-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump's First Post Election Interview

MNI POLITICAL RISK ANALYSIS - Week Ahead 9-15 Dec

MNI NBP Review - May 2023: Wait-And-See

Executive Summary:

- The NBP left interest rates unchanged for the eighth consecutive time.

- The statement was almost a carbon copy of April communique.

- Governor Glapinski said that he hopes MPC could discuss rate cuts by end-2023.

Full review document including a summary of sell-side views here:

The National Bank of Poland left all monetary policy settings unchanged for the eighth consecutive meeting, in line with virtually universal expectations. There were no major deviations from previous communications in accompanying comments, as the statement was almost a carbon copy of the April edition, while Governor Adam Glapinski’s press conference revolved around familiar tropes. The central bank refused to formally end its rate-hike cycle but the Governor said that scope for rate cuts may open by the end of this year.

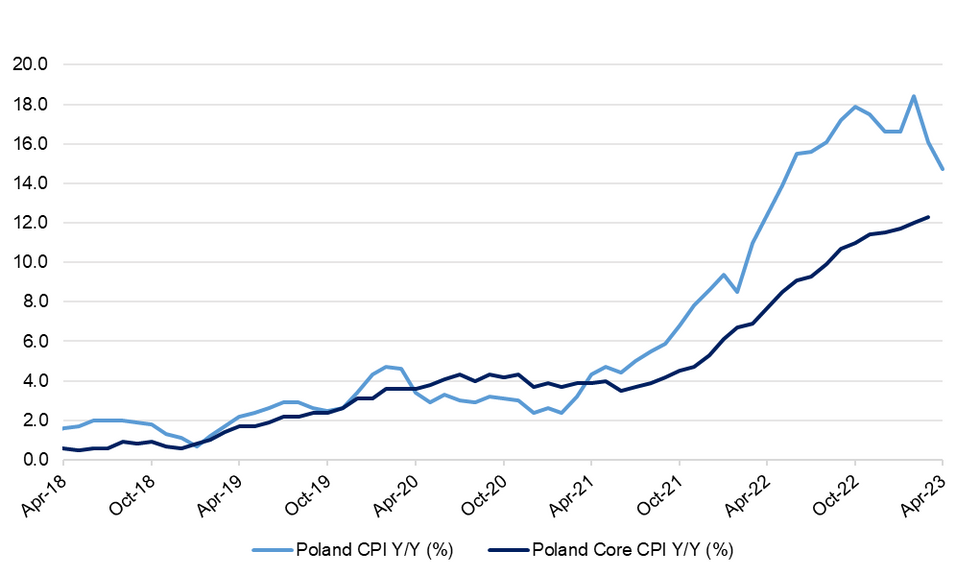

When it comes to the inflation outlook, Glapinski reiterated that headline inflation should reach single-digit levels later this year. He suggested that it could settle within the +7.0%-9.0% Y/Y range at the end of the year, adding that he hopes that it will be closer to the lower end of this range. His earlier “private forecast” for inflation of +6.0% Y/Y near the end of 2023 had to be revised after the statistics office reweighted its inflation basket, which will result in the recorded pace of price growth being slightly faster than earlier expected.

Fig. 1: Poland CPI vs. Core CPI Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

The Governor’s comments on the interest-rate outlook ultimately offered little in the way of fresh insights. The official emphasised that the MPC is not formally ending its rate-hike cycle and no such proposals were debated at the latest meeting. As a consequence, if it held any discussions on interest-rate action at the moment, it would rather be about tightening rather than loosening policy. What is more, any talk of interest-rate cuts would be “premature” at this stage.

Nonetheless, Glapinski refused to rule out rate cuts by the end of this year and said that he hopes that a discussion on loosening policy will become possible later in 2023. He took note of comments from several MPC members who flagged such a possibility and agreed that it is realistic if the central bank’s macroeconomic projection is realised and inflation continues to cool at a satisfactory pace. For now, the Council will make decisions on a meeting-by-meeting basis and stands ready to react to shocks in either direction.

Judging by the statement and press conference, we do not see any major shifts in the Governor’s stance. The NBP will likely stand pat at least until autumn, sticking with their “wait-and-see” approach. That being said, we see a risk of a token rate cut being delivered ahead of the parliamentary election due in October or November. In particular, continued PLN appreciation and headline inflation easing below +10% Y/Y (which has become something of a psychological barrier in Polish debate on the matter) would raise the risk of premature complacency.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.