-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Rate-Cuts Gain Momentum Post-PPI

- US Oil and Gas Rig Count Down 2 to 619: Baker Hughes

- MNI UK: PM-Aim Of Strikes To De-Escalate Red Sea Tensions

- MNI US DATA: Medical Prices Key To Soft Core PCE-Related Categories

- MNI NATO: Turkey's Erdogan Criticises US/UK Strikes On Houthi Targets

- MNI SECURITY: WH NSC Kirby: "We're Not Interested In A War With Yemen"

- MNI FREIGHT: US-Flagged Ships Should Restrict Transit Through Red Sea: Navcent

- MNI SECURITY: WH Spox Talks On Strikes As UKMTO Warns Of Incident In Gulf Of Aden

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Projected Rate Cuts Gain Momentum After Soft PPI Inflation Metrics

- Treasury futures bounce off lows, trading steady to mildly higher after lower than expected PPI Final Demand MoM (-0.1 vs. 0.1% est), YoY (1.0% vs. 1.3% est, prior down-revised to 0.8% from 0.9%). Ex Food and Energy lower than expected as well.

- The most scrutinized areas though will be those that feed into the Fed's preferred measure of inflation: PCE. On this front there is no reason from this report to expect any upside revisions to those expectations than had been imputed by analysts after yesterday's CPI, and perhaps some bias toward downward revisions if anything - especially based on what was reported for the key healthcare services categories.

- March'24 10Y futures tested initial resistance of 112-19 (High Jan 4) to 112-26.5 high before settling back to 112-16.5 last (+5.5). Next technical level to watch 113-12 (High Dec 27 and the bull trigger). Curves bull steepening: 2Y10Y climbed above -20 to -17.936 high (late October 2023 level).

- Short end rates held strong into the close, indicative of higher projected rate cuts through mid-2024: January 2024 cumulative -1.6bp at 5.313%, March 2024 chance of rate cut -77% w/ cumulative of -20.9bp at 5.120%, May 2024 fully pricing in 25bp cut now, cumulative -50.1bp at 4.828%. June 2024 cumulative -80.4bp at 4.525%. Fed terminal at 5.3275% in Jan'24.

- Reminder: The U.S. will observe the Martin Luther King Day public holiday on Monday, January 15. For FI futures: Globex opens normal time Sunday evening at 1800ET but close at 1300ET Monday. Monday Globex re-open at 1800ET precedes normal session hours Tuesday.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00482 to 5.33798 (-0.00126/wk)

- 3M +0.00254 to 5.31653 (-0.01273/wk)

- 6M -0.00218 to 5.15347 (-0.03937/wk)

- 12M -0.01317 to 4.78978 (-0.06472/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.648T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $681B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $668B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $96B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $255B

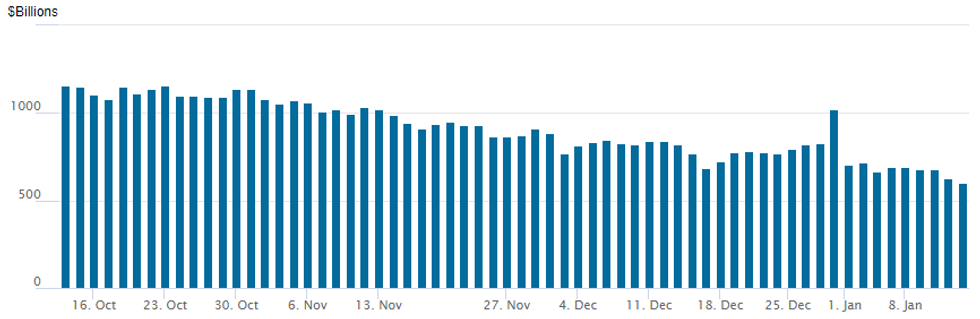

FED REVERSE REPO OPERATION: New Low Includes Counterparty Number

NY Federal Reserve/MNI

- RRP usage falls to $603.116B vs. $626.370B Thursday, today's usage marks the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties declines to 70 -- the lowest since January 5, 2022.

SOFR/TREASURY OPTION SUMMARY

SOFR options continue to revolve around call structure/rate cut positioning well after this morning's lower than expected PPI inflation measures for December. Data spurred a strong rally in short to intermediate FI markets while projected rate cuts for the first half of 2024 rebounded: January 2024 cumulative -1.6bp at 5.313%, March 2024 chance of rate cut -77% w/ cumulative of -20.9bp at 5.120%, May 2024 fully pricing in 25bp cut now, cumulative -50.1bp at 4.828%. June 2024 cumulative -80.4bp at 4.525%. Fed terminal at 5.3275% in Jan'24.

SOFR Options:

+5,000 SFRZ4 96.50/97.00/97.50 call flys, 6.0 vs. 96.35/0.05%

+30,000 SFRG4 95.12/95.25/95.37 call flys, 1.0

+50,000 SFRH4 95.25/95.37/95.43/95.56 call condors, 0.75

Block, 8,880 SFRZ4 94.12/94.62/95.00 put flys, 1.5 net ref 96.32

Block, +11,000 SFRU4 96.00/96.50 call spds vs. -0QU4 97.00/97.50 call spds, .75 cr conditional steepener: midcurve sold over

Block, 10,000 SFRZ4 97.75/98.00 call spds 2.5 vs. 96.28/0.05%

Block, 5,000 SFRG4 94.75/95.00 put spds .5 over SFRG4 95.00/95.37 call spds

Block, 5,000 SFRJ4 95.37/95.50/95.62 put flys, 2.0 ref 95.565

+4,000 SFRU4 95.00/95.25/95.50/95.75 put condors

Block, 5,000 SFRG4 94.75/94.87/95.00 put flys, 3.25 ref 95.01

+20,000 SFRH4 95.37/95.43 call spds, 0.5

-50,000 SFRH4 94.87/95.00/95.12/95.25 call condors 5.5 over SFRH4 94.62 puts ref 95.01 - unwind

Block, 5,000 SFRM4 94.75/95.00 2x1 put spds, 2.0 ref 95.53/0.03%

Block, 7,000 95.37/95.50 call spds 5.5 vs. 95.48/0.05

5,000 SFRU4 95.87/96.37/96.62/96.87 call condors

5,000 SFRG4 95.12/95.25/95.50 call trees ref 94.955

Blocks, 12,000 0QM4 96.75/97.25/97.75 call flys 3.5 over 0QM4 95.75/96.00 put spds

3,000 SFRM4 95.25/95.50/95.75 call flys

+15,000 0QH4 96.75/97.00 call spds, 6.0 ref 96.49

+6,000 2QH4 97.12/97.50 call spds, 5.5 ref 96.76

3,000 SFRH4 95.12 calls ref 94.96 to -.955

2,000 SFRM4 95.06/95.18 put spds ref 95.445/0.09%

1,500 0QF4 96.62/96.75 call spds ref 96.49/0.10%

2,000 SFRM4 95.50/95.75/96.00/96.12 broken call condors ref 95.425

2,000 SFRH4 94.81/SFRJ4 94.93 put spds

15,000 0QH4 96.75/97.25 call spds

Treasury Options:

-6,500 TYG4112.5 puts, 26 vs. 112-26/0.43%

+8,000 USG4 124/126 call spds 27-28 ref 122-27

2,000 FVG4 107.25/107.75/108.25 put trees, 3.5

+15,000 TYG4 113 calls, 31 vs. 112-25

-10,000 wk2 TY 112.25 puts, 3 ref 112-14/0.32%

1,500 TYG4 113/114 call spds vs. TYG4 110/111 put spds ref 112-10.5

EGBs-GILTS CASH CLOSE: Rally Led By Short-End/Belly

Gilts and EGBs rallied Friday, led by gains in the short-end and belly after US producer price data came in softer than expected.

- Core FI rallied at the open, with some apparent focus on soft 3M/3M UK GDP and services data within a mixed report. The main event of the day though was US PPI which pointed to a softer core PCE inflation reading for December than Thursday's CPI alone implied.

- This boosted rate cut expectations in the US which spilled over into Europe: implied ECB cuts this year ramped up 14bp on the session to 155bp, with BoE up 15bp to 136bp.

- Periphery spreads tightened once again, with 10Y BTP/Bund at the tightest closing level since April 2022.

- The German and UK curves bull steepened. 10Y German yields finished the week 2.5bp higher; Gilts were flat.

- After hours, we get potential ratings decisions for the EFSF/ESM/Latvia/Austria; Monday's session will likely be quieter than usual given a US holiday, with attention next week on UK labour market/inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 10.9bps at 2.517%, 5-Yr is down 7.5bps at 2.078%, 10-Yr is down 5.2bps at 2.184%, and 30-Yr is down 3.1bps at 2.395%.

- UK: The 2-Yr yield is down 9.5bps at 4.16%, 5-Yr is down 9.6bps at 3.661%, 10-Yr is down 4.9bps at 3.793%, and 30-Yr is down 1.6bps at 4.424%.

- Italian BTP spread down 2.1bps at 155bps / Spanish down 1bps at 90.8bps

EGB Options Mostly Upside To End The Week

Friday's Europe rates/bond options flow included:

- SFIG4 95.00/95.10/95.20c fly, bought for 1.25 on 8k

- SFIZ4 98.00/98.50cs, bought for 3 in 3.5k

- ERG4 96.37/96.50cs, bought for 1.5 in 3k

- ERH4 96.12 puts paper paid 1.5 on 18K

- 0RH4 98.00/98.25/98.50 c fly, bought for 2.75 in 4k

- 0RH4 98.12c, bought for 8 in 8.5k

FOREX USD Index Close To Unchanged On Week Amid Mixed US Inflation Figures

- Despite March Fed cut pricing building back up to a cumulative 21.5bps, broad volatility for the greenback this week remained relatively low, with the USD index’s weekly range unable to breach last Friday’s extremes. Mixed inflation data in the US prompted two-way flows for the DXY, but culminated in the index remaining close to unchanged levels from a week prior.

- USDJPY continues to register the most impressive daily ranges, with another 12- pip swing on Friday. Initial gains to 145.50 evaporated in the aftermath of the data and stale post-CPI longs were further challenged throughout the final session of the week. Despite trading as low as 144.37 the pair has stabilised around 144.80 as we approach the close.

- A key short-term support has been defined at 143.42, the Jan 9 low. A break of this level is required to instead signal a top and highlight a resumption of bearish activity.

- GBP/USD briefly made a round-trip back to the week’s best levels as the greenback initially extended upon the post-PPI pullback. Sustained cable gains through 1.2785 would open YTD highs and the bull trigger of 1.2827. Above here, the pair clears the best levels since August of last year.

- Stable equity markets continue to provide a relatively solid backdrop for emerging market fx, with Latin American currencies performing well on Friday. USDMXN hovers close to year-to-date lows at 16.80 and will eye a move towards support at 16.6262, the Jul 28 low.

- Swedish CPI and Eurozone IP & trade balance data highlight the docket on Monday. US banks will be closed in observance of Martin Luther King Jr. Day.

FX Expiries for Jan15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0885-90(E1.6bln), $1.0900-05(E537mln), $1.0950(E1.1bln), $1.1000(E1.2bln), $1.1030-50(E3.1bln)

- USD/JPY: Y144.00($572mln), Y145.00($730mln)

- AUD/USD: $0.6840(A$1.0bln)

- NZD/USD: $0.6175-95(N$1.2bln), $0.6340(N$972mln)

Late Equity Roundup: Holding Weaker, Narrow Range

- Stocks remain modestly weaker late Friday, DJIA underperforming S&P Eminis and Nasdaq stocks on narrow session ranges. Currently, DJIA is down 169.16 points (-0.45%) at 37543.05, S&P E-Mini future down 5.5 points (-0.11%) at 4810.5, Nasdaq down 21.2 points (-0.1%) at 14949.53.

- Laggers: Consumer Discretionary sector shares led laggers in the second half: auto makers and parts suppliers/producers weaker: Tesla -4.24% as some cited Red Sea attacks have halted factory production there, Borg-Warner -4.31%, Aptiv -3.01%, Ford -2.26% and GM -1.55%.

- Financial sector shares drew early focus after several banks kicked off the latest earning cycle with mixed results this morning, banks weighing on the Financials sector with Wells Fargo (-3.23%), Zion Bancorp -2.61%, Bank of America (-0.66%).

- On the flipside: Bank of NY Mellon climbed +3.85%, Citigroup reversed losses to +1.14% while JP Morgan held small gains after reporting +2% revenue in markets (FI gains tempered by losses in equities). It was notable today that JPM raised its CET1 ratio (a key indicator for credit investors) whereas both BAC and Citi saw theirs drop in 4Q23.

- Leading gainers: Energy and Communication Services sectors outperformed in the second half, oil and gas shares rebounding along with crude prices (WTI off highs to 72.75): Valero +2.18%, Marathon Petroleum +1.94%, Phillips 66 +1.73%. Communication Services sector was buoyed by telecom shares: AT&T +1.32%, Verizon +1.41%, T-Mobile +0.28%.

E-MINI S&P TECHS: (H4) Bull Trigger Remains Exposed

- RES 4: 4915.11 1.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 4900.00 Round number resistance

- RES 2: 4854.75 1.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4841.50 High Dec 28 and the bull trigger

- PRICE: 4815.00 @ 1520 ET Jan 12

- SUP 1: 4702.00 Low Jan 05

- SUP 2: 4692.24 2.0% 10-dma Envelope

- SUP 3: 4673.91 50-day EMA

- SUP 4: 4594.00 Low Nov 30

S&P E-Minis have remained above the Jan 5 low and the contract has traded higher this week. Key resistance and the bull trigger is at 4841.50, the Dec 28 high. Clearance of this level would resume the uptrend and open 4854.75, a Fibonacci projection. Support at the 20-day EMA of 4766.12 has recently been pierced. A clear break of this average would strengthen a short-term bearish threat and open the 50-day EMA, at 4673.91.

COMMODITIES Crude Gives Back Bulk Of US/UK Military Strike Gains, Gold Surges

- Crude futures have for the third day now sharply given back earlier gains, with some of that late weakness seen along with an intraday recovery in the USD index. Despite WTI still rising 1% on the day it’s set for down circa -1.5% on the week.

- Today’s earlier gains followed concerns that US/UK military strikes on Yemen’s Houthis will worsen Middle East tensions.

- All US and UK interest are now legitimate targets for the Houthi rebels according to a statement by the group Friday following earlier air strikes against them in Yemen, whilst the US Naval Forces Central Command issued a note calling for US-flagged vessels to restrict transit in the Red Sea following the US strikes against the Houthis in Yemen. At least three tanker firms have said they are going to suspend sending their ships via the southern Red Sea due to Houthi rebel attack escalations following US/UK air strikes on rebel positions in Yemen Friday.

- Citigroup have lowered the Brent price outlook for 2024 by $1/bbl to $74/bbl while the 2025 forecast has been cut by $10 to $60/bbl.

- WTI is +0.9% at $72.68 off a high of $75.25 but one which didn’t touch resistance at $76.18 (Dec 26 high).

- Brent is +1.1% at $78.29 after its high of $80.75 cleared $79.41 (Jan 4 high) but stopped short of a key resistance at $81.45.

- Gold is +0.9% at $2046.58 off earlier highs of $2062.26, buoyed by the aforementioned geopolitical risk. The earlier high stopped just short of resistance at $2064.0 (Jan 5 high).

- Weekly moves: WTI -1.5%, Brent -0.6%, Gold +0.1%, US nat gas +15%, EU TTF nat gas -7.4%

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/01/2024 | 0700/0800 | *** |  | SE | Inflation Report |

| 15/01/2024 | 0900/1000 |  | DE | German Annual 2023 GDP First Estimate | |

| 15/01/2024 | 0900/1000 |  | EU | ECB's Lagarde and Cipollone in Eurogroup meeting | |

| 15/01/2024 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/01/2024 | 1000/1100 | * |  | EU | Trade Balance |

| 15/01/2024 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/01/2024 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 15/01/2024 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/01/2024 | 1530/1030 | ** |  | CA | BOC Business Outlook Survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.