggest that 2-Year and 10-Year yields are of particular interest from the perspective of relative monetary policy outlook. While 2-Year Tsys are more sensitive to Fed policy, 10-Year JGBs are targeted by the BoJ's YCC framework and thus come under the spotlight amidst any talk of prospective policy normalisation in Japan.

- USD/JPY has shown strong correlations with the moves in U.S./Japan 2-Year and 10-Year yield gaps over the past six months. That said, the past two months have seen those relationships break a tad as both 2-Year & 10-Year yield spreads failed to print higher highs as USD/JPY climbed to a new cyclical peak (Fig. 1).

- Strong performance from European & U.S. equity markets (also on the back of the U.S. inflation print) failed to sap strength from the safe-haven yen Wednesday, even as the VIX index slipped below 20 for the first time since April.

- Wednesday also brought the expected reshuffle of Prime Minister Kishida's Cabinet but all the details were leaked by local media outlets beforehand.

- As a reminder, Japanese financial markets are closed in observance of a public holiday. Domestic news flow remains centred around the administration rejig but has not provided any notable fresh insights on that matter.

- Spot USD/JPY last deals at Y132.79, a touch lower on the day. A dip through the 100-DMA, which kicks in at Y131.24, would shift technical focus to Aug 2 low/round figure support at Y130.41/00. Bulls look for a rebound above Y135.96, which represents the 61.8% retracement of the Jul 14 - Aug 2 downleg.

Fig. 1: USD/JPY vs. U.S./Japan 2-Year Yield Spread vs. U.S./Japan 10-Year Yield Spread

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.