-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Canada Commits To Just One Of Three Fiscal Anchors

MNI POLITICAL RISK - Thune Eyes 'Deficit-Negative' Legislation

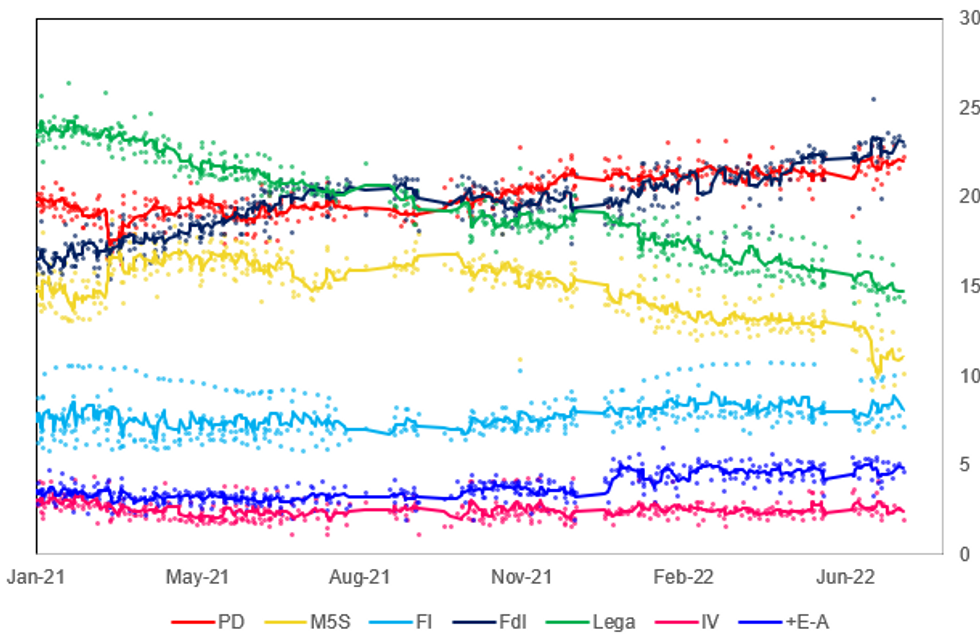

M5S Slump In Polls Continues As PM Draghi Shifts Closer To Exit Door

Opinion polling for the next Italian general election makes grim reading for the populist 5-Star Movement (M5S), which has seen its support collapse in the wake of a party splintering and the ongoing ructions that threaten to see PM Mario Draghi resign from office.

- M5S' average polling support stands at 10.8% in July, with this level declining steadily from an average of 14.4% in the first month of 2022.

- Following the boycott of a confidence vote in the Senate on 14 July by M5S, PM Draghi sought to offer his resignation to President Sergio Mattarella. While this was not accepted, sources close to Draghi have told MNI that he expects to resign from office next Wednesday, when he is due to address both houses of the Italian parliament. For full story follow this link: https://marketnews.com/homepage/mni-italy-pm-dragh...

- Opinion polling shows the three main rightist parties - the populist League (Lega), nationalist Brothers of Italy (FdI) and centre-right Forza Italia (FI) - commanding a combined support in the mid-40s in percentage terms, putting them in pole position to form the next gov't, should a snap general election be called.

- The next election must take place by 1 June 2023 at the latest. Observers have speculated that there may be some reluctance among some Deputies and Senators in particular to see a snap election, at least in the very short term. A number of pension and other financial benefits kick in for a large number of politicians from September onwards, potentially pushing the prospect of an election to the autumn.

Source: BiDiMedia, SWG, Tecne, Termometro Politico, Demopolis, EMG, Noto, Winpoll, Euromedia, Demos & Pi, Ipsos, Index, Piepoli, MNI

Source: BiDiMedia, SWG, Tecne, Termometro Politico, Demopolis, EMG, Noto, Winpoll, Euromedia, Demos & Pi, Ipsos, Index, Piepoli, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.