-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stocks Strong, Near Resistance

US TSYS: Short End Weaker on Potential 50Bp ECB Hike Thu; Stocks Well Bid

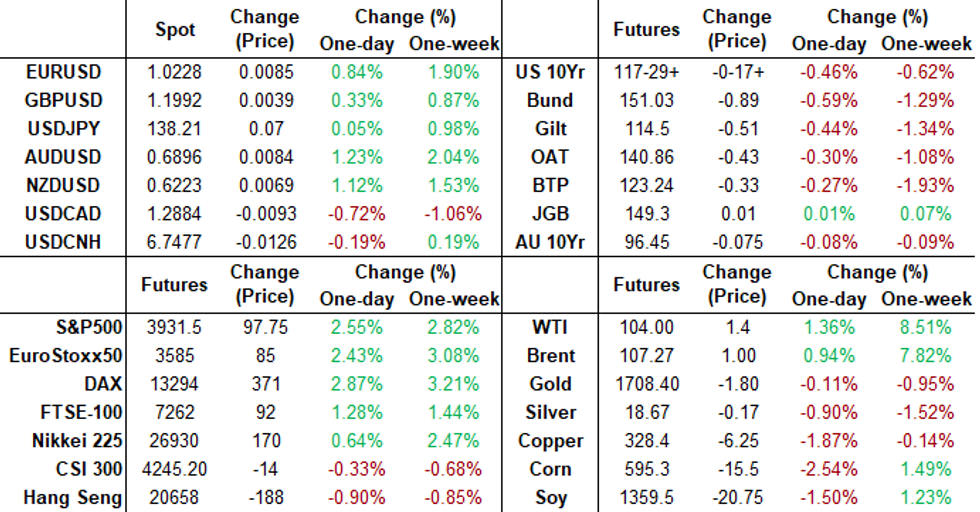

Rates weaker after the bell, inside range w/ Bonds back near middle of range -- curves flatter w/ the short end near lows, pressured after Reuters, then Bloomberg cited ECB sources pointing to potential 50bp hike at Thu's meeting vs the long-expected 25bp.- Yield curves flatter, 2s10s -2.041 at -21.556 vs. -15.344 high. Overall volumes remain light by the close, TYU2 915k after the bell. Pick-up in swappable debt issuance from domestic/foreign banks generated decent two-way hedging in short end to intermediates w/ surprise $10B BoA jumbo 3pt issuance leading total $18.55B issuance on the day, $39.3B/wk.

- Earlier risk-on tone coincided with headlines Russia's Nord Stream 1 pipeline to restart flow at reduced levels sometime Thu. Closed due to maintenance - the reopening underscored the morning risk-on tone, Tsys and EGBs lower.

- Equities extended gains following positive earnings annc's from: Signature Bank NY (SBNY) $5.26 vs. $5.057, Truist (TFC) $1.20 vs. $1.146, JNJ $2.59 vs. $2.553, Hasbro (HAS) $1.15 vs. $0.935, Halliburton (HAL) $0.49 vs. $0.449. Huge beat for Lockheed Martin (LMT) $6.32 vs. $3.974 est.

- Cross-asset, crude firmer (WTI +1.37 at 103.97 (vs. 99.97 low), Gold firmer but off highs +2.53 at 1711.75.

- In focus Wednesday: Existing Home Sales (5.41M prior, 5.40M est); MoM (-3.45%, -0.2%) at 0830ET. US Tsy $14B 20Y Bond auction re-open (912810TH1) at 1300ET.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00800 to 1.56214% (-0.00300/wk)

- 1M +0.03514 to 2.16157% (+0.04128/wk)

- 3M +0.02185 to 2.73171% (-0.00586/wk) * / **

- 6M +0.03143 to 3.29886% (-0.01243/wk)

- 12M +0.00657 to 3.86957% (-0.02686/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.74029% on 7/14/22

- Daily Effective Fed Funds Rate: 1.58% volume: $97B

- Daily Overnight Bank Funding Rate: 1.57% volume: $284B

- Secured Overnight Financing Rate (SOFR): 1.54%, $947B

- Broad General Collateral Rate (BGCR): 1.51%, $367B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $358B

- (rate, volume levels reflect prior session)

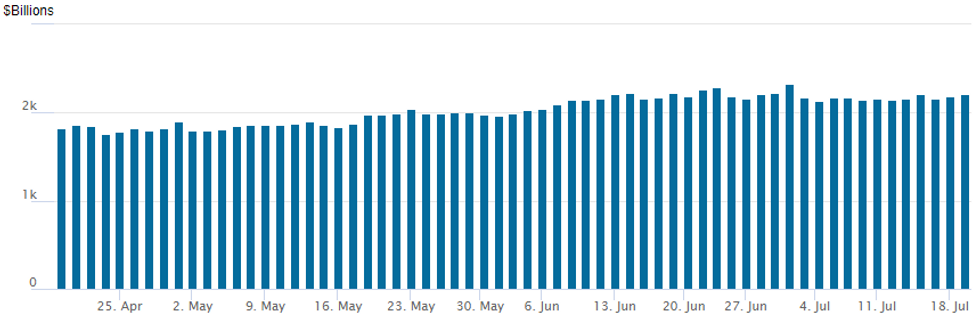

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,211.821B w/ 98 counterparties vs. $2,190.375B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Light summer volume on narrow ranges and lower implieds persisted Tuesday, Trade rotated around downside Treasury puts as underlying futures held mildly lower across the curve.- Highlight trade included early buy of +25,000 TYU2 116.5/118 2x1 put spds, buying one leg over for net of 0; 5Y options had 5,000 FVQ 111/111.25 put spds trade at 3.5 ref 111-21.75, 9,500 FVU 109.5 puts trade 11.5 ref 111-20.5.

- -3,000 Dec 97.00/97.50/98.00 put flys, 2.5

- +2,000 Dec 95.50/96.87 put over risk reversals, 1.5 vs. 96.115/0.40%

- 2,000 TYQ 116.75/117 put spds

- 5,000 FVQ 111/111.25 put spds, 3.5 ref 111-21.75

- 9,500 FVU 109.5 puts, 11.5 ref 111-20.5

- +25,000 TYU2 116.5/118 2x1 put spds, buying one leg over for net of 0

- 4,000 TYU2 121 calls, 20 ref: 118-07

EGBs-GILTS CASH CLOSE: Short End Hit On 50bp ECB Hike Talk

Short-end yields rose sharply Tuesday in a bear flattening move as speculation rose over a 50bp ECB July hike.

- Reuters, then Bloomberg, cited ECB sources pointing to potential for a 50bp hike at Thursday's meeting vs the long-expected 25bp. Implied pricing rose accordingly though ended on a knife's edge at 37.5bp (a 50/50 chance of either 25/50bp).

- Afternoon headlines that Russian gas flows would restart sparked a risk-on move, which kept hike pricing elevated and weakened the German short-end.

- BoE's Bailey reiterated the BOE was contemplating a 50bp hike in August.

- MNI's ECB meeting preview went out today - and also of note was our Policy sources piece eyeing potential for broad lawmakers backing for Draghi if he decides to stay ahead of his crunch speech Wednesday (BTP spreads continued to fall Tuesday).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 10.9bps at 0.631%, 5-Yr is up 10.3bps at 1.01%, 10-Yr is up 5.6bps at 1.271%, and 30-Yr is up 2.3bps at 1.463%.

- UK: The 2-Yr yield is up 5.2bps at 2.036%, 5-Yr is up 3.5bps at 1.903%, 10-Yr is up 1.7bps at 2.174%, and 30-Yr is up 4.7bps at 2.681%.

- Italian BTP spread down 1.5bps at 205.4bps / Spanish down 2.2bps at 120.6bps

FOREX: Euro Bounce Extends As ECB Policy Action In Focus, Antipodean FX Surges

- The Euro sits close to the top of the G10 pile Tuesday, with the release of several sources reports to Bloomberg and Reuters making a 50bps rate hike at this Thursday's ECB a certain topic for discussion - although the median consensus still looks for a smaller 25bps rise this week.

- EUR/USD made light work of the Monday highs upon release, and briefly breached resistance through 1.0258, the 20-day EMA, before consolidating just below. A sustained breach of this average would strengthen bullish conditions and signal scope for an extension within the bear channel and would place the focus on the significant breakdown area between 1.0341-59.

- The greenback is the poorest performer on Tuesday, extending the weakness noted on Monday as the USD Index (-0.67%) extends the pullback off last week's cycle high. The USD Index resides around 2.5% off last week’s peak.

- Antipodean currencies clocked +1% gains amid the supportive price action for major equity indices. The Aussie dollar had outperformed during the APAC session as participants parsed the latest round of RBA comments and the pair marched higher throughout Europe. This places the AUD/USD (+1.32%) rate north of $0.69 for the first time since July 1st, briefly reaching touted resistance at 0.6912, the 38.2% retracement of the Jun 3 - Jul 14 downleg.

- Bolstered risk sentiment also propped up Scandinavian FX, with SEK and NOK the main beneficiaries against the USD, rising around 1.8%.

- Overnight, eyes on potential comments from RBA Governor Lowe, due to speak at the Australian Strategic Business Forum, in Melbourne. Inflation data from the UK and Canada headlines the data docket on Wednesday before the key risk events on Thursday – central bank meetings/decisions from the BOJ and ECB.

FX: Expiries for Jul20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E1.1bln)

- USD/JPY: Y137.00($625mln), Y137.75($635mln), Y139.00($1.1bln)

- USD/CAD: C$1.2800-05($510mln), C$1.3285-00($1.0bln)

- USD/CNY: Cny6.6000($3.7bln), Cny6.7000($3.7bln), Cny6.8000(1.1bln)

Late Equity Roundup: Materials, Communication Services Lead Rally

Stocks continued to extend gains through the second half, near highs after the FI close: SPX eminis near highs are currently trading +98 (2.56%) at 3931.75; DJIA +676.84 (2.18%) at 31749.58; Nasdaq +324.8 (2.9%) at 11684.86.

- Early positive tone as earnings consistently beat estimates ahead the open: Signature Bank NY (SBNY) $5.26 vs. $5.057, Truist (TFC) $1.20 vs. $1.146, JNJ $2.59 vs. $2.553, Hasbro (HAS) $1.15 vs. $0.935, Halliburton (HAL) $0.49 vs. $0.449. Huge beat for Lockheed Martin (LMT) $6.32 vs. $3.974 est.

- Reporting after the close: Netflix (NFLX) $2.915 est, Interactive Brokers (IBkR) $0.912 est and JB Hunt (JBHT) $2.344 est.

- Expected to announce Wed: Abbott Labs (ABT) $1.117 est, Biogen (BIIB) $4.124, Tesla (TSLA) $1.831, Alcoa (AA) $2.392, United Airlines (UAL) $1.871.

- Green-light for risk assets, stocks continued to gain after late morning on headlines Nord Stream 1 pipeline to restart flow at reduced levels Thu.

- SPX leading/lagging sectors:Materials (+3.00%), Communication Services (+2.97%) supported by Netflix (+5.22%), Meta +4.93% and News Corp (NWS) +3.95%. Laggers: Utilities (+0.79%), Consumer Staples (+0.91%) and Health Care (+1.67%).

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) extends Mon's post-earning rally by another +16.55 at 317.91, United Health (UNH) +10.49 at 529.86, Boeing (BA) +7.29 at 155.01. Laggers: IBM -8.13 at 130.00, JNJ -1.93 at 172.30.

E-MINI S&P (U2): Remains Below Key Resistance

- RES 4: 4308.50 High Apr 28

- RES 3: 4204.75 High May 31 and a key resistance

- RES 2: 3952.01 50-day EMA

- RES 1: 3950.00 High Jun 27

- PRICE: 3875.00 @ 14:24 BST Jul 19

- SUP 1: 3723.75/3639.00 Low Jul 14 / Low Jun 17 and a bear trigger

- SUP 2: 3578.27 0.618 proj of the Mar 29 - May 20 - 31 price swing

- SUP 3: 3500.00 Round number support

- SUP 4: 3384.75 0.764 proj of the Mar 29 - May 20 - 31 price swing

S&P E-Minis traded higher Monday before finding resistance at the session high. Short-term gains are considered corrective - for now. Resistance to watch is unchanged at 3950.00, the Jun 27 high, and the 50-day EMA at 3952.01. A clear breach of this zone would strengthen a bullish case. On the downside, a resumption of weakness and a break of 3923.75 low, would instead open key support at 3639.00, Jun 17 low.

COMMODITIES: Risk On Boosts Oil Whilst Gazprom Poised To Restate Gas Exports

- Crude oil prices are up almost 1.5% today after yesterday’s surge, receiving a further boost from improved risk-on sentiment evidenced by US equities firming ever since the US open. Modest outperformance for WTI could be a continuation of TD Energy’s force majeure on the Keystone pipeline.

- Ahead, Biden is expected to announce executive action to address climate change tomorrow but is expected at this stage to stop short of declaring a state of emergency with the added powers it could provide.

- WTI (CLU2) is +1.3% at $100.66, having cleared the 20-day EMA of $100.53 and next opening the 50-day EMA of $102.29.

- Gold is +0.1% at $1710.83 after a relatively uneventful day despite broad-based USD weakness. It does little to change its downtrend, with support eyed at $1697.7 (Jul 14 high), clearance of which opens $1690.6 (Aug 9, 2021 low).

- Another more eventful day for gas meanwhile sees TTF prices dip -1.8% with Gazprom poised to restart gas exports through its Nord Stream 1 pipeline on Thursday at reduced capacity after planned maintenance according to people familiar with the matter.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/07/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 20/07/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 20/07/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 20/07/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/07/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/07/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 20/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/07/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/07/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/07/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.