-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY248 Bln via OMO Tuesday

MNI Eurozone Inflation Insight – November 2024

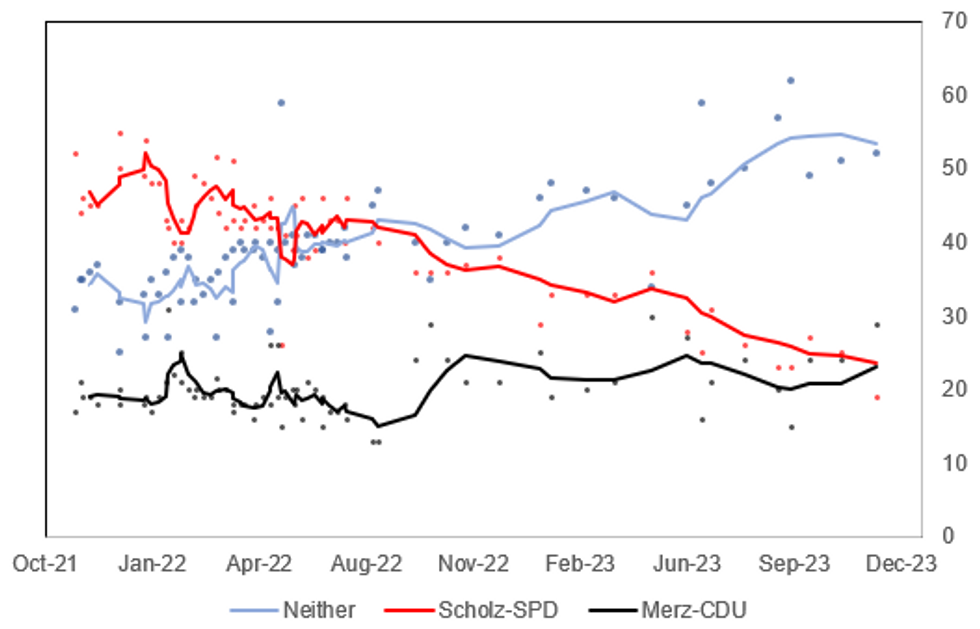

Merz Overtakes Scholz As Pref. Chancellor; Both Still Unpopular Choices

Chancellor Olaf Scholz is grappling with declining opinion polling ratings amid the continued inability of the federal gov't to reach an agreement on the 2024 budget. Opinion polling by Wahlkreisprognose in late Nov showed 19% of respondents preferred Scholz as chancellor compared to 29% for leader of the centre-right Christian Democratic Union (CDU) Freidrich Merz. This is the first time since preferred chancellor polling for this parliament began that Merz has outperformed Scholz, albeit with 52% of respondents claiming they preferred neither man.

- Scholz's declining support comes as the federal coalitionstruggles to come to a consensus on the 2024 budget. Reuters: "The failure of crunch talks between coalition leaders before Wednesday means it is unlikely parliament will approve a 2024 budget by the end of the year, leaving in limbo spending plans from climate projects to benefits and for local authorities.... coalition sources have told Reuters that little progress was made overnight and the parties were still far apart."

- Finance Minister Christian Lindner from the pro-business liberal wants to plug the EUR60bn hole in the federal budget (created by a Constitutional Court ruling regarding off-budget climate funds) with spending cuts. The environmentalist Greens want the debt brake suspended for another year, with a commitment to investment in climate projects and green transition, while Scholz's centre-left Social Democrats (SPD) will be loathe to agree with Lindner's plans to cut welfare payments.

Source: Wahlkreisprognose, Forsa, INSA, MNI

Source: Wahlkreisprognose, Forsa, INSA, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.