-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

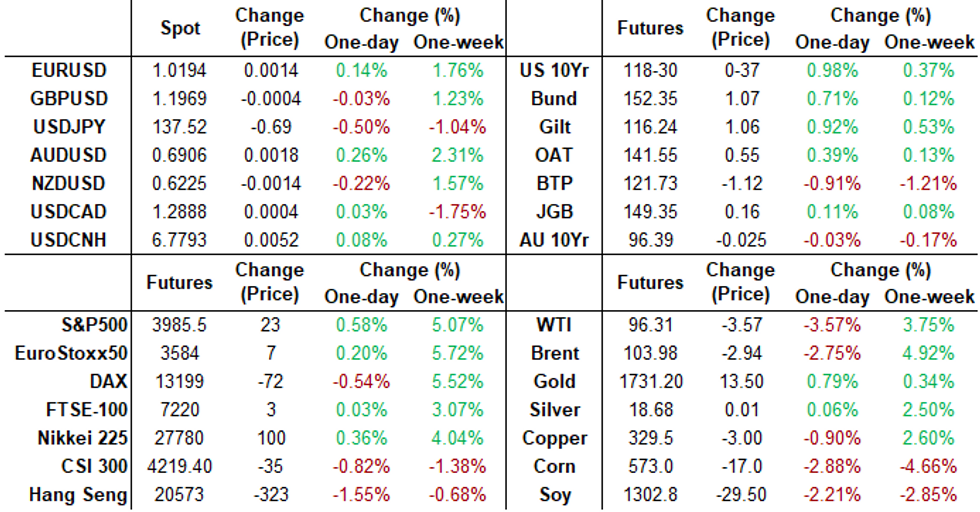

Free AccessMNI ASIA MARKETS ANALYSIS: Looking Past 50Bp ECB Hike

US TSYS: Weak Data Over 50Bp ECB Hike

Initially selling off after the ECB hiked 50bp this morning, Tsys reversed course after weaker than expected data - drifting near highs after the bell. Decent volumes (TYU2 1.5M) on wide ranges, yield curves mixed.- Tsys bounced on weak US data soon after: weekly jobless claims higher than expected at 251k vs. 240k, continuing claims 1.384M vs. 1.340M est, sharp miss on Philly Fed Mfg index at -12.3 vs. 0.8 est. Positive spin for stocks: data miss deemed positive in relation to watering down hawkish forward Fed expectations.

- Second leg higher: Tsys continued to extend session highs with the rally in European core sovereign with the front-loading aspects and not moving an assumed terminal rate.

- Underscoring rally: Huge 5Y Block buy: +40,000 FVU2 111-24, buy through 111-20.75 post-time offer at 0915:30, 111-27 last +11.75. Additional Blocks in second half: 5Y/10Y ultra-bond steepeners, weighted neutral.

- Long end seeing selling by bank and real$ accts ahead midday. While a 75bp hike next week remains priced in, probability of a third consecutive 75bp move at the September meeting has started to ebb.

- Friday data focus:

- Jul-22 0830 S&P Global US Mfg PMI (52.7, 52.0)

- Jul-22 0830 S&P Global US Services PMI (52.7, 52.7)

- Jul-22 0830 S&P Global US Composite PMI (52.3, 52.4)

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00343 to 1.56571% (+0.00057/wk)

- 1M +0.04543 to 2.25900% (+0.13871/wk)

- 3M +0.02400 to 2.78300% (+0.04543/wk) * / **

- 6M +0.04357 to 3.37743% (+0.06614/wk)

- 12M +0.02571 to 3.91871% (+0.02228/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.78300% on 7/21/22

- Daily Effective Fed Funds Rate: 1.58% volume: $95B

- Daily Overnight Bank Funding Rate: 1.57% volume: $274B

- Secured Overnight Financing Rate (SOFR): 1.53%, $916B

- Broad General Collateral Rate (BGCR): 1.51%, $369B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $361B

- (rate, volume levels reflect prior session)

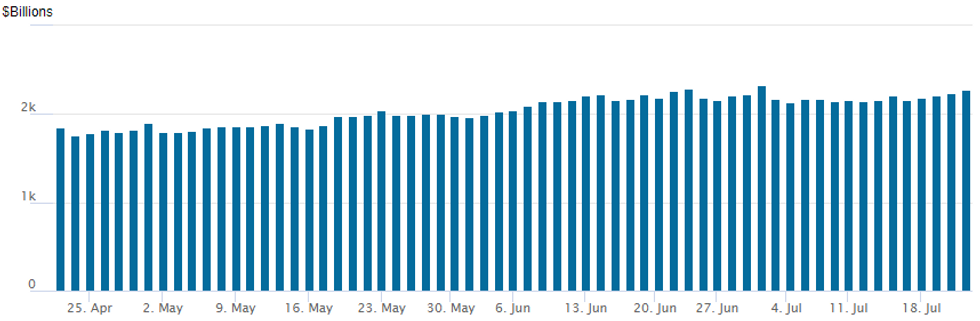

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,271.756B w/ 101 counterparties vs. $2,240.204B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

With a few exceptions, option trade continued to center on downside puts even as chances of more aggressive rate hikes in the latter half of the year started to fade.- Tsys held near session highs after initially selling off after the ECB hiked 50bp. Brief post-ECB hike sell-off in Tsys say 30YY hit 3.2035% high. Tsys bounced on weak US data soon after: weekly jobless claims higher than expected at 251k vs. 240k, continuing claims 1.384M vs. 1.340M est, sharp miss on Philly Fed Mfg index at -12.3 vs. 0.8 est.

- Highlight trade included ongoing buyer of +5,000 SFRZ3 95.00/95.50/96.00 put flys at 4.0 - adding to over 17,000 bought Wednesday. August expirys included a buy of +5,000 SFRQ2 96.50/96.62 put spds, 1.75.

- Late long end Treasury option trade included a Block of 7,500 USU 137 puts, 107 vs. 140-04/0.27% around same time as 5,320 USU2 138 puts traded 1-25. On the flipside, paper traded 10,500 TYQ2 118.5 calls, mostly 11-12.

- +5,000 SFRZ3 95.00/95.50/96.00 put flys, 4.0

- +5,000 SFRQ2 96.50/96.62 put spds, 1.75

- +5,000 short Aug 96.25/96.50/ 2x1 put spds, 2.0 vs. 96.53

- Block, 7,500 USU 137 puts, 107 vs. 140-04/0.27%

- 5,320 USU2 138 puts, 125

- total 10,500 TYQ2 118.5 calls, mostly 11-12

- 7,000 TYU2 117.5 puts, 60 ref 118-02.5 -01.5

- 2,000 FVU 112.25 calls, 30

- +3,000 USU 130/134 put spds, 34

- 2,000 TYU2 120 calls, 23

EGBs-GILTS CASH CLOSE: ECB Delivers Big Hike, But Reaction Mixed

The German curve twist flattened Thursday, with BTP spreads widening sharply and Gilts bull flattening, as the ECB delivered a bigger-than-expected 50bp hike.

- Schatz yields spiked 15bp on the ECB decision but that move almost completely faded as forward guidance was dropped and Lagarde was noncommittal on a September hike.

- BTP spreads widened sharply in a dramatic day including the resignation of PM Draghi in the morning and the ECB's announcement of the Transmission Protection Instrument (TPI).

- Ambiguous details on TPI contributed to BTP weakness. Compounding issues for BTPs, as cash markets closed, media outlets reported the next Italian election would be held on September 25 - our Politics Team has published a briefing on what to expect next.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 6.9bps at 0.676%, 5-Yr is up 1.3bps at 1.024%, 10-Yr is down 3.4bps at 1.223%, and 30-Yr is down 5.1bps at 1.403%.

- UK: The 2-Yr yield is down 6.8bps at 2.001%, 5-Yr is down 6.8bps at 1.848%, 10-Yr is down 9.2bps at 2.047%, and 30-Yr is down 12.9bps at 2.531%.

- Italian BTP spread up 18.8bps at 232.2bps / Greek up 13bps at 233.7bps

FOREX: Hawkish ECB Surprise Fails To Sustain Initial Euro Bullishness

- The larger-than-expected 50bp rate hike from the ECB sparked solid short-term demand for the single currency, however, this price action was short-lived and EURUSD then reversed aggressively to the lows of the day before consolidating throughout the US session.

- In the lead up to the press conference, the hawkish surprise took EURUSD to the best levels of the week, printing 1.0278. This was 5 pips above Wednesday’s high and coincided with a weaker US Philly Fed datapoint.

- Instead of the breach sparking some momentum buyers, Euro optimism quickly faded as markets attempted to grapple with the details surrounding the new Transmission Protection Instrument (TPI), announced by the central bank.

- With Euro bulls rapidly losing faith, the path of least resistance was lower and EURUSD quickly found itself trading below pre-rate announcement levels with one eye on the daily lows. Sure enough, the pair fell close to another half a percent, with 1.0154 marking the day’s low. Interestingly, E1.8bln worth of expiries between $1.0200-10 was a strong enough magnet to drag the pair back up approaching the NY cut where the pair seemed comfortable consolidating as the dust settled.

- Overall, currency markets remain close to Wednesday’s closing levels with whipsaws in the Euro largely being mirrored by the USD index. Slight outperformance has been seen in the JPY and CHF, both rising 0.35% amid an underwhelming day for commodities/risk.

- European Flash PMI’s will be in focus on Friday, as market participants look for further signals of weaker economic to start the third quarter. The UK and Canada both report retail sales data.

FX: Expiries for Jul22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0080-00(E1.4bln), $1.0140-50(E925mln), $1.0200-10(E562mln)

- USD/JPY: Y135.00($1.1bln), Y139.00($630mln), Y140.00($990mln)

- EUR/JPY: Y141.00(E485mln)

- AUD/USD: $0.6800(A$1.2bln), $0.6900(A$1.1bln)

- USD/CAD: C$1.2900($965mln), C$1.3000($602mln)

- USD/CNY: Cny6.7500($1.7bln), Cny6.8000($1.1bln)

Late Equity Roundup, Autos Outperform, Tesla +10%

Stocks drifting near midday highs after the FI close. SPX eminis currently trading +24.75 (0.62%) at 3987.25; DJIA +31.01 (0.1%) at 31901.29; Nasdaq +122.0 (1%) at 12017.52.

- Highlight earnings expected after the close: Boston Beer (SAM) $4.423 est, Capitol One Financial (COF) $5.105 est, PPG Ind $1.752 est, Tenet Healthcare (THC) $0.827 est, Seagate (STX) $1.9132 est, SVB Financial (SIVB) $7.723.

- SPX leading/lagging sectors: Consumer Discretionary outperformed for second day running (+2.12%) - autos leading w/ Tesla up 10.12% at 817.37 (+74.87) after reporting better than exp earnings late Wed ($2.27 vs. $1.855), Health Care rebounds after weaker showing Wednesday (+1.21%), Information Technology (+1.20%). Laggers: Energy (-2.59%), Communication Services (-0.43%) while Utilities and Consumer Staples sectors were +0.06%.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +3.86 at 325.31, Apple (AAPL) +2.25 at 155.29, Salesforce.com (CRM) +2.21 at 184.61. Laggers: Chevron (CVX) -2.66 at 143.86, IBM -2.44 at 126.74, Travelers Cos (TRV) -2.83 at 155.37 and McDonalds (MCD) -1.87 at 252.71.

COMMODITIES: Oil Slides With Increased Supply After Product Demand Concerns

- Improved risk sentiment through the day has seen crude oil prices only partially recovered from sliding through the European session on a combination of Libyan production ramping up again quite substantially, the Russian gas situation easing as Nord Stream 1 flows reached 40% of capacity and continued spillover from implied weak US gasoline demand.

- More recently Putin and Saudi Crown Price bin Salman will continue oil cooperation, whilst there has also been a curveball thrown up by Reuters sources reporting the Nord Stream turbine returning from Canada has been stuck in transit in Germany because Russia has so far not given the go-ahead to transport it back.

- WTI is -3.65% at $96.19, stepping back from resistance eyed at the 50-day EMA of $102.29 but still easily above support at $91.64 (Jul 15 low).

- Brent is -3.7% at $103.76, also away from the 50-day EMA of $107.46 having tested it yesterday.

- Gold on the other hand has jumped +1.1% to $1715.01 (with an intraday swing of 2%) after sustained downward pressure in recent weeks, helped by Tsy yields sliding through the session after the ECB’s front-loaded 50bp hike.

- Coming before news of Russia’s blocking of the turbine transport, TTF natural gas prices had edged up just +0.4% higher.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/07/2022 | 2301/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 22/07/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 22/07/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 22/07/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 22/07/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 22/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 22/07/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/07/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.