-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

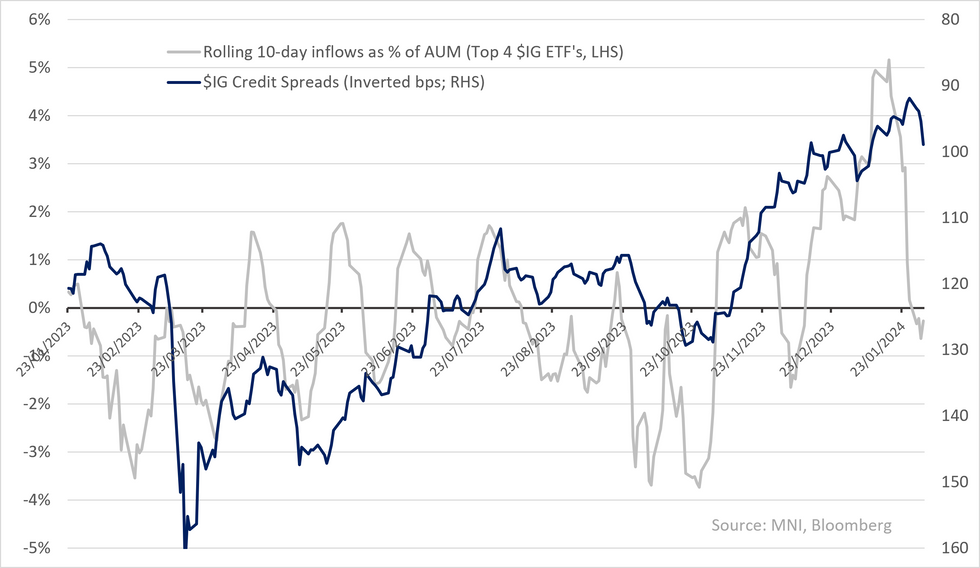

Free AccessWeekly Fund Flows

Flows to Wednesday showed easing in corporate bond demand as ETF data had indicated from late last week. $IG reversed to outflows while €IG inflows continued at a more muted paces. Perhaps more interesting was strong pick up in $HY inflows that was matched by €HY inflows (as % of AUM). We mentioned yesterday focus on ICR’s and in the US we’ve seen a rates rally that has been inflation/wages focused (& not activity driven) - this may (for now) be giving clear support for HY fundamentals.

More timely ETF data since points to continuing inflows into $HY & yesterday’s cash sell-off seems to have been more muted there ($IG +3.5bps vs. $HY -3.3bps). Adding onto that sentiment, despite YTD decompression across $ & €, $B’s are the best performing rating class YTD & in € its BB’s. In both cases its issues further down that’s caused headline decompression. Bloomberg's survey of investor sentiment on €HY was for continuing total returns on carry but underweight on spreads - investor focus on rates (vs. earnings).

$IG inflows in ETF's since look weaker (below). We see strong outflows in €IG (IEAC) - but local ETF space is smaller driver of flows. Feb supply expectations for $IG are $150b which would mark the busiest Feb over the last decade - Jan saw ~$190b in supply & €150b locally. Primary has been quiet this week/not testing spreads yet.

We’ve mentioned support for £ on rising yields earlier this month & finally saw spreads outperform over the last week – we also now have reports of a pickup in £IG inflows over the week. Spreads yesterday were +1.3, again outperforming $/ € moves. Yesterday’s post-BOE moves higher in rates were pared quickly yet we’re continuing to see £ rates underperform helping maintain credit yield differentials – 20bp pick up vs. $IG.

Outside of credit, $ Govvies faced outflows while Euro govvie inflows were flat. Equity inflows in both US & China continued at strong pace, noting any NYCB impact is likely to show in next week’s reports.

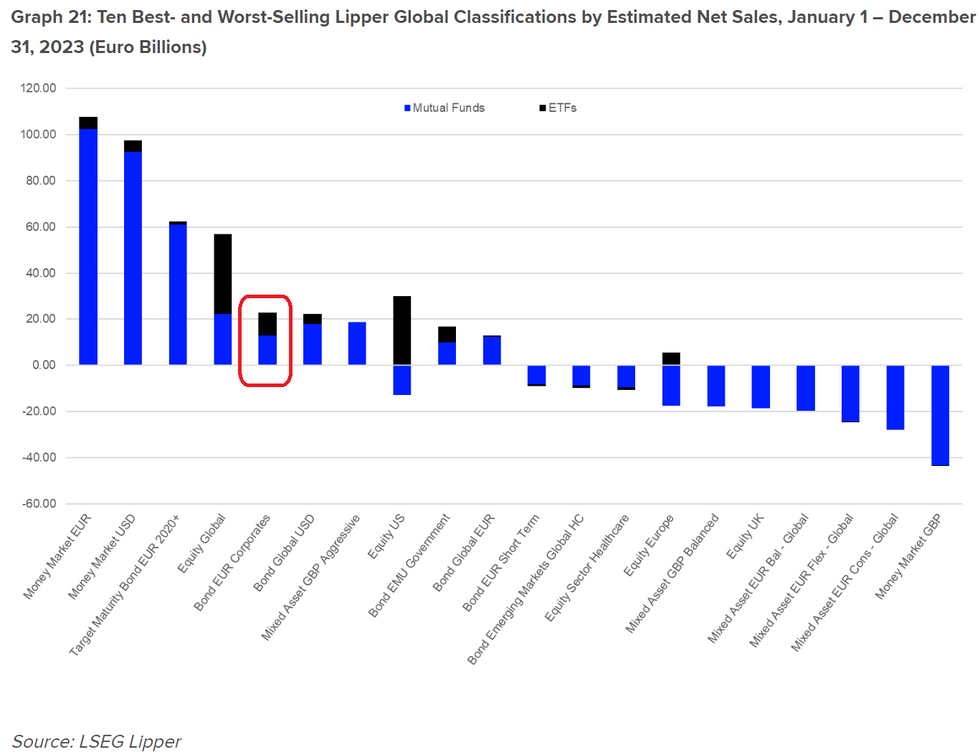

Refinitiv also reported on trends over 2023 in Europe - ETF’s saw +€155b inflows vs. mutual funds outflows of -€33b – ETF’s still only make up 11% of AUM, Index tracking mutual funds another 11% & Active mutual funds 78%. That mix is echoed in Euro corporate bonds where AUM still heavily skewed to mutual funds – though inflows in '23 year were ~balanced across both. As expected, money market netted top inflows (+€173b) closely followed by bond funds (+€158b) - driven by govvies. Money market inflows were skewed to € & $ funds with strong outflows from £ funds – attributed to post-LDI crisis normalisation in risk appetite

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.