May 17, 2024 09:00 GMT

Final Data Confirms Broad Deceleration Seen In April Flash HICP

EUROZONE DATA

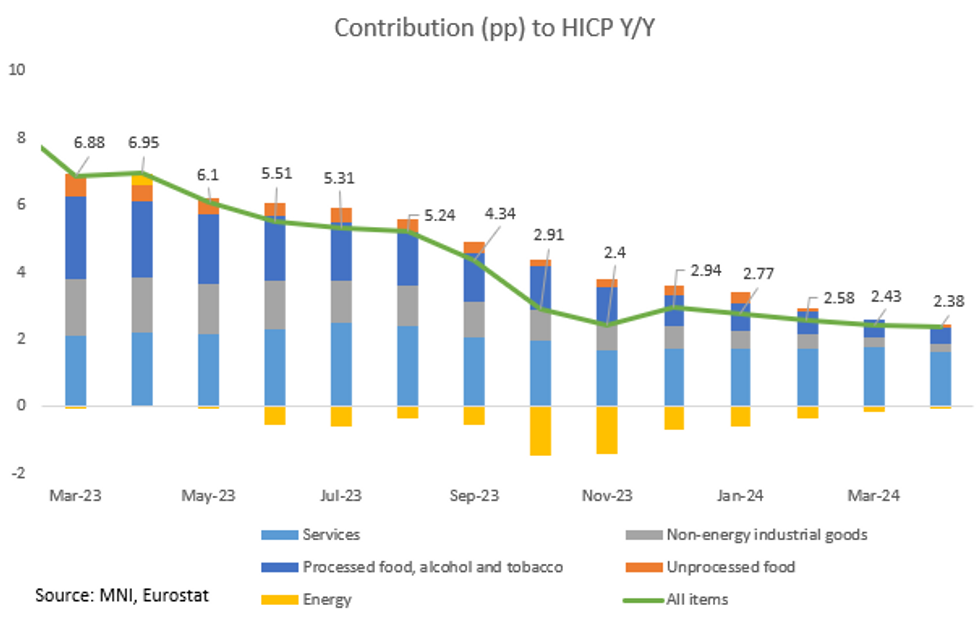

Eurozone Final HICP confirmed the April flash prints, at +2.4% Y/Y (vs +2.4% in March) and +0.6% M/M (vs +0.8% in March). Energy continued to see Y/Y deflation for the twelfth consecutive month, whilst Processed food, alcohol & tobacco, non-energy industrial goods (NEIG, or core goods) and Services disinflated Y/Y.

- Core inflation on an annual basis printed in line with with flash at +2.7% Y/Y (vs +2.9% in March), and on a monthly basis it slowed to +0.7% M/M from+1.1% in March.

- At a country level, Estonia saw a revision from flash HICP Y/Y down 0.2pp, Italy and Cyprus saw a -0.1pp revision, whilst Malta saw HICP revised up +0.1pp.

- The final readings show the contribution from services inflation fell to the lowest since August 2022, after stalling for the last few months, contributing +1.64pp, although it remains the largest contributor to HICP overall.

- Meanwhile, the contribution from Processed food, alcohol and tobacco fell for the thirteenth successive month to +0.49pp (vs +0.55pp prior) - the lowest since December 2021. Similarly, NEIG's contribution fell again for the fourteenth consecutive month to +0.23pp (vs +0.3pp prior).

- Energy's negative contribution continues to fade as base effects continue to drop out of the Y/Y comparison, resulting in a contribution of -0.04pp in April (vs -0.16pp in March).

- To note, Unprocessed foods contribution increased slightly to +0.06ppt from -0.02ppt in March maintaining similar levels to February 2024.

- Later today, the ECB releases calculations of key underlying inflation metrics based on the final data, which will form part of the Governing Council's decision-making process as it assesses price pressures going into the June meeting.

273 words