-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Risk On As Economy Contracts

US TSYS: Skittish Ahead Month-End, Stocks Well Bid Ahead Earnings

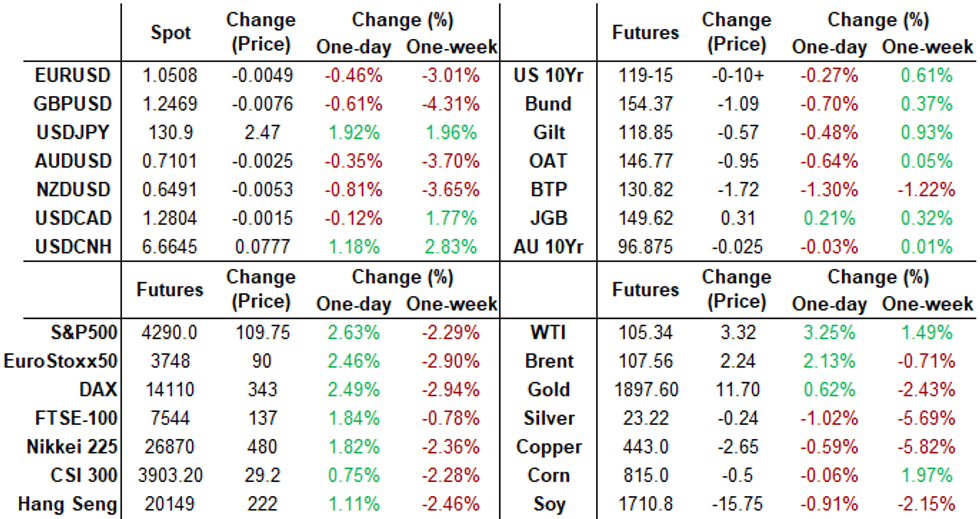

Skittish markets, FI trading weaker after the bell but well off lows. Curves bear flattening as the short end remains under heavy pressure (2YY +.0466 at 2.6375% vs. 2.6761%H; 30YY -.0103 at 2.9109% vs. 2.9690%H).

- Tsy and Eurodollar futures sold off pre/post-German inflation data that weighed on Bunds ahead the NY open, drew short cover support after GDP shrank -1.4% in Q1 vs. an estimates +1.0%.

- Weakness exacerbated by falling inventories, most notably wholesale trade (mainly motor vehicles) and retail trade (notably, "other" retailers and motor vehicle dealers). These are likely particularly volatile with offsetting swings in subsequent quarters.

- Futures moderated through the second half, inched lower $44B 7Y note auction (91282CEM9) tailed: 2.908% high yield vs. 2.890% WI; 2.41x bid-to-cover vs. 2.44x last month.

- Market also watching continued surge in US$ strength, DXY $ index that climbed to new 5Y high of 103.928.

- As well as stocks as they topped 4300.0 in late trade, awaiting earnings annc's from Apple (AAPL), Western Digital (WDC), Intel (INTC), Amazon (AMZN) after the close.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00014 to 0.32500% (-0.00143/wk)

- 1M +0.03629 to 0.80000% (+0.09657/wk)

- 3M +0.04714 to 1.28600% (+0.07239/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.02185 to 1.84814% (+0.02443/wk)

- 12M +0.00500 to 2.54914% (-0.05757/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $262B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $882B

- Broad General Collateral Rate (BGCR): 0.30%, $342B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $330B

- (rate, volume levels reflect prior session)

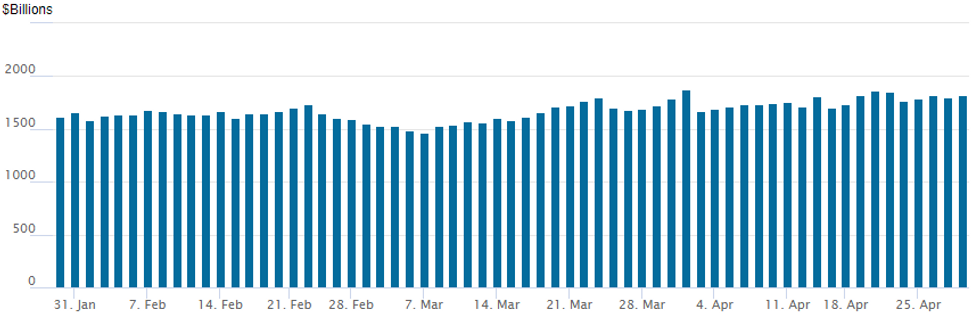

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,818.416B w/ 83 counterparties from prior session 1,803.1623B. Compares to all-time high of $1,904.582B on Friday, December 31.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

With some decent call trade in the mix, varied put trades drove volumes as underlying rate futures unwound midweek support Thursday. Underlying futures held weaker levels, early real vol evaporating as levels held near middle of the session range.- Rate-hike insurance position building gained momentum as market consensus over multiple 50bp hikes (as opposed to 75bp) grows - despite this morning's Real GDP surprising decline of -1.4% annualized (cons +1.0%).

- Block, 4,000 SFRU2 97.00/97.25 put spds, 6.0

- -20,000 short Dec 95.00/95.50 put spds, 6.0

- 6,500 short Aug 97.50/97.75 call spds

- Block, total 20,000 Dec 96.00/97.00/97.37 broken put flys, 13.5

- 4,200 short Dec 97.75/98.25 call spds

- +5,000 Sep 99.00 calls, 1.5

- +5,000 Sep 99.50 calls, 0.5

- Overnight trade

- Block, 10,000 Sep 97.12 puts at 21.5 vs. 5,000 Sep 98.12 calls at 7.0 vs. 4,000 EDU2 97.33

- 2,000 Sep 99.75/99.87 put spds

- 3,500 May 98.00 puts vs. Jun 98.18/98.31/98.43 put trees

- -6,000 USM 134/136/138/140 put condors, 62

- +12,000 FVM 111/112 put spds 13.5

- -2,900 TYM 118.5/121 strangles 1-0 to 63

- +2,000 FVM 116 calls, 2.5 vs. 113-00/0.02%

- +3,000 TYN 116/117 put spds 5 over TYN 122/123 call spds

- +24,000 TYM 122/123.5 calls, 9

- +5,000 FVM 110.5/112.5 put spds 20 over FVM 114.5 calls vs. 112-27.25/0.48%

- Overnight trade

- 2,000 TYM 117.5/119 put spds, 22

- 2,000 TYM 118/119 put spds, 21

EGBs-GILTS CASH CLOSE: Upside German Inflation Surprise Sets Bearish Tone

Strong German inflation data and a rebound in equities fuelled a core EGB sell-off Thursday, with periphery EGBs also weakening.

- German CPI came in above expectations, pushing Bund yields to session highs, though Spain's missed.

- Gilts outperformed, with direction mainly determined by EGBs and Tsys.

- Periphery spread widening continued: Italy 10Y yields hit highs of 2.743% intersession (+17bp) - highest since Mar 2020 with Bund spread above 184bp, a fresh post-Jun 2020 high; but settled down by day's end.

- Plenty of data yet to come Friday, including French and Italian inflation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.8bps at 0.198%, 5-Yr is up 10.8bps at 0.637%, 10-Yr is up 9.9bps at 0.9%, and 30-Yr is up 7.9bps at 1.053%.

- UK: The 2-Yr yield is up 5.3bps at 1.542%, 5-Yr is up 5.2bps at 1.627%, 10-Yr is up 6.5bps at 1.877%, and 30-Yr is up 7.3bps at 2.01%.

- Italian BTP spread up 4bps at 181.2bps / Greek up 6.4bps at 229.8bps

EGB Options: Large Bobl Risk Reversal, Bund Call Spread

Thursday's Europe rates/bond options flow included:

- UBM2 179/177/176p fly sold at 72 in 1.75k

- UBU2 185/183/181p fly, bought for 10 in 4k

- OEM2 127/126.5/126.25p fly, bought for 8 in 2.5k

- OEM2 126.50 put, bought for 31.5/33 in 5k

- OEM2 127.75/126.75 combo, bought the call for 25/25.5 in 20k

- RXM2 156.00/158.00 call spread bought for 44 in 20k (vs 154.12)

- RXM2 152/150ps, bought for 27.5 in 6k

- 2RU2 9900/9937/9962 broken c fly, bought for 5 in 2k

FOREX: Greenback Marches Higher, USDJPY Extends Advance Above 131.00

- The Dollar Index (DXY +0.65%) is set to extend its winning streak to six trading sessions. The index now boasts an impressive 5.5% advance throughout April with the Japanese yen and Chinese Yuan particular victims on Thursday.

- USDJPY continues to defy gravity and has now rallied over 400 pips from yesterday’s low print below 127.00. With any small risks associated with the Bank of Japan meeting out of the way, market participants were given the green light for the pair to extend its path of least resistance higher.

- Verbal murmurings from MOF officials, combined with weaker US growth data provided only brief price pullbacks, however, USDJPY continued to be very well supported on dips, eventually breaching the 131.00 handle and printing highs at 131.25.

- Technically, the break above 129.40/44 confirms a resumption of the primary uptrend and highlights a bull flag breakout. Next resistance resides at 131.96, 1.00 projection of the Feb 24 - Mar 28 - 31 price swing.

- USDCNH has advanced a further 1.1% on Thursday. Several banks have slashed their yuan forecasts with the currency headed for its biggest monthly decline since China unified its exchange market in 1994.

- The late bounce in major equity indices, as well as firmer crude prices, lent support to the likes of the Canadian dollar, the only G10 currency to appreciate against the dollar on Thursday.

- EURUSD price action confirms an extension of the bearish price sequence of lower lows and lower highs. 1.0494, the Feb 22 2017 low, was breached earlier in the session as the pair continues to narrow the gap to the 2017 lows, residing at 103.41.

- Some more Eurozone inflation data scheduled for Friday before Canadian GDP and US Core PCE Price index figures kick off the North American docket. The week will be rounded off by Michigan sentiment data and the MNI Chicago Business Barometer.

FX: Expiries for Apr29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0565-75(E2.0bln), $1.0600(E838mln), $1.0650(E288mln), $1.0700(E2.9bln), $1.0785-90(E587mln)

- USD/JPY: Y124.00($1.4bln), Y126.75($500mln)

- EUR/GBP: Gbp0.8475(E751mln)

- USD/CAD: C$1.2850($690mln)

- USD/CNY: Cny6.5400($500mln), Cny6.5500($570mln), Cny6.6500($560mln)

Late Equity Roundup: Surging Higher, AAPL, INTC, AMZN on Tap

SPX eminis looking strong after the FI close, extending highs w/ ESM2 +122.25 (2.92%) at 4302.25 -- just below initial key resistance of 4303.50/4355.50 High Apr 26 / Low Apr 18, followed by 4509.0 Apr 21 high.

- Several large program buys noted on the move, while month end extensions could be additional factor as Citi's model sees a rotation out of bond markets and into equities.

- Salient earnings after the close: Apple (AAPL), Western Digital (WDC), Intel (INTC), Amazon (AMZN).

- SPX leading/lagging sectors: Information Technology (+4.04%) with bounce in tech/hardware and semiconductor shares edges past Communication Services late (+4.27) lead by 17.6% surge in Meta (FB) while Google, Netflix and Twitter all trade stronger as well.

- Laggers: Utilities (+1.07%), Consumer Staples (+1.42%) and Industrials (+1.46%), latter weighed down by Stanley Black & Decker (beating estimate but has weak outlook) and Caterpillar (CAT) also beat estimate -- but demand shock (as in lack of) from China spurred sales.

- Meanwhile, Dow Industrials currently trades +747.46 points (2.24%) at 34048, Nasdaq +451.8 points (3.6%) at 12940.25.

- Dow Industrials Leaders/Laggers: Salesforce (+12.13), Home Depot (+12.08) and United Health (+12.2). Amgen (AMGN) lead laggers -10.77 at 238.02

E-MINI S&P (M2): Bear Cycle Remains Intact

- RES 4: 4631.00 High Mar 29 and key resistance

- RES 3: 4588.75 High Apr 5

- RES 2: 4509.00 High Apr 21 and a key short-term resistance

- RES 1: 4303.50/4355.50 High Apr 26 / Low Apr 18

- PRICE: 4231.75 @ 14:24 BST Apr 28

- SUP 1: 4136.75 Low Apr 26

- SUP 2: 4129.50 Low Mar 15 and a key support

- SUP 3: 4094.25 Low Feb 24 and a bear trigger

- SUP 4: 4063.24 1.618 proj of the Mar 29 - Apr 18 - 21 price swing

S&P E-Minis remain bearish despite holding above Tuesday’s low. This week’s lows have reinforced current bearish conditions and confirmed a resumption of the current bear cycle. Potential is seen for a continuation of this theme. This has opened 4129.50, the Mar 15 low. Key short-term resistance has been defined at 4509.00, Apr 21 high. Initial resistance though is seen at Tuesday’s high of 4303.50.

COMMODITIES: Oil Firms As German Green Light To Russia Embargo Seen

- Oil prices are up solidly, boosted by Germany dropping its opposition to the EU embargo of Russian oil having yesterday said it would only do so if introduced gradually. The potential for further short-term disruption sees front-dated futures contracts with the largest gains.

- A Reuters headline of two explosions being heard in Kyiv didn’t have an obvious impact with prices already trending higher.

- WTI is +3.4% at $105.49 as it tests initial resistance at $105.42 (Apr 21 high) after which it could open $109.2 (Apr 18 high).

- Brent is +2.5% at $107.9, sitting a little further off initial resistance at $109.80 (Apr 21 high).

- Gold is +0.2% at $1890.6 with a modest gain despite a continuation of USD strength and renewed pricing of hikes, pulling off an intraday low of $1872.2 that now forms initial support. Resistance is eyed at the 20-day EMA of $1941.3.

- European gas remains in focus, sliding -8% today as European buyers look at options to keep Russian supply with Hungary making payments in line with Moscow’s new mechanism despite the EU warning that opening ruble accounts would breach sanctions.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/04/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/04/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/04/2022 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 29/04/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/04/2022 | 0645/0845 | ** |  | FR | PPI |

| 29/04/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/04/2022 | 0800/1000 | ** |  | EU | M3 |

| 29/04/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/04/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/04/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/04/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/04/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/04/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/04/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.