-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Improved Risk Appetite Into Weekend

HIGHLIGHTS

- MNI US-EU: "Free Trade Agreement-Like Status" Could Be Reached Ahead Of VDL Trip

- MNI UK: Hamza Yusuf Leads SNP Polling Ahead Of Critical Week For Scottish Politics

- MNI OPEC+: WSJ Reports "Internal Discussions" In UAE On Leaving OPEC

- MNI OPEC+: Reuters: UAE Source Rejects WSJ OPEC Story

- MNI US-EU: China To Dominate Biden-Scholz White House Meeting

- FEDERAL RESERVE BOARD ISSUES SEMIANNUAL MONETARY POLICY REPORT, Bbg

- FED: EXPECTATIONS SHOW HIGH INFLATION ISN'T BECOMING ENTRENCHED, Bbg

- FED: EASING INFLATION TO 2% LIKELY MEANS BELOW-TREND GROWTH, Bbg

Key links: MNI INTERVIEW: Fed Rate Hikes Yet To Hit Services Prices-ISM / MNI: Wage Growth Still Inflationary, Fed Report Says / MNI Global Week Ahead: RBA & BOC Meets in Sight / MNI: Fed’s Logan- Reforms Needed To Strengthen Bond Market / MNI: EU Agrees Compromise Way Forward On Fiscal Rules Reform

US TSYS: Market Roundup: Bonds March Steadily Higher

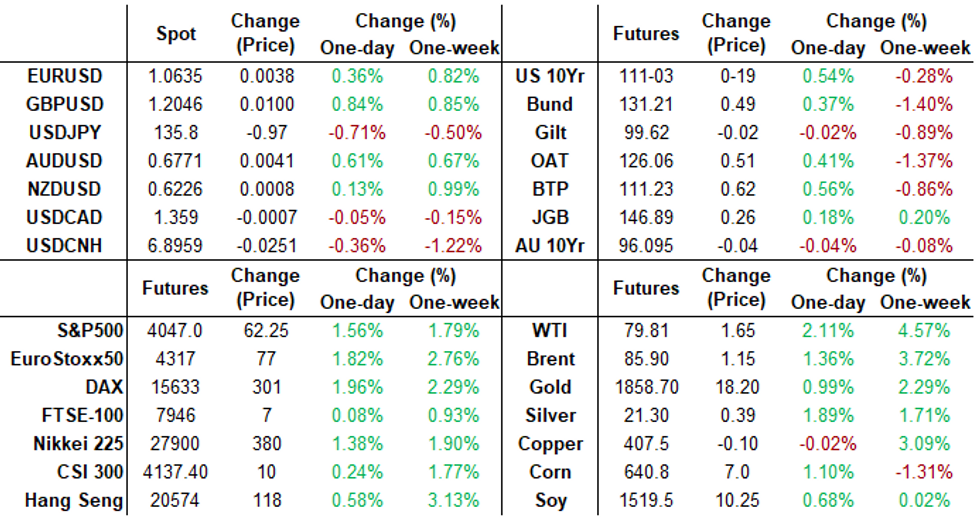

Tsys finish near late session highs, yield curves bull flattening - completely reversing the prior session move: 2s10s -6.376 at -89.840. Bonds lead the rally early, similar drift in EGBs with no new inflation metric surprises overnight.

- Tsys pared gains briefly after higher than expected ISM Services composite of 55.1 (54.5 est), components: Business: 56.3; Prices Paid: 65.6 (-2.2); New Orders: 62.6 (+2.2); Employment 54.0 (+4.0).

- Tsys quickly rebounded with Bonds to early Wednesday levels (pre-ISM prices paid driven sell-off). Short end, however, lagged the move: Fed funds implied hike steady for Mar'23 at 31.2bp, but gained in May'23 cumulative 59.4bp (+2.0) to 5.170%, Jun'23 77.0bp (+2.1) to 5.345%. Fed terminal climbed to 5.480% high in Oct'23, but receded to 5.450% at the close.

- Salient events later in the week:

- Fed Chair Powell semi-annual mon-pol report to Congress, Tue 1000ET

- Fed Chair Powell report to Congress: House Fncl Srvcs, Wed 1000ET

- ADP employment data for Feb (106k prior, 200k est), Wed 0815ET

- NFP employment data for Feb (517k prior, 200k est), Fri 0830ET

SHORT TERM RATES

NY Federal Reserve/MNI

- O/N +0.00028 to 4.55957% (-0.00214/wk)

- 1M +0.00771 to 4.70914% (+0.07428/wk)

- 3M -0.00171 to 4.98400% (+0.03057/wk)*/**

- 6M +0.00485 to 5.31571% (+0.08057/wk)

- 12M -0.01957 to 5.69443% (+0.05572/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.58% volume: $108B

- Daily Overnight Bank Funding Rate: 4.57% volume: $295B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.150T

- Broad General Collateral Rate (BGCR): 4.52%, $463B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $446B

- (rate, volume levels reflect prior session)

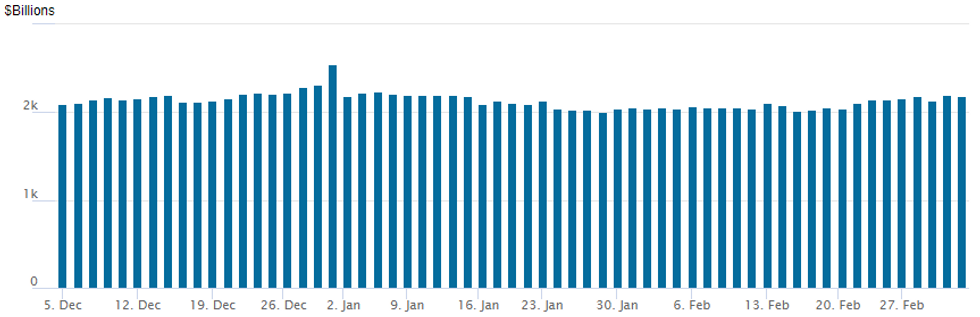

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,186.150B w/ 103 counterparties vs. prior session's $2,192.355B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better low delta put structures in SOFR and Tsy options, fading bounce in underlying off Thu's lows in early trade turned mixed by midday as underlying futures marched higher into the close. Largest position build over shortest period of time in SOFR options: 100,000 Red Sep'24 98.50/99.50/100.50 put flys, 0.5 - purpose of trade most likely to plug portfolio risk associated w/ near 4% bp drop in interest rates by fall of 2024

- SOFR Options:

- +100,000 SFRU4 98.50/99.50/100.50 put flys 0.5, Red Sep'24 underlying trades 95.75 (+0.060)

- Block, 9,000 SFRH3 95.00 puts, 4.0 vs. 94.985/0.60%

- +3,000 SFRM3 94.62/94.75/94.87 call flys, .75 vs. 94.70

- +10,000 SFRH4 96.25/97.25 call spds 9.25 ref 95.00

- 4,000 SFRU3 94.00/94.62 put spds ref 94.575

- 2,000 2QH3 96.12/96.25/96.50 broken put flys ref 96.21

- Block, 2,500 OQK3 94.56/94.81 put spds, 4.0 vs 95.405

- 2,100 SFRJ3 94.25/94.37/94.5 put flys, ref 94.63

- 2,000 SFRJ3 94.87/95.37 call spds ref 94.63

- over 13,800 SFRM3 94.50 puts, 94.62 -.605

- 8,600 SFRU3 94.18/94.31 put spds, ref 94.58 to .575

- Treasury Options:

- +5,000 USJ 120/122 put spds, 27

- 1,000 TYJ 111 calls, 57 last, total volume over 5,600 from 44 low

- 3,000 TYJ 107/108 put spds, 5 ref 110-28

- 2,500 TYK3 111/112 put spds ref 110-26

- 3,000 TYJ3 111/112 put spds, ref 110-26

- over 3,300 TYM3 106 puts, 19 ref 110-28

- over 4,200 TYJ3 108 puts, 8 ref 110-24.5

- over 3,700 TYJ3 110 puts, 39 ref 110-22.5

- 2,500 FVJ3 108.75 calls, 3.5 ref 106-16.5

- 2,000 FVK3 110 calls, 4 ref 106-15.5

FOREX: Renewed Optimism For Equities Weighs On Greenback

- A slightly higher-than-expected US ISM Services gave a very brief boost to the greenback, however a moderate decline in the prices paid component was enough to sap any momentum for the move. Overall, the USD index is posting losses of around 0.35% on Friday, a partial pullback from yesterday’s, however currency markets have maintained tight ranges ahead of the weekend close. Additionally, participation has been low, with volumes and activity generally comfortably below recent averages.

- The softer tone for the US Dollar is reflective of a more optimistic mood across equity markets with e-mini S&P 500 futures rising around 1.3% on Friday. The more positive backdrop amid lower US yields has benefitted the Japanese yen, with USDJPY sliding back towards 136.00, having briefly tested above 137 on Thursday.

- In similar vein, GBP is towards the top of the G10 leaderboard. Sterling trades more favourably due to an upside revision to the final February services and manufacturing PMI releases. Despite the bounce, GBPUSD trend conditions are bearish and key resistance at 1.2147 has remained intact.

- AUD has also firmed amid the positive risk backdrop, however, NZD has underperformed on the session. Price action in AUDNZD looks to be short-covering and a recouping of the losses posted earlier this week. The 50-day EMA at 1.0886 looks to have capped the topside and may prove influential with next week’s RBA decision on the docket.

- Elsewhere next week, central bank decisions in both Canada and Japan will precede the key US employment data on Friday.

FX: Expiries for Mar06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E550mln), $1.0630-50(E864mln)

- USD/JPY: Y135.00-10($547mln), Y135.75-00($615mln), Y137.00-24($1.5bln)

- GBP/USD: $1.1874-91(Gbp2.3bln), $1.2050-60(Gbp2.7bln)

- AUD/USD: $0.6735(A$582mln), $0.6760-65(A$644mln), $0.6775-85(A$1.2bln)

- NZD/USD: $0.6180-00($1.0bln)

- USD/CAD: C$1.3324($1bln), C$1.3600($562mln)

- USD/CNY: Cny6.9500($1.0bln)

Late Equity Roundup: Finishing Strong, SPX at Mid-Feb Lvls

Stocks remain strong in late trade, SPX eminis at highest levels since Feb 21 as ESH3 breaches two resistance levels: RES 1: 4018.89 50-day EMA and RES 2: 4033.48 20-day EMA. A clear break of both would signal a possible reversal with site son 4096.00 Feb 17 high as next major resistance. SPX eminis currently trading +60.75 (1.52%) at 4045.25; DJIA +335.97 (1.02%) at 33338.6; Nasdaq +219.3 (1.9%) at 11681.98.

- SPX leading/lagging sectors: Communication Services continues to outperform (+2.11%) lead by interactive media/services shares, namely META 6.35% while DISH climbs +3.69%. Next up: Consumer Discretionary (+2.05%) supported by autos: Tesla +4.69%, F +3.98%, GM +3.49%; and Information Technology (+2.03%) lead by hardware and equipment shares (TRMB +3.54%, AAPL +3.26%, ANET +2.76%)

- Laggers: Energy shares, weaker on the open have rebounded (sector now +1.55%), replaced by Consumer Staples (-0.05%) as food and staples underperformed, namely Costco (COST -2.64%), with Industrials second to lowest sector (+0.90%).

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +7.51 at 356.61, Boeing (BA) +5.90 at 215.96, Home Depot (HD) +4.80 at 297.82. Laggers: United Health (UNH) -2.33 at 475.37, Travelers (TRV) -0.56 at 182.63, WMT -0.15 at 140.35.

COMMODITIES

- WTI Crude Oil (front-month) up $1.63 (2.09%) at $79.80

- Gold is up $17.44 (0.95%) at $1853.44

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/03/2023 | 0100/0900 |  | CN | National People's Congress opens | |

| 06/03/2023 | 0730/0830 | *** |  | CH | CPI |

| 06/03/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/03/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2023 | 1000/1100 |  | EU | ECB Lane Lecture at Trninty College | |

| 06/03/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.