-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Greenback Slips Further Despite Higher US Yields

HIGHLIGHTS

- Treasuries closed early sitting 4.5-6.5bp cheaper, with post-Thanksgiving catch-up before a continued sell-off through the session helped by European FI.

- Higher yields haven't supported the USD index, which has dipped Friday for a 0.5% decline on the week as equity markets edge higher over the week (the S&P 500 near unchanged Friday).

- Crude futures meanwhile ended the session moving swiftly lower for a fifth consecutive weekly decline, with focus on next week's rescheduled OPEC+ meeting after reports of members moving closer to an agreement on production quotas.

- Highlights on the calendar next week include Australia and European CPI data, the RBNZ meeting, US growth and PCE data, the rescheduled OPEC+ meeting and Fed Chair Powell in a fireside chat on Friday.

US TSYS: Off Lows After Thanksgiving Catch-Up, Powell On The Horizon Next Week

- Cash Tsys closed 4.5-6.5bp cheaper across the curve having pared losses over the hour leading up to the early close. The intraday flattening pushed 2s10s back to -48bps off a high of -45bps in London hours, back where it started the overnight session after the Thanksgiving closure for a modest 1.5bp steepening on Wednesday.

- The latest bid came with WTI pushing lower late in the session, helped by today’s successful Israel-Hamas hostage swaps but the timing of the move suggests its more likely attributed to pre-weekend positioning.

- An hour earlier, TYZ3 closed at 108-15 (-13+) after lifting a couple ticks shortly beforehand. The prior low of 108-10+ saw it move another step closer to support at 108-05+ (50-day EMA). Volumes have been inflated today by quarterly roll activity.

- PMIs earlier were mixed and provided little immediate directional bias, with services beating to offset softer manufacturing, but the details showing overall headcount falling for the first time since Jun’20.

- Next week gets off to a quiet start before data and Fedspeak pick up Tuesday. Focus is later on in the week though, with the second Q3 GDP release Wed, monthly PCE/core PCE Thu and Fed Chair Powell in a fireside chat Friday.

EGBs-GILTS CASH CLOSE: A Poor Week Ends On A Soft Note

Core European FI ended a poor week on a soft note, with UK and German yields up 2-3bp across most of their respective curves. 10Y Gilt yields closed the week 18bp higher for their their worst week in the past five.

- "Higher for longer" has been a resurgent theme in rates this week, with Friday's session bringing multiple cautionary comments by central bank officials on that front (BoE's Pill, ECB's Lagarde/Holzmann/Guindos).

- That - and a slightly hawkish tilt to US rates in the afternoon, amid a holiday period - helped pull back ECB/BoE cut pricing further, and kept a lid on Bunds and Gilts, carrying on from previous sessions' weakness on broadly stronger-than-expected European PMI data and issuance concerns in Germany and the UK.

- The German curve saw weakness focused on the short- and very long ends, with the UK's twist steepening as 2Y yields fell.

- Periphery spreads were mostly tighter to Bunds, with Greece outperforming, and Portugal lagging.

- The focus next week will be flash November Eurozone inflation data, which is expected to continue the disinflationary theme seen in recent reports.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 2.8bps at 3.072%, 5-Yr is up 2bps at 2.616%, 10-Yr is up 2.4bps at 2.643%, and 30-Yr is up 3.1bps at 2.819%.

- UK: The 2-Yr yield is down 0.5bps at 4.711%, 5-Yr is up 2.1bps at 4.33%, 10-Yr is up 2.6bps at 4.283%, and 30-Yr is up 2.3bps at 4.746%.

- Italian BTP spread down 1.6bps at 175.5bps / Portuguese up 2bps at 66.6bps

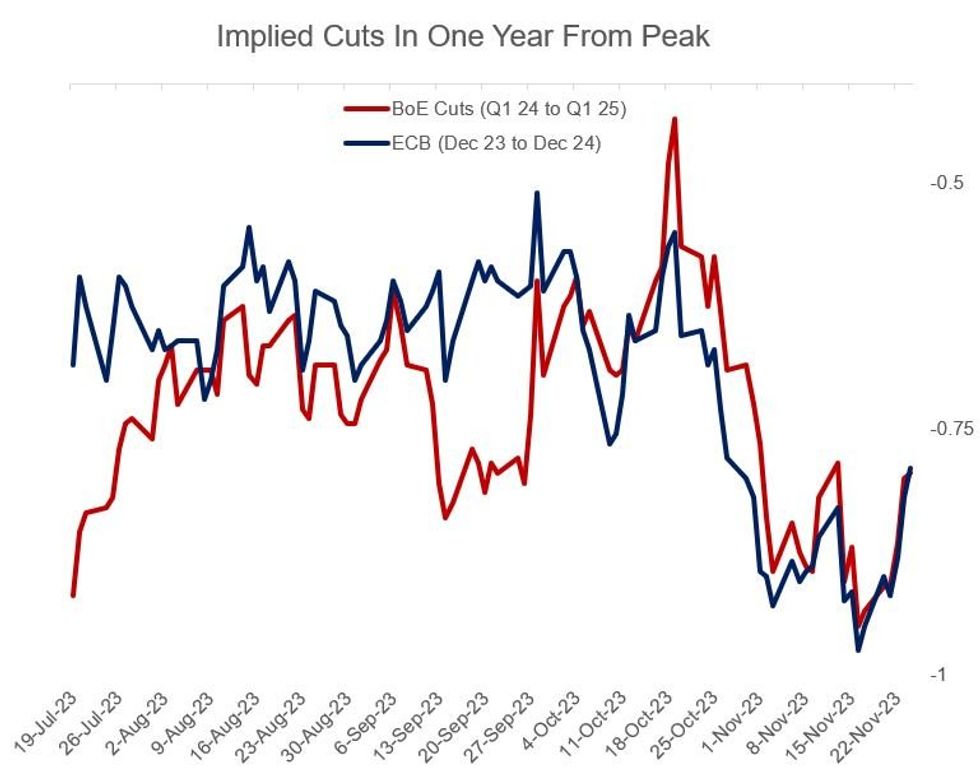

EU STIR: ECB/BoE Implied 1-Year Cuts Pared Back This Week By 15-16bp

Implied futures pricing for ECB and BoE cuts was pared for the 3rd consecutive session Friday. On the week, around 15bp of ECB cuts and 16bp of BoE cuts have been pared from the implied path a year out from their respective peaks.

- The ECB is seen cutting the depo rate by 79bp between the Dec 2023 peak and Dec 2024, 3bp less than seen Thursday. The first full 25bp cut remains priced cumulatively by the June meeting. While the session had few major flashpoints, ECB speakers reiterated that the fight against inflation is not yet over. On that note, next week brings Eurozone PMIs, arguably the final major input ahead of the ECB's mid-December decision (priced 100% as a hold).

- Meanwhile, a reiteration of hawkish comments from BoE chief economist Pill helped bias BoE-dated OIS in a hawkish direction once again today.

- The BoE is seen reaching its terminal Bank Rate in Feb/Mar 2024, after around 6bp of further tightening (up from the 2-3bp that had been priced earlier this week ahead of stronger-than-expected PMIs and the Autumn Statement). The Bank is then seen cutting 79bp in the 12 months to follow - around 1bp less than seen Thursday. The first full 25bp cut is seen edging into September 2024, vs August as had been seen earlier in the week.

FOREX: Overall Greenback Pressure Extends, GBPUSD Above 1.2600

- Equity markets have continued to edge higher this week which has continued to weigh on the greenback overall, with the USD index set to decline around 0.5% since last Friday’s close. The softer-than-expected US CPI earlier this month continues to bolster the renewed bearish theme for the USD.

- Gains on Friday have been broad based, however, the more risk sensitive ccys such as GBP, AUD and NZD have outperformed, potentially using the Israel/HAMAS developments as positive at the margin.

- GBPUSD's rally today puts spot clear of most notable options interest rolling off across the coming week, with markets looking to gauge the recent shift in BoE rate expectations across 2024, after the Autumn Statement prompted pricing (and a handful of sell-side analysts) to push back expectations for the first rate cut next year well into Q3. Close to $4bln rolls off across the Monday-Friday cuts next week between 1.2250-1.2500, and with few UK data releases, focus will be on a slew of central bank speakers.

- 1.2589 resistance has been cleared on today's rally (50% of the Jul 14 - Oct 4 bear leg). A close at current or higher levels makes 1.2686 and 1.2720 the next key topside levels of note.

- Elsewhere, AUDUSD touched multi-month highs during today’s session. The trend needle continues to point north, and the latest rally has resulted in a clear break of former resistance at 0.6522, the Aug 30 and Sep 1 high. This reinforces the bullish theme and signals scope for a continuation higher near-term towards 0.6616 next, the Oct 8 high.

- Bucking the trend this week has been the Japanese Yen which, although remaining unchanged on the week, has had a strong bounce from the 147.15 Tuesday low to trade back around 149.50 as we approach the close.

- Highlights on the calendar next week include, Australia and European CPI data, the RBNZ meeting, US growth data and the rescheduled OPEC+ meeting.

FX Expiries for Nov27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0845-65(E2.8bln), $1.0950(E935mln), $1.1005(E787mln)

- USD/JPY: Y148.00-15($755mln), Y150.00($1.6bln), Y153.00($537mln)

- AUD/USD: $0.6822(A$1.5bln)

Larger FX Option Pipeline Further Out

- EUR/USD: Nov28 $1.0850-55(E1.2bln), $1.0935-55(E2.1bln); Nov29 $1.0895-00(E1.3bln)

- USD/JPY: Nov28 Y148.50($1.0bln), Y148.95-00($1.5bln), Y149.85-05($1.4bln), Y152.85-00($1.2bln); Nov29 Y148.00-15($1.5bln); Nov30 Y148.30($1.3bln), Y149.00($2.2bln), Y151.00($1.0bln)

- AUD/USD: Nov28 $0.6285-90(A$1.1bln); Nov29 $0.6500(A$2.4bln), $0.6525(A$1.1bln)

- USD/CAD: Nov30 C$1.3000($2.7bln)

US FI OPTIONS: Lighter Session Post-Thanksgiving

Friday's US rates / bond options flow included:

- SFRZ3 94.87/96.00p strip, sold at 167.5 in 9k (ref 94.60)

- SFRZ3 96.00/95.43/94.87p fly, sold at flat in 20k

- SFRU4 97.00/98.00cs, bought for 5.75 in 10k.

- SFRH4 95.00/95.50cs traded for 3.5 in 2k

- SFRU4 96.00/96.50cs traded 8 in 5k

- SFRF4 94.87/95.00/95.25c ladder, sold the 2 at 0.25 in 5k.

- 0QZ3 95.25/95.00ps traded 2 in 2k

- 0QZ3 95.37p traded 6 in 4k

- 0QZ3 95.50/95.62/95.75/95.87c condor traded 2.5 in 5k (on block)

- 2QM4 96.75/97.00/97.12 broken c fly vs 95.12/95.00ps, bought the fly for 2.25in 4k (ref 96.195, 5 del)

EU FI OPTIONS: Limited Trade Includes Further Sonia Call Structures (After Condors)

Friday's Europe rates / bond options flow included:

- SFIM4 94.90/95.05/95.20c fly, bought for 1 in 5k. Note this comes after very heavy buying of call condors throughout the week

- DUZ3 105.00/105.10/105.20c fly, sold at 0.75 in 4k

- RXZ3 129.50p, bought for 1.5 in 2k (expiry today)

US STOCKS: ESA Consolidates Early Week Gains With Step Closer To Key Resistance

- The S&P e-mini closed at 4568.25 for near unchanged from Wednesday after a small lift ahead of the cash early close fifteen minutes earlier.

- It consolidates gains seen earlier in the week (for a 0.9% gain from Friday), which mark initial resistance at 4580.50 (Nov 22 high) after which lies a key resistance at 4597.50 (Sep 1 high).

- In cash space, the S&P 500 finishes 0.1% higher from Wednesday, outperforming the Nasdaq 100 (-0.1%) but underperforming the Dow Jones (+0.3%) and Russell 2000 (+0.6%).

- Gains were led by health care (+0.5%) and energy (+0.45%, despite lower WTI) whilst communication services (-0.7%) lagged.

- Consumer spending has also been in focus with Adobe earlier tracking Black Friday online spending up 5.5% Y/Y. Staples (+0.4%) have outperformed discretionary (+0.1%) – notable names include Best Buy (+2.2%), Walmart (+0.9%), Target (+0.7%) and Amazon (little changed).

COMMODITIES: Crude Sees A Late Slide To End Fifth Week Lower

- Crude futures have seen a sizeable decline late in the session to leave them lower for the fifth consecutive week.

- Middle East tensions, which have been a big driver of oil since October 6 Hamas attacks, are easing after successful hostage swaps Friday.

- The upcoming OPEC+ meeting remains heavily in focus. Bloomberg and Reuters sources led stories Friday remain supportive of a deal being reached between Nigeria and Angola for revised 2024 production quotas.

- It allows the group to focus on the more pressing issue of cut rollovers or the potential of collective further cut efforts with Saudi seemingly unlikely to bear any more burden alone where further cuts are concerned. Russia’s intent remains under question while Iran’s production increases this year with - more expected in the short term - have provided further headaches for Saudi.

- WTI is -2.5% at $75.18. It remains within Wednesday’s wide ranges on the initial uncertainty surrounding the upcoming OPEC+ meeting, after which lies support at $72.37 (Nov 16 low).

- Brent is -1.5% at $80.23, still above support at $76.60 (Nov 8 low).

- Gold is +0.4% at $2000.82, gaining through the session as the USD index has faded. Resistance remains at the bull trigger at $2009.4 (Nov 7/Oct 27 high) having come close in the prior two sessions.

- Weekly moves: WTI -1.1%, Brent -0.5%, Gold +1%, US HH nat gas -6.8%, EU TTF nat gas +3.5%

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR FIX

1M 5.34716 0.00427

3M 5.38658 0.0069

6M 5.39152 0.01452

12M 5.25962 0.02731

REPO REFERENCE RATES (rate, change from prev. day, volume):

* Secured Overnight Financing Rate (SOFR): 5.31%, no change, $1547B

* Broad General Collateral Rate (BGCR): 5.30%, no change, $572B

* Tri-Party General Collateral Rate (TGCR): 5.30%, no change, $564B

Showing for Nov 22. SOFR held at 5.31% for the third day running, its lowest rate since Oct 30. SOFR volumes pulled back further away from recent highs of $1640B ahead of Thanksgiving

EFFECTIVE FED FUNDS RATE:

New York Fed EFFR for prior session (rate, chg from prev day):

* Daily Effective Fed Funds Rate: 5.33%, no change, volume: $102B

* Daily Overnight Bank Funding Rate: 5.32%, no change, volume: $263B

Showing for Nov 22. Volumes were unchanged and remain in their recent range.

FED: RRP Usage Drops To Fresh Recent Low After Thanksgiving

- RRP uptake fell $66B from Wed to $866B today.

- It pushes through last week’s $912B for a fresh recent low for RRP uptake and the lowest since Jul'21.

- 94 counterparties vs 97 on Wed.

US DATA: Mixed PMIs Slightly Stronger Than Expected On Balance

- The preliminary November US PMIs from S&P Global were mixed across the board but a beat for services helped drive surprise, but still very moderate, strength in overall activity.

- The manufacturing PMI fell more than expected to 49.4 (cons 49.9) from 50.0.

- The services PMI surprisingly increased marginally to 50.8 (cons 50.3) from 50.6.

- The composite PMI was stronger than expected as it held put at 50.7 (cons 50.4).

Select excerpts from the press release:

- “Total new orders returned to growth, thereby ending a three-month sequence of contraction. That said, demand conditions at manufacturers were unchanged on the month.”

- First cut in headcount since Jun’20: “Relatively subdued demand conditions and dwindling backlogs led firms to cut their workforce numbers for the first time since June 2020, as service providers joined goods producers in reducing headcounts.”

- Cooling input prices, higher service selling prices: “Cost pressures softened further, with input prices rising at the slowest pace in just over three years. Higher service sector output charges pushed up the rate of total selling price inflation, with manufacturers seeing a slower increase in factory gate charges in November.”

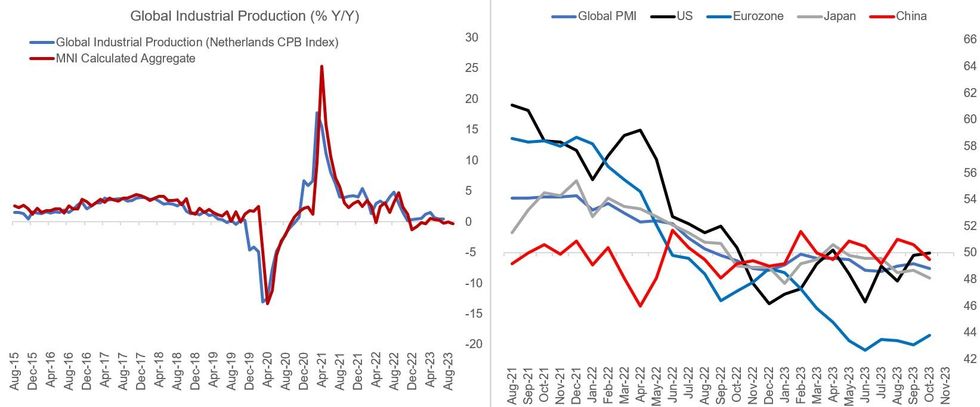

GLOBAL: World Industry Decelerates In September, Mixed Outlook For EM vs DM (1/2)

Global industrial production decelerated in September, even as trade volumes picked up, per the Netherlands CPB release out earlier today.

- Global IP volumes (by production weights) peaked in February this year and have only slowly recovered from Q2 lows - thanks mostly to emerging market production picking up as advanced economies have sputtered.

- September's 0.2% M/M rise in global IP was a slowdown from 0.6% in August but the 4th month in 5 of sequential expansion. Strength has been led by emerging markets which have on aggregate seen IP expand in 4 of the past 5 months, including 0.5% M/M in September (a deceleration from 0.9% prior), let by China (+1.0% vs +1.3% prior).

- Among developed economies, where IP dipped for the 3rd month in 5 (at -0.1% vs +0.3% prior), the Eurozone was the weakest link in September at -1.0% M/M (vs +0.4% prior), taking over the reins as biggest dragger from Japan which saw a 3rd consecutive monthly contraction but a smaller one than in August (-0.2% vs -0.5%).

- The CPB's estimate is close to MNI's tracking estimate of global IP, which indicates a further strength in emerging market IP in October (led by emerging Asia) based on early data, with some weakness Y/Y in the US (eurozone data is out next month).

- Global manufacturing PMIs paint a more mixed picture, relapsing slightly in October to 48.8 vs a nascent rise in the previous 2 months (Sept was 49.2), so the manufacturing sector is still in mild contraction - though it was actually EMs that led the way lower, down 0.8pp to 50.1 on weaker China and India figures, with DMs ticking up 0.1pp to 47.5. November flash figures for Europe were more encouraging but still contractionary (and the US's relapsed into <50 territory).

- Overall there doesn't appear to be much momentum in global industry as a whole, with more signs of life out of EM for now - though Eurozone industry has begun showing signs of bottoming.

Source: CBP, MNI, S&P Global/Markit

Source: CBP, MNI, S&P Global/Markit

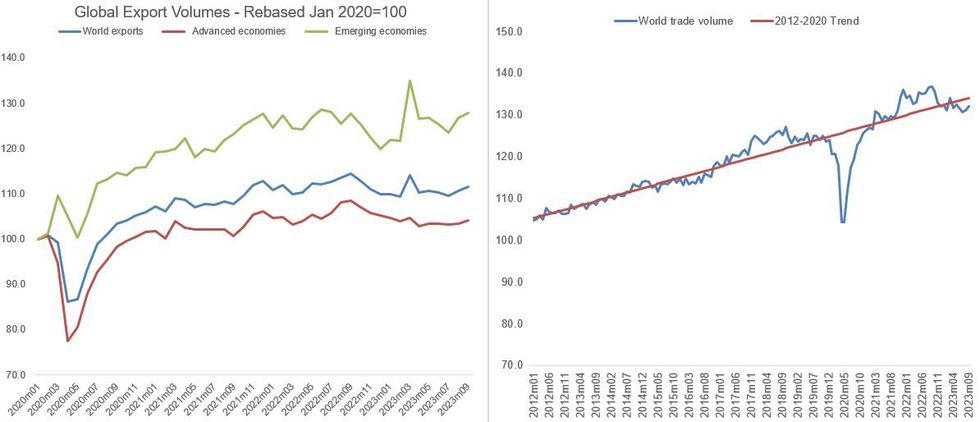

GLOBAL: World Trade Volumes Picking Back Up, Still Below-Trend (2/2)

By way of contrast, CPB-estimated global trade volume growth accelerated to 0.7% M/M in September (0.4% prior), with both imports (+0.6%) and exports (+0.8%) rising robustly. And it was developed economies that were predominantly boosting trade, with their exports/import volumes up +0.7%/+1.1% respectively (mostly on US and Japanese contributions), vs emerging markets' exports/imports down -0.5%/up +0.8%, respectively.

- Looking at the bigger picture, EM trade has held up relatively well vs DM. While global export volumes are up around 10% from pre-pandemic levels, they are up close to 28% for EM and just 4% for DM.

- More broadly, trade volumes in the chart below reflect the crash during pandemic lockdowns, followed by the resurgence over 2021-22 as supply chains began to reopen and demand for goods remained high.

- Since Q4 2022 though trade volumes have pulled back, as backlogs cleared and global goods demand began to wane. They are now slightly below the longer-term trend.

- That said, even apart from the September uptick in CPB trade figures, there are potential signs of an upturn in global trade growth in the coming months, with some exporters seeing stronger results (eg SKorea), and the Kiel Institute showing a "significant increase" of 2% M/M in global trade in October, based on an evaluation of ship movements.

Source: CPB, MNI Calculations

Source: CPB, MNI Calculations

CANADA DATA: Underlying Retail Sales Softer Than Headlines Suggest

- Note that sales of autos (+1.5%) and gasoline (+3.2%) are heavy drivers behind the strength in nominal sales, which registered a surprise 0.6% M/M in September (advance had 0.0%) after -0.1% in Aug.

- Instead, core retail sales (ex gasoline stations & fuel vendors and motor vehicle & parts dealers) declined -0.3% M/M after -0.4% M/M.

- Overall volumes meanwhile increased a seasonally adjusted 0.2% M/M after -0.5%, but again autos (+1.2%) and gasoline (+2.3%) dominated. Core retail sales volumes instead fell -0.5% M/M.

- Despite this underlying weaker picture and the heavy decline for flash manufacturing sales in October, the paring in GoC losses has been relatively restrained with 2s and 5s still trading 2.5-2bp cheaper post-data for 4-3.5bp cheaper on the day.

MNI SARB Review - November 2023: Dovish Vote Shift, Hawkish Talk

Executive Summary:

- The SARB kept the repo rate unchanged at 8.25%.

- The vote split shifted to 5-0 from 3-2 in September.

- Governor Kganyago flagged continued concern with upside risks to inflation.

MNI SARB Review - November 2023.pdf

The South African Reserve Bank (SARB) left the repo rate unchanged at 8.25% in a unanimous decision, which represents a dovish shift from September’s 3-2 vote split, where two dissenters were calling for a 25bp rate hike. The central bank delivered minor adjustments to its macroeconomic forecasts, with the inflation path seen slightly lower than before. However, Governor Lesetja Kganyago balanced the dovish signal sent by the shift in vote split by reiterating that the risks to the inflation outlook remain tilted to the upside and the Monetary Policy Committee (MPC) stands ready to take action should they start to materialise. The next meeting has been scheduled for January 25.

The combination of hawkish tone with a dovish shift in vote split and an on-hold decision spell a period of unchanged interest rates for the coming months. The SARB considers its current monetary policy settings to be sufficiently restrictive to eventually bring inflation to the target and, barring any major price shocks, the next policy move is likely to be a cut. Meanwhile, the MPC’s communications point to a continued sense of concern with upside risks to the inflation outlook, which should provide a sufficient barrier to starting an easing cycle in early 2024. The outlook for monetary policy may be affected by the imminent replacement of Deputy Governor Kuben Naidoo, perceived as a relatively dovish policymaker, with groundwork being laid for the succession process.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.