-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

Key Inter-Meeting Fed Speak – Dec 2024

US TREASURY AUCTION CALENDAR: Avg 3Y Sale

Consumer & Transport: Week in Review

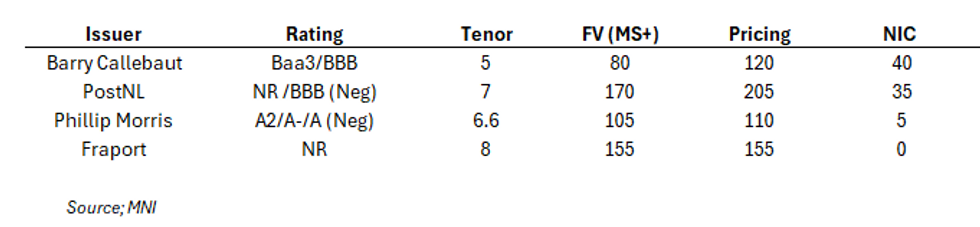

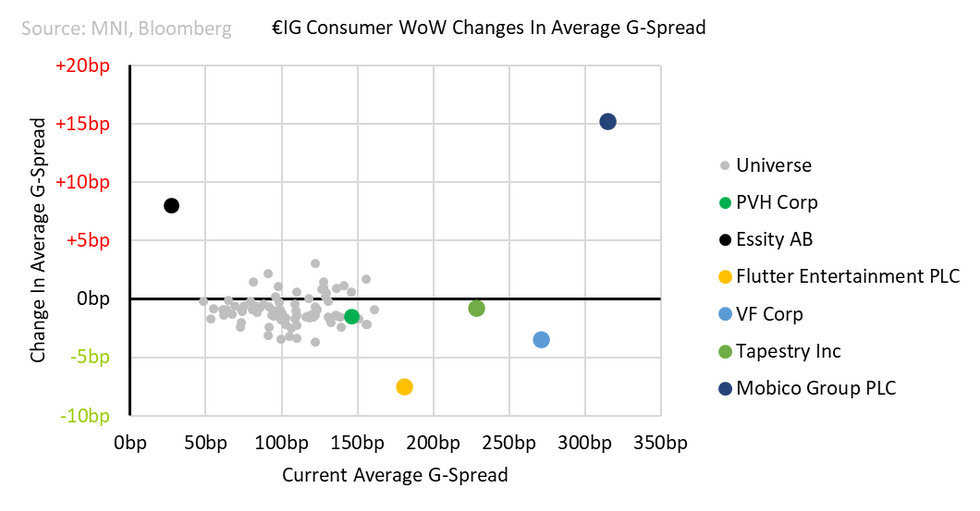

After Pandora's 15bp NIC & and Coty's 20 two weeks ago we added "a repeat of this week looks unlikely ahead of a seasonal summer lull particularly in July/August." We spoke to soon; PostNL handing out 35 and Barry Callebaut 40. They came while secondaries held firm - in PostNL's case we were eyeing IDSLN28s mids & for Barry a switch from anything broadly consumer related looked attractive yet nothing moved. If the new issues don't trade the NICs away, it leaves some tough questions to be answered on secondary levels; like why one would be parked in combustibles heavy Altria or Imperial over the largest cocoa processor for 5bps more carry.

"A high-grade airport not pricing through its curve" was another fascination we had two weeks ago with Avinor. Fraport has reminded us to not get too excited about airports with its unrated issuance and moves in secondary. As Ryanair's CEO O'Leary said last month when justifying his €3-4b net cash target, another downturn is only a matter of time. When/if that does happen the new Fraport 32s would be high up on our list of potential shorts.

In macro, Eurozone retail sales continued the April weakness we have already saw in US/UK prints, falling -0.5% MoM which left it flat yoy. We got early read-through on May card data (see below) which pointed to paring of April weakness including in Apparel. Other key notes from the week linked below.

- The Post-mortem on PostNL

- PVH29s cheap view back

- Tesco short-end coming out as expected but it's taking our cheap views with it

- LCC's May Traffic

- Early May US card data, VF still depressed on second measure

- VF and Flutter's equity vol has little read-through for us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.