-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

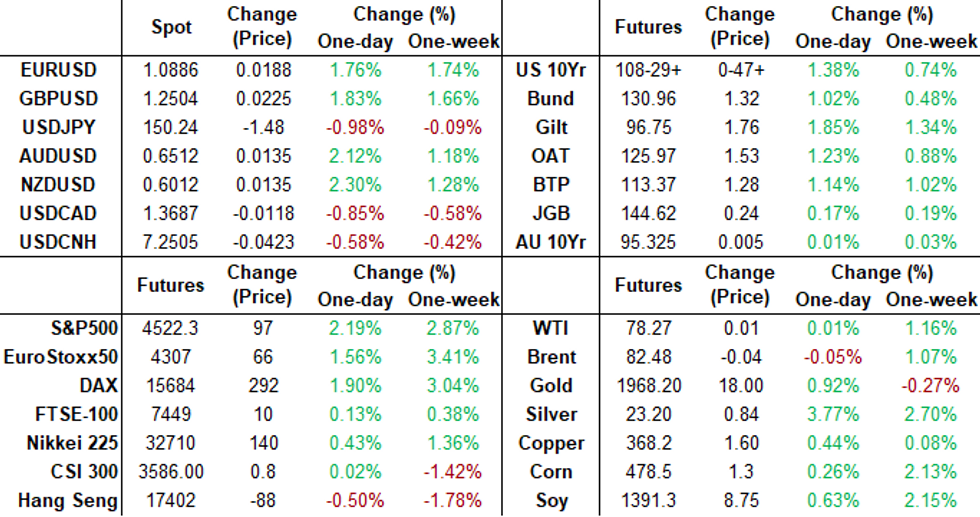

Free AccessMNI ASIA MARKETS ANALYSIS: Rates, Equities Surge Post-CPI

- MNI: US OCT CPI 0.0%, CORE 0.2%; CPI Y/Y 3.2%, CORE Y/Y 4.0%

- MNI US: Sen Reed Urges House To Pass CR So Congress Can Consider Ukraine/Israel Aid

- BARKIN: WE ARE NOT IN A RECESSION RIGHT NOW, bbg

- MAJORITY LEADER CHUCK SCHUMER HOPES HOUSE PASSES JOHNSON'S STOPGAP FUNDING, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US TSYS Disinflationary CPI Green Lights Another Fed Pause in Dec

- Treasury futures near late session highs after the bell, actually holding to a narrow range ever since marking midmorning highs following this morning's lower than expected CPI data: CPI MoM (0.0% vs. 0.1% est, 0.4% prior), YoY (3.2% vs. 3.3% est, 3.7% prior); CPI Ex Food/Energy MoM (0.2% vs. 0.3% est, 0.3% prior), YoY (4.0% vs. 4.1% est).

- Dec'23 10Y futures topped initial resistance (108-25, High Nov 3 and the next bull trigger) to 108-31 high, the contract currently trading 108-28.5 (+1-14.5), yield currently 4.4375% (-.2004) vs. 4.4298% low.

- Heavy overall volumes (TYZ3>2.4M) as markets react to this morning disinflationary CPI inflation measures for October. USD index greenback slowly been extending its decline throughout the session with the USD index down 1.5% as we approach the APAC crossover.

- Post-CPI: projected rate cut resurfaces in early 2024: December at 0bp at 5.338%, January 2024 cumulative -.5bp (7.1bp pre-CPI) at 5.332%, March 2024 pricing in -32.9% chance of a .25 rate cut (-16% pre-CPI) with cumulative of -8.7bp at 5.240%, May 2024 pricing in -52.8% chance of a rate cut with cumulative of -21.9bp at 5.108%. Fed terminal has fallen to 5.325% in Feb'24 vs. 5.405% pre-CPI.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00662 to 5.32953 (+0.00723/wk)

- 3M +0.01049 to 5.39021 (+0.01257/wk)

- 6M +0.01554 to 5.43478 (+0.02001/wk)

- 12M +0.01415 to 5.34833 (+0.03188/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $102B

- Daily Overnight Bank Funding Rate: 5.32% volume: $248B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.494T

- Broad General Collateral Rate (BGCR): 5.30%, $596B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $576B

- (rate, volume levels reflect prior session)

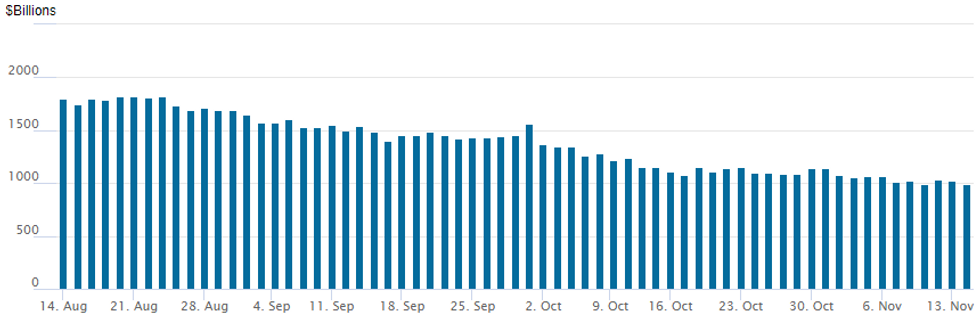

FED REVERSE REPO OPERATION: Back Below $1T

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage falls to the lowest level since August 2021 w/ $988.298B w/97 counterparties today vs. $1,020,272B in the prior session. Usage fell below $1T for the first time since August 2021 last Thursday, November 9: $993.314B.

SOFR/TREASURY OPTION SUMMARY

SOFR and Treasury options posted heavier volumes Tuesday, trade decidedly bullish as underlying futures surged higher following lower than expected CPI inflation data for October. Large call spread buys and put spread unwinds noted below. Projected rate cut resurfaces in early 2024: December at 0bp at 5.338%, January 2024 cumulative -.5bp (7.1bp pre-CPI) at 5.332%, March 2024 pricing in -32.9% chance of a .25 rate cut (-16% pre-CPI) with cumulative of -8.7bp at 5.240%, May 2024 pricing in -52.8% chance of a rate cut with cumulative of -21.9bp at 5.108%. Fed terminal has fallen to 5.325% in Feb'24 vs. 5.405% pre-CPI.

- SOFR Options:

- +50,000 SFRF4 95.00/95.12 call spds, 1.5

- Block, 10,000 0QZ3 95.75/96.00 call spds, 6.5 ref 95.66

- Block, 5,000 SFRH4 94.00/94.18/94.37 put flys, 0.75 ref 94.775

- -20,000 0QZ3 95.37/95.50 put spds 3.75

- Blocks, 12,500 SFRZ3 94.06/94.37/94.43/94.56 put condors, 0.75-1.0 ref 94.63

- Block, 6,000 SFRF4 94.37/94.50/94.62 put flys, 1.0 ref 94.77

- 2,000 SFRZ3 94.62/94.68/94.75 call flys,

- 6,000 SFRM4 96.00 calls vs. SFRU4 97.00 call spread

- Block, 5,000 SFRJ4 95.25/95.37 call spds, 3.25 ref 95.035

- 4,000 SFRZ3 94.50 puts ref 94.5725

- Block, 10,000 0QZ3 95.75/96.00 call spds, 3.75/splits ref 95.43

- Block, 5,000 SFRZ3 94.62/94.68 call spds 0.5 over SFRZ3 94.37 puts ref 94.575

- Block, 2,587 SFRZ3 94.43/94.56 put spds 1.0 over SFRZ3 94.62 calls ref 94.575

- 6,275 SFRF4 94.68/94.75/94.81/94.87 call condors ref 94.645

- 2,000 SFRF4 94.43/94.62/94.75 put flys

- 2,000 0QZ3 95.31 puts ref 95.445

- 3,300 SFRH4 94.12/94.25 put spds

- 4,600 SFRH4 94.56/94.68/94.81 put flys, ref 94.645

- 5,000 SFRH4 94.75/95.00 call spds ref 94.645

- Treasury Options:

- 10,000 Wed/wkly TY 105.5/106.75 1x2 put spds

- 3,000 TYZ3 112 calls, 1 ref 108-25.5

- 3,000 TYZ3 107.5/108 put spds, 6 ref 108-25

- Block +10,000 TYF3 103.5 puts, 3 ref 109-00.5

- 2,800 USZ3 116/117/118/119 call condors, 10 ref 115-10

- 7,000 TYF4 109.5/111 1x2 call spds, 5 ref 109-01.5

- over 11,000 TYZ3 109 calls, 18-19 ref 108-13.5

- 2,000 FVZ3 104.75 puts, 3 ref 105-24.5

- Update, over 31,000 Wed/wkly TY 109 calls ref 107-16 to 108-14.5

- 5,000 USZ3 116/119 call spds ref 113-13

- over 5,100 TYZ3 107 puts

- 6,000 Wed/wkly TY 106.25/106.75 put spds ref 107-16.5

- 2,400 TUZ3 101.37/101.75 call spds ref 101-08.25

- 8,700 Wed/wkly TY 108.5 calls, 3 ref 107-17

EGBs-GILTS CASH CLOSE: Bull Flattening Rally As US CPI Misses

European yields dropped sharply Tuesday after a softer-than-expected US inflation report triggered a global FI rally.

- Core instruments had a fairly constructive morning. But the early moves paled in comparison to the move after the US CPI print (core +0.2% M/M vs 0.3% expected) and its details all but cemented the perceived likelihood of the Federal Reserve being finished with its hiking cycle.

- The post-data reaction saw deeper ECB and BoE cut pricing and a bull flattening in both the German and - to a greater degree, UK - curves.

- 10Y German yields hit the lowest since mid-Sept, with 10Y Gilt the lowest since early June.

- Periphery EGB instruments rallied alongside, with Italian spreads narrowing most, but GGBs failing to match the Bund rally.

- European data had limited impact in comparison to the US: EZ flash Q3 GDP was in line, with the headline German ZEW expectations above-survey.

- UK labour data out this morning was mixed, with attention turning to the CPI reading out Wednesday. MNI's UK inflation preview (and review of the labour market data) available at this link.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 9.3bps at 2.988%, 5-Yr is down 11.1bps at 2.553%, 10-Yr is down 11.3bps at 2.6%, and 30-Yr is down 9.5bps at 2.816%.

- UK: The 2-Yr yield is down 7.7bps at 4.584%, 5-Yr is down 14.1bps at 4.182%, 10-Yr is down 16.2bps at 4.152%, and 30-Yr is down 15.9bps at 4.576%.

- Italian BTP spread down 4bps at 181bps / Spanish down 1.7bps at 103.7bps

EGB Options: Largely Upside Seen Tuesday

Tuesday's Europe rates/bond options flow included:

- DUZ3 105.00/105.20cs 1x1.5, bought the 1 for 4.25 in 4k

- DUZ3 105.00/105.10/105.20c fly, bought for 1.5 in 4.5k

- RXZ3 133/136cs, bought for 4 in 1.2k

- RXZ3 132.00/133.00 call spread bought for 16 in 6k

- SFIH4 94.90/95.10 cs vs 94.60/94.40 ps, bought the cs for half in 3k

- ERU4 96.125/96.00/95.875 put fly sold at 1.5 in 5k

FOREX USD Index Slumps 1.5% As US CPI Sparks Fed Easing Bets in 2024

- Softer-than-expected US CPI prompted a significant gap lower for the USD index in the aftermath of the data. As markets price in more, and faster, Fed rate cuts next year, the greenback has slowly been extending its decline throughout the session with the USD index down 1.5% as we approach the APAC crossover.

- It is worth noting that both AUD and NZD are now up over 2% on the day with the surge for major equity benchmarks providing additional tailwinds to risk-sensitive currencies. The antipodean FX strength is only behind the Swedish Krona as the best performer in G10.

- In similar vein, EUR and GBP are up just shy of 1.8%. For EURUSD, multiple resistance levels have been breached, and in most recent trade, 1.0882, the Sep 1 high has been pierced. Most notable topside level now comes in at 1.0945, the Aug 30 high and a key resistance.

- For cable, price is zoning in on the 1.25 handle ahead of tomorrow’s UK CPI data. We noted that resistance at 1.2428, Nov 6 high and the bull trigger, was cleared, triggering an impressive move towards the Sep 14 high of 1.2506.

- The lower core yields and favourable price action for stocks have underpinned a similarly impressive rally in merging market currencies, including 2.5% rallies for both the ZAR and PLN against the greenback, only trumped by the Chilean peso which has recovered 3.5% on Tuesday.

- Activity data from China takes focus overnight with industrial production and retail sales to be the latest barometers for the health of the Chinese economy. Australian wage price index will also cross. Afterwards, all eyes will be on the UK CPI data, before US retail sales, PPI and Empire State Manufacturing round off Wednesday’s docket.

FX Expiries for Nov15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0570-85(E1.8bln), $1.0675-80(E1.3bln), $1.0700-20(E2.3bln), $1.0800(E1.1bln)

- USD/JPY: Y148.90-00($1.7bln), Y150.00($1.2bln), Y151.27($783mln), Y152.00($2.3bln), Y152.25($691mln)

- EUR/JPY: Y163.30(E542mln)

- GBP/USD: $1.2535-36(Gbp851mln)AUD/USD: $0.6330-35(A$1.5bln)

- USD/CAD: C$1.3645-55($521mln)

- USD/CNY: Cny7.2500($1.8bln)

Equities Roundup: Post CPI Rally Holds, S&P Back to Mid-Sep Levels

- Stocks currently holding near session highs, risk appetite strong following this morning's lower than expected CPI inflation data for October.

- Back to mid-September levels, S&P E-Mini futures are up 84.25 points (1.9%) at 4509.75, Nasdaq up 309.1 points (2.2%) at 14076.59, DJIA up 470.8 points (1.37%) at 34809.73. Eminis rallied though initial technical resistance of 4508.00 (High Sep 20) with focus on 4552.38 (76.4% retracement of the Jul 27 - Oct 27 bear leg).

- Broad based rally led by Real Estate, Consumer Discretionary and Utility sector shares, the former led by management and services shares: CBRE +7.67%, CoStar Group 4.60%. Consumer Discretionary sector supported by strong gains in auto and parts makers: Aptiv +6.16%, Ford +5.65%, Tesla +5.4, GM +5.25%.

- Meanwhile, Utility sector shares were buoyed by independent power and water providers: AES +7.5%, AWK +5.34%.

- Laggers: Energy, Consumer Staples and Health Care sectors outperformed, oil and gas shares weighed on the former: Exxon Mobil -0.75%, EQT -0.05% while Occidental Petroleum gained 0.25%. Household and personal product stocks weighed on Staples: Procter&Gamble -0.1%, Kimberly-Clark -0.16%.

- Meanwhile, equipment and service providers weighed on Health Care: McKesson -2.35%, Cardinal Health +1.69%, Cencora Inc -1.66%

- Corporate earnings expected after the close: Advanced Auto Parts, TJX and Cisco

E-MINI S&P TECHS: (Z3) Bulls Remain In The Driver’s Seat

- RES 4: 4597.50 High Sep and a key resistance

- RES 3: 4566.00 High Sep 15

- RES 2: 4552.38 76.4% retracement of the Jul 27 - Oct 27 bear leg

- RES 1: 4520.75 Intraday High Nov 14

- PRICE: 4518.00 @ 1500 ET Nov 14

- SUP 1: 4341.05 20-day EMA

- SUP 2: 4257.75/4122.25 Low Nov 3 / Low Oct 27 and the bear trigger

- SUP 3: 4100.00 Round number support 4124.19

- SUP 4: 4090.35 1.764 proj of the Jul 27 - Aug 18 - Sep 1 price swing

S&P e-minis maintain a firmer tone and the contract has traded higher today, extending the current bull cycle. Resistance at 4425.38, a trendline drawn from the Jul 27 high, has been cleared. This reinforces bullish conditions and signals scope for gains above 4500.00 towards 4552.38, a Fibonacci retracement. On the downside, initial firm support is 4341.05, the 20-day EMA.

COMMODITIES Gold Surges On Post CPI USD Slide But Only Fleeting Impact On Crude

- Crude has erased all earlier gains, as a tailwind from the weaker dollar after softer than expected US CPI has proven short-lived despite the USD index extending lows.

- Global oil demand growth for this year has been revised up again by 100kbpd to 2.4mbpd to reach 102mbpd, with Chinese demand accounting for 1.8mbpd of all growth, according to the IEA Monthly Oil Market Report.

- The EU's top diplomat, Josep Borrell, has told reporters, after a meeting of EU foreign ministers today, that EU officials are "finalising" the "last details" of the 12th package of sanctions on Russia, expected to include a ban on Russian diamonds and measures to tighten enforcement of the price cap on Russian oil.

- Works to expand the Trans Mountain Pipeline project are allowed to restart Nov. 14, according to Reuters.

- WTI is -0.05% at $78.22, off an earlier high of $79.48 that moved closer to $80.20 (Oct 6 low).

- Brent is -0.1% at $82.44, off a high of $83.75 that had seen a step closer to resistance at $84.71 (20-day EMA).

- Gold is +0.8% at $1963.29 as it surges on that USD weakness and a tumbling of US Treasury yields after the CPI report. Prior heavy waekness for the yellow metal means it is still below resistance at $1978.4 (Nov 7 high) although it did touch an earlier high of $1970.94.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/11/2023 | 0030/1130 | *** |  | AU | Quarterly wage price index |

| 15/11/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/11/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/11/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/11/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate M/M |

| 15/11/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 15/11/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 15/11/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/11/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 15/11/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/11/2023 | 1000/1100 | * |  | EU | Trade Balance |

| 15/11/2023 | 1000/1100 |  | EU | European Commission Autumn Econ Forecasts | |

| 15/11/2023 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/11/2023 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/11/2023 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 15/11/2023 | 1330/0830 | *** |  | US | Retail Sales |

| 15/11/2023 | 1330/0830 | *** |  | US | PPI |

| 15/11/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/11/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 15/11/2023 | 1430/0930 |  | US | Fed Vice Chair Michael Barr | |

| 15/11/2023 | 1500/1000 | * |  | US | Business Inventories |

| 15/11/2023 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/11/2023 | 1800/1800 |  | UK | BOE's Haskel speech at the Resolution foundation | |

| 15/11/2023 | 2030/1530 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.