-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA MARKETS ANALYSIS: Chicago PMI Rises, Still Soft

- MNI US-CHINA: US Commerce Sec Raimondo To Visit China In August

- MNI SECURITY: US State Dept: US Officials To Attend Ukraine Peace In Saudi Arabia

- MNI ITALY: China Talks Up BRI Links As Minister Calls For End To Participation:

- MNI SECURITY: Israel Downplays Normalization Talks - Riyadh To Host UKR Peace Talks

US TSYS: Tsy Borrowing Est's Larger Than Expected

- Treasury futures remain in positive territory, well off mid-session highs after the Tsy anncd larger than expected Q3 issuance of $1.007 trillion in privately-held net marketable debt in the third quarter and an additional USD852 billion in the fourth quarter.

- Treasury's third quarter estimate is USD274 billion more than previously announced in May, primarily due to a low cash balance at the start of the quarter. Adjusted for changing cash balance levels, third quarter borrowing is expected to be the greatest quarterly borrowing on record.

- Reminder, the Treasury's quarterly refunding, which is expected to show coupon increases, will be released at 8:30 a.m. August 2.

- Meanwhile, lending standards saw another quarter of tightening across the board through Q2, for the most part either at a accelerated pace than was the case with the April release or showing a similar trend.

- Earlier data: The Chicago Business Barometer™, produced with MNI, ticked up by 1.3 points to 42.8 in July, the second consecutive monthly increase. However, with the exception of Prices Paid, all of the sub-indices remain in contractive territory (sub-50).

- Focus turns to ISMs on Tue (Mfg 46.98 est, prices paid 44.0 est), ADP on Wednesday (+188k est vs. 497k prior), and July employment data next Friday, current estimate of +200k job gains vs. +209k in June.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00026 to 5.31784 (+.02011 total last wk)

- 3M -0.00659 to 5.36532 (+.02070 total last wk)

- 6M -0.01487 to 5.43313 (+.01957 total last wk)

- 12M -0.02476 to 5.38312 (+.04638 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $106B

- Daily Overnight Bank Funding Rate: 5.32% volume: $258B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.419T

- Broad General Collateral Rate (BGCR): 5.28%, $597B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $574B

- (rate, volume levels reflect prior session)

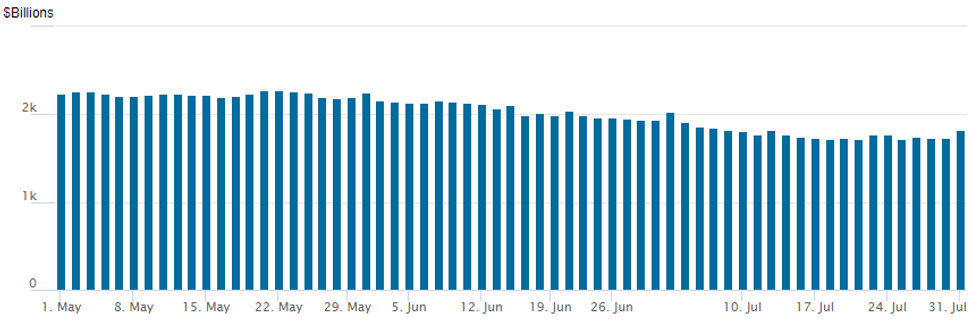

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation rebounds to $1,821.124B, w/105 counterparties, compared to $1,730.227B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TREASURY OPTION SUMMARY

Two-way trade carried over from overnight, positioning ahead of Friday's July employment data. Underlying Tsy and SOFR futures mildly higher while rate hike projections through year-end remain muted.

- SOFR Options:

- Block, 5,000 SFRZ3 94.06/94.18 put spds, 1.0 ref 94.625

- 5,000 SFRV3 94.75/95.25 call spds

- 2,000 SFRH4 93.75/94.00 put spds, 1.5 ref 94.84

- 1,000 2QQ3 96.87/97.12 3x2 call spds ref 96.365

- 3,000 OQU3 95.25/95.62 put spds vs. 2QU3 96.00/96.37 put spds

- 1,500 OQQ3 95.12/95.50 1x2 put spds vs. 2QQ3 96.31 puts

- Treasury Options:

- 5,000 FVU3 104.75/106 put spds

- over 9,000 TYU3 114.5 calls, 5 last ref 111-14.5

- 2,300 FVZ3 105.5 puts, 36 ref 107-12.75

- 3,000 TYU3 108/109 put spds, 5 ref 111-14

- 2,000 USU3 119 puts, 14 ref 124-16

- over 10,000 TYU3 109 puts, 10 last

- over 5,000 TYU3 109/110 put spds, 9 last ref 111-17

- Block 2,100 TUU3 101 puts, 4.5 ref 101-17

- 2,000 FVU3 106.5 puts, 29.5 ref 106-25.25

- over 3,000 TYU3 112 calls, 33 last

- 1,500 TYU3 113 calls ref 111-08

- 1,500 USV3 116/118/119/121 put condors ref 124-13

- over 5,100 FVV3 108 calls, 35.5 last

- over 2,800 FVU3106.5 puts, 35 last

- over 2,500 FVU3 107 calls, 31.5 last

EGBs-GILTS CASH CLOSE: Shrugging Off Sticky Eurozone Core Inflation

The German curve twist steepened while the UK's twist flattened Monday.

- Eurozone flash July inflation reading was the highlight of the European schedule, and showed a slight upside surprise on core vs survey - but were largely in-line based on national-level prints and had little lasting impact.

- Afternoon trade proved slightly more constructive, as US Treasuries gained (in part after softer-than-expected MNI Chicago PMI data).

- Schatz yields closed slightly lower, in contrast to UK 2Y yields ticking higher (note that ECB terminal hike expectations rose 1bp on the day, but BoE was up 6bp ahead of Thursday's MPC decision).

- Further down the curve, 10Y Bund yields closed unchanged, with its UK counterpart seeing a 2bp dip in yields.

- Greece outperformed on the periphery, potentially on the prospective achievement of investment grade status with Scope Ratings on Friday following Japan's R&I move today (although neither impacts ECB purchase/bond index inclusion).

- Tuesday morning brings final manufacturing PMIs and German labour market data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at 3.038%, 5-Yr is down 0.9bps at 2.536%, 10-Yr is unchanged at 2.492%, and 30-Yr is up 0.1bps at 2.57%.

- UK: The 2-Yr yield is up 1.2bps at 5%, 5-Yr is down 1.8bps at 4.394%, 10-Yr is down 1.7bps at 4.309%, and 30-Yr is down 1.9bps at 4.462%.

- Italian BTP spread down 1.2bps at 161bps / Greek down 6.6bps at 126.9bps

EGB Options Primarily Upside Rate Plays To Start The Week

Monday's Europe rates / bond options flow included:

- 3RU3 96.75/97.00/97.62/97.87c condor, bought for 19 and 19.25 in 6.5k

- ERU3 96.12/96.37/96.50 broken c fly, bought for 8.5 in 4k (ref 96.175).

- ERU4 98/99cs, bought for 7.5 in 4k

- 3RU3 96.75/97.00/97.62/97.87c condor, bought for 19 and 19.25 in 6.5k

- Buys SFIZ3 94.15/94.40/94.65 call fly vs selling 93.50/93.40 put spread -bought for 3.5 in 4k

FOREX: AUDJPY Rises 1.8% Amid BOJ Bond Purchase Operation, Focus Turns To RBA

- The Japanese Yen remains softer against all others in G10 on Monday, falling on the back of an unexpected BoJ operation to curb a rise in local bond yields. The Bank's operation was the first of its kind since February, intervening by buying as much as $2bln in JGBs at market rates.

- USDJPY (+0.78%) spiked in response and eventually traded to a high of 142.68 before consolidating just north of 142.00 for the majority of the US session. Price action leaves the pair at the highest since early July, narrowing the gap with the key bull trigger and medium-term resistance at 145.07.

- More impressive was the move in AUDJPY and NZDJPY, rising by 1.8% and 1.6% respectively. Antipodean currency strength comes ahead of Tuesday’s RBA rate decision, at which the bank is seen raising rates by 25bps to 4.35%. The moves also follow the mixed China PMI releases overnight. The official PMIs, in aggregate, suggest China's economy lost momentum in July, with the composite index slipping to 51.1 (from 52.3). However, the manufacturing reading beat expectations, with some positive details as well. The market may also be looking through the weaker services read, given efforts in recent weeks to boost consumption growth and potentially easier housing market restrictions.

- In similar vein, the Canadian dollar has also rallied around half a percent, alongside similar advances for both SEK and NOK, amid constructive price action for crude futures. Both the Euro and the USD index have had traded in tight ranges on Monday, with little impact from month-end rebalancing.

- Elsewhere in emerging markets, it is worth noting the Chilean Peso is 1.35% lower against the dollar following a more aggressive-than-expected 100bp rate cut late Friday.

- Aside from the RBA decision, Tuesday’s docket is highlighted by US July ISM Manufacturing PMI and JOLTS Job Openings.

FX Expiries for Aug01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000-10(E896mln), $1.1030-50(E3.4bln), $1.1100(E1.5bln), $1.1180(E615mln), $1.1200(E1.5bln)

- USD/JPY: Y142.00($1.3bln), Y142.50($590mln), Y143.90-00($590mln)

- GBP/USD: $1.2850-63(Gbp837mln)

- USD/CNY: Cny7.1500($1.5bln)

Late Equities Roundup: Health Care, Communication Services Lagging

- Stocks are trading mixed in late trade, SPX see-sawing back near modest session lows. Currently, DJIA is up 5.19 points (0.01%) at 35460.95, S&P E-Mini futures down 1.75 points (-0.04%) at 4604.25, Nasdaq up 3.6 points (0%) at 14318.27.

- Laggers: Health Care, Consumer Staples and Communication Services sectors underperform in the second half. Pharmaceuticals and Biotech shares weighed on Health Care: JNJ -4.25% after a judge rejected the companies effort to limit talc-related lawsuits over the weekend. Meanwhile, Waters Corp -4.15%, Mettler-Toledo -3.86% in the second half. Food and drink shares weighed on staples while T-Mobile -2.2% weighed on Communication Services after reporting mixed earning/guidance last Friday.

- Leading gainers: Energy, Real Estate and Materials sectors outperformed Monday. Oil and Gas shares outperformed equipment/services providers as crude prices continued to gain (WTI + 1.20 at 81.78): Chevron +3.15%, Exxon +2.87%, Devon Energy +2.0%.. Metals and mining shares buoyed the Materials sector: Steel Dynamics +2.5%, Nucor +2.35%.

- Technicals: E-mini S&P contract traded to a high of 4634.50 last Thursday before reversing. This highlights a possible short-term bearish signal. Price has found resistance at the top of a bull channel drawn from the Mar 13 low - the channel top is at 4643.65 today. An extension lower would expose the 20-day EMA - at 4534.05 and a break of this level would strengthen bearish conditions. Clearance of the channel top is required to resume the uptrend.

E-MINI S&P TECHS: (U3) Channel Resistance Still Intact

- RES 4: 4718.87 3.0% 10-dma envelope

- RES 3: 4670.25 2.00 proj of the Jun 26 - 20 - Jul 7 price swing

- RES 2: 4643.65 Bull channel top

- RES 1: 4634.50 High Jul 27

- PRICE: 4615.75 @ 14:18 BST Jul 31

- SUP 1: 4534.05 20-day EMA

- SUP 2: 4470.00 Low Jul 12

- SUP 3: 4432.24 50-day EMA

- SUP 4: 4397.06 Bull channel base drawn from the Mar 13 low

The E-mini S&P contract traded to a high of 4634.50 last Thursday before reversing. This highlights a possible short-term bearish signal. Price has found resistance at the top of a bull channel drawn from the Mar 13 low - the channel top is at 4643.65 today. An extension lower would expose the 20-day EMA - at 4534.05 and a break of this level would strengthen bearish conditions. Clearance of the channel top is required to resume the uptrend.

COMMODITIES: WTI Clears Key Resistance For YTD Highs

- Crude prices have seen additional gains today and a further clearing of resistance as signs of further supply tightening from Saudi Arabia and stronger oil demand from Chinese support prices.

- The latest Bloomberg survey and Goldman Sachs note suggested Saudi Arabia will extend its 1mbpd voluntary output cuts into September, whilst a Reuters survey suggested OPEC crude output fell by 840kbpd MoM to 27.34mbpd in July.

- GS said global oil demand has risen to an all-time high in July of 102.8mb/d and revised 2023 demand by around 550kb/d. It sees solid demand driving a larger-than-expected 1.8mb/d deficit in the second half this year. Goldman’s Currie said in an interview the largest factor behind the latest oil price rally is Chinese demand.

- WTI (CLU3) is +1.6% at $81.88 having pierced key resistance at $81.44 (Apr 12/13 highs) and then $81.75 (Jun 23 high) to open 2022 lows with $83.59 (Jul 11, 2022 high).

- Brent is +0.7% at $85.56 off an earlier high of $85.79 which stopped just short of testing resistance at $85.60 (Jan 27 high) after which lies the key $86.18 (Jan 23 high).

- Gold is +0.4% at $1966.62 and has gained strongly despite coming off earlier highs, considering a net push higher in the USD index and only a small dip in Treasury yields. Resistance remains at the bull trigger of $1987.5 (Jul 20 high).

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 01/08/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 01/08/2023 | 2350/0850 | * |  | JP | labor forcer survey |

| 01/08/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/08/2023 | 0130/1130 | * |  | AU | Building Approvals |

| 01/08/2023 | 0130/1130 | ** |  | AU | Lending Finance Details |

| 01/08/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/08/2023 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 01/08/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/08/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 01/08/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/08/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/08/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 01/08/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 01/08/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 01/08/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/08/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/08/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/08/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 01/08/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 01/08/2023 | 1400/1000 |  | US | Chicago Fed's Austan Goolsbee | |

| 01/08/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 01/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 02/08/2023 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.