-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Covid Surge Saps Risk Appetite

HIGHLIGHTS

- US TO REQUIRE NEGATIVE COVID TEST FOR TRAVELERS FROM CHINA, Bbg

- MILAN REPORTS 50% PASSENGERS WITH COVID IN FLIGHTS FROM CHINA, Bbg

US TSYS: Covid Curbs Back On

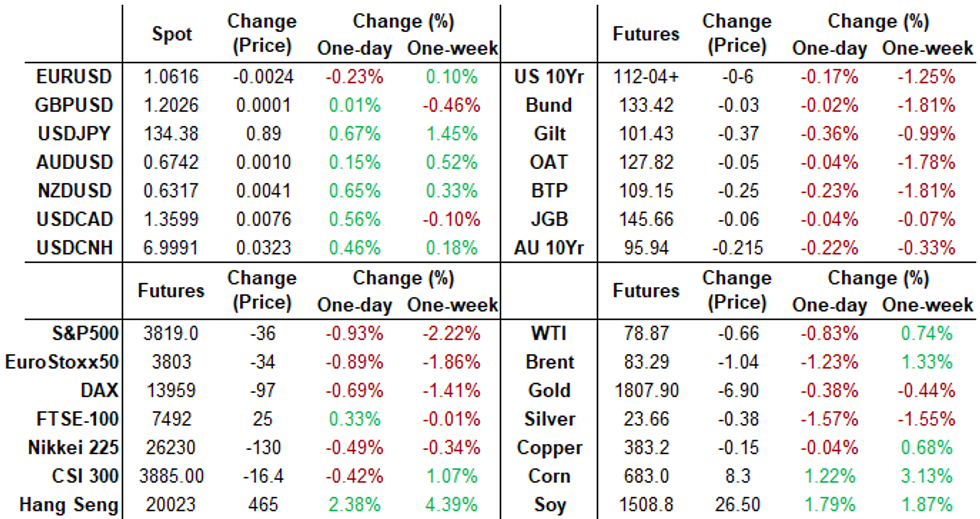

Tsys finishing well off early session highs, near midday lows on light holiday volumes (TYH3 appr 675k by the close - had started the session around 300k).

Markets see-sawed lower following mixed midmorning data:

- Pending Home Sales much weaker than expected at -4.0% MoM vs. -1.0% est (YoY -38.6% vs -36.7% prior); Richmond Fed Index much stronger than expected at +1 vs -10 est.

- Mkt optimism over China reopening faded as covid infections surged (MILAN REPORTS 50% PASSENGERS WITH COVID IN FLIGHTS FROM CHINA, Bbg; US TO REQUIRE NEGATIVE COVID TEST FOR TRAVELERS FROM CHINA, Bbg).

- Carry-over curve steepening through the session: 2s10s +6.476 at -47.469, least inverted lvl since mid-November amid fair amount of unwinds in crowded flattener positions going into year end.

- Fed funds futures have the policy rate peaking at under 5% by mid-'23 and then receding to around 4.5% by year-end - expectation of rate cuts in late 2023 potentially overpriced.

- Tsy futures dip slightly after $43B 5Y note auction (91282CGC9) tail: 3.973% high yield vs. 3.970% WI; 2.46x bid-to-cover vs. 2.39x the prior month. US Tsy $35B 7Y Note auction Thu (91282CGB1).

SHORT TERM RATES

US DOLLAR LIBOR: Settlements resume with London back from extended Christmas holiday:

- O/N -0.00028 to 4.31643% (-0.00029 total last wk)

- 1M -0.00329 to 4.38357% (+0.03400 total last wk)

- 3M +0.00343 to 4.72986% (-0.01943 total last wk)*/**

- 6M -0.00200 to 5.15114% (-0.03372 total last wk)

- 12M +0.02643 to 5.47029% (-0.03500 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 4.33% volume: $109B

- Daily Overnight Bank Funding Rate: 4.32% volume: $277B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.048T

- Broad General Collateral Rate (BGCR): 4.27%, $389B

- Tri-Party General Collateral Rate (TGCR): 4.26%, $361B

- (rate, volume levels reflect prior session)

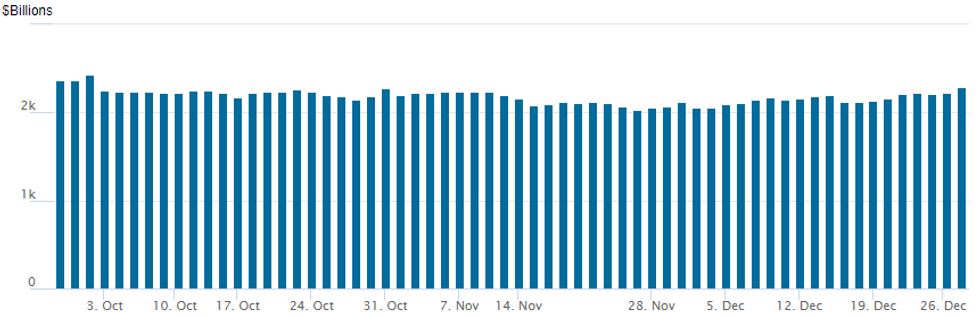

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,293.003B w/ 104 counterparties vs. $2,221.259B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Light holiday volume revolved around low delta puts in Tsy 10Y, Eurodollar and SOFR options Wednesday, largely traded prior to underlying futures giving up early gains to weaker in the second half.- SOFR Options:

- +4,000 SFRM3 94.68/94.75 put spds, 1.75

- Block, 5,000 SFRF 94.81/94.93/95.06 put flys, 2.0 ref 95.11

- -15,000 2QH 97.37/97.62/97.75 call flys, 2.0 vs. 96.735/0.05%

- -1,200 SFRZ4 97.00 straddles, 162.5

- 2,500 OQF3 96.25 calls, 4.5 ref 95.935

- 2,000 OQJ3 96.75/97.00 call spds ref 96.31

- Eurodollar Options:

- 4,000 EDM3 94.75 puts, 18.5 ref 94.87-.875

- Treasury Options:

- 2,500 FVH 107/109 strangles, 107 ref 107-30

- 2,500 TYH 110.5/111.5 put spds, 26 ref 112-09.5

- 2,000 FVG 103.5 puts, 1 ref 107-30.75

- 4,000 TYG 116.5 calls, 5 ref 112-15.5

- 3,000 TYG 117.5 calls, 3 ref 112-16.5

- 5,000 wk5 TY 112.25 puts, 10 ref 112-20

- 1,500 TYG 109.75 puts ref 112-17.5

- 4,000 TYH 107.5/108/109 broken put flys ref 112-16 to -16.5

- 1,250 TYG 111 puts vs 112.75/114 call spds, 0.0 ref 112-16.5

EGB/ Gilts: Bunds Retrace Half Earlier Gains; Gilts Steady

- Bunds ground higher through the European morning session, with futures moving from a low of 133.29 in the Asian session to a high of 134.11 around when the US came in. However, more than 50% of the intraday move was retraced in early afternoon trading. 10-year Bund yields now stand 2.8bp lower on the day but 9.7bp higher than the pre-Christmas closing level. This is not a million miles from the 9.1bp increase in 10-year UST yields seen this week but the German curve has steepened much more with Schatz yields up just 1.9bp in 2-days versus 5.4bp for 2-year USTs.

- Peripheral spreads have widened with 10-year BTP-Bund spreads around 6.5bp wider on the day at writing.

- Gilts had been the big movers on their open, catching up with some of the moves seen yesterday in Bunds and Treasuries. Yields across the curve were over 10bp higher on the day at one point with a parallel curve shift, but 10-year yields are now up around 3.3bp on the day with a steeper curve (2-year gilt yields up 2.2bp).

- There has been very little in the way of domestic European drivers, and with little liquidity in the holiday period some of the moves have been exaggerated.

Late Equity Roundup: Covid Spread Saps Risk Appetite

Major indexes look to finish the session weaker after posting modest gains through midmorning as optimism about China reopening faded as covid infections surged (MILAN REPORTS 50% PASSENGERS WITH COVID IN FLIGHTS FROM CHINA, Bbg). Off noon lows, SPX eminis currently trade -29 (-0.75%) at 3826; DJIA -196.94 (-0.59%) at 33044.11; Nasdaq -102.4 (-1%) at 10250.77.

- SPX leading/lagging sectors: Energy sector support over last few sessions evaporated as crude slipped lower (WTI -0.67 at 78.86), sector -1.41% w/ O&G refiners underperforming (EQT -6.49%, APA -3.99%, CTRA -3.85%). Information Technology (-1.01%) and Communication services (-1.00%) followed, software/service providers outperformed hardware and equipment makers (WDC -2.86%, AAPL -2.25%)

- Leaders: Utilities (+1.04%), Financials (+0.28%) outperformed, banks trading better (JPM +1.03%, JPM +0.90%, WFC +0.52%).

- Dow Industrials Leaders/Laggers: JPM +1.25 at 132.99, JNJ -0.08 at 177.35, United Health (UNH) -0.18 at 531.81. Laggers: Apple (AAPL) -3.03 at 127.00, Home Depot (HD) -2.63 at 316.92, Salesforce.com (CRM) -2.40 at 128.26.

E-MINI S&P (H3): Trend Outlook Remains Bearish

- RES 4: 4250.00 High Aug 26

- RES 3: 4194.25 High Sep 13 and a key resistance

- RES 2: 4043.00/4180.00 High Dec 15 / 13 and the bull trigger

- RES 1: 3936.38 50-day EMA and a key resistance

- PRICE: 3825.00 @ 1500ET Dec 28

- SUP 1: 3778.45 61.8% retracement of the Oct 13 - Dec 13 uptrend

- SUP 2: 3735.00 Low Nov 3

- SUP 3: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

- SUP 4: 3735.00 Low Oct 21

S&P E-Minis trend signals are bearish and last week’s low prints reinforce this condition. The contract is trading above its recent lows - for now. Short-term gains are considered corrective with resistance at 3936.38, the 50-day EMA. A clear break of this hurdle is required to suggest potential for a stronger recovery. On the downside, a reversal lower would confirm a resumption of the downtrend and open 3778.45, a Fibonacci retracement.

COMMODITIES

- WTI Crude Oil (front-month) down $0.72 (-0.91%) at $78.81

- Gold is down $8.2 (-0.45%) at $1805.55

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/12/2022 | 0800/0900 |  | ES | Retail Sales | |

| 29/12/2022 | 0900/1000 | ** |  | EU | M3 |

| 29/12/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 29/12/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 29/12/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 29/12/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 29/12/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 29/12/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.