-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Steady FOMC, Taper Likely in November

US TSYS: Steady FOMC, But Likely Taper in November Leaves Tsys Mixed

Fed left rate steady while main takeaway from Powell's press conference is that the taper is very likely going to be announced in November barring a poor September jobs report. "That could come as soon as the next meeting," he said, adding that the taper could end sometime in the middle of 2022. MNI had reported before the meeting the Fed would likely signal such a timeline at this meeting.

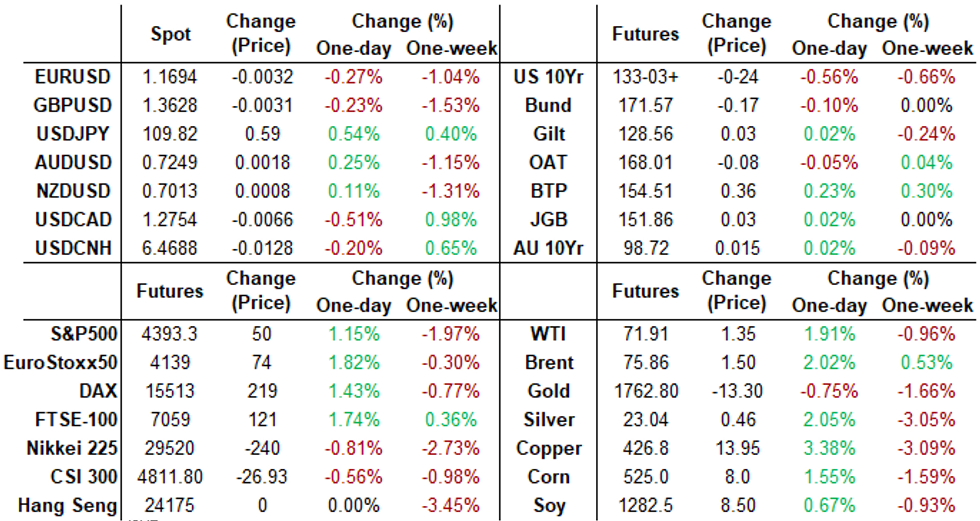

- Tsy futures trade mixed after the bell-- rotating around near steady 10s. Curves broadly flatter as 30Y Bond trades near late session highs, short end under heavy pressure.

- The 5s30s yield curve fell below 100.0bps to 96.726 low -- level last seen around July 2020. One desk noted 2-3s "are actually up more in yield" due to the "slight movement in the dots -- as front end will be affected by eventual hikes" while the long end outperforms on "move toward 'fighting' inflation."

- Overnight reverse repurchase agreement operations: "at an offering rate of 0.05 percent and with a per-counterparty limit of $160 billion per day, twice prior limit to "help ensure continued support for effective policy implementation."

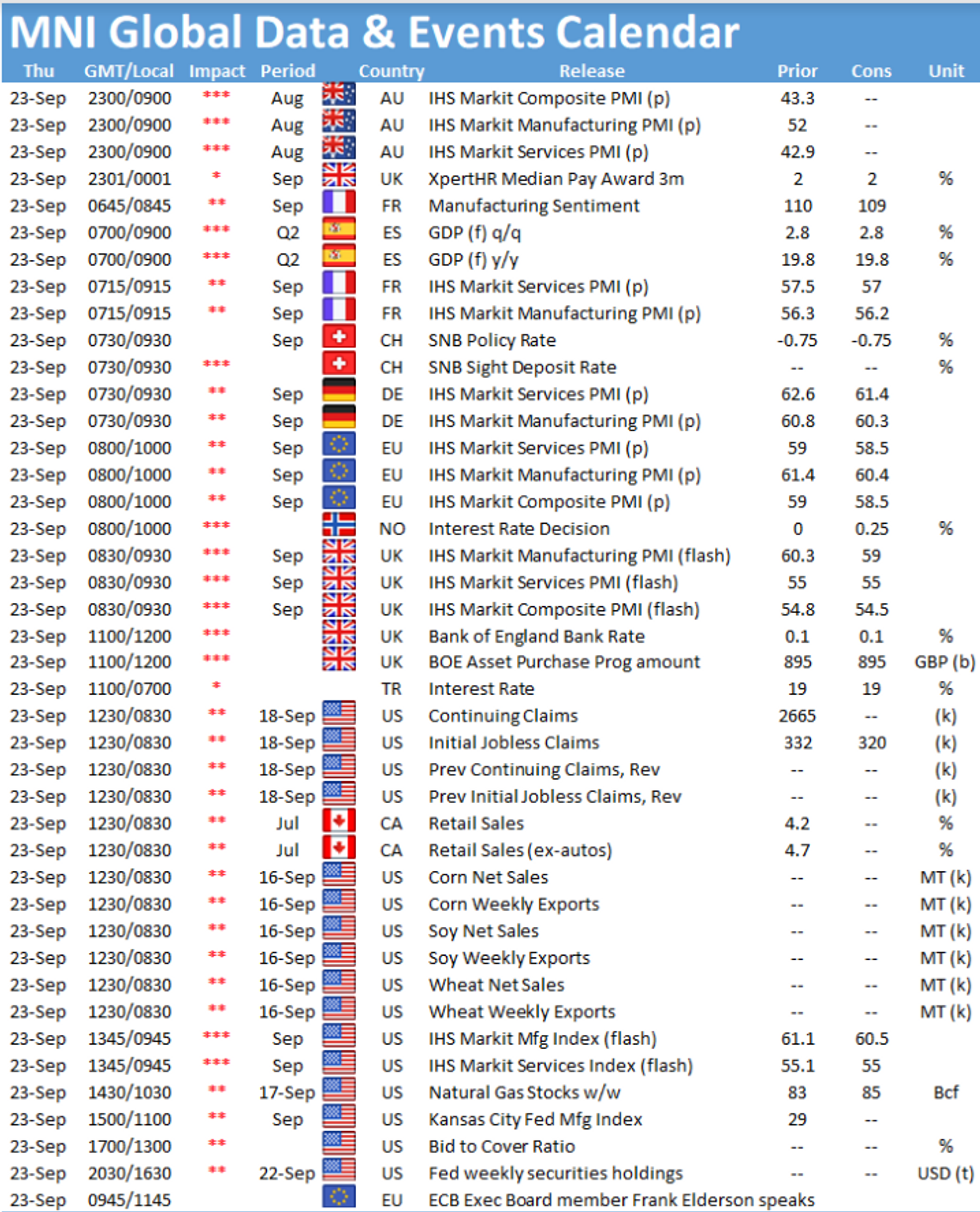

- Focus turns to Thu's weekly claims (+320k est vs. 332k prior), Markit PMIs, Fed exits blackout Thu evening.

- Currently, 2-Yr yield is up 2.2bps at 0.2363%, 5-Yr is up 2.6bps at 0.8553%, 10-Yr is down 1.2bps at 1.3108%, and 30-Yr is down 2.4bps at 1.8317%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00575 at 0.07250% (+0.00175/wk)

- 1 Month +0.00150 to 0.08325% (-0.00025/wk)

- 3 Month +0.00087 to 0.12925% (+0.00538/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00212 to 0.15550% (+0.00325/wk)

- 1 Year +0.00112 to 0.22525% (+0.00088/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $277B

- Secured Overnight Financing Rate (SOFR): 0.05%, $894B

- Broad General Collateral Rate (BGCR): 0.05%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $353B

- (rate, volume levels reflect prior session)

- No buy operation scheduled due to FOMC

- Next scheduled purchases

- Thu 9/23 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 9/24 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED Reverse Repo Operation, Fourth Consecutive Record High

NY Fed reverse repo usage climbs to new record high of 1,283.281B from 77 counter-parties vs. Tuesday's record $1,240.494B.

EURODOLLAR/TREASURY OPTIONS SUMMARY

Eurodollar Options:- Block, 10,000 Jun 99.81/99.87 1x2 call spds, 1.0

- +5,000 Green Dec 99.25 calls, 2.5 vs. 98.555/0.15%

- Update, +10,000 Green Mar 98.62/98.75/99.00 2x3x1 put flys, 3.75

- +3,000 Red Dec 99.12/99.37 put spds, 3.5

- +/-2,000 short Dec 99.37/99.50/99.62 put flys, 3.0

- buyer Blue Oct 98.37/98.50 2x1 put spds, 0.5

- Overnight trade

- -5,000 Green Nov 99.25 calls, 1.0 vs. 98.915/0.04%

- +4,000 Green Oct 98.93 puts, 6.5 vs. 98.955/0.50%

- 5,000 wk2 TY 133.25 puts, 31

- 2,000 USZ 160 puts, 53

- 2,000 TYX/TYZ 131.5 put spds, 14

- +2,000 TYV 132/132.5 1x2 call spds, 3

- Overnight trade

- 2,500 TYV 132.25/132.75 2x1 put spds, 4

- 4,000 TYX 132 puts, 16

- +2,000 wk3 TY 132/132.25/132.75 put flys, 7 vs. 133-02/0.10%

EGBs-GILTS CASH CLOSE: Italy Rallies As Market Awaits Fed, BoE

Bunds and Gilts strengthened slightly Wednesday, in a largely noncommittal session for European FI ahead of the Federal Reserve decision in the evening and the Bank of England Thursday.

- Italy was the standout performer, with 10Y spreads falling through the 100bp mark vs Germany to the tightest level since April on headlines that Italy would skip selling debt via syndication this autumn (though as MNI pointed out, it's unclear why this was a major surprise).

- ECB's Muller noted that the central bank could boost regular QE purchases after PEPP concludes, though later clarified "I am not sure if increasing the volume of APP purchases in the spring is the best way to avoid a cliff effect."

- Apart from BoE Thursday, flash PMIs will be in focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.1bps at -0.711%, 5-Yr is down 0.1bps at -0.634%, 10-Yr is down 0.7bps at -0.324%, and 30-Yr is down 0.8bps at 0.165%.

- UK: The 2-Yr yield is unchanged at 0.279%, 5-Yr is down 0.3bps at 0.482%, 10-Yr is down 0.8bps at 0.799%, and 30-Yr is down 0.1bps at 1.118%.

- Italian BTP spread down 2.5bps at 98.8bps / Spanish ad down 0.6bps at 63.6bps

EGB Options: Mixed German Trade Pre-FOMC

Wednesday's European rates / bond options flow included:

- OEX1 135.75/136.25cs 1x2, sold at 6.25 in 2k

- RXV1 173/172/171p ladder sold at 75 in 2,050

- DUZ1 112.30/40cs 1x2, bought for 0.75 in 4k

- DUZ1 112.30/112.40cs 1x3, bought for -2.5 in 2k vs RXZ1 173.5/175cs 1x3 sold at 22 in 300x900

- 2LZ1 99.125/98.875 ps with 2LZ1 99.125/99.00 ps, bought the strip for 9.25 in 4k

- SFIZ1 99.90/99.85ps 1x2, bought for -0.25 in 2k

FOREX: Initial Greenback Weakness Reverses, DXY Makes One-Month Highs

- After some initial choppy price action, greenback weakness resulted across the board following the release of the September FOMC decision/statement. The Dollar Index made fresh lows for the week in the aftermath of the release, briefly touching below the 93.00 mark.

- Referencing the substantial progress for the labor market during the press conference, Chair Powell was clear that the test could be met by the following meeting. Adding that tapering ending around mid-2022 may be appropriate was enough to bolster a greenback recovery.

- The DXY surged throughout the press conference, making new highs for the session and then extending to the week's best levels and the highest point since August 23.

- Particular weakness for the Japanese Yen with equity indices in the green saw USDJPY bouncing significantly from 109.11 support once more to trade 0.55% higher on Wednesday.

- EURUSD echoed broad dollar sentiment, breaching both sides of the week's range and eventually breaking below 1.1700 support. This opens key support at 1.1664, Aug 20 low and an important bear trigger, a break of which would strengthen a medium-term technical bearish case.

- CAD the best performing G10 currency, despite the weaker dollar. Further catch up with recent moves in oil prices in play here as well as a relief rally following Monday's election. CADJPY has firmed 1.2%, approaching its 200-day moving average at 86.42.

- Improved risk sentiment has outweighed the broader moves in the dollar with AUD and NZD also around 0.3% higher, bucking a recent string of losing days.

- Central Bank meetings continue tomorrow with the SNB and the BOE decisions/statements. On the data front, European Flash PMIs are scheduled before Canadian Retail Sales and US unemployment claims headline the NY session docket.

FOREX: Expiries for Sep23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E3.5bln), $1.1745-50(E2.3bln), $1.1790-00(E1.6bln), $1.1815-25(E850mln)

- USD/JPY: Y108.25-35($699mln), Y108.95-00($700mln), Y109.50-70($1.3bln), Y109.85-00($967mln)

- GBP/USD: $1.3600(Gbp576mln), $1.3700(Gbp533mln), $1.3800(Gbp718mln)

- AUD/USD: $0.7240-50(A$1.2bln)

- USD/CAD: C$1.2600($1.7bln), C$1.2620($920mln), C$1.2650($503mln), C$1.2705-25($840mln)

- USD/CNY: Cny6.4790-00($985mln), Cny6.50($762mln)

EQUITIES: Stocks Swallow Taper News, But Prospective Hike Path Tempers Progress

- Equity markets traded positively on both sides of the pond Wednesday, with the Wall Street swallowing Fed communication that a taper of asset purchases could begin at the next meeting, with asset purchases concluding mid-2022.

- This announcement was largely inline with expectations, but a more aggressive dot plot on rate hikes from 2022 onwards capped markets, with the e-mini S&P fading as Powell's press conference continued.

- The S&P 500's energy and financials sector topped markets Wednesday, with more buoyant WTI and Brent crude futures pricing driving margins higher for explorers and producers. Banks and financials shrugged off a flattening US yield curve, with the likes of Wells Fargo, Charles Schwab and Goldman Sachs adding over 3% apiece.

- European markets traded similarly positively, with the UK's FTSE-100 outperforming (up 1.50%) as the likes of Royal Dutch Shell and BP made solid point contributions.

COMMODITIES: Energy Prices Inch Higher as Markets Bake In Tight Winter Supply

- WTI and Brent crude futures shrugged off a rallying greenback to trade higher Wednesday, with expectations of tight supply across the winter months building globally. Active WTI futures topped $72/bbl, erasing the week's early underperformance as positive sentiment was reflected across the futures curve. Wednesday price action opens gains toward the Sep15 high initially at $72.87 ahead of the bull trigger at $73.58.

- Elsewhere, Goldman Sachs affirmed the upside risk to prices this coming winter, forecasting an oil price of $90/bbl should the winter season be colder than expected. This echoes similar sentiment from Bank of America in recent weeks, who saw a risk of prices as high as $100/bbl on seasonal tightness in energy markets.

- A surprisingly large build in gasoline inventories as part of the DoE stockpiles data was shrugged off by markets Wednesday, with the larger than expected draw in headline crude and distillates supplies providing a decent counter. Further evidence of supply coming back online following Hurricane Ida emerged, with refinery utilization higher by 5.4% on the week vs. Exp. 1.33%.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.