-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Down-Rev's Temper Nov Jobs Gains

- MNI ISRAEL: PA Head Abbas Calls For International Peace Conference

- MNI EU: German Fin Min-Deal On Fiscal Rules Possible Before Christmas

- MNI SPAIN: Calviño Shift To EIB Leaves PM Sanchez Looking For New Economy Minister

- MNI RUSSIA: Putin Confirms 2024 Presidential Run

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Markets Roundup: Surprise Jobs Gain Tempered by Down-Revisions

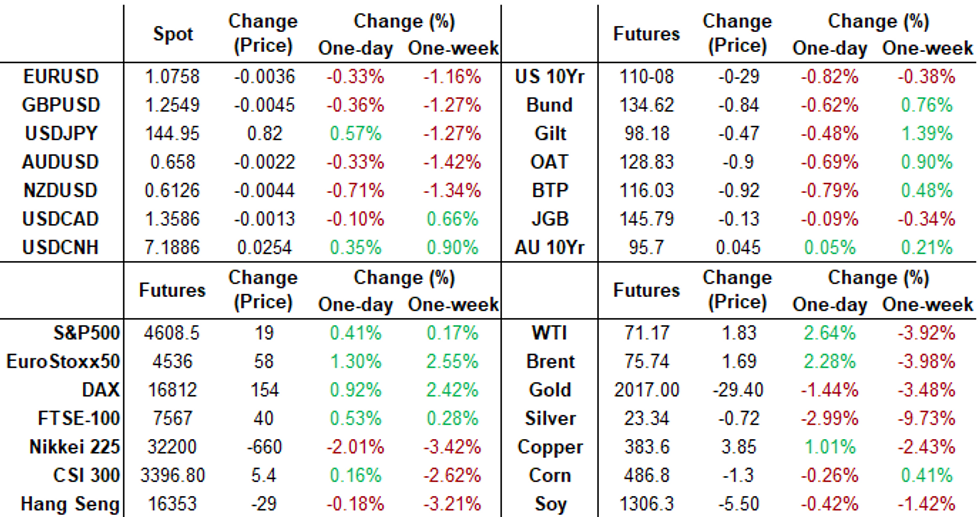

- Tsy futures gap lower after slightly stronger than expected Change in Nonfarm Payrolls (+199k vs. 183k est, +150k prior), Change in Private Payrolls softer (+150k vs.158k est, 99k prior), Unemployment Rate dips to 3.7% vs. 3.9% est.

- Futures quickly scaled back appr half the initial post-data sell-off as markets digested the down-revisions to prior and unrounded releases.

- U.S. employers added more jobs than expected in November and average hourly earnings growth was also hotter than expected, which could add to the Federal Reserve's resolve to keep rates higher for longer to cool the labor market and rein in inflation. Projected rate cut for March 2024 consolidated from -55.2% pre-data to -44.5% by the close, May 2024 down to -63.5% vs. -70.1% pre-data.

- Average hourly earnings added 0.4% in November, a tenth higher than expected and marking a gain of 4.0% over the past 12 months. The employment-to-population rate rose 0.3 percentage point as the labor force continued to expand.

- Tsys held off lows following higher than expected U. of Mich. Expectations that climbed to 66.4 vs. 57.0 est, (56.8 prior), Sentiment 69.4 vs. 62.0 est, while 1 Yr Inflation est fell to 3.1% vs. 4.3% est (4.5% prior), 5-10 Yr Inflation 2.8% vs. 3.1% est (3.2% prior).

- All relevant ahead of next Wednesday's FOMC policy announcement while markets get to see final CPI and PPI inflationary figures on Tuesday and Wednesday respectively.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00241 to 5.35498 (+0.00832/wk)

- 3M -0.00579 to 5.36604 (-0.00919/wk)

- 6M -0.00947 to 5.29211 (-0.04879/Wk)

- 12M -0.00915 to 5.02012 (-0.09829/wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.702T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $615B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $603B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $255B

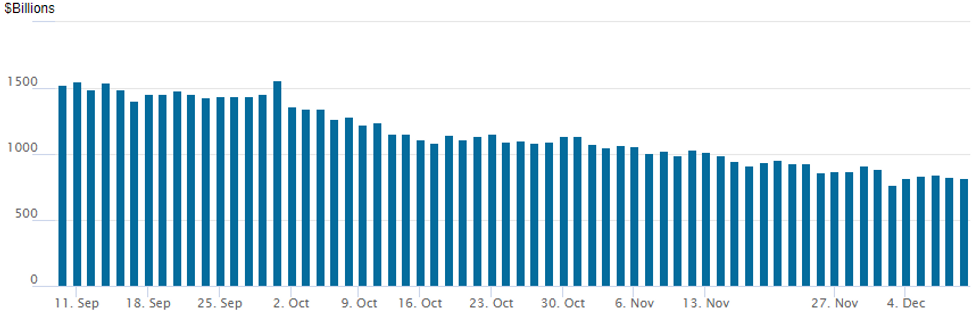

FED REVERSE REPO OPERATION

The NY Fed Reverse Repo operation usage slips to $821.408B w/ 82 counterparties vs. $825.734B yesterday. Operation usage fell to the lowest level since early July 2021 of $768.543B on December 1. Usage fell below $1T for the first time since August 2021 last on November 9 ($993.314B).

SOFR/TREASURY OPTION SUMMARY

SOFR option trade turned mixed after underlying futures sold off following stronger than expected NFP report but less hawkish than rounded figures suggested. Call flys still targeted potential rate cuts in 2024 while large put structures were also reported as projected rate cuts for early 2024 receded: December flat at 5.333%, January 2024 cumulative -.7bp at 5.323%, March 2024 chance of rate cut at -44.5% vs. -55.2% pre-data with cumulative of -11.8bp at 5.211%, May 2024 -63.5% vs. -70.1% pre-data, cumulative -27.7bp at 5.052%. Fed terminal at 5.33% in Feb'24.- SOFR Options:

- 30,000 SFRJ4 94.62/94.75/94.87/95.00 call condors, 4.0 ref 95.125

- 17,000 SFRH4 94.62/94.75 2x1 put spds w/ SFRH4 94.37/94.50 put spd, 3.5-4.0

- 3,750 SFRH4 94.62/94.75/94.87 put flys, ref 94.81

- Block, 10,000 SFRF4 94.68/95.18 call spds, 11.25/splits ref 94.81

- Block, 5,000 SFRH4 94.75/95.00strangles, 17.0 ref 94.80

- Block, 50,000 SFRJ4 94.37/94.75/94.81/95.00 broken put condors, 3.25

- 2,000 SFRF4 94.68/94.75/94.81 put flys

- 15,000 0QZ3 95.62 puts, 4.0 ref 95.89

- Block, 3,000 0QM4 97.00 calls, 24.0 ref 96.405

- Block, 5,000 SHRH4 94.25 puts, 1.25 ref 94.865

- Block, 7,000 2QH4 97.12/97.87 call spds 8.5 vs. 96.555/0.17%

- 2,000 SFRF4 94.93/95.00 call spds ref 94.865

- 2,000 SFRH4 94.75/94.87/95.00 call flys

- 5,000 SFRH4 94.87/95.00/95.12/95.25 call condors ref 94.87

- Block, 4,000 2QH4 96.87/97.87 call spds, 15.5 vs. 96.57/0.28%

- 1,500 SFRF4 94.75/94.81 2x1 put spds

- 4,000 0QZ3 95.75 puts ref 95.915

- 3,000 0QZ3 95.56/95.68/95.75/95.87 put condors, ref 95.925

- Treasury Options:

- Block, 3,000 TYH4 108.5/111 strangles on a 4x3 ratio

- 5,000 TYF4 108.5/110 put spds 29 ref 110-10

- 6,000 TYF 108.75 puts, 10 ref 110-24 to -24.5

- Update 12,000 TYF4 108.25/109.25 put spds ref 110-24.5 to -22.5

- 3,000 wk2 TY 111.5/112 call spds, 2 ref 110-24

- 4,400 wk2 FV 107/108.25 strangles, 9.5 ref 107-11.25 (expire today)

- 1,000 wk3 TY 109.75/110 2x3 put spds ref 110-26

- 2,000 TYF4 110 puts, 27 ref 110-31

- Block: 6,050 TYF4 108.5/109.5 put spds, 12 ref 110-31

EGBs-GILTS CASH CLOSE: Core FI Gains Pared In Otherwise Strong Week

European yields rose sharply Friday, paring gains made earlier in the week but still mostly ending the week lower.

- After trending higher for most of the morning session, Bund and Gilt yields jumped in the afternoon as the highly anticipated US jobs report came in stronger than expected on both the unemployment rate and hourly earnings measures.

- ECB and BoE cut pricing for 2024 was reduced, sharply in the case of the ECB's (135bp of 2024 reductions implied, vs 143bp Thursday).

- The German curve closed bear flatter, with the UK's relatively flat. Periphery EGB spreads widened as ECB cut pricing was pared back.

- On the week, spurred by dovish ECB commentary for the most part, 10Y Bund yields dropped 9bp, having dropped 19bp at one point. Gilt yields fell 10bp on the week, vs 20bp at the lows.

- Next week's schedule is extraordinarily busy: in addition to the ECB and BoE decisions, we also get the Fed and US CPI.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.7bps at 2.693%, 5-Yr is up 9.7bps at 2.234%, 10-Yr is up 8.5bps at 2.276%, and 30-Yr is up 6.6bps at 2.468%.

- UK: The 2-Yr yield is up 7.3bps at 4.59%, 5-Yr is up 8.1bps at 4.11%, 10-Yr is up 7.3bps at 4.041%, and 30-Yr is up 6.6bps at 4.526%.

- Italian BTP spread up 5.1bps at 179.7bps / Spanish up 2.1bps at 102.4bps

EGB Options: Put Structures En Vogue To End The Week

Friday's Europe rates/bond options flow included:

- DUF4 106.00/105.80/105.60p fly, bought for 3 and 3.5 in 4k

- ERH4 96.25/96.12ps 1x2, bought for 1.75 in 3.5k

- ERM4 96.50/96.25/96.00p fly, bought for 4.25 in 8k

- ERM4 96.37/96.25/96.00p ladder, sold at 1 in 2.5k.

FOREX USD Index Firms, Underpinned by Solid Jobs Report

- The USD index has rallied the best part of half a percent on Friday, underpinned by both a recovery/stabilisation for USDJPY and a firm US jobs report that saw a higher-than-expected change in nonfarm payrolls and the unemployment rate edge down to 3.7%.

- The daily changes do not do justice to the aggressive intra-day price action across the G10 FX space. In particular USDJPY traded in a very volatile manner once more, although the 271-pip range fortunately stayed well within Thursday’s extremes. Over the data, the higher jobs figure and average hourly earning prompted USDJPY to trade as highs as 145.21, although the pair swiftly reversed course as the finer details of the rounded earnings data was not as hawkish as on first glance. With thoughts of yesterday’s collapse fresh on the mind, USDJPY sold off down to 143.76 in short order before stabilising.

- UMich data saw sentiment rise and inflation expectations fall which offered a further reprieve for the greenback and has translated into the 0.5% advance for the index. Overall, this equals the rally on the week as the dollar extends its recovery from the late-November lows.

- Underperfoming on the session was NZD (-0.71%), whereas the Canadian dollar showed relative resilience, rising 0.1% against the USD. The recent break of trendline support for USDCAD, drawn from the Jul 14 low, strengthens the current downtrend and signals scope for a continuation lower near-term.

- A busy macro calendar next week with three major central bank decisions (Fed, ECB & BOE) alongside US CPI, US Nov retail sales, Euro area & US December Flash PMI's.

FX Expiries for Dec11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0720-30(E2.1bln), $1.0745-60(E756mln), $1.0780-00(E976mln)

- USD/JPY: Y144.05-25($951mln), Y145.00($500mln), Y146.00($852mln), Y147.00($1.3bln), Y148.30-50($1.3bln)

- GBP/USD: $1.2610-15(Gbp548mln)

- AUD/USD: $0.6550(A$895mln), $0.6600(A$548mln)

- USD/CAD: C$1.3550-60($530mln), C$1.3575-80($530mln)

Late Equity Roundup: Energy, IT Shares Outperform

- Stocks are breaching early session highs in late trade after recovering from post-NFP knee-jerk selling: at the highest level since early August S&P E-Mini futures are up 20.5 points (0.45%) at 4610, Nasdaq up 75.4 points (0.5%) at 14415.48, DJIA up 138.46 points (0.38%) at 36255.2.

- Leading gainers: Energy and Information Technology sector shares lead gainers in the second half, gas storage and transportation shares outpaced equipment and service shares: Targa Resources +1.96%, Williams +1.63%, ONEOK +1.43%.

- Meanwhile, Information Technology sector shares followed: Qorvo +4.07%, Nvidia +2.31% and Micron +2.25%. Earlier, construction/building product shares had supported Industrials: Allegion +5.47%, Carrier Group +3.86% (anncd sale of security division for appr $5B to Honeywell).

- Laggers: Consumer Staples, Utilities and Real Estate sectors continued to underperform, household/personal product makers weighed on the former: Kimberly-Clark -1.51%, Estee Lauder -1.49%, Church & Dwight -1.36%.

- Electricity/gas providers weighing on Utilities: Alliant Energy -1.12%, Atmos Energy -107%Xcel Energy -1%. Real Estate Investment Trusts, particularly office and specialized REITs weighed on Real Estate: SBA Comm -2.84%, Alexandria Real Estate -2.04%, Boston Properties -0.68%.

E-MINI S&P TECHS: (Z3) Trend Needle Continues To Point North

- RES 4: 4700.00 Round number resistance

- RES 3: 4685.25 High Jul 27 and the bull trigger

- RES 2: 4644.75 High Aug 2

- RES 1: 4611.50 Intraday High Dec 8

- PRICE: 4609.75 @ 1500ET Dec 8

- SUP 1: 4525.42 20-day EMA

- SUP 2: 4462.25 50-day EMA

- SUP 3: 4420.25.25 Low Nov 14

- SUP 4: 4354.25 Low Nov 10

A bullish theme in S&P e-minis remains intact and the contract continues to trade closer to its recent highs. Since the October 27 reversal, corrections have been shallow - this is a bullish signal. Note too that moving average studies are in a bull-mode position, highlighting positive market sentiment. A resumption of gains would signal scope for a climb towards 4644.75, the Aug 2 high. Initial support lies at 4525.42, the 20-day EMA.

COMMODITIES WTI Rebounds But Can’t Prevent Weekly Decline, Gold Tumbles Post-Payrolls

- WTI has rebounded today after hitting lowest levels since late June yesterday. However, crude remains around 3.8% down on the start of the week as strong non-OPEC supply and fears around OPEC+ voluntary cut commitments breed bearish sentiment.

- The day’s gains were supported from a macro backdrop by an on balance stronger than expected payrolls report and stronger consumer sentiment.

- US oil and gas rig count rose by 1 to 626 rigs, according to Baker Hughes Dec. 8, the highest since the week ending Sep. 22. Oil rig count: -1 to 503

- The US Energy Department is seeking to buy 3mn bbl of crude for the US SPR with March delivery according to an official solicitation.

- OPEC+ output fell by 110k bpd in November m/m to 42.6mn bpd according to a Platts survey.

- WTI is +2.7% at $71.21, pushing back closer to resistance at $72.37 (Nov 16 low).

- Brent is +2.4% at $75.79 vs resistance at $79.73 (20-day EMA).

- Gold is -1.4% at $2000.64 off a low of $1994.73 having seen sustained downward pressure since the payrolls report. It’s pushed through support at $2007.5 (20-day EMA) to open $1975.0 (50-day EMA). It’s a week that started with a spike to an all-time high of $2135.39 first thing in Monday Asia trading.

- Weekly moves: WTI -3.9%, Brent -3.9%, Gold -3.5%, US HH nat gas -8.8%, EU TTF nat gas -11.3%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/12/2023 | 0700/0800 | *** |  | NO | CPI Norway |

| 11/12/2023 | - | *** |  | CN | Money Supply |

| 11/12/2023 | - | *** |  | CN | New Loans |

| 11/12/2023 | - | *** |  | CN | Social Financing |

| 11/12/2023 | 1600/1100 | ** |  | US | NY Fed Survey of Consumer Expectations |

| 11/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/12/2023 | 1630/1130 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/12/2023 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 11/12/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.