MNI ASIA MARKETS ANALYSIS: Midrange Ahead Thu's Data/Speakers

- Treasuries looked to finish moderately lower Wednesday, off session lows as rates held near the middle of the week's range.

- Generally a subdued session with only New Home Sales data to trade off of, many are sidelined as they wait for Thursday's heavy data and speaker schedule, not to mention next week's September employment data for fresh catalysts.

- Treasury curves continued to steepen, 2s10s marking the highest since early June 2022 at 23.585.

US TSYS: Near Mid-Range Ahead Thu's Heavy Speaker, Data Docket

- Treasuries look to finish weaker - near late session lows Wednesday, but closer to the middle of the week's range on a relatively muted session. Some accounts appear to be plying the sidelines to await tomorrow's flood of data and Fed speakers not to mention next week's September employment data.

- Little reaction to this morning's new home sales - slightly better than expected in August at 716k (saar, cons 700k) after an upward revised 751k (initial 739k) in July.

- Dec'24 10Y Tsy futures are currently -10 at 114-17 vs. 114-16.5 low -- still well off initial technical support at 114-09.5 (Sep 24 low).

- Curves continued to steepen to new 2+Y highs, the 2s10s curve marking 23.585 high.

- Projected rate cuts into early 2025 held steady to mixed, latest vs. morning levels (*) as follows: Nov'24 cumulative -40.4bp (-39.1bp), Dec'24 -78.0bp (-79.1bp), Jan'25 -111.0bp (-112.5bp).

- Looking ahead to Thursday's session: weekly claims, GDP, PCE, Cap Goods, Durables, Pending home sales and a flurry of Fed speakers including Barr, Cook, Kashkari, Williams and Chairman Powell.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00081 to 4.85528 (-0.00194/wk)

- 3M -0.01566 to 4.64317 (-0.04808/wk)

- 6M -0.02318 to 4.28644 (-0.06495/wk)

- 12M -0.02846 to 3.76676 (-0.06473/wk)

- Secured Overnight Financing Rate (SOFR): 4.84% (+0.01), volume: $2.171T

- Broad General Collateral Rate (BGCR): 4.83% (+0.01), volume: $811B

- Tri-Party General Collateral Rate (TGCR): 4.83% (+0.01), volume: $768B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 4.83% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 4.83% (+0.00), volume: $269B

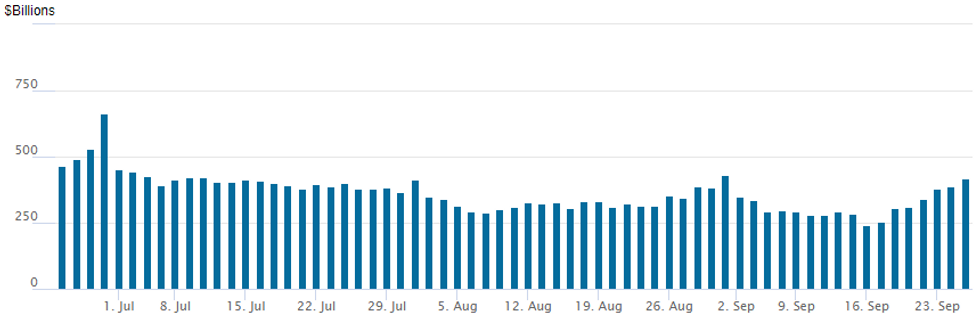

FED Reverse Repo Operation

NY Federal Reserve/MNI

RRP usage climbs back over $400B to $416.913B this afternoon from $388.977B prior. Compares to $239.386B on Monday September 16 2024 -- the lowest level since early May 2021. Number of counterparties at 72 from 65 prior.

US SOFR/TREASURY OPTION SUMMARY

Option desks report better SOFR call structures on net Wednesday, most covering Oct-Nov expirys as underlying futures held mildly firmer in the very short end to weaker out the strip. Projected rate cuts into early 2025 held steady to mixed, latest vs. morning levels (*) as follows: Nov'24 cumulative -40.4bp (-39.1bp), Dec'24 -78.0bp (-79.1bp), Jan'25 -111.0bp (-112.5bp). Salient trade includes:- SOFR Options:

- +11,000 SFRV4 96.18/96.25 call spds, 1.0 ref 96.07

- 5,000 SFRZ4 95.68/95.75/95.87/95.93 put condors ref 96.09

- 3,700 SFRX4 96.50/96.62 call spds ref 96.09

- 3,700 SFRX4 95.68/95.93/96.18 call flys ref 96.055 vs. -.06

- +5,000 2QZ4 96.25/96.50/97.50/97.75 call condors 19.5 ref 97.005

- -4,000 SFRX4 95.75/95.93/96.12 call flys, 4.5 ref 96.09

- +6,000 SFRZ4 96.12/96.25/96.56 call trees, 0.0 ref 96.09

- -4,000 SFRV4 95.87/95.93/96.00/96.06 put condor 1.75 ref 9608

- -20,000 SFRZ4 95.37/95.50 call spds 12.25 ref 96.075

- Block, +10,000 SFRH5 96.75/97.00 call spds 1.0 over 2QH5 97.25/97.50 call spds

- Block, 3,000 SFRZ4 95.62/95.75 put spds 1.0 vs. 96.065/0.06%

- Block, 10,000 SFRH5 96.62/96.87 call spds vs. 2QH5 97.12/97.37 call spds, 0.0 net

- 10,000 SFRV4 95.87/96.12/96.37 call flys ref 96.075

- 2,000 SFRX4 96.12/96.25/96.37 call trees ref 96.075

- 7,700 SFRV4 96.25 calls, 2.5

- 1,650 0QV4 97.12/97.50 call spds vs. 2QV4 97.06/97.31 call spds

- Block, 3,000 SFRX4 96.00/96.12 call spds 4.5 over 95.50/95.81 put spds

- Block, 3,000 SFRV4 96.50/96.56 call strip 1.25 ref 96.08

- 4,500 SFRV4 95.87/96.00 3x2 put spds ref 96.08

- 3,000 SFRZ4 95.75/95.87 2x1 put spds ref 96.085

- Treasury Options:

- 2,100 TYZ4 112.5/114.5 put spds, 44

- 5,000 TYZ4 113.5 puts, 45 ref 114-17.5

- 2,600 TYX4 109.75/111 put spds ref 114-18.5

- -10,000 Wednesday 10Y 114.75/115 put spds, 15

- 2,750 FVX4 108.75/109.5 3x2 put spds

- over 2,500 TYX4 116.5 calls, 13-14

BONDS: EGBs-GILTS CASH CLOSE: Bellies Underperform

Yields pushed higher across the European space Wednesday, reversing most of the prior session's declines as curve bellies underperformed.

- In a session that was fairly light in both meaningful headlines and data, intraday movements were largely flow and supply related.

- Gilts underperformed, with weakness focused in the belly of the UK curve following soft demand at the 7-year auction.

- There was little reaction in STIR futures to commentary by BoE's Greene that suggested she could back a cut in November.

- A large apparent block sale trade in US rates kept pressure on global FI in the European afternoon.

- OAT spreads widened on further fiscal concerns (Finance Minister Armand noting that the deficit could top 6% of GDP this year) - 10Y out 2.4bp vs Bunds. OATS underperformed periphery EGBs, whose spreads likewise finished wider.

- The German curve also saw belly underperformance, in sympathy with Gilts.

- Thursday's calendar includes Italian and German confidence surveys, Spanish retail sales, the ECB's Economic Bulletin, and the SNB decision (Preview here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at 2.122%, 5-Yr is up 3bps at 1.998%, 10-Yr is up 2.7bps at 2.175%, and 30-Yr is up 1.3bps at 2.492%.

- UK: The 2-Yr yield is up 4.4bps at 3.962%, 5-Yr is up 6.3bps at 3.835%, 10-Yr is up 4.9bps at 3.99%, and 30-Yr is up 5.1bps at 4.566%.

- Italian BTP spread up 1.7bps at 134.9bps / Spanish up 1.5bps at 80.2bps

EGB OPTIONS: Large Euribor Call Condor Buying Features Weds

Wednesday's Europe rates / bond options flow included:

- DUZ4 107.5/107.9cs with 107.6/107.8cs strip, bought for 12.5 in 3k.

- ERZ4 96.625/96.75/96.875/97.00c condor sold at 3.75 in 5k.

- ERZ4 97.00/96.87/96.75, bought for 3.25 in 3.7k.

- ERZ4 97.25/97.375/97.50/97.625c condor, bought for 45k total for 1.25 and 1.5

- ERZ4 97.37/97.62/97.87c fly, bought for 1.25 in 22.5k.

- ERZ4 97.125/97.25/97.375 1x3x2 call fly paper paid 0 for the wings on +5K.

- ERZ4 97.12^, bought for 20.5 in 5k, this was also bought in 5k Tuesday

- SFIZ4 95.50/95.65/95.80c fly, bought for 3.25 in 5.5k

FOREX: USD Index Trades on Firmer Footing, NZD Underperforms

- Following the first daily close below 100.50 since July 2023, the USD index firmly reversed on Wednesday, benefitting from the persistent step higher for US yields and the steepening of the curve.

- The Japanese yen stands out as a relative underperformer, as USDJPY extends session highs around 144.75, and up 1.05% on the session. AUD and NZD are also among the worst performing G10 currencies, both giving up the majority of Tuesday’s substantial moves higher.

- EURUSD also stands out on a chart. Having pierced the 1.1200 handle and very briefly eclipsing the late August highs, the pair now resides down 0.52% around 1.1122 as we approach the APAC crossover. Bolstering this theme of the single currency turnaround, EURJPY matched key resistance at the 50-day EMA (161.67 high), before sharply reversing course back below 161.00.

- The higher yields helped cement the CHF weakness on Wednesday as markets await the SNB’s decision tomorrow. Most analysts believe the SNB will cut rates by 25bps tomorrow, however, there are a small minority expecting a bolder cut, citing the focus will be on any indication of SNB discomfort with franc strength.

- Latest price action signals scope for a stronger GBPCHF recovery and exponential moving averages have now converged into bull mode. This could target a move towards resistance around 1.15, a psychological/inflection point over the past two years.

- BOJ minutes will precede the SNB decision. Focus then shifts to the final reading of Q2 US GDP and durable goods data for August. Fed Chair Powell is also due to deliver pre-recorded opening remarks at the US Treasury Market Conference.

FX OPTIONS: Expiries for Sep26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000-05(E760mln), $1.1050-65(E628mln), $1.1150(E1.3bln), $1.1180-90(E1.4bln), $1.1250(E689mln)

- USD/JPY: Y143.75($539mln), Y144.00-10($693mln), Y144.50($549mln), Y145.00($1.3bln)

- EUR/GBP: Gbp0.8440-55(E692mln)

- AUD/USD: $0.6900-10(A$1.4bln)

- NZD/USD: $0.6330-40(N$2.3bln)

- USD/CAD: C$1.3400($1.0bln), C$1.3450-60($2.4bln)

US STOCKS: Late Equities Roundup: Dow Underperforming

- Dow Industrials traded weaker, near session lows late Wednesday while S&P Eminis and Nasdaq indexes see-sawed +/-10.0 around steady. Relatively subdued trade as accounts await more substantive data to trade off of such as next week's September employment data to gauge the Fed's next move for rates. Currently, the DJIA is down 252.86 points (-0.6%) at 41956.01, S&P E-Minis down 11.5 points (-0.2%) at 5780.25, Nasdaq up 6.7 points (0%) at 18081.26.

- Utilities and Information Technology sectors continued to lead gainers in late trade, independent and electricity providers supported the former: Vistra +6.90%, Constellation Energy +4.56%, AES Corp +2.59%. Semiconductor stocks buoyed the IT sector for the second day running: Hewlett Packarrd +4.85%, Intel +3.49%, AMD +2.55%.

- Conversely, Energy and Health Care sectors continued to underperform, crude prices coming off recent highs (WTI -1.88 at 69.68) likely weighing on O&G shares: Haliburton -3.6%, Diamondback Energy -2.51%, Schlumberger -2.58%. Pharmaceuticals weighed on the Health Care sector: Amgen -4.97%, IQVIA Holdings -3.64%, Charles River Labs -3.42%.

EQUITY TECHS: E-MINI S&P: (Z4) Trend Needle Continues To Point North

- RES 4: 5868.50 1.00 proj of the Apr 19 - Jul 16 - Aug 5 price swing

- RES 3: 5818.12 0.50 proj of the Sep 6 - 17 - 8 minor price swing

- RES 2: 5800.00 Round number resistance

- RES 1: 5797.50 High Sep 19

- PRICE: 5780.25 @ 1505 ET Sep 25

- SUP 1: 5680.47 20-day EMA

- SUP 2: 5622.43 50-day EMA

- SUP 3: 5500.00 Round number support

- SUP 4: 5451.25 Low Sep 6 and a bear trigger

A bull cycle in S&P E-Minis remains in play and price is trading just below its recent high. The contract has traded through a key and major resistance at 5785.00, the Jul 16 high and a bull trigger. A clear breach of this hurdle would confirm a resumption of the long-term uptrend. Sights are on the 5800.00 handle next. First key support is 5622.43, the 50-day EMA. Initial support lies at 5680.47, the 20-day EMA.

COMMODITIES: Crude Plunges on Libya Deal, Gold Trades Near Fresh Record High

- WTI has slipped further today as Libyan tensions appear to ease, paving the way towards a supply return.

- WTI Nov 24 is down by 2.5% at $69.8/bbl.

- For WTI futures, the next resistance to watch is $72.25, 50-day EMA. It has been pierced and a clear break would undermine a bear theme.

- A further reversal lower would refocus attention on $64.61, the Sep 10 low and bear trigger.

- Spot gold rose to a fresh record high of $2,670 earlier in Wednesday’s session before paring the move to trade marginally higher on the day.

- The yellow metal is currently up by 0.2% at $2,662/oz.

- Moving average studies are in a bull-mode set-up, highlighting a clear uptrend and positive market sentiment. The focus is on $2675.5 next, a Fibonacci projection.

- Meanwhile, after yesterday’s 4% rally on the back of China stimulus news, copper has edged down by 0.1% to $449/lb today.

The recent gain in copper undermines an earlier bearish theme and instead highlights a stronger bull cycle. $453.83, the 50.0% retracement of the May 20 - Aug 7 bear leg, has been pierced. Clearance of this level would expose $464.60, the Jul 5 high.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Country | Event |

| 26/09/2024 | 0600/0800 | * |  | GFK Consumer Climate |

| 26/09/2024 | 0700/0900 | ** |  | Economic Tendency Indicator |

| 26/09/2024 | 0730/0930 | *** |  | SNB Interest Rate Decision |

| 26/09/2024 | 0800/1000 | ** |  | M3 |

| 26/09/2024 | 0800/1000 | ** |  | ISTAT Business Confidence |

| 26/09/2024 | 0800/1000 | ** |  | ISTAT Consumer Confidence |

| 26/09/2024 | 0900/1100 |  | ECB's Elderson remarks at governance & risk meeting | |

| 26/09/2024 | 1230/0830 | *** |  | Jobless Claims |

| 26/09/2024 | 1230/0830 | ** |  | WASDE Weekly Import/Export |

| 26/09/2024 | 1230/0830 | *** |  | GDP |

| 26/09/2024 | 1230/0830 | * |  | Payroll employment |

| 26/09/2024 | 1230/0830 | ** |  | Durable Goods New Orders |

| 26/09/2024 | 1310/0910 |  | Fed's Susan Collins, Adriana Kugler | |

| 26/09/2024 | 1325/0925 |  | New York Fed's John Williams | |

| 26/09/2024 | 1330/1530 |  | ECB Lagarde address at ESRB Conference | |

| 26/09/2024 | 1400/1000 | ** |  | NAR Pending Home Sales |

| 26/09/2024 | 1415/1615 |  | ECB's De Guindos in macroprudential policy panel | |

| 26/09/2024 | 1430/1030 | ** |  | Natural Gas Stocks |

| 26/09/2024 | 1500/1100 | ** |  | Kansas City Fed Manufacturing Index |

| 26/09/2024 | 1600/1800 |  | ECB's Schnabel at Wirtschaftsrat der CDU e.V | |

| 26/09/2024 | 1700/1300 |  | Fed's Neel Kashkari, Michael Barr | |

| 26/09/2024 | 1700/1300 | ** |  | US Treasury Auction Result for 7 Year Note |

| 26/09/2024 | 1900/1500 | *** |  | Mexico Interest Rate |