-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Japan Govt Keeps Economic Assessment, Ups Imports

MNI EUROPEAN OPEN: CAD, MXN Weaken On Tariff Threat, JPY Firms

MNI ASIA MARKETS ANALYSIS - Canadian Manufacturing Contracts at Near Fastest Pace Since COVID

Highlights:

- FX volumes running around half of daily average as US holiday crimps activity

- Market-implied BoE pricing consolidates above 6.30%, adding to mortgage woes

- Global PMIs, Fed minutes and ECB consumer survey takes focus Wednesday

US TSYS: TY Futures Back Near Unchanged On Independence Day

- TYU3 trades in the higher half of a narrow 8+ tick range for currently just 1 tick richer on the day at 111-31.

- The earlier session low of 111-25+ probed support at the same level from Jun 30, mostly through the London session before pulling higher later when more firmly into US hours to leave it back in yesterday’s range. A more concerted push lower could open 111-14+ (Mar 9 low) after which lies the key 110-27+ (Mar 2 low).

- Volumes are unsurprisingly thin with the US out for Independence Day (cumulative volumes 180k), ahead of tomorrow’s snap back to more normal trading activity ahead of the FOMC minutes before the usual data releases in the build up to Friday’s payrolls report.

STIR: US Rates Take Cue From ECB/BOE Pricing In Wafer Thin Holiday Trade

- Fed Funds implied rates have seen an unsurprisingly quiet session for Independence Day, holding a little lower in likely spillover from slightly softer peak ECB and BOE pricing.

- Ahead of Wednesday’s FOMC minutes and with payrolls firmly on the horizon, there is +21bp priced for the July FOMC (-0.5bp on the day), building to a cumulative +34bp to a 5.41% terminal effective rate in November (-0.5bp).

- It’s followed by 5bp of cuts to Dec’23 (-1bp) and 56bp of cuts to Jun’24 (-4bp).

- There’s a similar story in SOFR futures, with the largest gains seen in the SFRM4 (+0.04). The Z3 is the most active on the day with volumes of just 50k.

EGBs-GILTS CASH CLOSE: Steeper As Hike Pricing Is Pared Back

Peripheries underperformed in European trade as the UK and German curves steepened Tuesday, in a quieter session with the US markets closed for holiday.

- Despite thinned liquidity, there was decent price action. ECB and BoE terminal hike pricing pulled back the most in 4 sessions (by 3 and 1bp respectively), though there was little data / speakers driving (Bundesbank chief Nagel had little new to say).

- The UK curve bull steepened modestly, with Germany's twist steepening.

- BTP spreads widened the most since early May, with Italian yields rising as Bunds strengthened - no particular catalyst evident for either move.

- Short-end GGBs pared losses after Greek PM Mitsotakis pledged early repayment of 2 years of bailout debt by year-end. But Greek 10s still underperformed on the periphery.

- Wednesday brings the ECB's consumer expectations survey, French and Spanish industrial data, and Services/Composite PMIs (mostly Finals).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.9bps at 3.221%, 5-Yr is down 1.6bps at 2.601%, 10-Yr is up 1.6bps at 2.453%, and 30-Yr is up 5.3bps at 2.448%.

- UK: The 2-Yr yield is down 2.4bps at 5.319%, 5-Yr is down 2.9bps at 4.688%, 10-Yr is down 2.4bps at 4.416%, and 30-Yr is down 2.3bps at 4.422%.

- Italian BTP spread up 4.9bps at 174.6bps / Greek up 7.2bps at 134.1bps

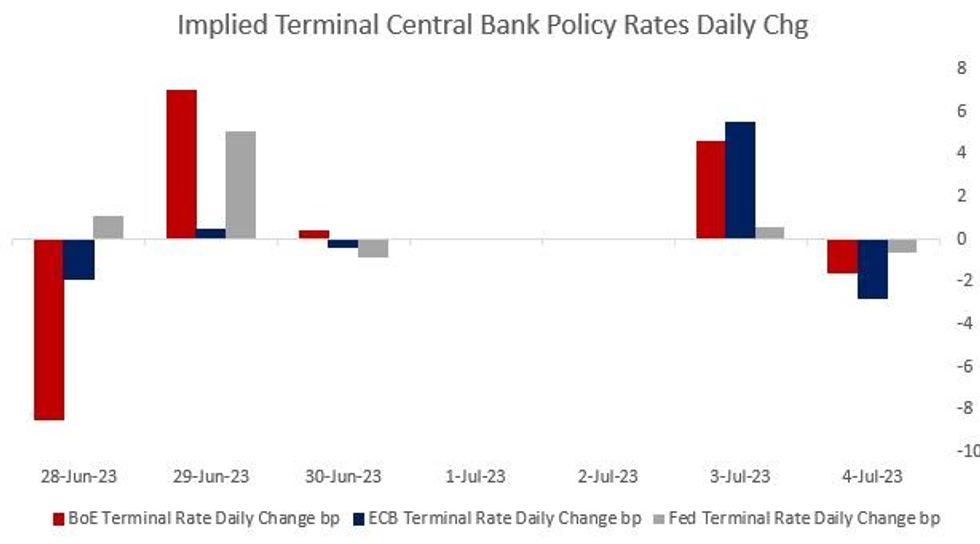

EU STIR: Slightly Softer Peak ECB and BoE Pricing, Still Higher For The Month

ECB and BoE terminal rate pricing pulled back the most in 4 sessions Tuesday. With few macro or headline catalysts, this mostly represented a pullback from Monday's sharp rise amid thinned liquidity on a US holiday - and most of the July rise remains intact.

- ECB terminal depo Rate pricing -2.7bp to 4% (51bp of further hikes left in the cycle to Dec 2023). Peak ECB pricing continues to find a ceiling at the 4% mark, with which it flirted throughout Tuesday's session after touching 4.06% Monday. There remains high conviction in a 25bp raise in July (still 88% priced).

- BoE terminal Bank Rate pricing -1.6bp to 6.3% (130bp of further hikes left in the cycle to Feb 2024). 50bp hike pricing for August's meeting has pulled back a little, with 43bp implied versus 46bp last Friday.

US FI Options: Limited July 4 Trade Includes Rate Steepener And Downside

Tuesday's US rates / bond options flow included:

- SFRZ3 94.00/93.75ps, bought for 1.75 in 10k

- FFV3/X3 paper paid 6.5 on ~9.7K.

- TYQ3 110.00 puts paper paid 0-09 on 2K, delta -15%.

EU FI Options: Various Call/Put Spreads In Thin Trade Tuesday

Tuesday's Europe rates / bond options flow included:

- RXQ3 135.50/136.00cs, bought for 6.5 now ~6k total.

- ERU3 96.25/95.75ps vs 0RU3 96.62/96.60ps, sold mid at 11.5 in 2k

FOMC Minutes Preview: July 2023

We've published a preview of tomorrow's FOMC minutes (released 1400ET/1900UK on Jul 5), focusing on Fed rate hike messaging since the Jun 13-14 meeting.

This includes MNI's Hawk-Dove matrix, sell-side outlooks for the minutes, and MNI's interview last month with Atlanta Fed Pres Bostic.

See PDF in link below:

ECB: ECB Consumer Survey Eyed For Further Inflation Anchoring

Wednesday's release of the ECB's monthly Consumer Expectations Survey for May (0900UK/1000CET) will again be eyed primarily for any movement in consumers' inflation expectations.

- While not nearly as important as actual incoming inflation data, ECB officials including Chief Economist Lane have cited the CES as a consideration in policy-setting, with May's meeting accounts noting some concern over the March uptick ("The upward movement in inflation expectations reflected in the ECB Consumer Expectations Survey also warranted ongoing monitoring.").

- That March uptick reversed in the survey covering April, with markets reacting in mildly dovish fashion: median 12-month ahead inflation expectations fell to 4.1% from 5.0% in March, and 3-years-ahead falling to 2.5% from 2.9%. That compares to a 0.4pp jump in March for 12-month expectations/0.5pp for 3-year.

- While the mean estimates remained relatively more elevated than the medians, the overall readings showed downward progress, and the measures of expectations were below the "perceived" prior inflation levels, suggesting that consumers see disinflation in the pipeline from very high rates.

Source: ECB, MNI

Source: ECB, MNI

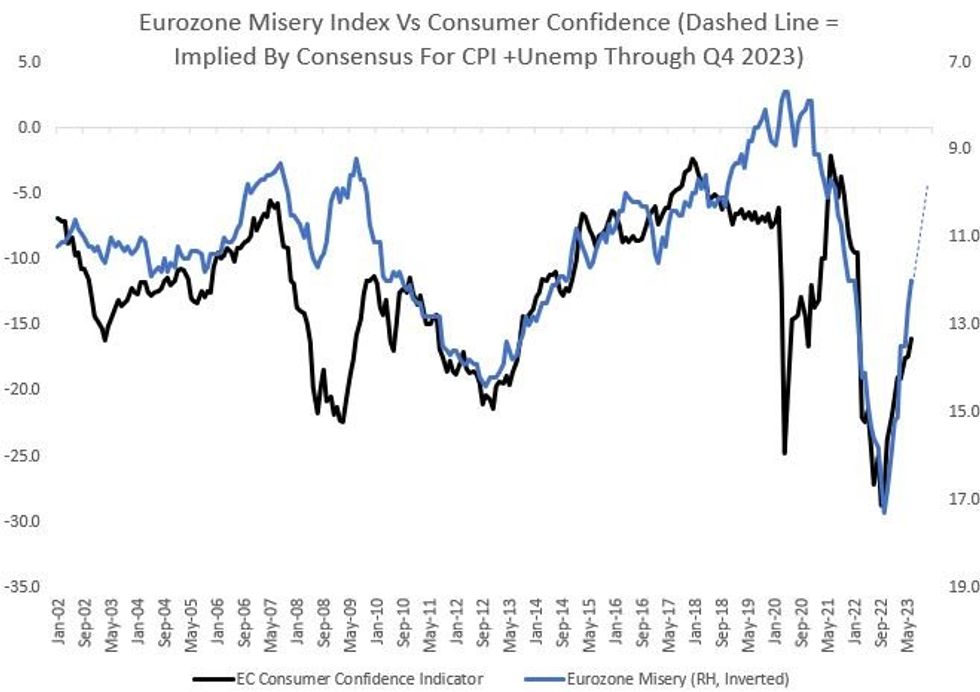

ECB: Eyeing Consumer Resilience Ahead Of Sept ECB Decision

All areas of the ECB's May CES survey will be of some interest as a guide to the impact so far of monetary tightening and the state of the eurozone consumer entering the summer.

- There's probably nothing in this report that would sway the July meeting decision (which looks very likely to be a 25bp raise), but the ECB will pay attention to any significant shifts as it assesses whether to hike again in September. Outside of inflation the major areas of the survey are housing and credit, income and consumption, and labour and growth.

- The CES isn't a consumer confidence survey per se, but in general confidence is on course to continue picking up over the course of the rest of the year despite monetary tightening and other headwinds.

- The chart below shows that as the "misery index" (unemployment + inflation) subsides, consumer confidence rises - based purely on BBG survey projections for Unemployment and Inflation the rest of the year, the European Commission's index (separate from the ECB's survey) should return to pre-Ukraine crisis levels by late 2023. If the ECB's surveys reflect a similarly buoyant consumer, it could add to the case for a September hike.

Some sell-side analyst views on Wednesday's survey are below.

- Citi: "Consumer confidence has shown signs of rebound -we will be watching the trends to see how growth will recover into H2."

- Nomura: "This is an important survey of expectations, with the inflation expectations numbers the most important to watch....Look out in this survey for expectations on house prices, incomes, spending, economic growth and unemployment."

- TD Securities: The 3-year inflation expectation component has been volatile in a wide 3.8% to 4.6% range in the last 6 months, with a sharp drop in June. While July's ECB meeting is nailed on, a reversal of June's decline will keep the Governing Council worried about inflation prospects."

Source: EC, Eurostat, BBG, MNI

Source: EC, Eurostat, BBG, MNI

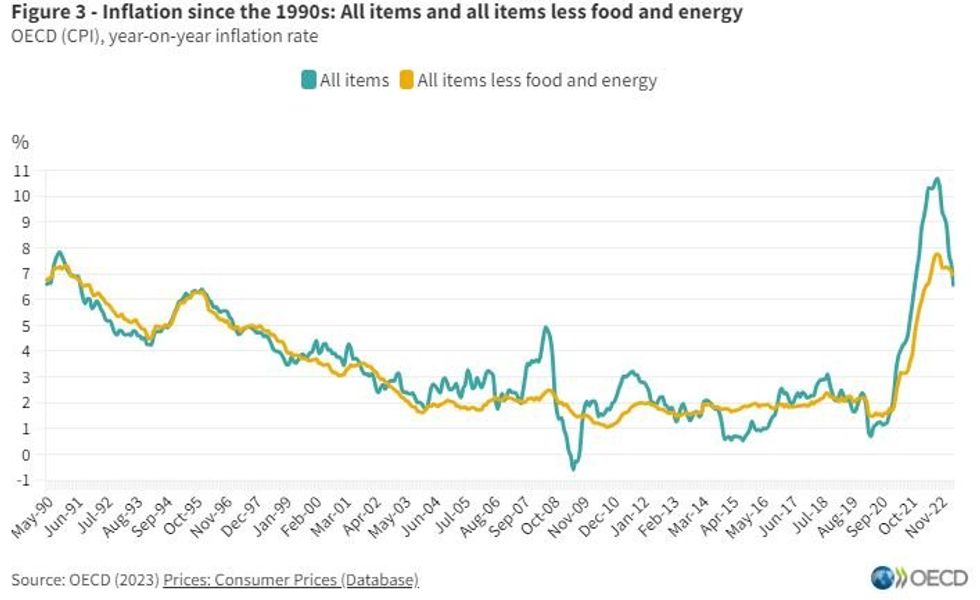

OECD Inflation Slowing, But Core Progress Very Limited

The OECD's aggregate inflation indices for May were published today - while that's a bit of a delay vs some of the prelim readings we've gotten for June already, they offer a helpful like-for-like comparison across geographies and show a post-2021 low for headline OECD CPI at 6.5% Y/Y (vs 7.4% in April).

- But that headline decline was largely energy driven (that inflation category was -5.1% Y/Y, and negative in 16 OECD countries with major exceptions including Italy and others which posted +10% Y/Y).

- Food inflation slowed to 11.0% Y/Y from 12.1%.

- That meant aggregate OECD core inflation progress was more stubborn than for headline, at 6.9% Y/Y (just 0.2pp lower than April), with services prices rising 5.7% Y/Y (0.3pp below April's reading).

- That's below the OECD core peak of 7.8% Y/Y in Oct 2022 (when headline was 10.7%), but significantly above the pre-pandemic period in which core inflation struggled to move above 2%.

- It's difficult to gauge the "momentum" of core disinflation vs Y/Y base effects as the OECD only publishes seasonally-adjusted monthly data for a few countries. But 0.9pp of annual inflation progress over 7 months from the peak is a disinflation rate of just over 0.1pp a month. At that pace it would take years to bring inflation down to even close to pre-pandemic levels.

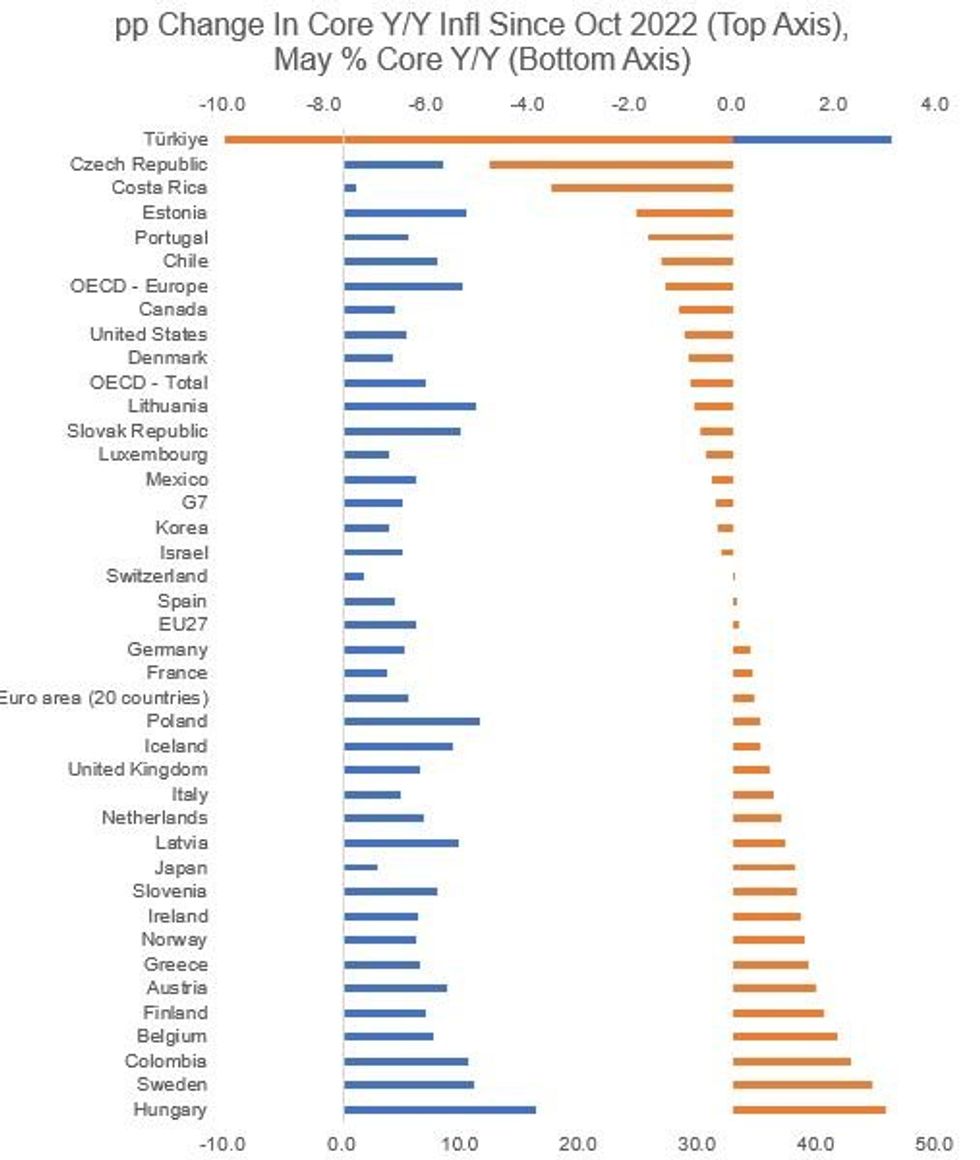

OECD: Divergence In Core Inflation Progress Since Global Peak

Since the October 2022 OECD inflation peak, there has been only mixed progress on core inflation, with the US making noticeable strides, and Western Europe lagging.

- The OECD report showed headline inflation declining Y/Y in May in all countries except the Netherlands, Norway, and the UK - but on core a total of 9 countries saw an uptick Y/Y (including Japan, but the UK and Sweden saw the biggest, up 0.3/0.4pp).

- The highest OECD inflation rates in May were observed in Hungary and Turkiye (20+%), with the lowest (<3%) including Denmark, Greece, and Costa Rica.

- On core: Turkiye and Hungary still lead the pack (46.2% and 16.2% respectively in May), one key divergence being that the former is down the most since the OECD core peak in Oct 2022 (-25pp), while the latter has seen the biggest rise (3pp) in that period. Sweden (+2.7pp), Colombia (+2.3pp), Belgium (+2.0pp), and Finland (+1.8pp) round out the biggest increases in core.

- Switzerland and Costa Rica were the only OECD members registering below 2% core in May (1.6% and 1.1% respectively).

- Looking at the G7, all countries came in below the OECD CPI core inflation aggregate of 6.9% in April, with the closest call being the UK which was the only G7 country to see core inflation tick up in May (to 6.5%) vs April.

- With flash June data in hand we know the eurozone core Y/Y figure ticked higher slightly last month, but that's largely due to base effects from June 2022. EZ core momentum is slowing but perhaps not quickly enough for comfort.

Source: OECD, MNI Calculations

Source: OECD, MNI Calculations

FOREX: Independence Day Keeps Lid on Volumes, General Activity

- Sanguine Independence Day trade kept currency markets generally muted, with futures volumes indicating market activity running at about 50% of usual daily average.

- Prices generally respected recent ranges, however EUR and USD underperformed most others in G10. Strength across oil and commodity markets helped boost the likes of AUD and CAD, which extended recent corrective recoveries.

- The overarching trend outlook for AUDUSD remains bearish following recent weakness and the extension of the reversal that started Jun 16. The pair has traded below the 20- and 50-day EMAs, suggesting scope for a deeper retracement. A continuation lower would open 0.6562, 76.4% of the May 31 - Jun 16 rally, Initial firm resistance is at 0.6721, the Jun 27 high. The latest bounce is likely a correction.

- Regional PMI data takes focus across Asia-Pacific hours, with Australia, Japan, China and India all seeing June PMI updates. European territories and US follow later in the day, alongside Eurozone PPI, the latest consumer sentiment survey from the ECB and May factory orders. ECB's Nagel, Visco, Villeroy and de Cos are set to speak ahead of the FOMC minutes.

Expiries for Jul05 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E2.2bln), $1.1000(E1.4bln)

- USD/JPY: Y145.25($680mln)

- GBP/USD: $1.2530(Gbp736mln), $1.2565-75(Gbp1.2bln)

- USD/CNY: Cny7.2000($1.6bln)

US STOCKS: Stalling For A Second Day Amidst Holiday-Thinned Trade

- The S&P E-mini has seen a particularly narrow range of just 7.5pts today in holiday-thinned trade, currently -0.04% at 4490.5 to fade European equities closing lower (FTSE 100 -0.16%, DAX -0.26%).

- It’s the second consecutive day of no notable change having consolidated Friday’s shunt higher into month/quarter-end despite month-end extensions indicating a need for a rotation into bonds.

- Friday’s increase pushed above its bull trigger at 4493.75 (Jun 16 high) with a high of 4498 (Jun 30 high) after which lies 4532.08 (2.236 proj of May 4-19-24 price swing). Tomorrow’s return to more typical market activity could provide more of a test of this clearance with the FOMC minutes eyed.

COMMODITIES: Crude Oil Spurred Day After Saudi And Russia Cuts

- Crude has consistently climbed today for solid gains the day after the pledged Saudi Arabia 1mbpd output cut into August from yesterday providing some support to offset ongoing economic growth fears. Announced yesterday, the news was further supported by the announced 500kbpd cut to Russia exports in August.

- The day’s gains go against more bearish technical developments though.

- WTI is +2.05% at $71.22, still off resistance at $72.72 (Jun 21 high) whilst support is seen at $66.96. Particularly thin holiday trade sees the most active trade in CLQ3 options at $75/bbl calls.

- Brent is +2.1% at $76.25, still off resistance at $77.25 (Jun 21 high) whilst support is seen at $71.43 (May 31 low).

- Gold is +0.15% at $1924.77 having again pulled back after a trip past $1930 before it could more meaningfully test resistance at the 20-day EMA of $1933.9. Gains are considered corrective with support at $1893.1 (Jun 29 low).

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/07/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/07/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/07/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 05/07/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/07/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/07/2023 | 0700/0300 | * |  | TR | Turkey CPI |

| 05/07/2023 | 0715/0915 | ** |  | ES | S&P Global Services PMI (f) |

| 05/07/2023 | 0745/0945 | ** |  | IT | S&P Global Services PMI (f) |

| 05/07/2023 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/07/2023 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/07/2023 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/07/2023 | 0830/0930 | ** |  | UK | S&P Global Services PMI (Final) |

| 05/07/2023 | 0900/1100 | ** |  | EU | PPI |

| 05/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/07/2023 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 05/07/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 05/07/2023 | 1800/1400 | * |  | US | FOMC Statement |

| 05/07/2023 | 2000/1600 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.