-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Will The Sanctions on Russia Accelerate The ‘Great Rotation’?

- One interesting topic that has been making the headlines in the past decades has been the ‘De-dollarization’ and the ‘Great Rotation’ from USD to non-USD FX reserves, particularly for China.

- China, which has historically been one of the top holders of US Treasuries (with Japan), has been gradually losing its interest in US ‘safe-haven’ securities in recent years.

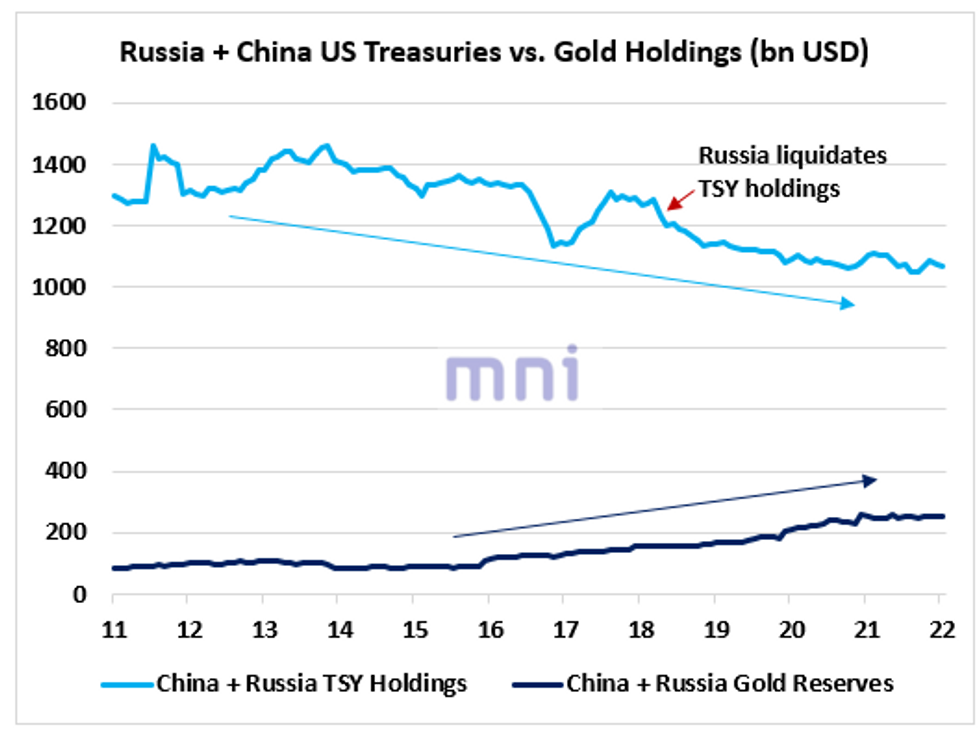

- The chart below shows that the combined holdings of US Treasuries from China and Russia have declined from a 1,46tr USD in November 2013 to 1.06tr USD in January 2022 according to the TIC data.

- As a reminder, Russia liquidated nearly all of its TSY holdings between March and May 2018.

- Investors have been questioning if the recent sanctions imposed to Russia will accelerate the loss of China’s interest in US Treasuries.

- Russia’s accessibility to its FX reserves more than halved following the freeze of assets from Western economies as a response to the Ukraine invasion, erasing its last eight years’ effort of nearly doubling its reserves from 368bn USD to 630bn USD.

- Therefore, interests for gold could continue to surge in the medium term; the chart shows that Russia and China’s total gold holdings have increased by 170bn USD to 250bn USD in the past 6 years.

- Some analysts have argued that China’s reported measure of gold holdings (120bn USD, slightly below 2,000 tones) has been very questionable given that China has been the world’s biggest producer of gold since 2007, contributing to 12% of the annual production (380 tones).

- As gold export from the Chinese domestic market is prohibited by the PBoC, it is very likely that Chinese gold reserves are significantly higher than currently reported, implying that the Russia/China gold holdings dark blue line would also be much higher.

Source: Bloomberg/MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.