-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: No Closer to Debt Ceiling Agreement

- MNI FED: Bullard Reiterates Call For Higher Rates

- MNI US: Study Cmte Chair Hern: House Vote On Debt Ceiling Plan As Early As Next Week

- FED'S BOSTIC: MORE CAUTION IN BANK LENDING WILL ALLOW FED TO HIKE RATES LESS, Bbg

- FED'S BOSTIC SAYS ONE MORE RATE INCREASE IS HIS BASELINE - Bbg

- PERRY: DEBT CEILING PLAN HAS TO REPEAL INFLATION REDUCTION ACT, Bbg

- GOLDMAN CHANGES ECB CALL, NOW SEES 3.75% TERMINAL RATE, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Market Roundup: Short End Back Near March FOMC Levels

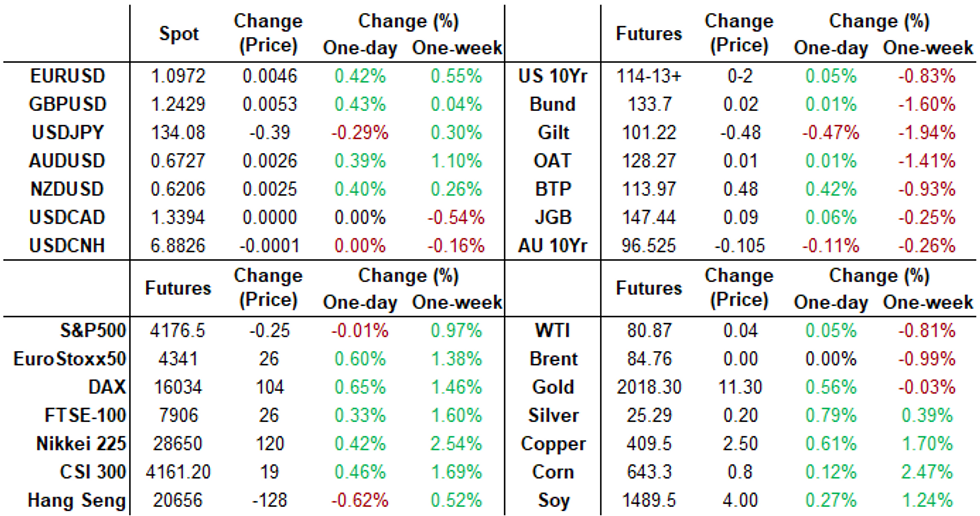

- Treasury futures trading firmer for the most part, curves flatter (2s10s -3.767 at -63.574) with Bonds outperforming mildly weaker short end rates (2s currently -1.38 at 102-29.75, yield +.0131 at 4.2073).

- Short end rates reversed support, traded weaker soon after StL Fed President Bullard reiterated in a Reuters interview his call for higher rates while avoiding "extensive forward guidance at the next FOMC meeting."

- Fed fund pricing for 25bp rate hike for May holds steady while June gained climbed to 27.5 cumulative at 5.104%; chances of Dec cut has receded back near March 22 FOMC level of appr -22bp at 4.603%.

- From a technical point of view after the 10Y futures contract breached both the 20- and 50-day EMAs Monday, a continuation lower would signal scope for weakness towards 114-07, the Mar 29, 30 low and 113.26, the Mar 22 low. The latest bear cycle does appear to be a correction.

- A reversal higher and a break of resistance at 116-08, Apr 12 high, would signal a resumption of the uptrend and expose 117-01+, the Mar 24 high and the bull trigger.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02095 to 4.93840 (+.04534/wk)

- 3M +0.02060 to 5.04845 (+.06557/wk)

- 6M +0.04701 to 5.06809 (+.12507/wk)

- 12M +0.07242 to 4.87069 (+.18642/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00000 to 4.80871%

- 1M +0.00142 to 4.95271%

- 3M -0.01457 to 5.25043% */**

- 6M +0.01643 to 5.41129%

- 12M +0.00557 to 5.42557%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $106B

- Daily Overnight Bank Funding Rate: 4.82% volume: $279B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.406T

- Broad General Collateral Rate (BGCR): 4.77%, $527B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $518B

- (rate, volume levels reflect prior session)

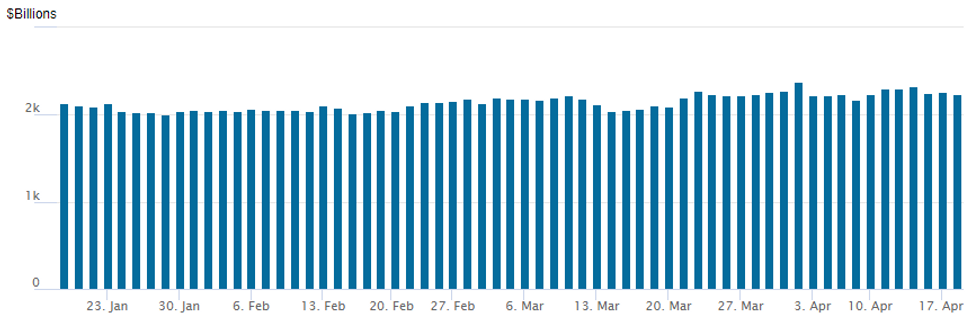

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,238.994B w/ 106 counterparties, compares to prior $2,256.845B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Better downside put structure trade carried over from overnight through much of Tuesday. Hedging or speculating on policy risk on whether an anticipated 25bp hike from the FOMC on May 3 will be the last. SOFR focus on Jun'23 and Jul'23 put condors. Jun'23 options expire on Jun 16, two days after the June FOMC (Jul options on July 14, well before the July 26 FOMC). Volumes receded in the second half with some notable call trades and strangle sales below:- SOFR Options:

- +10,000 SFRU3 99.75 calls, .75 vs. 95.13/0.05%

- +2,000 SFRM3 94.745/94.87/94.93/95.00 put condors 0.0-0.25

- -15,000 SFRK3 95.37/95.75/95.87 broken call trees on 2x1x1 ratio, 2.75

- +5,000 SFRM3 94.25/94.50 put spds, 0.5

- 9,000 SFRM3 94.56 puts, 1.0

- Block, 3,000 SFRN3 94.62/94.87/95.75 broken call flys on 1x ratio, 30.5 net ref 95.185

- 2,000 SFRU3 94.50 puts, 6.5 ref 95.17

- 3,000 SFRM3 95.00/95.12/95.31/95.43 call condors ref 94.925

- 1,250 SFRM3 94.18/94.93/95.00/95.12 put condors ref 94.925

- 4,500 SFRN3 94.75/95.00/95.25/95.50 put condors ref 95.175

- 3,000 SFRN3 94.50/94.93/95.00/95.18 broken put condors ref 95.155

- 2,500 SFRU3 96.00/96.37 call spds ref 95.16

- Treasury Options:

- -5,000 TYM3 113.5/117.5 strangles, 58 vs 114-12/0.45%

- 2,400 TYM3 115.5/116.5/117.5 call flys, 1 ref 114-13

- -4,000 TYM 112.5/113.5 strangles 160-159

- 2,000 TYK3 113.5/114/114.5 put flys, 7 ref 114-13

- 2,500 FVM3 112.5/113.5 call spds ref 109-05.25

- 1,500 wk4 10Y 111.5/113 put spds ref 114-10.5

- 3,000 wk4 10Y 112/113.5 put spds ref 114-10.5

- 3,000 TYM3 113 puts, 37 ref 114-09

EGBs-GILTS CASH CLOSE: UK Short End Underperforms Pre-CPI

Weakness at the UK short end was the standout move in Tuesday's trade, with flattening seen across European curves.

- The 2Y UK segment underperformed, with an 8.8bp rise in implied BoE terminal Bank Rate pricing driving the move.

- The 4.86% rate implied for October is the highest since Mar 9, spurred by strong UK wage growth data Tue morning, and ahead of Wednesday's key CPI reading.

- The short end was the weak link on the German curve as well, though it easily outperformed its UK counterpart (ECB terminal pricing rose by just 3bp, with comments by Chief Econ Lane affirming that there would be a hike of at least some magnitude in May).

- Periphery spreads tightened slightly, though came off session lows in in the afternoon as equities came off their highs.

- Apart from UK CPI Wednesday, we get final Eurozone CPI and multiple ECB (Lane, Knot, de Cos, Schnabel) speakers, with BoE's Mann also appearing.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.7bps at 2.906%, 5-Yr is up 2.5bps at 2.52%, 10-Yr is up 0.4bps at 2.477%, and 30-Yr is down 1.8bps at 2.533%.

- UK: The 2-Yr yield is up 7.8bps at 3.691%, 5-Yr is up 7.7bps at 3.588%, 10-Yr is up 5.6bps at 3.747%, and 30-Yr is up 5.2bps at 4.098%.

- Italian BTP spread down 0.7bps at 182.4bps / Spanish down 0.8bps at 101.7bps

EGB Options: 2024 Euribor Upside Features

Tuesday's Europe rates / bond options flow included:

- ERH4 98.50/99.00cs, bought for 2.75 in 5k

- ERU4 99.50/100.00/100.50c fly bought for 1 in 5k

FOREX: Greenback Gives Up Monday Advance, GBP In Focus Ahead Of March CPI

- The dollar gave back the majority of the Monday gains early Tuesday and there was little impact on currency markets as we progressed through the US session. The USD index sits closed to unchanged on the week as we approach the APAC crossover.

- AUD and NZD are outperforming, rising just shy of 0.5% following the China GDP data overnight. GDP increased 4.5% y/y in Q1, beating the market consensus of 3.8% y/y, marking the quickest growth within a year and underpinning the bid for higher beta currencies. Initially firmer equities had acted as an additional tailwind to antipodean FX, and despite the turnaround for major indices, little effect was seen across G10 FX.

- Close to in line Canadian CPI kept USDCAD in a very tight range. With the pair sitting close to unchanged on the session, CAD underperformance is notable.

- GBPUSD has risen 0.45% as of writing, largely reversing the prior day’s declines in line with the general greenback sentiment. The pair did receive a boost from pay and jobs data this morning, which showed average weekly earnings beating forecast on both a inc. and ex. bonus basis. Resultingly, GBP is close to the top-end of the G10 leaderboard.

- Cable remains in an uptrend and the Friday / Monday pullback is - for now - considered corrective. A resumption of gains would refocus attention on Friday’s 1.2546 high where a break would resume the uptrend and open 1.2599, Jun 7 2022 high.

- On Wednesday, the focus will be on UK March CPI data where the headline annual rate is expected to moderate to 9.8% and the core reading at 6.0%. Markets will also receive the final reading of Eurozone March CPI figures.

FX Expiries for Apr19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850(E912mln), $1.0900-15(E623mln), $1.0930-40(E956mln), $1.1000(E705mln), $1.1015-30(E943mln), $1.1049-50(E1.9bln)

- GBP/USD: $1.2450(Gbp803mln)

- USD/JPY: Y132.50-60($739mln), Y132.90-00($522mln), Y133.35-45($929mln), Y135.00-10($616mln)

- NZD/USD: $0.6230-35(N$805mln)

- USD/CAD: C$1.3300($565mln), C$1.3445-55($1.0bln)

- USD/CNY: Cny7.00($1.0bln)

Equities Roundup: Late Session Rebound

- Stocks have been holding a narrow range since midmorning, Dow (+13.0 around 34,000.0) and SPX (+2.0 at 4178.75) shares mildly higher while Nasdaq trades mildly weaker (-10 at 12147.70) in late trade.

- Stock indexes drifted higher after the open but pared gains around midmorning, S&P Eminis marked 4165.25 low following a couple larger sell programs a few minutes after StL Fed Bullard reiterated in a Reuters interview his call for higher rates while avoiding "extensive forward guidance at the next FOMC meeting."

- Health Care, Communication Services and Utilities sectors underperformed, buoyed by modest gains in Industrials, Materials and Financial sectors.

- From a technical perspective, S&P E-minis remains bullish and today’s gains reinforce current conditions. The contract has traded to a fresh cycle high and is approaching the 4200.00 handle.

- Sights are on 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4069.41, the 50-day EMA. Initial support to watch lies at 4106.03, the 20-day EMA.

E-MINI S&P (M3): Bull Cycle Extends

- RES 4: 4244.00 High Feb 2 and a bull trigger

- RES 3: 4223.00 High Feb 14

- RES 2: 4205.50 High Feb 16

- RES 1: 4200.00 Round number resistance

- PRICE: 4179.50 @ 1500ET Apr 18

- SUP 1: 4148.00/4106.03 Low Apr 17 / 20-day EMA

- SUP 2: 4069.41 50-day EMA

- SUP 3: 3980.75 Low Mar 28

- SUP 4: 3937.00 Low Mar 24

The trend outlook in S&P E-minis remains bullish and today’s gains reinforce current conditions. The contract has traded to a fresh cycle high and is approaching the 4200.00 handle. Sights are on 4205.50, the Feb 16 high ahead of 4244.00, the Feb 2 high and a key medium-term resistance. Firm support lies at 4069.41, the 50-day EMA. Initial support to watch lies at 4106.03, the 20-day EMA.

COMMODITIES: Crude Oil Muddles Through, Gold Builds As DXY Declines

- Crude oil are closing out near flat on the day after some intraday volatility to consolidate yesterday’s slide despite today seeing a sizeable retracement in USD moves having weighed so heavily yesterday.

- OPEC Secretary-General Haitham al-Ghais rejected the criticism by the IEA that voluntary oil production cuts by several OPEC+ states would aggravate inflation and cause heightened economic uncertainty.

- WTI (CLK3) is unch% at $80.83 off a low of $79.87 that remained off support at $79.00 (Apr 3 high).

- The CLM3 sees largest OI now though, with the day’s most active strikes for sizeable downside protection at $70/bbl puts.

- Brent is -0.0% at $84.71 off a low of $83.81 that briefly cleared supprot at $83.50 (Apr 3 low), a clearer break of which could open $79.95 (Mar 31 high).

- Gold is +0.5% at $2004.82 as it recovers along with the dollar index turning lower, but remains easily below resistance at $2048.7 (Apr 5 high).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2023 | 0430/1330 | ** |  | JP | Industrial production |

| 19/04/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 19/04/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 19/04/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 19/04/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 19/04/2023 | 0900/1100 | *** |  | EU | HICP (f) |

| 19/04/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 19/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 19/04/2023 | 1035/1235 |  | EU | ECB Lane Speech at Enterprise Ireland Summit | |

| 19/04/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 19/04/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/04/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 19/04/2023 | 1500/1700 |  | EU | ECB Schnabel Lecture at Leibniz-Zentrum ZEW | |

| 19/04/2023 | 1630/1730 |  | UK | BOE Mann Panellist at Brandeis International Business School | |

| 19/04/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 19/04/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 19/04/2023 | 2300/1900 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.