-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Deferring Re-Open Hopes

US TYS SUMMARY: Springtime Indoors

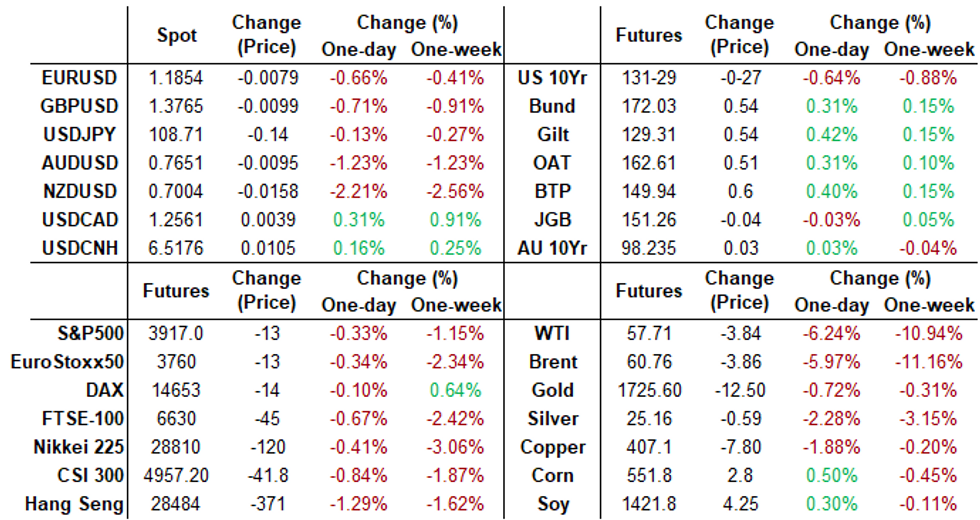

The overnight risk-off tone spurred on by pick-up in extended or renewed lockdowns in Europe continued through the US Session -- accelerating into the NY rates close:deferring re-opening hopes weighed on stock indexes (hotel, travel shares hit hard), ESM1 extending session lows, while Tsys neared late overnight highs into the close.

- US Data support for rates: new home sales fell: -18.2% TO 0.775M SAAR; U.S. current acct deficit widened by $7.6B, +4.2%, to -$188.5B in Q4, reflects expanded deficit on goods and reduced surplus on services. USD gained on European headlines: MERKEL IMPOSES EASTER LOCKDOWN, EXTENDS CURBS; NETHERLANDS EXTENDS LOCKDOWN UNTIL APRIL 20, RUTTE SAYS; ASTRAZENECA MAY HAVE GIVEN OUTDATED DETAILS ON COVID VACCINE, Bbg.

- Yield curves bull flattened, long end made continued to rally after the bell, short end anchored on 2Y issuance: US Tsy $60B 2Y Note (91282CBU4): draws 0.152% high yield (0.119% last month) in-line w/ 0.152% WI, bid/cover 2.54 vs. 2.44 previous.

- Heavy Fed funds sales -30k FFJ1, 99.935 to 99.93; -27k FFH1, 99.93.

- Tone change in Eurodollar options accelerating, more constant and varied upside call buying, liquidation/unwinds put positions.

- The 2-Yr yield is unchanged at 0.1472%, 5-Yr is down 3.7bps at 0.8254%, 10-Yr is down 5.6bps at 1.6382%, and 30-Yr is down 4.6bps at 2.3529%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settles:

- O/N +0.00025 at 0.07688% (+0.00000/wk)

- 1 Month +0.00125 to 0.10863% (+0.00025/wk)

- 3 Month +0.01013 to 0.20063% (+0.00375/wk) (Record Low of 0.17525% on 2/19/21)

- 6 Month +0.00125 to 0.20538% (+0.00300/wk)

- 1 Year +0.00313 to 0.27938% (+0.00313/wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $68B

- Daily Overnight Bank Funding Rate: 0.07%, volume: $241B

- Secured Overnight Financing Rate (SOFR): 0.01%, $869B

- Broad General Collateral Rate (BGCR): 0.01%, $358B

- Tri-Party General Collateral Rate (TGCR): 0.01%, $332B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.199B accepted vs. $1.665B submission

- Next scheduled purchases:

- Wed 3/24 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.825B

- Thu 3/25 1010-1030ET: Tsy 20Y-30Y, appr $1.750B

- Fri 3/26 No buy operation

US TSYS/OVERNIGHT REPO

Overnight repo remains at special across the curve. Still off last March lows, Bills bounce slightly, current levels:

T-Bills: 1M 0.0025%, 3M 0.0025%, 6M 0.0203%; Tsy General O/N Coll. 0.00% vs. -0.01% Friday.

| Duration | Current | Old Issue |

| 2Y | -0.03% | -0.01% |

| 3Y | -0.01% | -0.16% |

| 5Y | -0.39% | -0.09% |

| 7Y | -0.18% | -0.01% |

| 10Y | -0.23% | -0.11% |

| 30Y | -0.10% | -0.06% |

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options- Block, 16,400 Blue Jul 81/85 put spds, 12.5 vs. 98.465/0.28%

- Block, 10,000 Green Dec 95 puts, 58.5 vs. 98.94/0.90%

- Block, 12,224 Green Dec 92 puts, 39.5 vs. 98.94/0.74%

- Total 43,000 (blocked) short Dec 97/100 call spds 2.5 vs. 99.565/0.20%

- +12,000 short Dec 90/93 put spds, 4.5 vs. 99.555/0.18%

- +2,500 Green Jul 90/91/92/93 put condors, 3.75

- -3,000 Green Sep/Green Dec 90 straddle strips, 88.5 covered

- Block, -17,500 Blue May 98.62 puts, 15.5 vs. 98.62/0.51% at 0844:27ET

- Block, 23,750 Blue Dec 98.75/99.12 put spds, 29.0 vs. 98.32/0.16% at 0840:19ET

- Overnight trade

- Block, 10,000 Green Dec 98.88/99.50 2x1 put spds, 15.5 at 0814:23ET

- Block, total 10,000 short Dec 97/100 call spds 3.0 naked

- Block, 14,000 short Dec 97/98 call spds, 2.0 vs. 99.57/0.11%

- Block, total 19,000 short Jul 97/100 call spds 2.5 naked from 0619-0620ET

- Block: total 14,000 short Jul 97/100 call spds 2.5 vs. 99.685/0.28% from 0704-0706ET

- 11,000 TUM 110.37 calls, 4

- 11,000 TYM 135 calls, 7

- 10,000 TYJ 132 puts 10 over TYK 130 puts

- Block, 12,000 TYM 132 straddles, 202 at 0921:30ET

- 12,000 TYM 132 puts, 109

- 4,000 TYK 134 calls, 5

- 2,000 TYK 132 straddles, 131

- +6,500 TYM 134 calls, 16-14

- -1,000 FVK 123.5 puts, 15.5

- Overnight trade

- -6,000 TYJ 130.25/130.75/131.25/131.75 put condors, 9 vs. 131-24/0.18%

- -5,000 TYK 133 calls, 13

- +/-3,000 TYJ 132.5 calls, 3-4

- +2,300 FVK 124.25 calls, 11.5

- Block, 10,000 TYK 130.5/133 put over risk reversals, 13 naked

EGBs-GILTS CASH CLOSE: Lockdown Concerns

Core FI rallied throughout the day with a prevailing risk-off tone globally, with European COVID/lockdown concerns continuing to mount. Germany's announcement of a strict Easter lockdown was a focal point overnight, while the UK-EU vaccine export debate simmered.

- Gilts outperformed Bunds; periphery spreads tightened slightly after earlier widening, with a sizeable rally in the afternoon. Weekly ECB PEPP purchase data show only E0.9bln of redemptions last week, broadly in line w expectations.

- Issuance highlight was E13bn total of EU SURE dual-tranche 5Y/25Y via syndication. Germany sells E4bn of Bund Wednesday, while the UK sells linkers.

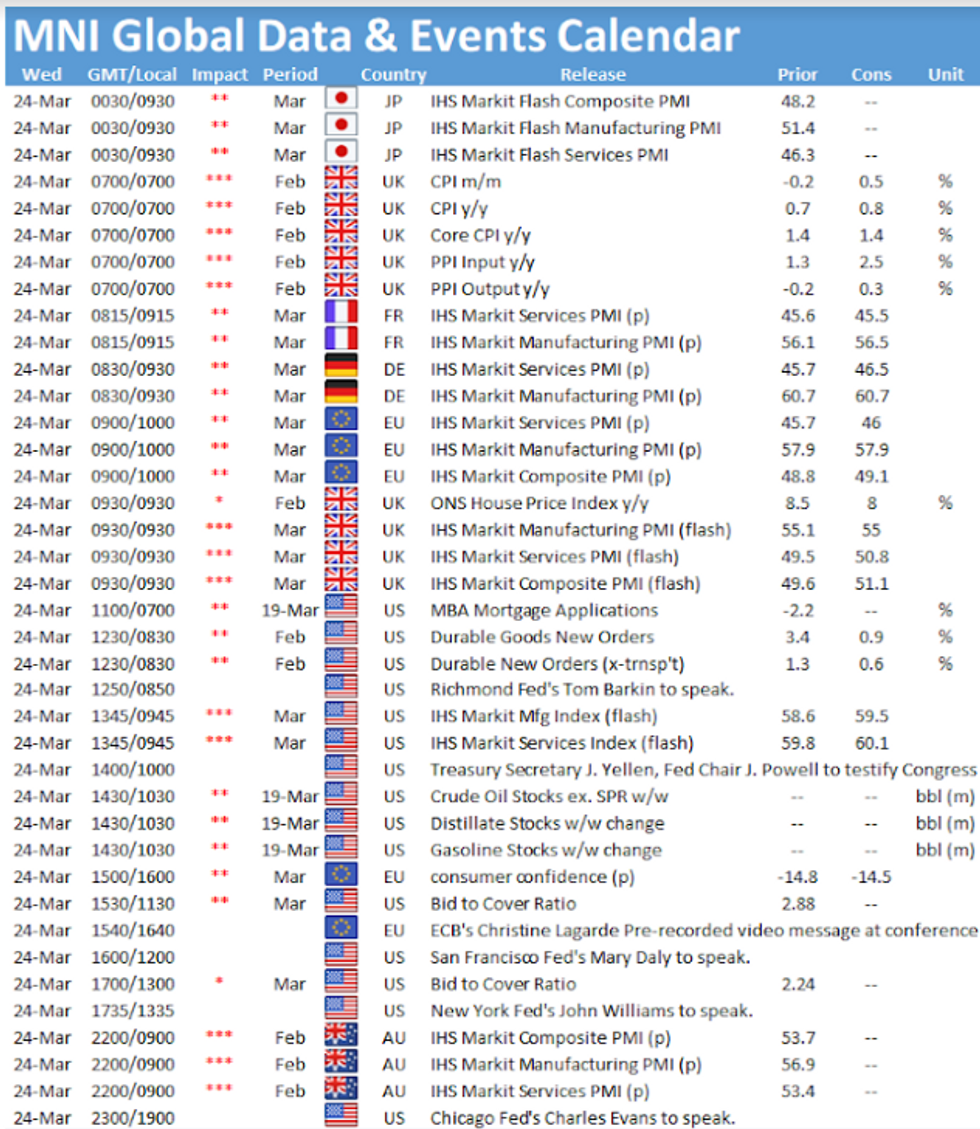

- UK jobs data was a little better than expected, with earnings in line. Looking forward to Weds, the scheduled highlight is flash March PMIs.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is down 0.9bps at -0.709%, 5-Yr is down 1.6bps at -0.67%, 10-Yr is down 3bps at -0.341%, and 30-Yr is down 3.4bps at 0.231%.

- UK: The 2-Yr yield is down 2.8bps at 0.046%, 5-Yr is down 4bps at 0.33%, 10-Yr is down 5.1bps at 0.763%, and 30-Yr is down 5.3bps at 1.288%.

- Italian BTP spread down 1.5bps at 94.3bps / Spanish spread down 1.5bps at 63.4bps

OPTIONS/EUROPE SUMMARY: Euribor Put Spread Features In Thin Trade

Tuesday's options flow included:

- ERU1 100.37/100.25ps, bought for half in 7.5k, total 15k

- DUK1 112.20/30 call spread bought for 2 in 5k

- RXK1 166.5p, bought for 3 and 4 in 3.75k

- RXM1 170.5/169/176.5p fly, was bought for 16.5 in 3k

FOREX: Dented Sentiment Prompts AUD/USD to Resume Downleg

- A risk-off feel was evident from the European open, with growth and risk-proxies including NZD and AUD flagging in favour of USD and JPY. There was no specific catalyst for the risk-off, but a confluence of factors from lockdown extensions in the Eurozone, heightened vaccine protectionism and concern over New Zealand's tempering of house price growth that weighed from the off.

- The downtick in risk sentiment as well as the NZD resulted in AUD/USD resuming the downleg from the February high, narrowing the gap with early March lows as well as the 100-dma support at 0.7610.

- Greenback strength put the USD index on track for a test of the March highs at 92.503. A break above here opens the 200-dma resistance crossing at 92.672.

- UK inflation and prelim March Eurozone & UK PMI data take focus Wednesday. Most metrics are seen broadly inline with February's turnout, indicating continued modest growth across manufacturing, but a still flagging services sector. ECB's Lagarde speaks, but on the topic of climate change, not policy.

- From the US, durable goods orders and speeches from Fed's Barkin, Powell, Williams, Daly and Evans are due.

FX OPTIONS: Expiries for Mar24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1960-75(E732mln)

- USD/JPY: Y108.00($1.3bln-USD puts)

- EUR/NOK: Nok10.20(E844mln-EUR puts)

- USD/CNY: Cny6.50($631mln)

- USD/MXN: Mxn20.50($1.1bln-USD puts)

PIPELINE: Nomura, Santander Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/23 $1.75B *Rentenbank 5Y +3

- 03/23 $1B *OMERS Finance Trust 5Y +18

- 03/23 $3.25B #Nomura $1.25B 5Y +105, 7Y +120, 10Y +130

- 03/23 $2.25B #Banco Santander $1.5B 5Y +103, $750M 10Y +133

- 03/23 $Benchmark Northern States Power WNG 10Y, 31Y

- 03/23 $Benchmark ISDB (Islamic Development Bank) 5Y Sukuk +39a

EQUITIES: Futures Off Lows After Inside Session

- US stock futures rolled off the overnight highs as the European session got off to a negative start. Prices recovered during US hours, but an inside session leaves Tuesday trade non-directional.

- This translated to mixed cash markets, with the S&P500 broadly flat, while the NASDAQ and Dow Jones ebbed lower.

- Materials and industrials performed poorly, while utilities and real estate were at the top of the table.

- Europe was similarly mixed, with UK's FTSE-100 off around 0.4% while Spain's IBEX-35 outperformed, rallying just shy of 0.6%.

COMMODITIES: Oil Resumes Sell-Off, Tumbles 6%

- Despite steady price action to start the week, crude futures extended most recent losses, tumbling ~6% on Tuesday, as of writing. The latest slide came during a resurgence of infections and slow progress with immunisations in a number of countries, including much of Europe, threatening the resumption of international passenger air travel.

- Today's moves have reinforced the recent bearish theme. WTI futures are now breaking through the March 18 low of $58.28. This constitutes the bear trigger and a sustained break would open $55.65, the 38.2% retracement of the Nov 2 - Mar 8 rally.

- A firm US dollar index prompted a leg lower in precious metals. Spot silver continued it's most recent poor performance, sliding 6% from last Thursday's top. The decline gathered momentum today on a break of $25.39 price support. Spot remains in a short-term technical bear leg and has had two consecutive days falling in the region of 2% to commence the week. Gold lost 0.8% amid the resurgent dollar but still remains above the March 18th low of $1720.

- Copper (down 2%) also suffered during the session. According to Bloomberg, speculators have decreased their bullish LME copper bets by 1,199 net-long positions to 56,154, weekly bourse data on futures and options show. This net-long position is the least bullish in about 10 months.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.