-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: BOJ Tankan To Show Slipping Sentiment

MNI: PBOC Net Drains CNY288.1 Bln via OMO Friday

MNI ASIA MARKETS ANALYSIS - Rates Rally and USD Lower In Thanksgiving Trade

- Treasury futures hold onto an overnight rally in spillover from weaker US data and dovish FOMC minutes

- Risk continues to be traded in buoyant fashion with the greenback maintaining its short-term downward bias, whilst the Japanese Yen leads the G10 pack

- Stocks firm slightly against the backdrop whilst oil broadly tracks sideways on continued Russia price cap discussions

- New Zealand retail sales cross in early APAC trade, marking the highlight of a very empty Friday data calendar. Final readings of German and Mexican GDP are the only data points of note.

US TSYS: TYZ2 Consolidates Post-Data/FOMC Climb

- TYZ2 sees a Thanksgiving early close 11 ticks higher at 113-09+ although ran a very narrow range of 113-09+-113-15 through US hours on unsurprisingly slim volumes.

- The day’s gains were seen earlier in London hours before plateauing with a beat for the German Ifo survey.

- In clearing resistance at 113-11 (Nov 16 high), it has opened the key 113-30 (Oct 4 high) but is yet to make inroads. Tomorrow’s docket is suitably quiet post-Thanksgiving, with a return of Fedspeak on Monday and an eye on Powell for Wednesday.

EURODOLLAR FUTURES: Yield Curve Nudges Lower In Holiday Trade

- Eurodollars saw little change in the front EDZ2 today but rallied 2-5bps further out the curve to the green pack in thin trade.

- The result is a terminal yield of 5.24% in EDM3 sitting 8bps lower than Tuesday’s close prior to a net rolling over in US data and dovish FOMC minutes.

- With a roughly parallel shift lower in the yield curve, EDM3/EDZ3 inversion remains around 45bps with the pace accelerating into 2024 with EDZ3/EDZ4 at -1.25.

FED: "Various" Issues With A Higher Terminal Rate

As we noted after the dovish reaction to the Nov FOMC Minutes release, the standout language was that "Many participants commented that there was significant uncertainty about the ultimate level of the federal funds rate" but "various participants noted that...their assessment of the ultimate level of the federal funds rate that would be necessary to achieve the Committee's goals was somewhat higher than they had previously expected."

- That is a dovish development, the keys being "various" and "somewhat".

- "Various participants" is a somewhat vague term that began appearing in the minutes a couple of years ago, but a reasonable interpretation in the context of the paragraph is that it is less than "many".

- And both that and "somewhat" seem slightly more cautious vs Powell's prepared comments opening the Nov press conference: "There is significant uncertainty around that level of [sufficiently restrictive rates]. Even so, we still have some ways to go, and incoming data since our last meeting suggest that the ultimate level of interest rates will be higher than previously expected."

- Powell's likely one of the "various" participants - he said at the presser that the data since September's Dots "do suggest to me that we may ultimately move to higher levels than we thought", though "that level is very uncertain".

- The 2023 Dot had looked likely to be raised from 4.6% to 4.9% with risks that it would exceed 5%. With the language employed in the minutes appearing deliberate (perhaps even massaged after the Oct CPI reading?), the bar is set a little higher to get a >5% terminal Dot at next month's meeting.

FOREX: JPY Remains On Top In Subdued Thanksgiving Session

- Risk continues to be trade in a buoyant fashion following yesterday’s weaker US data and confirmation that the Fed sees the pace of hikes slowing, with a 50bp move seeming very likely in December. The greenback maintains its short-term downward bias, and most G10 ranges have remained modest during the US Thanksgiving session.

- The Japanese Yen leads the G10 FX pack, with Tokyo returning from a mid-week holiday and USDJPY (-0.82%) extending below initial support at 139.64, the Nov 18 low. A substantial break now turns the focus to 137.68, Nov 15 low and a bear trigger.

- Despite a relatively small decline for the USD index (-0.18%), there has been broad based greenback losses once more. The likes of GBP, AUD and NZD have all advanced just shy of half a percent.

- Furthermore, echoing the moves from yesterday, the Chinese Yuan is underperforming as advisers and analysts told MNI that the People’s Bank of China is expected to cut banks’ reserve requirement ratio in coming days as fresh Covid outbreaks fuel concerns about the sluggish economic recovery.

- Additionally, both CAD and EUR remain close to unchanged, with the latter straddling either side of the 1.0400 mark after failing 30 pips shy of important resistance at 1.0479, the Nov 15 high and the bull trigger.

- New Zealand retail sales cross in early APAC trade, marking the highlight of a very empty Friday data calendar. Final readings of German and Mexican GDP are the only data points of note.

EGBs-GILTS CASH CLOSE: Gilts Underperform Inverting Bunds

Bunds enjoyed another constructive session Thursday while Gilts weakened, with trade on the quiet side amid a US holiday.

- Despite an above-expected IFO, German curve inversion once again caught the eye as growth concerns persisted: with the short end relatively anchored, multiple spread segments of the curve hit fresh closing lows for the cycle.

- Plenty of central bank communications: ECB Oct meeting minutes met expectations that 50bp hike at the Dec meeting was more likely than 75, though Schnabel said room for a slowdown in hike pace is limited.

- Among other BoE speakers, Ramsden delivered dovish-tilting comments, though terminal hike pricing firmed overall on the session and the short end underperformed on the UK curve.

- With a risk-on cross-asset theme, periphery EGB spreads tightened.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2.8bps at 2.113%, 5-Yr is down 7bps at 1.896%, 10-Yr is down 8bps at 1.85%, and 30-Yr is down 8.3bps at 1.793%.

- UK: The 2-Yr yield is up 7.9bps at 3.209%, 5-Yr is up 3.6bps at 3.22%, 10-Yr is up 2.7bps at 3.038%, and 30-Yr is up 7.9bps at 3.275%.

- Italian BTP spread down 5.3bps at 182.4bps / Greek down 3bps at 223bps

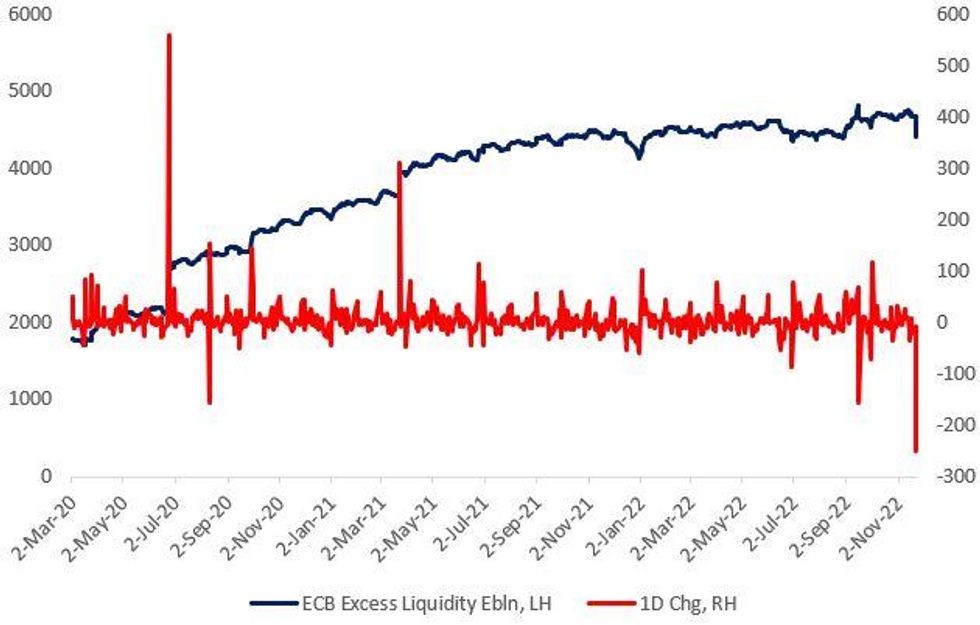

ECB: Excess Liquidity Sees Biggest Drop In A Decade, But Remains Very High

The latest reading of ECB excess liquidity reflects the settlements of the early TLTRO repayment on Nov 23, with a 1-day drop of E248.4bln (see chart).

- That's the largest fall since 2011, but it has only a limited impact on the overall level which at E4.42trn has only returned to late August 2022 levels.

- There's still E1.8trn in TLTROs outstanding, with the next voluntary early repayment settlement date on Dec 21 and which is tentatively expected by analysts to bring excess liquidity down to about E4.0-4.1trn ahead of year-end.

- The next repayment amount will be known on Dec 9, and this will help shape the ECB's discussion around the balance sheet / QT outlook at the Dec 15 meeting.

Source: BBG, ECB, MNI

Source: BBG, ECB, MNI

STIR: BoE Terminal Pricing Edges Higher

ECB and BoE hike pricing was steady/higher Thursday, with central bank communications in focus.

- Dec ECB hike pricing was steady at 59bp; while terminal pricing finished about 3.5bp lower at 2.88% (mid-23), it came off lows around 2.84% after ECB's Schnabel downplayed potential for a major downshift in the hike pace. The accounts of the Oct meeting had little impact.

- In contrast, BoE Dec hike pricing hit a fresh post-Nov meeting low at 54bp on dovish-leaning comments by Saunders, but recovered to 57bp, steady on the day.

- Terminal BoE pricing finished about 5bp higher at 4.64% (Sep '23), which would be the highest close since Nov 9 if it holds.

EU OPTIONS: Euribor Upside Highlights Thursday Trade

Thursday's Europe rates/bond options flow included:

- OEG3 117/114ps, 1x2 bought for 26.5 and 23 in 3k total

- RXZ2 143.5c, bought for 7 in 1.5k

- ERM3 97.25/97.50cs vs 96.50/96.25ps, bought the cs for 3.25 in 14k

- ERZ2 97.87/98.00/98.12c fly, bought for 2.5 in 16k

- SFIZ2 96.20/30/40/50c condor, bought for 5 in 3k

COMMODITIES: Crude Oil Sideways, EU Nations Remain Divided On Price Cap

- Crude oil has moved sideways through the session in holiday trade, consolidating yesterday’s slide on China Covid fears and relaxations on the proposed Russia price cap that reduced fears of tighter supply.

- On the latter, EU nations remain divided on setting a price cap with that $65-70/bbl criticized for not being harsh enough, with six nations reported to oppose the current price cap levels. Putin says a price cap will have "serious consequences" for the global energy market.

- Separately, Venezuela’s government and opposition will resume political talks after more than a year in Mexico, potentially paving the way to lift crude oil sanctions.

- WTI is +0.01% at $77.95, with resistance at $82.43 (Nov 18 high) and key medium-term support at $74.96 (Sep 28 low).

- Brent is -0.1% at $85.34 with resistance at $90.63 (Nov 18 high) and support at $82.31 (Nov 21 low).

- Gold is +0.3% at $1754.34 with the US dollar fading, nudging slowly towards resistance at the bull trigger at $1786.5 (Nov 15 high).

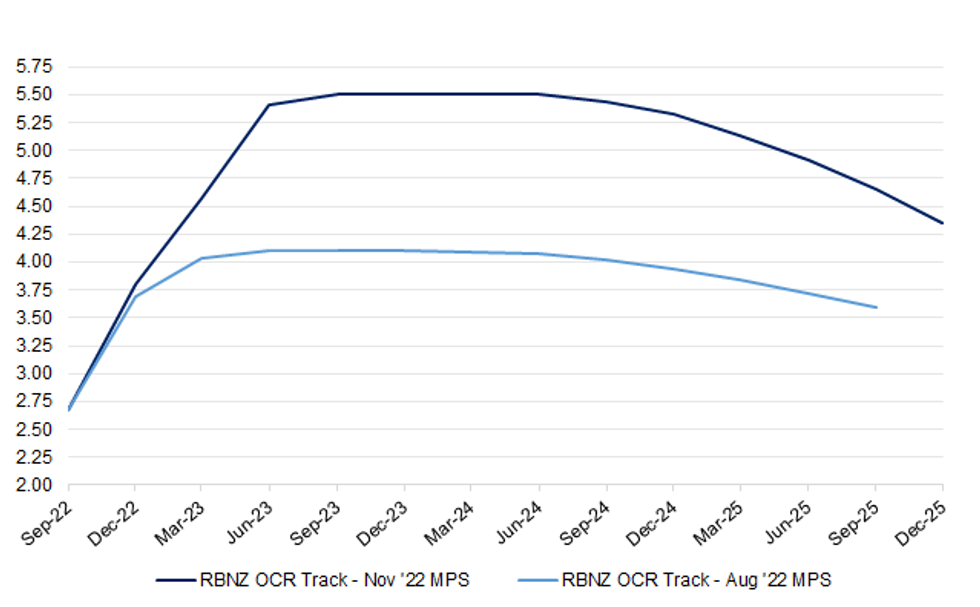

MNI RBNZ Review - November 2022: MPC Ups Ante In War On Inflation

EXECUTIVE SUMMARY

- The RBNZ stepped up the pace of its rate-hike cycle and raised the OCR by 75bp, while flagging a debate over an even larger increase in the policy rate. Inflation remains a clear focus, with recent CPI readings exceeding expectations and calling for a firmer response from the Reserve Bank.

- The central bank now expects a 12-month recession starting in 2Q2023, which will lead to a peak-to-trough 1% contraction in GDP. Still, the Committee charted a steeper OCR track as it is ready to sacrifice growth for the sake of achieving its Monetary Policy Remit.

- The staff revised the estimate of a neutral OCR level higher, taking into account elevated inflation expectations, which further raised pressure on the RBNZ to step up the pace of tightening. Governor Orr noted that the OCR is now in "officially contractionary" territory, albeit projections suggest that February may see a repeat of this week's jumbo-sized rate hike.

Click here to see the full review:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.