-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Bond Lead Sell-Off, Weak 30Y Sale

US TSYS: PPI Lower Than Expected, 30Y Bond Sale Tails

Yield curves continue to steepen off 22 year inverted lows (2s10s tapping -33.863 high, at -35.089 +8.642 after the bell) w/ carry-over selling in long as 30YY tapped 3.1877 high. Chunky block sales in 5s, 30s and 30Y Ultras adding to weaker tone ahead next week sees Tsy 20Y bond supply, retail sales anticipated to be strong- Short end holding onto cooler inflation (50bp hike over 75bp in Sep) after lower than expected PPI today, final demand inflation surprisingly fell -0.5% M/M (cons +0.2%), pushing the annual rate down from 11.3% to 9.8% Y/Y (cons 10.4%).

- Tys extend lows after $21B 30Y auction (912810TJ7) tails: 3.106% high yield vs. 3.092% WI; 2.31x bid-to-cover vs. 2.44x the prior month. Indirect take-up recedes to 70.65% vs. 73.20% in Jul; direct bidder take-up climbs to 18.51% vs. 16.34% prior; primary dealer take-up 10.84% vs.14.46%.

- Cross asset update: Stocks have trimmed gains, rotating around steady: SPX eminis currently trades -0.75 (-0.02%) at 4209.25; DJIA +19.59 (0.06%) at 33328.18; Nasdaq -72.2 (-0.6%) at 12782.35. Spot Gold little weaker at 1785.53 -6.85; Crude firmer (WTI +2.02 at 93.95) after reports of a leak at Fourchon forced Shell and Chevron to shut off near half dozen fields.

- Data on tap for Friday: Import/Export prices, University of Michigan Sentiment (52.5 est vs. 51.5 prior).

- Currently, 2-Yr yield is up 0.7bps at 3.2206%, 5-Yr is up 6bps at 2.9816%, 10-Yr is up 9.8bps at 2.8785%, and 30-Yr is up 13.3bps at 3.1656%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00771 to 2.32400% (+0.01200/wk)

- 1M -0.00943 to 2.39100% (+0.02157/wk)

- 3M -0.01757 to 2.90514% (+0.03843/wk) * / **

- 6M -0.05786 to 3.48871% (+0.06314/wk)

- 12M -0.07000 to 3.92814% (+0.06828/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.92271% on 8/10/22

- Daily Effective Fed Funds Rate: 2.33% volume: $93B

- Daily Overnight Bank Funding Rate: 2.32% volume: $281B

- Secured Overnight Financing Rate (SOFR): 2.28%, $970B

- Broad General Collateral Rate (BGCR): 2.26%, $390B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $377B

- (rate, volume levels reflect prior session)

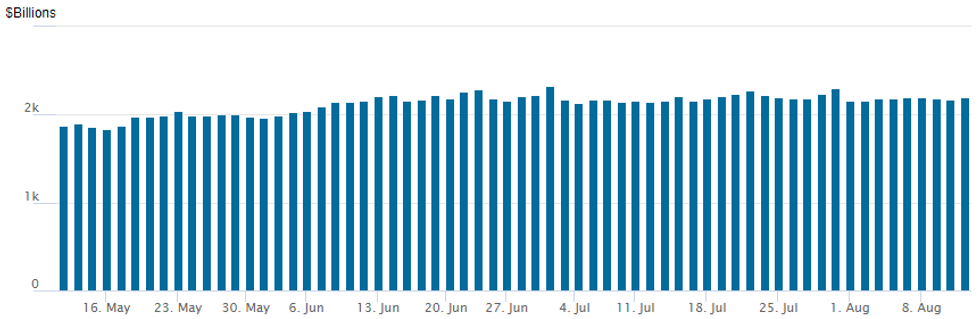

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,199.247B w/ 103 counterparties vs. $2,177.646B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Modest option volumes noted Thursday despite the wide range in underlying futures, curves bear steepening with carry-over weakness in the long end. Salient trade did appear to be bullish with selling of SOFR puts and scale buyer of September 10Y call flys.SOFR Options:

- -10,000 SFRV 96.25 puts, 8.5 vs. 96.495

- +1,000 SFRV2 96.50/96.75 1x2 call spds, 1.0

- Block, 2,500 SFRZ2 96.12/96.25/96.62/96.75 put condors, 4.5

- 2,000 SFRU2 97.06/97.18 call spds

- 4,000 short Mar 99.25 calls, 1.5

- 2,000 TYU 119.25 calls, 44

- +3,000 TYU 116 puts, 2

- -2,500 FVZ 113 straddles, 234-233

- +11,000 TYU 120.5/1215.5/122.5 call flys 7-8 ref 119-11.5 TO -17.5

- 1,300 USU 140/142 put spds,

- 4,000 TYU 120/121 call spds

EGBs-GILTS CASH CLOSE: 10Y Yields Hit August Highs

The German and UK curves bear steepened Thursday as some of the prior session's post-US CPI dovishness was reconsidered.

- The second weak US inflation print in as many days (PPI) saw limited immediate reaction, and the follow-through was actually bearish with Bund and Gilt yields reversing higher from session lows and steepening accelerating.

- Gilts underperformed Bunds, though 10Y yields on both curves hit their highest levels of the month - with the recent caveat that trading volumes today were very limited in typical August trade.

- Periphery spreads compressed despite a fairly soft tone in overall risk appetite (equities were flat/lower on the day).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2bps at 0.566%, 5-Yr is up 5.6bps at 0.712%, 10-Yr is up 8.3bps at 0.971%, and 30-Yr is up 10.2bps at 1.229%.

- UK: The 2-Yr yield is up 5.5bps at 2.002%, 5-Yr is up 8.2bps at 1.882%, 10-Yr is up 10.8bps at 2.059%, and 30-Yr is up 11.3bps at 2.449%.

- Italian BTP spread down 5.4bps at 205.9bps / Greek down 4.2bps at 226.6bps

EGB Options: Both Upside And Downside In Rates

Thursday's Europe rates / bond options flow included:

- RXU2 152/153 call spread bought for 84 in 5k

- ERU2 99.375/99.50 cs vs 99.25/99.125ps, bought the cs for 0.75 in 5k

- ERV2 98.75/98.50ps 1x2, bought for -0.25 in 4k

- ERZ2 98.75/98.875/99.00/99.25 broken call condor, bought for -1.25 (receive) in 4k

- 0RU2 98.37/98.25ps v 98.87/99.12cs, bought the ps for flat in 4k

- SFIU2 97.50p sold at 4.5 in 1k

- SFIU2 97.00p, bought for half in 3k

FOREX: USD Index Matches Wednesday Low And Bounces

- The first half of Thursday’s session in currency markets saw general dollar weakness as markets continued to ponder the latest dip in US CPI data. As such, the USD index gravitated slowly towards Wednesday’s low print but momentum to the downside abruptly halted, and the greenback found firm support at this level.

- Fed rhetoric since the data points to officials being closely aligned that victory should not be declared and that the path for monetary policy in the short-term does not necessarily change. In similar price action to late yesterday, market participants were happy to sell rallies in US rates and the bear steepening of the yield curve appeared to support the US Dollar during the second half of the session.

- USDJPY once again traded in a volatile manner and was able to trade down to 131.74 amid the initial greenback weakness. However, the turnaround prompted a significant 125 pip rally back to the 133 mark as we approach the APAC crossover.

- EURUSD price action was considerably more subdued and the pair was unable to make a new high above 1.0368. A slow grind lower to 1.0315 as of writing indicates the pair may once again close below the channel top intersection (1.0344) and the notable breakdown pivot at 1.0341 dating back to Jan 2017. Note that a deeper pullback would be a bearish development and suggests a reversal lower inside the channel. Watch support at 1.0123, the Aug 3 low.

- Overall, daily adjustments for majors have remained subtle with NZD (+0.41%) outperforming and CNH (-0.31%) the laggard.

- First estimate of Q2 GDP from the UK highlights Friday’s European data calendar before Eurozone Industrial Output figures. In the US, UMich Consumer Sentiment data rounds off the week.

FX: Expiries for Aug12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0185-00(E812mln), $1.0225-30(E639mln), $1.0300(E1.8bln), $1.0325(E800mln), $1.0350(E766mln), $1.0435-40(E521mln)

- USD/JPY: Y132.00($810mln), Y132.45-50($575mln), Y133.98-00($1.7bln)

- GBP/USD: $1.2300(Gbp576mln)

- AUD/USD: $0.7100(A$593mln)

- USD/CAD: C$1.2700($1.3bln), C$1.2800($880mln), C$1.3135-55($1.5bln), C$1.3200($1.1bln)

- USD/CNY: Cny6.80($899mln), Cny6.85($500mln)

Late Equity Roundup, Trimming Gains, Energy Sector Holds Lead

Stocks see-sawing around steady after the FI close, have been gradually unwinding early gains since the London session close. No particular headline driver for reversal after carry-over bid for stocks following Wed's flat July CPI. SPX eminis currently trades -0.75 (-0.02%) at 4209.25; DJIA +19.59 (0.06%) at 33328.18; Nasdaq -72.2 (-0.6%) at 12782.35.

- SPX leading/lagging sectors: Energy sector continues to outperform (+3.03%) with Devon Energy DVN) +7.29%, Marathon Oil (MRO) +6.45%, Schlumberger (SLB) +5.90%. Financials follow up (0.82%) with banks and insurance names leading; Materials (+0.41%). Laggers: Consumer Discretionary (-0.86%) with auto makers weaker vs. component makers; Health Care -0.75%, Real Estate -0.70%, Information Technology-0.43%.

- Dow Industrials Leaders/Laggers: Disney (DIS) +5.59 at 118.02 after profits surge 50%, Goldman Sachs (GS) +4.33 at 352.24, Travelers (TRV) +4.23 at 169.24. Laggers: United Health (UNH) -5.66 at 532.06, Amgen (AMGN) -2.98 at 249.11,Johnson and Johnson (JNJ) -2.95 at 167.72.

E-MINI S&P (U2): Bullish Extension

- RES 4: 4345.75 2.00 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 3: 4306.50 High May 4

- RES 2: 4272.35 1.764 proj of the Jun 17 - 28 - Jul 14 price swing

- RES 1: 4247.00 Intraday high

- PRICE: 4240.25 @ 14:16 BST Aug 11

- SUP 1: 4080.50 Low Aug 2

- SUP 2: 4008.43/3913.25 50-day EMA / Low Jul 26 and a key support

- SUP 3: 3820.25 Low Jul 18

- SUP 4: 3723.75 Low Jul 14

S&P E-Minis have continued to move higher today, confirming a resumption of the current uptrend. This reinforces short-term bullish conditions and the extension maintains the positive price sequence of higher highs and higher lows. The focus is on 4272.35 next, a Fibonacci projection. On the downside, initial trend support is at 4080.50, the Aug 2 low. The 50-day EMA intersects at 4016.17 - a key support.

COMMODITIES: Crude Oil Clears 20-day EMAs As Demand Firms

- Crude oil has gained strongly today with rising oil demand and some potential carry-over in risk on sentiment from yesterday’s softer US CPI inflation, before some late US supply disruption.

- OPEC sees global oil demand rising 3.1mbpd in 2022 (a decrease of -260kbpd from previous forecast) vs the IEA seeing a 2.1mbpd increase (+380k from previous) and Goldman see crude oil demand increasing from here with Brent forecast at $130/bbl by year-end and gasoline above $5.

- Brief pop higher and then quick retracement on news of a leak at the Fourchon booster station in Louisiana pushing Shell to shut its Mars, Ursa and Olympus oil & gas fields as well as Mars and Amberjack pipelines in the Gulf of Mexico, followed by Chevron also shutting some oil fields.

- WTI is +2.7% at $94.35 having earlier cleared the 20-day EMA at $94.40, next opening the 50-day EMA at $98.12. Strong price gains elicit some protection taken out with the most active strikes of the day in the CLU2 at $85/bbl puts.

- Brent is +2.3% at $99.62 having cleared the 20-day EMA at $99.12, next opening the 50-day EMA at $101.79.

- Gold is -0.24% at $1787.84 after a mixed session, moving lower as Tsy yields ultimately moved higher but with moves limited by a weaker dollar. It has cleared trendline resistance of $1794.6 in recent days before pulling back, leaving resistance next eyed at the bull trigger of $1807.9 (Aug 10 high) and key short-term support at $1754.4 (Aug 3 low).

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/08/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 12/08/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 12/08/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/08/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/08/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/08/2022 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/08/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 12/08/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/08/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/08/2022 | 0900/1100 | ** |  | EU | industrial production |

| 12/08/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/08/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/08/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.