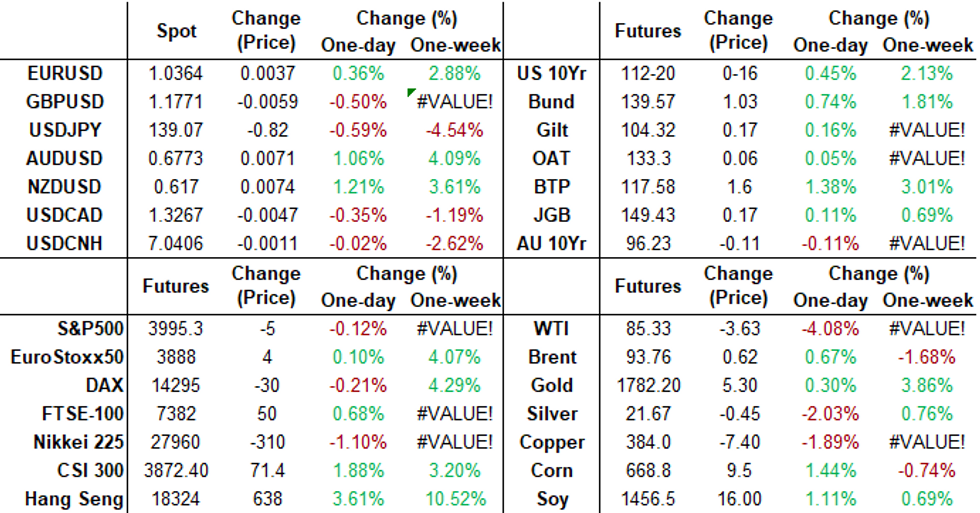

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: PPI Miss, Geopol Risks

HIGHLIGHTS

- AP: RUSSIAN MISSILES CROSSED INTO POLAND, KILLING 2 CITES SENIOR US INTELLIGENCE OFFICIAl

- POLAND CONVENES NATIONAL SECURITY COMMITTEE MEETING: SPOKESMAN, Bbg

- ORBAN CALLS DEFENSE MEETING AFTER DRUZHBA, POLAND INCIDENTS:MTI

- FED'S HARKER: SEES FED GOING ON HOLD AT SOME POINT NEXT YEAR

- FED'S HARKER: I DON'T LIKE TO BASE POLICY ON A COUPLE OF HEADLINE NUMBERS .. AS LONG AS WE'RE MOVING CONSISTENTLY TO COLLAPSE INFLATION DOWN, WE CAN PAUSE, Bbg

- FED COOK: HAVE TO BE CAREFUL HOW MONETARY POLICY IS WIELDED .. FED WANTS SUSTAINABLY STRONG LABOR MARKET, Bbg

Key links: MNI: Fed's Harker Sees Soft Landing For US Labor Market / MNI: Bostic Anticipates More Fed Hikes Will Be Needed / MNI BRIEF: Barr Expects To Say More About SLR Review Next Year

US TSYS: Risk Off on Stray Missile Induced Volatility

Tsys firmer, back near early session highs after second half risk-off driven volatility. Risk-off early in second half after unconfirmed reports of "stray" missile strike in Poland near Ukraine border. Tsys bounced as risk-off action ensued amid sporadic headlines and calls for security council meetings in Poland and Hungary. Pentagon officials are aware of the reports but can't corroborate.

- Tsys surged higher this morning after lower than forecasted PPI (MoM +0.2% vs. 0.4% est; YoY +8.0% vs. +8.3% est) saw Tsys extend early rally past last Thursday's post-CPI levels.

- BLS: The index for final demand goods moved up 0.6 percent in October, the largest advance since a 2.2-percent rise in June. Most of the October increase can be traced to a 2.7 percent jump in prices for final demand energy.

- FI support cooled after Philly Fed Harker, Fed Gov Cook and lastly Atlanta Fed Bostic offered cautionary opinions/outlooks: Harker: doesn't like to "base policy on a couple headline number", yet sees the Fed "going on hold some point next year". Cook: HAVE TO BE CAREFUL HOW MONETARY POLICY IS WIELDED, Bbg. Bostic: sees "glimmers of hope" that inflation is cooling, but expects more hikes as tighter money has not yet constrained business activity enough to seriously dent inflation.

- Year end pivot/hike step-down gains traction: Fed funds implied hike for Dec'22 at 50.9bp, Feb'23 cumulative 85.7bp to 4.70%, terminal funds rate 4.9% in May'23/Jun'23 (5.08% pre-CPI).

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00500 to 3.81357% (-0.00129/wk)

- 1M +0.01700 to 3.90357% (+0.02828/wk)

- 3M +0.00585 to 4.64971% (+0.04357/wk) * / **

- 6M -0.01886 to 5.08500% (+0.00100/wk)

- 12M -0.02343 to 5.46014% (+0.00885/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.64971% on 11/10/22

- Daily Effective Fed Funds Rate: 3.83% volume: $99B

- Daily Overnight Bank Funding Rate: 3.82% volume: $284B

- Secured Overnight Financing Rate (SOFR): 3.79%, $1.041T

- Broad General Collateral Rate (BGCR): 3.75%, $429B

- Tri-Party General Collateral Rate (TGCR): 3.75%, $405B

- (rate, volume levels reflect prior session)

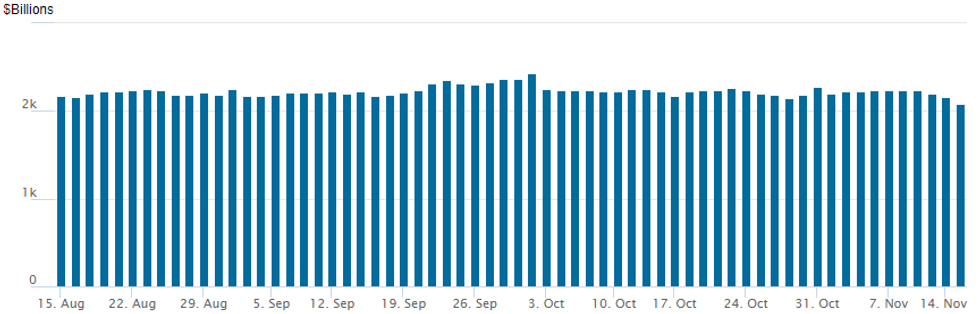

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,086.574B w/ 99 counterparties vs. $2,200.586B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Variety of trades made up for modest overall option volumes Tuesday, better put volumes in SOFR options on net with early buys evaporating as underlying climbed post-PPI; Tsy options saw better call interest overall.- SOFR Options:

- -5,000 SFRU3 94.00 puts, 6.0 vs. 95.36/0.08%

- +3,000 SFRM3 95.00 straddles 65-65.5

- +2,500 SFRH3 94.37/94.50/94.75 put flys, 2.5

- Block, total 8,000 SFRF 94.75/95.00/95.25 put flys, 6.0 ref 95.15

- 2,000 SFRZ2 96.75 calls, cab

- 4,000 SFRZ2 94.25 puts, ref 95.645

- Block, 4,000 SFRZ2 95.56/95.68 call spds, 0.75 ref 95.48

- 1,850 SFRZ2 95.43/95.56 put spds ref 95.48

- 5,000 SFRF3/SFRG3/SFRH3 94.93/95.06 put spd strip ref 95.145

- 3,300 SFRG3 95.00/95.12 put spds, ref 95.14

- 8,000 SFRZ2 95.50/95.56 call spds vs. 95.31/95.37 put spd ref 95.48

- 3,200 SFRZ2 95.68/95.75 call spds, cab ref 95.4775

- 6,500 SFRM3 94.37/94.50/94.75 put flys, ref 95.145

- 10,000 SFRM3 94.50 puts, 1.5 ref 95.145

- Eurodollar Options:

- +15,000 EDU3 95.12 calls 3.5 over SFRU3 95.37 calls, 3.5

- Treasury Options:

- +3,500 TYZ 113.5 calls, 17 vs. 112-20.5/0.28%

- -3,000 TYH 113 straddles, 333-334

- -3,500 TYF 113.114.5 2x3 call spds 41-40

- +8,000 TYZ2 113 calls, 27-28 vs. 112-23

- +4,800 TYG 115/118 call spds, 34 vs. 112-25.5

- +5,000 TYF 114.5/TYZ 113 call spds, 5/Jan over vs. 112-31

- 3,300 TYG 113.5/115 call spds

- Block, +20,000 TYF 114/116 call spds, 29 vs. 112-21/0.21%, another 13k on screen (unwind)

- 3,400 TYZ 112.5 calls, 33

EGBs-GILTS CASH CLOSE: BTPs Outperform

Yields fell sharply across the German and UK curves Tuesday, but periphery EGBs outperformed as the risk rally continued.

- Bunds and Gilts strengthened for most of the morning session, cresting in the early afternoon after a soft US producer prices print added further fuel to the "peak inflation" narrative.

- While that rally partially reversed, yields closed at around late-morning levels.

- The short end outperformed on both curves: ECB terminal rate pricing (2.90%) dipped a few bp; BoE steady at 4.90%.

- 10Y BTP spreads hit another fresh post-July low below 200bp as stocks continued to gain and the dollar weakened.

- Attention after the cash close turns to ECB's Elderson and Holzmann.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 4.6bps at 2.17%, 5-Yr is down 1.6bps at 2.066%, 10-Yr is down 3.9bps at 2.108%, and 30-Yr is down 5.1bps at 2.052%.

- UK: The 2-Yr yield is down 5.8bps at 3.101%, 5-Yr is down 4.5bps at 3.314%, 10-Yr is down 7.3bps at 3.295%, and 30-Yr is down 2.6bps at 3.471%.

- Italian BTP spread down 8.5bps at 194.9bps / Spanish down 3.6bps at 101.6bps

EGB Options: Upside Plays Continue

Tuesday's Europe rates / bond options flow included:

- RXZ2 141.00/143.00cs 1x2, bought for 16 in 5k

- ERZ2 97.875/98.00/98.125c fly, bought for 1.25 in 2k

- ERF3 97.00/97.125/97.25/97.50 broken c condor, bought for 1.25 in 3.75k

- SFIZ2 96.35/96.45/96.55c fly, bought for 2 in 4k

FOREX: Volatile Session Amid US Data, Late Russian Missile Reports

- Currency markets traded in volatile fashion on Tuesday, with the greenback initially extending its most recent weakness before sharply reversing in late US trade.

- Strength in equity markets was weighing on the greenback overnight with the USD index extending the most recent weakness following the US inflation data last week. A set of weaker producer price data from the US exacerbated this dollar weakness with the USD index extending its four-day decline to 5.1%.

- Likely profit taking after moves appeared stretched on an intra-day basis prompted some moderation with the greenback edging higher throughout the US trading session. This greenback recovery, however, gained significant traction amid headlines that Russian missiles had strayed into Poland from Ukraine, potentially causing two deaths.

- The greenback firmed across the board with EURUSD briefly trading back below 1.03 handle with a considerable turnaround from the post-PPI highs of 1.0479 earlier in the session. 1.0272/0163 Low Nov 14 / 11 are the immediate points of support before more significant support at 1.0094, High Oct 27.

- As markets await details of the event and an emergency meeting in Poland, risk sentiment has stabilised and the USD has slipped back into negative territory approaching the APAC crossover.

- Overall strength in equity markets continues to underpin the likes of AUD and NZD as well as Cable, that have all risen over 1% on Tuesday. Underpeforming on the day are the Swiss Franc and Chinese Yuan, remaining close to unchanged on the day.

- Australian Wage Price Index will be published overnight before UK and Canadian CPI data on Wednesday. US retail sales report for October highlights the US data docket.

FX Expiries for Nov16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200-10(E1.8bln), $1.0250-55(E1.0bln), $1.0500(E508mln)

- USD/JPY: Y137.50($500mln), Y140.00-10($777mln), Y140.75-00($840mln), Y147.90-00($1.1bln)

- USD/CNY: Cny7.2000($2.6bln), Cny7.3000($3bln)

Late Equity Roundup: Late Risk Off on Geopol Uncertainty

Stocks firmer in late trade, well off highs following unconfirmed reports of "stray" missile strike in Poland near Ukraine border. Tsys bounced as risk-off action ensued amid sporadic headlines and calls for security council meetings in Poland and Hungary. Pentagon officials are aware of the reports but can't corroborate.

- Stocks off lows ahead the FI close: SPX eminis currently trading +24.5 (0.62%) at 3991.25; DJIA +4.22 (0.01%) at 33541.56; Nasdaq +140.9 (1.3%) at 11337.43.

- SPX leading/lagging sectors: Communication Services sector outperforms but off highs (+1.31%) media & entertainment leads (Paramount +6.44%, Google +2.27%, NFLX +3.20%); Information Technology (+2.39%) follows, semiconductors leading. Laggers: Materials (-0.43%), Health Care (-0.32%), Financials (+0.17%).

- Dow Industrials Leaders/Laggers: Walmart (WMT) +10.35 at 148.74 after strong earnings ($1.50 vs. $1.32 est) forward guidance; Home Depot (HD) +5.10 at 312.02, Visa (V) +2.58 at 209.44. Laggers: United Health (UNH) -11.57 at 502.18, McDonalds (MCD) -4.67 at 267.60, Amgen (AMGN) -3.49 at 281.81.

E-MINI S&P (Z2): Bullish Extension

- RES 4: 4175.00 High Sep 13 and a key resistance

- RES 3: 4146.63 76.4% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 4100.00 Round number resistance

- RES 1: 4050.75 Intraday high

- PRICE: 4005.00 @ 1500ET Nov 15

- SUP 1: 3842.49 50-day EMA

- SUP 2: 3750.00 Low Nov 9

- SUP 3: 3704.25 Low Nov3 and key short-term support

- SUP 4: 3641.50 Low Oct 21

S&P E-Minis remains bullish and the contract is trading higher today, extending recent gains. Price rallied sharply higher last week and cleared resistance at 3928.00, Nov 1 high. The break strengthens a short-term bullish condition and price has established a sequence of higher highs and higher lows on the daily scale. This opens 4100.00 next. On the downside, key short-term support has been defined at 3704.25, the Nov 3 low.

COMMODITIES: Oil Swings With Poland Missile Reports and Druzhba Pipeline Halt

- Reports of Russian missiles killing two in Poland have pushed major commodities higher before retracing somewhat. Poland and Hungary are calling emergency meetings whilst AP cites senior US intelligence officials. However, the Pentagon has subsequently not been able to corroborate reports at this time and there have also been unconfirmed Twitter comments that suggest it could be debris from a rocket shot down by Ukraine, helping retrace a sizeable portion of the move.

- The Druzhba pipeline has also been halted after an artillery hit to its electricity supply according to Hungarian oil and gas company MOL, although MOL says its operational and Hungary’s strategic oil reserves are sufficient to keep the main refinery in Szazhalombatta running until the damage is repaired.

- WTI is currently +1.8% at $87.38 having earlier cleared key support at $84.7 (Nov 10 low) before bouncing. It opens the bear trigger at $81.30 (Oct 18 low).

- Brent is +1.3% at $94.34, having tested key support at $91.73 (Nov 10 low) before bouncing.

- Gold is +0.2% at $1775.4 off a high of 1786.53 that came closer to resistance at the psychological $1800.0.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/11/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/11/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/11/2022 | 0900/1000 | *** |  | IT | HICP (f) |

| 16/11/2022 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 16/11/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/11/2022 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/11/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/11/2022 | - |  | ID | G20 Summit in Indonesia | |

| 16/11/2022 | - |  | TH | APEC Leaders’ Summit | |

| 16/11/2022 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 16/11/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/11/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/11/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 16/11/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/11/2022 | 1415/1415 |  | UK | BOE Treasury Select Committee hearing on Nov Monetary Policy Report | |

| 16/11/2022 | 1450/0950 |  | US | New York Fed's John Williams | |

| 16/11/2022 | 1500/1000 | * |  | US | Business Inventories |

| 16/11/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/11/2022 | 1500/1600 |  | EU | ECB Lagarde Speech at European School Frankfurt Anniversary | |

| 16/11/2022 | 1500/1600 |  | EU | ECB Panetta at ABI's Executive Committee Meeting | |

| 16/11/2022 | 1500/1000 |  | US | Fed Vice chair for Supervision Michael Barr | |

| 16/11/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/11/2022 | 1935/1435 |  | US | Fed Governor Christopher Waller | |

| 16/11/2022 | 2100/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.