-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Near Highs, Mixed Data, Strong 5Y

- Treasury futures are back near early highs following mixed data, Philly Fed Non-Mfg April '23 lows.

- US Treasuries rebounded after well received $67B 5Y Note auction traded through (4.235% vs. 4.242% WI).

- Former ECB member Bini Smaghi posited ECB will cut 50bp midyear then wait.

Markets Roundup: Tsys Back Near Early Highs

- Treasury futures have see-sawed back near to higher opening levels following a well received $67B 5Y note sale (4.235% vs. 4.242% WI). Jun'24 10Y futures currently trade +4 at 110-20.5 vs. 110-16 pre-auction, compares to midmorning low of 110-11.5.

- Jun'24 10Y futures briefly marked session high of 110-23.5 this morning but quickly reversed course to extend session lows (TYM4 110-11.5) after the mixed initial data:

- Durable Goods Orders (1.4% vs. 1.0% est, prior down revised to -6.9% from -6.2%), Durables Ex Transportation (0.5% vs. 0.4% est); Cap Goods Orders Nondef Ex Air (0.7% vs. 0.1% est, prior down revised to -0.4% from 0.0%), Cap Goods Ship Nondef Ex Air (-0.4% vs. 0.1% est).

- Philly Fed Non-Mfg Activity missed estimate (-18.3 vs. -8.8 prior) - the lowest print since April 2023 and included fairly weak details: new orders remained negative, sales/revenues fell to a near-zero reading, full-time employment growth was "less widespread", and the price indexes "continued to indicate overall increases in prices".

- Consumer Confidence index dipped from 104.8 to 104.7, defying expectations of a rise to 107.0 (prior was revised down from 106.7). Present Situation rose from 147.6 (rev. from 147.2) to 151.0, with Expectations slipping from 76.3 (rev. from 79.8) to 73.8.

- Meanwhile, The S&P CoreLogic index posted 6.03% Y/Y growth, below the 6.12% expected but up from 5.57% prior; the 20-City index was in line at 6.59% vs 6.60% prior and 6.15% prior.

- Wednesday Data Calendar: Wholesale Sale/Inventories, Tsy $43B 7Y Note Auction while Fed Gov Waller will discuss economic outlook at Economic Club NY at 1800ET (text, Q&A).

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00201 to 5.33016 (+0.00145/wk)

- 3M +0.00187 to 5.30942 (-0.00306/wk)

- 6M +0.00353 to 5.22513 (-0.00387/wk)

- 12M +0.01698 to 5.00990 (+0.00612/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.820T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $671B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $660B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $85B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $245B

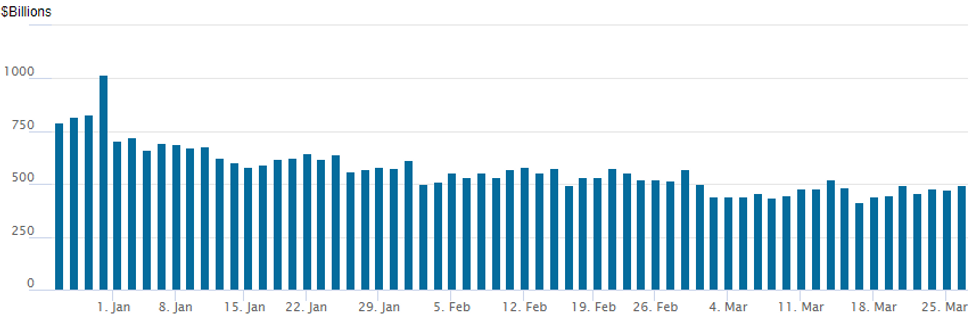

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $496.062B from $473.787B on Monday. Compares to Friday, March 15 when usage fell to $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties slips to 73 vs. 74 yesterday (compares to 65 on January 16, the lowest since July 7, 2021)

SOFR/TEASURY OPTION SUMMARY

Better SOFR and Treasury call volume carried over from overnight with some sporadic downside put flow in early NY trade. Pause in upside calls after underlying futures reversed support, trade moderately weaker post data. Projected rate cut pricing runs steady to mildly softer: May 2024 at -12.9% w/ cumulative -3.2bp at 5.296%; June 2024 -63.1% vs. -65.8% late Monday w/ cumulative rate cut -19.0bp at 5.139%. July'24 cumulative at -29.6bp from -30.1bp earlier.

- SOFR Options:

- -2,000 2QM4 96.00 puts, 8.5 vs. 96.33/0.27%

- +3,000 SFRK4/SFRM4 94.87 put spds, 2.0

- Block, 6,000 SFRU4 95.87 calls, 7.0 vs. 95.185/0.17%

- 3,000 SFRN4 95.37/95.75 1x2 call spds

- 2,500 SFRZ4 95.75/96.00/96.25/96.50 call condors vs. SFRZ4 94.75/95.00 put spds, ref 95.465

- +4,000 0QZ4 96.75/97.25 call spds .5 over 3QZ4 96.75/97.25 call spds

- 4,000 SFRN4 95.75 calls, ref 95.17

- -8,500 SFRJ4 95.06/95.18 call spds, 0.25 ref 94.88

- 2,000 SFRU4 94.75/94.87 put spds vs. SFRU4 95.37/95.50 call spds ref 95.175

- Treasury Options:

- over 20,900 wk4 Wednesday 10Y 110.25 puts, 4 last (expire tomorrow)

- +15,000 wk5 TY 111 calls, 3

- 3,000 TYK4 108 puts, 6 last

- 2,000 FVM4 107 calls, 31.5 last

- 4,500 FVK4 108 calls, 10.5 last

EGBs-GILTS CASH CLOSE: Gains Resume Ahead Of Euro Inflation Round

Gilts and Bunds resumed their advance Tuesday, with bull flattening in the UK and German curves.

- Central bank hawks came across relatively dovish: BoE's Mann didn't explicitly say that rate cuts weren't appropriate at this stage (just that market expectations had gone too far), while ECB's Muller noted that the time for rate cuts is drawing nearer.

- Data was fairly inconsequential from a markets perspective, but some attention was paid to a wider-than-expected 2023 French fiscal deficit which posed upside risks to 2024's shortfall and makes further spending cuts likely - OAT spreads to core EGBs had widened in recent days amid pre-release reports of a large deficit.

- Overall, core instruments traded well within Monday's ranges. Periphery EGB spreads tightened modestly to Bunds in a broadly risk-on session.

- Spain kicks off the March flash inflation round on Wednesday morning - our preview of the Eurozone-wide data went out today (PDF here).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at 2.872%, 5-Yr is down 1.8bps at 2.371%, 10-Yr is down 2.2bps at 2.35%, and 30-Yr is down 1.9bps at 2.507%.

- UK: The 2-Yr yield is down 0.3bps at 4.181%, 5-Yr is down 1.5bps at 3.857%, 10-Yr is down 1.7bps at 3.971%, and 30-Yr is down 2.8bps at 4.456%.

- Italian BTP spread down 1.9bps at 130.3bps / Spanish down 0.7bps at 83.1bps

EGB Options: Predominantly Rate Trades Tuesday, Including Sonia Upside

Tuesday's Europe rates/bond options flow included:

- SFIK4 95.10/95.20/95.30c fly, bought for 1.5 in 5k

- SFIM4 95.10/95.45cs, bought for 5 in 2.5k

- SFIM4 94.60/94.50 ps, bought for 0.25 in 5k

- ERM4 96.25/96.00ps 1x2, bought for 2.75 in 7k

- ERU4 96.75/97.00/97.25c ladder, bought for 3 in 4k

FOREX CHF Remains Notable Underperformer Amid Tight DXY Range

- The Swiss Franc is the poorest performing currency on Tuesday, helping EURCHF (+0.45%) rise above the key upside level and bull trigger at 0.9788. The pair printed a high of 0.9814 during US hours, the highest level since June 2023.

- A sustained break of this level, along with 0.9020 in USDCHF (+0.51%) could unlock the next stage of weakness for the CHF after last week's surprise SNB rate cut, at which the bank became the first in G10 to ease monetary policy after the post-pandemic tightening cycle.

- We highlighted yesterday that while the AUDUSD technical theme remains bearish, exponential moving average indicators appear positive for AUDCHF, and the dovish SNB combined with the overall buoyant backdrop for global equities could point to further strength ahead for the cross.

- Importantly, we do have Australian data overnight, with February CPI expected to tick up to 3.5% Y/y on Wednesday. The data precedes Thursday’s February retail sales data, and for both releases, attention will be paid following last week’s stellar jobs report.

- Elsewhere in G10, major pairs are showing very moderate adjustments, with the USD index marginally in the green approaching the APAC crossover. While USDJPY remains just 0.10% higher on the day, the pair has bounced 40 pips off the overnight lows to 151.60. The slow grind higher comes in the face of further verbal rhetoric from MOF officials denouncing speculative moves in the yen. USDJPY remains very close to the significant multi-decade resistance point at 151.91/95.

- Focus for Wednesday will turn to Spanish CPI, which kicks off the Eurozone inflation schedule, previewed by MNI here. Later in the session, Fed’s Waller is due to speak about monetary policy at the Economic Club of New York, where a Q&A is expected.

Expiries for Mar27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0750-60(E713mln), $1.0800-20(E1.9bln), $1.0825-40(E1.5bln), $1.0848-50(E700mln), $1.0860-80(E4.7bln)

- USD/JPY: Y150.00($2.0bln), Y151.50-70($1.2bln), Y152.00($665mln)

- GBP/USD: $1.2600(Gbp1.1bln)

- AUD/USD: $0.6500-10(A$2.3bln)

- USD/CAD: C$1.3650($1.3bln)

- NZD/USD: $0.5995-00(A$959mln), $0.6070-75(A$500mln), $0.6095(A$648mln)

- USD/CNY: Cny7.2500($683mln)

Late Equities Roundup: Interactive Media, Auto Shares Remain Firm

- Stocks remain firmer in late Tuesday trade, Communication Services and Consumer Discretionary sectors outperforming. Currently, DJIA is up 1.82 points (0.21%) at 39396.11, S&P E-Mini Future up 8 points (0.15%) at 5286.5. Nasdaq up 42.5 points (0.3%) at 16427.33.

- Leading Gainers: Media and entertainment shares buoyed the Communication Services sector in the first half: Fox +1.58%, Netflix +0.95%, Google +0.92%. Automakers lead gainers in the Consumer Discretionary sector: off first half highs, Tesla gained 3.91% (likely due to Italian officials approaching Musk for van and truck production), GM +1.7%, BorgWarner +1.05%.

- Laggers: Energy and Utilities pared prior session gains, oil and gas shares weighing on the former: APA -4.16%, Occidental Petroleum -1.21%, EOG Resources -1.02%. Gas and multi energy providers weighed on Utilities: Dominion Energy -3.3%, NRG and Eversource Energy both -2.25%, NextEra -1.92%.

E-MINI S&P TECHS: (M4) Bulls Remain In The Driver’s Seat

- RES 4: 5428.25 1.00 proj of the Oct 27 - Dec 28 - May 1 price swing

- RES 3: 5400.00 Round number resistance

- RES 2: 5398.12 Bull channel top drawn from the Jan 17 low

- RES 1: 5322.75 High Mar 21

- PRICE: 5288.00 @ 1500 ET Mar 26

- SUP 1: 5236.50 Bull channel base drawn from the Jan 17 low

- SUP 2: 5213.02 20-day EMA

- SUP 3: 5157.00 Low Mar 11

- SUP 4: 5098.36 50-day EMA

The trend condition in S&P E-Minis is unchanged and remains bullish. Last week’s extension reinforces this theme and the break of 5257.25, Mar 8 high, confirmed a resumption of the uptrend. Note that moving average studies remain in a bull-mode position reflecting positive market sentiment. Sights are on 5398.12, the top of a bull channel drawn from the Jan 17 low. Initial firm support is 5213.02, the 20-day EMA. A move lower is considered corrective.

COMMODITIES WTI Edges Lower

- Front month WTI is pulling back but remains above earlier lows. Crude rallied yesterday driven by the chance that the US will reinstate sanctions on Venezuela, limited short term hope for a ceasefire in Israel, tighter supplies from OPEC+ output cuts in Q2 and a weaker US dollar.

- WTI MAY 24 is currently down 0.4% on the day at $81.6/bbl. Sights remain on $83.87 next, the Oct 20 ‘23 high. A break of this level would open $84.87, the Sep 15 ‘23 high and a key resistance. Support to watch is $79.64, the 20-day EMA.

- OPEC+ is unlikely to make any output policy changes until the next full OPEC+ ministerial meeting in June, three OPEC sources told Reuters.

- Front month Henry Hub has reversed earlier gains to trade lower on the day with curtailed LNG feedgas flows and high storage weighing on prices, while the US weather forecast averages near normal.

- US Natgas APR 24 is down 5.2% at $1.53/mmbtu.

- Meanwhile, spot gold hit an intra-day high of $2,200/oz early on Tuesday, before paring gains to $2,178 currently, leaving the yellow metal just 0.3% higher on the day.

- The trend condition in gold remains bullish and recent moves signal scope for a climb towards $2230.1, a Fibonacci projection. Key short-term trend support has been defined at $2146.2, the Mar 18 low.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/03/2024 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 27/03/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 27/03/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 27/03/2024 | 0800/0900 | *** |  | ES | HICP (p) |

| 27/03/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 27/03/2024 | 0900/1000 |  | EU | ECB Cipollone At House of the Euro Event | |

| 27/03/2024 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/03/2024 | 1000/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 27/03/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/03/2024 | 1230/1330 |  | EU | ECB Elderson At Climate-Related Financial Risks Panel | |

| 27/03/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 27/03/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/03/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 27/03/2024 | 2200/1800 |  | US | Fed Governor Christopher Waller |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.