-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: JOLTS Helps Spark Risk Off

- Treasury yields slide after a second month of lower than expected JOLTS job openings along with a trend decline in quits rates.

- Regional banks also tumble in the delayed aftermath from JPMorgan's takeover of First Republic Bank, whilst WTI saw its largest one day fall in percentage terms since Jan 4.

- The USD index unwound earlier gains on the release, with JPY outperforming amidst the risk-off environment.

US TSYS: Only Modest Paring Of Gains Post JOLTS & Regional Banks Pressures

- Cash Tsys have seen a bid re-emerge in recent trading, more notably so for the long-end, but remain off highs seen after JOLTS data showed further labor market moderation. Coming on day one of the two day FOMC meeting, it has also seen WTI slide by than 5% and regional banks under pressure.

- Debt limit back and forth continues, with Schumer most recently saying they can only debate spending after the clean debt bill is passed, with a full two-year debt-limit extension required. McConnell will be at the May 9 meeting that was earlier reported that Biden will have with McCarthy.

- 2YY -16.7bp at 3.974%, 5YY -17.6bp at 3.459%, 10YY -14.0bp at 3.428% and 30YY -9.4bp at 3.714%.

- TYM3 trades +1-03+ at 115-19+, just within earlier highs of 115-21 with next resistance seen at 115-30+ (Apr 26 high).

- Aside of course from the FOMC decision, tomorrow includes ADP employment and ISM services.

STIR FUTURES: Implied Fed Rates Holding Reversal Of Last Week's Core PCE Boost

- Fed Funds implied rates have slowly nudged higher in recent hours but the day’s move remains defined by the shift lower after the US open which then accelerated on softer than expected JOLTS labor data.

- Seen with a 21.5bp hike for tomorrow’s decision (vs 24bp as the US came in) in what is now seen as a terminal for an effective 5.05%. The hike is seen reversed in Sep rather than Nov, with 21bp of cuts from current levels to 4.62% in Nov (-17bp on the day) and 42bp of cuts to 4.42% for Dec (-18bp).

- The Dec’23 rate has fully unwound increases seen after last week’s core PCE beat and yesterday’s ISM Mfg Prices paid increase.

- In SOFR space, these large moves continue into 2024 contracts, which despite paring post-data gains still sit +0.20-0.205 on the day.

FOREX: JPY Outperforms Amid Lower US Yields, Post RBA Aussie Rally Moderates

- USDJPY looks set to retrace a portion of its recent surge on Tuesday, as below estimate US data has placed renewed downward pressure on front-end US yields, prompting a relief rally for the struggling Yen over the course of the US session.

- Additionally, significant pressure on major equity indices has exacerbated the move with USDJPY seeing a near 1% reversal to print session lows at 136.32. Currently down 0.6%, the pair looks set to snap a 3-day winning streak. Initial support lies at 136.14, the May 1 low. However, more significant support is seen at 135.13, the Apr 19 high and a recent breakout level.

- Weaker equities have acted as a headwind for the Australian dollar, which earlier in the session had been the best performing major. The RBA surprisingly raised its cash rate by 25 basis points to 3.85%, stressing that it aimed to return inflation to its 2-3% target in a "reasonable timeframe", strengthening language on future hikes.

- Despite the initial AUD surge, the late reversal has been most notable against the JPY, with AUDJPY declining roughly 1.7% from the day’s highs and reversing the entire overnight advance.

- Elsewhere, the Norwegian Krone was the worst performer in G10 as crude futures are registering losses of over 5%. The moves come ahead of Thursday’s Norges bank meeting where they are expected to raise rates by 25bps, in line with the guidance handed down in March. Initial resistance in USDNOK has been breached at 10.7922, targeting a move to the 2023 high of 10.8778.

- New Zealand employment data and commentary from RBNZ’s Orr kicks off proceedings on Wednesday. US ADP employment and the ISM Services PMI are also scheduled. The focus will inevitably be on the subsequent FOMC decision, where a 25bp hike could mark the end of the Fed’s hiking cycle.

US STOCKS: Retracing Losses But Energy and Banks Still Weigh Heavily

- The S&P E-mini continues to chip away at its earlier slide in a greater retracement than that seen in Treasury’s paring of gains, although at 4138 is still down -1.1%.

- Energy (-4.1%) leads the declines with WTI holding -5% on the day, followed by financials (-2.4%) which continue to be pinned lower by banks despite a small intraday recovery (SPX banks -3.3%, broader KBW index -4.6%). PACW remains of note, still -24% despite earlier trimming of -40% declines.

- The day’s low of 4105.75 punched through support at the 20-day EMA of 4135.41, opening 4068.75 (Apr 26 low), whilst yesterday’s high of 4206.75 (May 1 high) continued to offer resistance.

COMMODITIES: Risk-Off Sees Crude Slump and Gold Surge

- Macro factors have been at the fore today, as crude oil has slumped 5% for the largest daily drop since Jan 4 and notably before the start of US regional banking issues in mid-March. The majority of declines came with softer than expected US JOLTS labor data not long after the US open with regional banks also sliding and dampening risk sentiment.

- The market reaction was exacerbated coming off low volumes, after yesterday saw the lowest volumes since Dec’22 after Asian and UK holidays.

- WTI is -5.2% at $71.75 off a low of $71.45, clearing support at Apr 28 and Mar 30 lows and briefly $71.76 (61.8% retrace of Mar 20 – Apr 12 rally) to open the round $70.

- Brent is -4.9% at $75.40, clearing $76.52 (61.8% retrace of Mar 20 – Apr 12 rally) to open $75.00 round number support.

- Gold is +1.6% at $2014.84 having jumped as US Tsy yields tumbled and earlier USD strength was reversed. It earlier cleared resistance at $2015.1 (Apr 17 high) before retreating, with a further push higher opening the bull trigger at $2048.7 (Apr 13 high).

US DATA: JOLTS Show Further Steady Moderation In Labor Market

- A second monthly downside surprise for JOLTS job openings in March, at 9.590M (cons 9.736M) after minimal revisions.

- An also sizable decline in the previously known level of unemployment meant the ratio to unemployed only edged from 1.68 to 1.64, a new low since Oct’21 and down from the 1.96 of Dec but still historically elevated vs the 1.2 averaged in 2019.

- Quit rates also pushed lower, with the total down from 2.56 to 2.48% and private from 2.85% to 2.74%, both technically the lowest since Feb’21.

US DATA: JOLTS Quits Rate Dip Heavily Focused In Leisure & Hospitality

- The private quits rate fell 0.1pp from 2.85 to 2.74% in March but monthly declines were heavily concentrated in accommodation & food services (-1.3pps to 4.7%) and mining & logging (-0.6pps to 2.3%).

- The former, which makes up the bulk of the leisure & hospitality sector, is the lowest since Nov’20 but remains 0.4pps above its Feb’20 level.

- Previous declines in the quits rates have been relatively broad based but this month saw the opposite, with 6 rather than 7 sectors seeing quit rates below immediate pre-pandemic levels.

- Similarly, the private quit rate ex leisure & hospitality sector actually nudged up very slightly from 2.47 to 2.50.

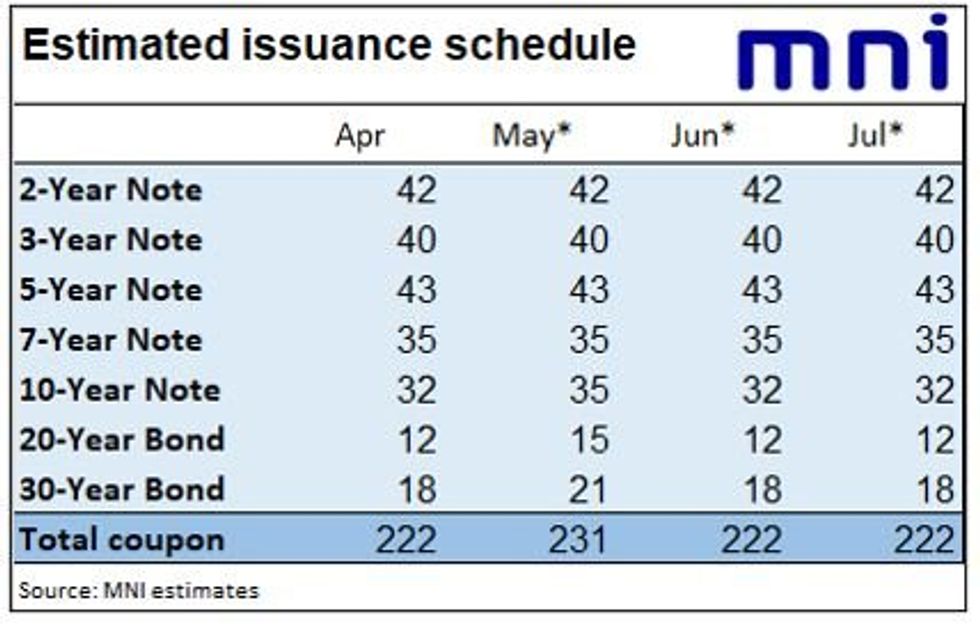

MNI UST Issuance Deep Dive: May 2023 - Refunding Preview

EXECUTIVE SUMMARY:

- The May 3 quarterly refunding announcement (0830ET/1330 UK) is overshadowed by the prospect of Treasury soon running out of cash as it continues to run up against the debt limit.

- Analyst expectations for the “x-date” by when all available resources run out range between late July and mid-August (whereas previously several had expected September).

- There is little to no need to change coupon auction sizes in the coming quarter, and the capacity to do so is limited given the debt limit.

- But there is some expectation that sizes will increase beginning either in the August or November refunding windows, and some analysts see a buyback facility introduced at a future date.

Please see PDF for full analysis:

MNI_US_DeepDive_Issuance_2023_05.pdf

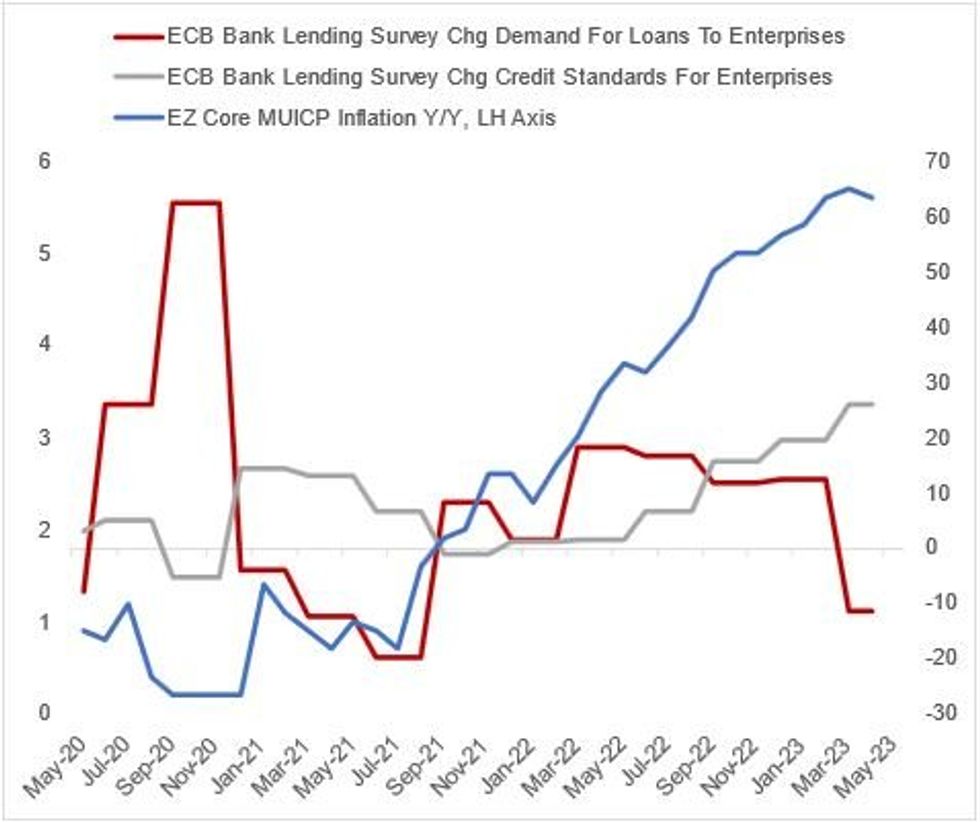

MNI ECB Preview - May 2023: Stepping Down, But Not Done Yet

EXECUTIVE SUMMARY:

- The ECB is set to hike its key policy rates by 25bp on May 4, with latest inflation and banking sector data diminishing the case for 50bp.

- Given the uncertain outlook, the ECB is unlikely to provide explicit forward guidance at this juncture, though will likely nod to further tightening being likely in the baseline scenario.

- There is potential for a TLTRO "bridge" operation to be announced Thursday; more surprising - but possible - would be a decision on APP runoff beyond June .

FOR THE FULL PUBLICATION PLEASE USE THE FOLLOWING LINK:

MNI Norges Bank Preview - May'23: Persistent NOK Weakness to Drive Further Hikes

Executive Summary:

- Bank expected to raise rates by 25bps, inline with the guidance handed down in March

- Non-MPR meeting, so no new path projections due

- Persistent weakness in NOK points to higher rate path going forward

MNI BCB Preview – May 2023: Maintaining Steadfast Approach

Executive Summary

- Consensus believes the Copom will keep the Selic rate unchanged at 13.75%.

- Despite the annual rate of inflation falling to 4.16% and consistent verbal criticism from the Lula administration on the need for lower rates, the BCB committee remain resolute with its approach to maintaining the current restrictive stance.

- Persistently high core inflation and a further deterioration of short- and medium-term inflation expectations make it premature to start easing policy at this juncture.

Click to view the full preview:

MNI Brazil Central Bank Preview - May 2023.pdf

Administration Desires Versus BCB Caution

Verbal criticism from the Lula administration, led by the President and his finance minister, Fernando Haddad, has been relentless since the March meeting. The president has made numerous references to the interest rate being too high, consistently grading it as a major problem for the nation. The latest remarks from Lula stated that “we can no longer live in a country where the interest rate does not control inflation. In fact, it controls unemployment in this country, because it’s responsible for a part of the situation that we are living today.”

BCB Governor, Roberto Campos Neto, has remained steadfast that the central bank’s approach is correct and will not be prematurely influenced. He has stated that “the technical timing is different from the political timing” in guiding decisions on rates. “And that’s why the central bank’s independence is so important.” Campos Neto added any central banker prefers to cut rates than to lift them, and officials “want to find the structural conditions” to ease the policy. He added that the new fiscal rule presented by Lula to Congress “goes in the right direction.” However, he has indicated that the central bank needs to wait to judge its effects on inflation expectations.

Disinflation Continues For Now, Inflation Expectations Deteriorate

Since the last Copom meeting, inflation readings have further declined, however, the backdrop and outlook remain challenging. The mid-April reading of IPCA headline inflation clocked in at 4.16% and was marginally below the median surveyed estimate, representing a decline from 5.60% before the March meeting. Despite this easing in the data, services and core inflation remain at a high level, which policy makers have been clear still warrant the need to preserve the BCB’s restrictive monetary policy stance.

FED: Reverse Repo Operation

- Coming the day ahead of the FOMC decision, RRP uptake increased $27B after sliding $86B yesterday in post-month end gyrations, with the amount almost exactly the same as the average through April.

- The number of counterparties dipped by 1 to a typical 102.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.