-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

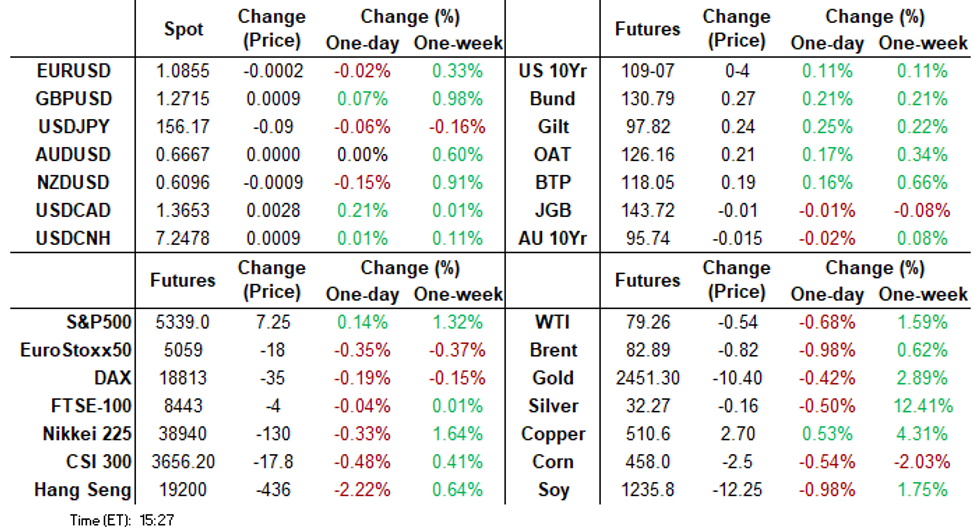

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI ASIA MARKETS ANALYSIS: Focus on May 1 FOMC Minutes, UK CPI

- Treasuries rebounded from Monday's losses Tuesday, taking the dovish side of two-way comments from Fed Gov Waller.

- Waller said the Fed wants to see several more months of good inflation data before cutting rates, but conceded the "economy now seems to be evolving closer to what the committee expected."

- Position squaring likely added to the rebound ahead of Wednesday's UK CPI data and the May 1 FOMC minutes.

US TSYS Focus Turns to May 1 FOMC Minutes

- Treasuries rebounded from Monday's losses Tuesday, taking the dovish side of two-way comments from Fed Gov Waller. Decent corporate debt issuance climbed over $12B, rate lock hedging helped constrain short cover/position squaring support.

- Recent U.S. economic data indicate high interest rates are helping to cool off demand and disinflation has likely resumed, but the Federal Reserve needs to see several more months of good inflation data before cutting rates, Governor Christopher Waller said Tuesday.

- Rate cut projections hold steady vs. late Monday: June 2024 at -5% w/ cumulative rate cut -1.2bp at 5.318%, July'24 at -20% w/ cumulative at -6.3bp at 5.267%, Sep'24 cumulative -19.9bp, Nov'24 cumulative -27.6bp, Dec'24 -43.7bp.

- Look ahead to Wednesday: May 1 FOMC Minutes, Existing Home Sales and US Tsy 20Y Bond Sale.

- The message from Chair Powell and other members since the May meeting has been a fairly emphatic "high for longer", with policy currently seen as restrictive but needing further time to work to bring inflation down.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00166 to 5.32225 (+0.00249/wk)

- 3M +0.00274 to 5.32946 (+0.00366/wk)

- 6M +0.00687 to 5.29466 (+0.01145/wk)

- 12M +0.01865 to 5.15806 (+0.03554/Wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.866T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $717B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $707B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $75B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

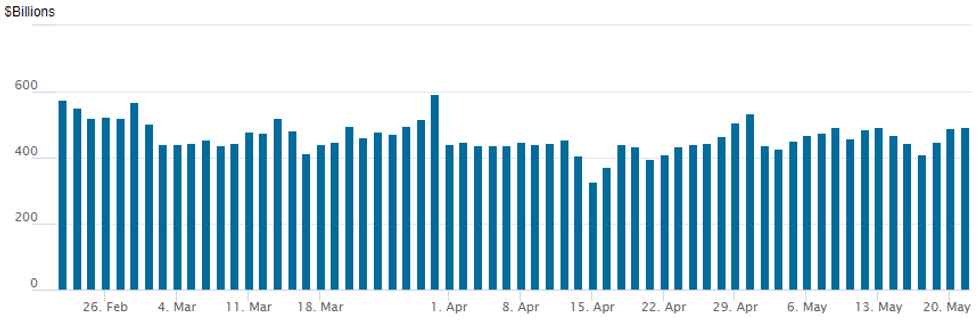

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage inches up to $491.720B from $489.728B prior; number of counterparties 81. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

SOFR/TEASURY OPTION SUMMARY

Large SOFR call spreads Blocks preceded some late put fly crosses Tuesday, 10Y vol sales fairly consistent as underlying futures rebound from Monday's selling. Rate cut projections steady vs. late Monday: June 2024 at -5% w/ cumulative rate cut -1.2bp at 5.318%, July'24 at -20% w/ cumulative at -6.3bp at 5.267%, Sep'24 cumulative -19.9bp, Nov'24 cumulative -27.6bp, Dec'24 -43.7bp.- SOFR Options:

- +5,000 2QU4/3QU4 96.50 call spd, 0.75

- Block, 20,000 SFRN4 94.75/94.87/95.00 put flys, 4.5

- Block, 20,000 SFRN4 94.81/94.87/94.93 put flys, 1.25

- -5,000 SFRZ4 94.50/94.62 2x1 put spds 1.25

- +6,000 SFRZ4 9550/9575ps 10.0 ref 95.095

- -5,000 SFRZ4 94.87 puts, 10.5 ref 95.10

- +6,000 0QZ4 95.37/95.50/95.75 2x3x1 call flys 1.5 ref 95.31

- +10,000 SFRU4 94.62/94.75/94.81 put trees 2.5 ref 94.865

- +5,000 SFRZ4 95.25/95.43/95.62 call flys, 1.5 vs 95.11/0.05%

- +10,000 0QZ4 96.25/96.75 call spds vs 2QZ4 96.37/96.75 call spds 1.25 net

- -5,000 SFRU4 94.81/0QU 95.25 put spds 1.5-1.0

- Block, +30,000 SFRZ4 95.50/96.37 call spds, 8.0 vs. 95.10/0.19%

- Block, +10,000 SFRU4 95.62 calls, 2.75 vs. 94.86/0.10%

- Block, +30,000 SFRZ4 95.50/96.00 call spds, 5.5 vs. 95.085/0.13%

- Treasury Options:

- 25,300 TYN4 108.5/110.5 strangles, 40

- 3,000 TYM4 110/110.5 call spds, ref 109-06

- Block/screen, -14,300 TYM4 109.25 straddles, 27 ref 109-05

- 1,300 USM4 119/120 call spds, ref 116-31

EGBs-GILTS CASH CLOSE: Gilts Strengthen On Eve Of Key CPI Release

Gilts outperformed Bunds Tuesday, ahead of key UK data releases Wednesday.

- Morning developments were limited, focused mainly on corporate/sovereign supply (including a solid 20Y Gilt auction), with German PPI on the soft side and a pickup in Q1 Eurozone labour costs garnering some interest ahead of Thursday's negotiated wage print.

- Global core FI was buffeted by North American developments in the afternoon, strengthening on soft Canadian CPI, but pulling back as Fed Governor Waller said it would take "several more" constructive inflation prints before he would consider rate cuts.

- In the end, gains resumed with Bund and Gilt futures hitting fresh session highs into the cash close.

- The 5Y-10Y segment outperformed on both the German and UK curves, while EGB periphery spreads widened modestly on the day.

- Attention swiftly turns to UK CPI/PPI/fiscal data early Wednesday.

- Our CPI preview is here (PDF): the MNI Markets team sees two-way risks to the MNI-compiled sell-side median for services CPI (5.47%), with slightly more upside risks to the Bloomberg consensus (5.4%).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.3bps at 2.97%, 5-Yr is down 2.9bps at 2.544%, 10-Yr is down 3bps at 2.499%, and 30-Yr is down 2.4bps at 2.642%.

- UK: The 2-Yr yield is down 3.6bps at 4.31%, 5-Yr is down 3.6bps at 4.011%, 10-Yr is down 3.9bps at 4.13%, and 30-Yr is down 3.8bps at 4.611%.

- Italian BTP spread up 1.4bps at 129.8bps / Spanish up 1.2bps at 76.7bps

FOREX CAD Pressured Following Soft CPI, G10 FX Markets Subdued Overall

- A very brief hawkish reaction to Fed Governor Waller stating that several more positive CPI readings will be required to cut rates. However, with other elements of his speech in line and a more balanced Q&A, the greenback swiftly pared this initial advance, leaving the USD index close to unchanged in an overall subdued session for G10 currencies.

- The one bit of excitement was in Canada, where a softer CPI report has prompted rate cut speculation for June to build. USDCAD is 0.20% higher on the session at 1.3650 with an overall bullish trend condition remaining intact here despite the most recent pullback.

- We also noted that EURCAD has recently broken above a cluster of highs from the past six months around 1.4780 and hovers close to the most recent highs of 1.4822. Exponential moving averages are also in a bull mode position.

- Elsewhere, NZD also underperforms ahead of tomorrow’s RBNZ decision, where the central bank will also release updated staff forecasts and hold a press conference. It is unanimously expected to leave rates at 5.5% as it is yet to be confident that inflation will sustainably return to target.

- NZDUSD did also weaken on Monday following a Q2 RBNZ survey of inflation expectations showed households saw a slightly lower median expected inflation rate for the next two years. This may have prompted some profit taking, given the solid run of form for NZD which has been supported by the optimistic risk backdrop.

- The Norwegian Krone crept higher in early trade amid the quieter markets on Tuesday. USD/NOK has so far respected support at 10.6478/10.6537, and a recovery in Brent crude prices could pose downside risks for the pair.

- As well as the RBNZ, Wednesday’s calendar is highlighted by UK inflation data and the FOMC minutes of the May meeting.

Late Equities Roundup: Utilites, Financials Outperforming

- Stocks holding mildly higher in late trade, cautious in extending recent all-time highs ahead tomorrow's key UK CPI inflation data and the May 1 FOMC minutes. Currently, the DJIA is up 20.92 points (0.05%) at 39829.47 (40073.06 high), S&P E-Minis up 3.75 points (0.07%) at 5335.5 (5348.25 high), Nasdaq up 11 points (0.1%) at 16806.01 (16804.15 high).

- Utilities and Financial sectors continued to lead gainers in late trade, shares of electricity and independent power providers outperforming: Constellation Energy +2.5%, Vistra +2.02%, CenterPoint Energy +0.93%. Banks supported the Financial sector as they recovered some ground lost on Monday: JPM +1.6% (-3.57% Monday after Dimon commented would not buy back shares at current levels), Citigroup +1.59%, Wells Fargo +1.43%.

- Laggers: Energy and Industrial sectors underperformed in late trade, oil and gas shares weighing on the former: Coterra Energy -1.86%, EQT Corp -1.19%, Marathon Oil -0.98%. Ground transportation shares weighed on the Industrials sector: JB Hunt -3.07%, Union Pacific -3.6%, CH Robinson -2.24%.

- Reminder: a few late cycle corporate earnings still expected this week: Target, Petco, Analog Devices, Toll Brothers, TJX, Synopsys, Nvidia (after market Wednesday), Autodesk, Dollar Tree Inc.

E-MINI S&P TECHS: (M4) Holding On To Its Gains

- RES 4: 5417.75 2.00 proj of the Apr 19 - 29 - May 2 price swing

- RES 3: 5400.00 Round number resistance

- RES 2: 5372.73 1.764 proj of the Apr 19 - 29 - May 2 price swing

- RES 1: 5349.00 High May 16

- PRICE: 5340.50 @ 1515 ET May 21

- SUP 1: 5229.67 20-day EMA

- SUP 2: 5179.44 50-day EMA

- SUP 3: 5036.25 Low May 2

- SUP 4: 4963.50 Low Apr 19 and bear trigger

The uptrend in S&P E-Minis remains intact and the contract is holding on to its latest gains. Recent gains have resulted in a break of a key resistance at 5333.50, Apr 1 high. This confirms a resumption of the primary uptrend and signals scope for a climb to 5372.73, a Fibonacci projection. Moving average studies remain in a bull-mode set-up, highlighting a clear uptrend. Initial support is at 5229.67, the 20-day EMA.

COMMODITIES Crude Weakens, Spot Gold, Copper Consolidate

- WTI is ending the day trading lower as the market focuses on demand outlooks and the effects of a possible delay in US Fed rate cuts.

- WTI Jun 24 is down 0.8% at $79.2/bbl.

- A bearish theme in WTI futures remains intact, with attention on $76.07 next, the Mar 11 low. Initial firm resistance to watch is at $84.46, the Apr 26 high.

- Spot gold has edged down by 0.2% to $2,420/oz on Tuesday, as the yellow metal consolidates after hitting a fresh all-time high yesterday.

- Yesterday’s initial gains resulted in a print above resistance at $2431.5, the Apr 12 high and bull trigger. The break confirms a resumption of the primary uptrend and paves the way for a climb towards 2452.5 next, a Fibonacci projection.

- On the downside, the 50-day EMA, at $2288.7, represents a key support. A clear break of it would be bearish.

- Meanwhile, copper is up by 0.6% at $511/lb, as it too consolidates just below the record high it reached in Monday’s session.

- Copper futures remain in a clear uptrend, with the contract trading through a key resistance at $503.95, the Mar 2022 high. A clear breach of this level would open $520.65, a Fibonacci projection.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/05/2024 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/05/2024 | 2300/1900 |  | US | Cleveland Fed President Loretta Mester | |

| 22/05/2024 | 2301/0001 | * |  | UK | Brightmine pay deals for whole economy |

| 22/05/2024 | 2350/0850 | ** |  | JP | Trade |

| 22/05/2024 | 2350/0850 | * |  | JP | Machinery orders |

| 22/05/2024 | 0200/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 22/05/2024 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 22/05/2024 | 0600/0700 | *** |  | UK | Producer Prices |

| 22/05/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 22/05/2024 | 0600/0800 | ** |  | SE | Unemployment |

| 22/05/2024 | 0805/1005 |  | EU | ECB's Lagarde at ESMA event on effectiveness of capital markets | |

| 22/05/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/05/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/05/2024 | 1245/1345 |  | UK | BOE's Breeden Panellist on macroprudential policies | |

| 22/05/2024 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/05/2024 | 1400/1000 | * |  | US | Services Revenues |

| 22/05/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/05/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/05/2024 | 1800/1400 | *** |  | US | FOMC Minutes |

| 23/05/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.