-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI INTERVIEW2: Poland To Push For EU Defence Fund

MNI ASIA MARKETS ANALYSIS: Markets Skittish Ahead Debt Talks

- MNI FED: Kashkari: Reiterates June Hike Close Call

- MNI BRIEF: Fed's Bostic Ready For June Pause In Rate Moves

- MNI FED: Bostic: Comfortable Waiting A Bit To See How Things Play Out

- MNI Bullard: Expecting Two More Rate Hikes This Year

US

FED: Minneapolis Fed’s Kashkari (’23 voter) tells CNBC that right now, the June rate decision is a “close call” for him, broadly reiterating his comments to WSJ published Sunday.

- He told the WSJ: "I'm open to the idea that we can move a little bit more slowly from here"… "I would object to any kind of declaration that we're done. If the committee chooses to skip a meeting because we want to get more information, I could make the argument why that makes sense,"… "A skip to get more information is very different in my mind than [saying], 'Hey, we think we're done.'"

- Other comments are in keeping with an essay published earlier today (found here): FED'S KASHKARI SAYS BANKS IN HIS REGION NOT SEEING STRAINS. With other two-sided comments in his CNBC appearance, FOMC-dated OIS briefly increased 1bp for Jun and 2.5bp for Dec but has just as quickly fully reversed it.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said Monday he's comfortable waiting to see how the economy is reacting to past interest rates increases before entertaining any further hikes.

- "We’ve had a lot of tightening over the last year or so, and the policy works with a lag," he told a Richmond Fed conference. "I’m comfortable waiting a little bit to see how things pan out."

- "Let’s take it one meeting at a time and just let things play out. People have a good sense of our commitment to getting inflation to 2% and beyond that I’d like this to be as orderly a movement as possible," he said.

FED: Atlanta Fed’s Bostic (’24 voter) notes the Fed has done a lot of tightening and that policy acts with a lag.

- He’s comfortable waiting a bit to see how things play out and will take it one meeting at a time to assess the outlook and won’t pre-judge the June policy decision.

- The remarks follow May 15 comments that if the decision were to be held now he would probably vote to hold rates. Instead, with the next FOMC decision still not until Jun 14 (currently 7.5bp of hike priced), his comments imply a similar stance to Daly’s earlier “extreme data dependence”.

FED: Paraphrasing Bullard (non-voter): We’re sitting today with rates just a little over 5%. In past FOMC SEP, a little over 5% was what many members said would be a good level to get to in 2023. If you look at what’s happened in the first half of this year, that was based on a forecast of very low growth and the idea that inflation would come down pretty rapidly in 2023. But those things haven’t materialized.

- I think we’re going to have to grind higher with the policy rate. I’m thinking two more moves this year – where exactly they’ll be this year I don’t know but I have often advocated for sooner rather than later.

- Other Bloomberg headlines: BULLARD: US RECESSION PROBABILITIES ARE OVERSTATED ; BULLARD SAYS RECESSION NOT HIS BASE CASE FOR US ECONOMY; BULLARD: LABOR MARKET SLOWING SOME, DOESN'T MEAN RECESSION

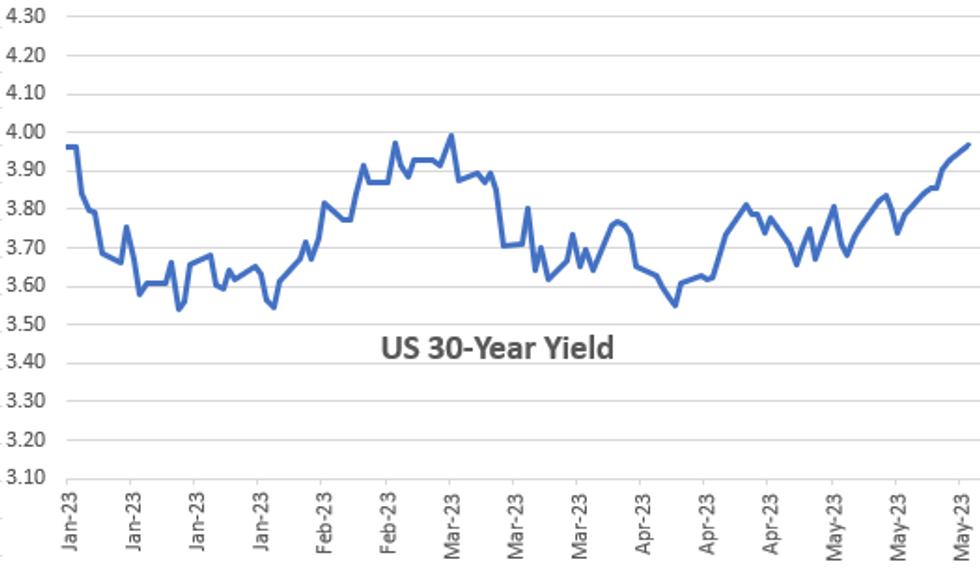

US TSYS: Yields Inch Higher, Markets Skittish As Debt Default Nears

Treasury futures holding mildly weaker levels after the close, lower half of a modest session range after a couple brief rounds of volatility. Cautious trade with no economic data to react to Monday, participants are eager for a breakthrough in US debt ceiling negotiations (talks resume tonight around 1730ET).- Aside the potential default risk, markets are eager for the release of May FOMC minutes this Wed at 1400ET. Early Fed speak proved balanced to mildly hawkish.

- SOFR futures are trading weaker in the very short end after MN Fed President Kashkari commented on CNBC that the June rate decision is a “close call” for him, broadly reiterating his comments to WSJ published Sunday. While Kashkari told WSJ he is "open to the idea that we can move a little bit more slowly from here", the focus is on "I would object to any kind of declaration that we're done."

- Federal Reserve Bank of Atlanta President Raphael Bostic said Monday he's comfortable waiting to see how the economy is reacting to past interest rates increases before entertaining any further hikes.

- Early knee-jerk risk-off moves, rates gapped back to pre-open levels at midmorning, stocks ticked lower following social media posts that a "large explosion" near the Pentagon complex had occurred. Markets snapped back just as quickly as the rumors proved false.

- Decent volumes (TYM3 1.6m) driven by a pick-up in Jun/Sep Treasury futures rolling ahead first notice date of May 31.

OVERNIGHT DATA

No economic data Monday, focus on this Wednesday's May FOMC minutes release at 1400ET

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 73.26 points (-0.22%) at 33357.07

- S&P E-Mini Future up 9.25 points (0.22%) at 4214.25

- Nasdaq up 81.2 points (0.6%) at 12740.45

- US 10-Yr yield is up 4 bps at 3.7129%

- US Jun 10-Yr futures are down 3/32 at 113-15

- EURUSD up 0.0013 (0.12%) at 1.0818

- USDJPY up 0.56 (0.41%) at 138.54

- WTI Crude Oil (front-month) up $0.44 (0.62%) at $71.99

- Gold is down $4.85 (-0.25%) at $1973.00

- EuroStoxx 50 down 9.67 points (-0.22%) at 4385.63

- FTSE 100 up 14.12 points (0.18%) at 7770.99

- German DAX down 51.39 points (-0.32%) at 16223.99

- French CAC 40 down 13.8 points (-018%) at 7478.16

US TREASURY FUTURES CLOSE

- 3M10Y +5.404, -153.989 (L: -173.764 / H: -153.029)

- 2Y10Y -0.925, -60.677 (L: -62.086 / H: -57.511)

- 2Y30Y -1.235, -35.534 (L: -38 / H: -31.188)

- 5Y30Y +0.812, 20.162 (L: 16.582 / H: 22.389)

- Current futures levels:

- Jun 2-Yr futures down 1.875/32 at 102-17.125 (L: 102-15.625 / H: 102-23.125)

- Jun 5-Yr futures down 2/32 at 108-20 (L: 108-16.5 / H: 108-31.25)

- Jun 10-Yr futures down 3/32 at 113-15 (L: 113-10.5 / H: 113-30)

- Jun 30-Yr futures down 10/32 at 126-27 (L: 126-20 / H: 127-24)

- Jun Ultra futures down 16/32 at 134-9 (L: 134-03 / H: 135-20)

US 10YR FUTURES TECH: (M3) Remains Vulnerable

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 117-00 High May 4

- RES 2: 115-18+/116-16 High May 16 / 11

- RES 1: 114-05/114-27 High MAy 19 / 50-day EMA

- PRICE: 113-15 @ 1315ET May 22

- SUP 1: 113-08+ Low Mar 15

- SUP 2: 112-30 61.8% retracement of the Mar 2 - 24 rally

- SUP 3: 112-21 Low Mar 13

- SUP 4: 111-31 76.4% retracement of the Mar 2 - 24 rally

Treasury futures remain soft following last week’s bearish activity. 113-30+ , the Apr 19 low and a key support, has been breached, strengthening the case for bears. A continuation lower would open 112-30, a Fibonacci retracement. On the upside, firm resistance is seen at 115-18+, the May 16 high. Ahead of 115-18+ is resistance at the 50-day EMA, at 114-27, and a key short-term hurdle for bulls.

SOFR FUTURES CLOSE

- Jun 23 -0.040 at 94.803

- Sep 23 -0.055 at 94.985

- Dec 23 -0.050 at 95.350

- Mar 24 -0.040 at 95.815

- Red Pack (Jun 24-Mar 25) -0.025 to -0.005

- Green Pack (Jun 25-Mar 26) -0.025 to -0.01

- Blue Pack (Jun 26-Mar 27) -0.025 to -0.02

- Gold Pack (Jun 27-Mar 28) -0.02 to steady

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00418 to 5.09791 (+.03682 total last wk)

- 3M -0.01262 to 5.15085 (+.09367 total last wk)

- 6M -0.00735 to 5.13918 (+.16106 total last wk)

- 12M +0.00969 to 4.88735 (+.27652 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00315 to 5.06214%

- 1M -0.00872 to 5.12686%

- 3M -0.01800 to 5.37471% */**

- 6M -0.01171 to 5.45486%

- 12M -0.01357 to 5.43100%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.39271% on 5/19/23

- Daily Effective Fed Funds Rate: 5.08% volume: $132B

- Daily Overnight Bank Funding Rate: 5.07% volume: $287B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.363T

- Broad General Collateral Rate (BGCR): 5.02%, $578B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $572B

- (rate, volume levels reflect prior session)

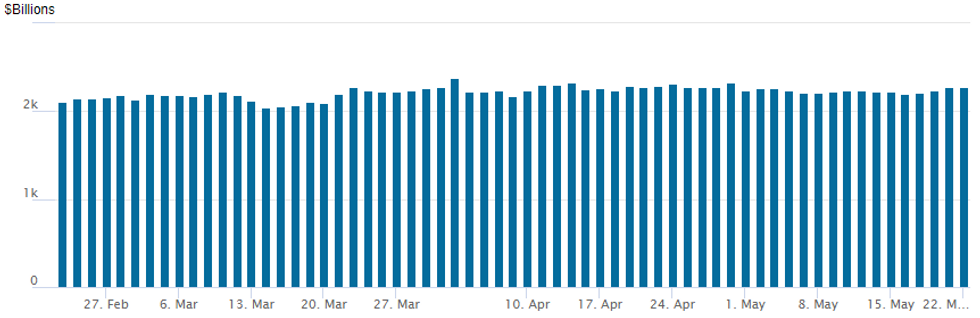

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,275.311B w/ 105 counterparties, compares to prior $2,276.720B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: Over $8B Corporate Issuance Monday

$8.15B High grade corporate debt issuance to price Monday- Date $MM Issuer (Priced *, Launch #)

- 05/22 $3.2B #Citigroup 11NC10 +245

- 05/22 $1.5B #American Tower $650M 5Y +155, $850M 10Y +187.5

- 05/22 $1.2B #Penske Truck Leasing $700M 3Y +180, $500M 7Y +250

- 05/22 $1B #National Securities Clearing $400M 2Y +90, $600M 5Y +130

- 05/22 $750M #Travelers 30Y +150

- 05/22 $500M #Pricoa Global Funding 5Y +135

- Rolled to Tuesday's order of business:

- 05/23 $1B NWB (Netherlands Bank) WNG 5Y SOFR+45a

EGBs-GILTS CASH CLOSE: Greece Steals The Show

The German and UK curves bear flattened Monday, with GIlts underperforming. But Greece stole the show, with GGB yields collapsing after a market-friendly legislative election result over the weekend.

- Greek 10Y BTP yields fell 14bp, dropping to the lowest spread vs Bunds since January 2022, and reaching the highest premium vs BTPs in the euro era.

- Otherwise, most European instruments sold off steadily following a constructive start, with most weakness between 1000-1400UK time.

- The largest single move of the day came on false reports on social media of an explosion outside the US Pentagon which were quickly debunked. Bund and Gilt yields dropped 3bp but quickly reversed to set fresh session highs.

- There were few macro catalysts besides. ECB's Villeroy noted a likely peak in rates by September, but this was no surprise and markets were unmoved.

- Tuesday sees several central bank appearances, including ECB's de Guindos, Muller, Villeroy and Nagel, as well as BoE's Bailey and Haskel. Additionally, after a quiet day on the data front, the flow picks up Tuesday with May flash PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 5.2bps at 2.809%, 5-Yr is up 4.2bps at 2.448%, 10-Yr is up 3.1bps at 2.459%, and 30-Yr is up 3.1bps at 2.634%.

- UK: The 2-Yr yield is up 9.3bps at 4.053%, 5-Yr is up 8.1bps at 3.903%, 10-Yr is up 6.8bps at 4.064%, and 30-Yr is up 3.8bps at 4.452%.

- Italian BTP spread up 1.1bps at 185.5bps / Greek down 17.3bps at 141.8bps

FOREX: USD Treads Water Amid Debt-Ceiling Negotiations, JPY Under Pressure

- The Dollar index trades at unchanged levels from Friday’s close as markets continue to await concrete progress over the US debt-ceiling negotiations. Hawkish Fed speak weighed on front-end rates in the US, having more of an effect on the Japanese Yen, with USDJPY rising back to 138.50.

- USDJPY has recovered the entirety of Friday’s sharp decline and the pair has spent the majority of late session consolidating around 138.50. Price action reaffirms that bullish conditions remain intact following last weeks’ strong gains. A key resistance zone between 137.77-91, the May 2 and Mar 8 high respectively, has been cleared. The break strengthens bullish conditions and confirms a resumption of the uptrend that started on Jan 16. The focus is on 139.00 and 139.59, a Fibonacci retracement. Initial firm support is seen at 135.78, the 20-day EMA.

- In similar vein, there was some pressure on the Chinese Yuan. USDCNH crept higher to the best levels of the session through the London close, however Friday's highs still sit well above at 7.0750.

- Today's uptick has put the pair back into overbought territory, with the 14d RSI just north of 70 and inline with levels seen late last week. This is the highest level for the technical measure since September last year - which was followed by a ~3% pullback in the pair over the subsequent two weeks. The moves come after the Chinese authorities issued their first warning over the pace of CNY depreciation last week - stating that they will curb speculation "when necessary" and maintain FX stability.

- After a slow session, void of any tier-one data releases, the economic calendar hots up on Tuesday with a host of global flash manufacturing and services PMIs. US new home sales and Richmond manufacturing will also cross. Focus will then quickly turn to Wednesday’s RBNZ decision.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

| 23/05/2023 | 0030/0930 | ** |  | JP | Jibun Bank Flash Japan PMI |

| 23/05/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/05/2023 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0715/0915 |  | EU | ECB de Guindos Address at European Financial Integration Conf | |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/05/2023 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/05/2023 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/05/2023 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/05/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/05/2023 | 0915/1015 |  | UK | BOE Bailey, Pill, Tenreyro, Mann at MPR Hearing | |

| 23/05/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 23/05/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/05/2023 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 23/05/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/05/2023 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/05/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 23/05/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/05/2023 | 1445/1545 |  | UK | BOE Haskel Panellist at Richmond Fed Conference | |

| 23/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/05/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.