-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

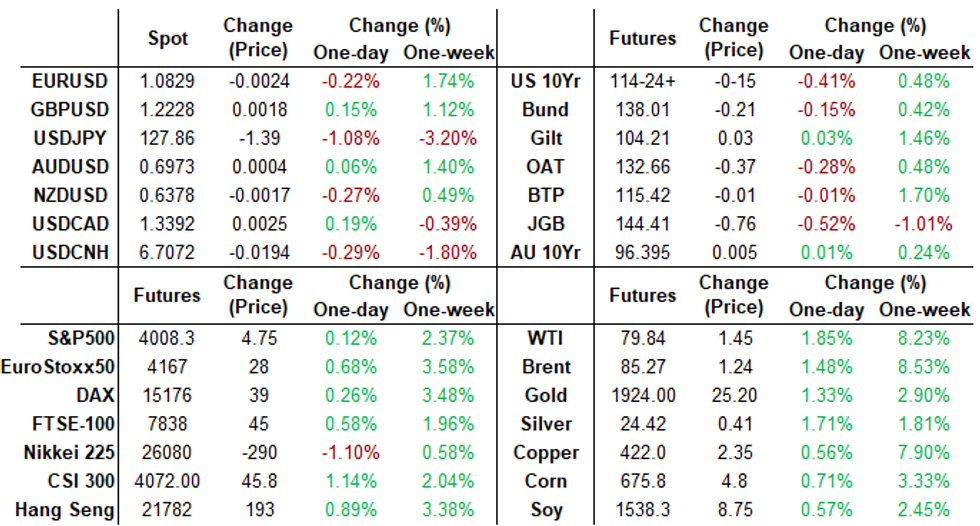

Free AccessMNI ASIA MARKETS ANALYSIS: Risk Ends Wk on Positive Note

HIGHLIGHTS

- MNI US-CHINA: Biden To Push Kishida And Rutte On Semiconductor Export Controls

- Fed’s Bostic Leans to Smaller Rate Hike After Inflation Slowdown, Bbg

- YELLEN SAYS DEBT LIMIT PROJECTED TO BE REACHED ON JAN. 19, Bbg

- DEUTSCHE BANK NO LONGER EXPECTS GERMAN RECESSION THIS WINTER, Bbg

- DEUTSCHE BANK RAISES GERMAN 2023 GDP FORECAST TO 0% FROM -1%, Bbg

Key links: MNI US Inflation Insight, Jan'23: Cementing February Downshift / MNI INTERVIEW: CPI Rent Passthrough May Be Longer - Detmeister / MNI US EARNINGS CALENDAR - Another 4.5% of the S&P Reports Next Week / MNI EGB Issuance, Redemption and Cash Flow Matrix - W/C Jan 16 / MNI POLICY: BOE Mortgage Support Would Ease Collateral Squeeze / MNI: Growing Chinese Savings Seen Hard To Boost Consumption /

US TSYS: Latest Sentiment Data Underscores Case for Soft Landing

While equities continue to drift higher after better than expected UofM sentiment, rates have gradually receded, trading near late session lows after the bell.

- UoM data climbed from 59.7 prior to 64.6 (60.7 est) underscoring the case for a soft landing for the economy as sentiment hit its highest lvl since Apr'22, while 1Y inflation exp recedes to lowest lvl since Apr 2021 at 4.0% vs. 4.3% exp (4.4% prior).

- At the margin it suggests growing headwinds to input prices but only after a string of solidly negative readings, averaging -0.4% M/M through Jun-Nov during which period core goods inflation has fallen notably.

- Earlier data showed surprising strength for import prices, rising 0.4% M/M (cons -0.9%) and with a broadly similar sized upside surprise for ex-petroleum prices at 0.8% M/M (cons -0.3%).

- Limited react to Tsy Sec Yellen comments on debt ceiling: next Thu, Jan 19, US outstanding debt "is projected to reach the statutory limit. Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting," she said.

- Decent first half trade died down in the second half w/ US markets closed for Dr Martin Luther King Jr Day. Limited docket for Tuesday while equity earnings resume: Goldman Sachs and Morgan Stanley expected to announce before the NY open. Data picks up in earnest on Wednesday January 18 with Retail Sales, PPI, Business Inventories, Net TIC flow.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 4.31371% (+0.00028/wk)

- 1M -0.00457 to 4.45443% (+0.05286/wk)

- 3M -0.03728 to 4.79243% (-0.01743/wk)*/**

- 6M -0.02857 to 5.10114% (-0.09586/wk)

- 12M -0.05214 to 5.35700% (-0.20197/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $107B

- Daily Overnight Bank Funding Rate: 4.32% volume: $286B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.108T

- Broad General Collateral Rate (BGCR): 4.27%, $447B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $414B

- (rate, volume levels reflect prior session)

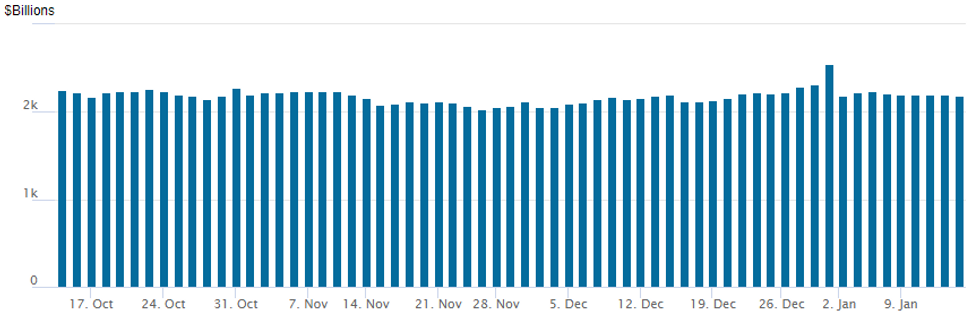

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,179.781B w/ 103 counterparties vs. prior session's $2.202.989B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Carry-over put trade dominated Friday's session, including several net vol short put tree buys and put condors in short end SOFR options.- SOFR Options:

- Block, 3,500 SFRU3 95.25/95.50 put spds, 14.5 ref 95.30

- Block, 2,500 SFRU4 93/95 put spds, 9.0 ref 96.98

- Block, 4,000 SFRU3 95.25/95.50 put spds, 14.5 ref 95.295

- Block, 16,000 SFRU3 94.87/95.00/95.25 broken put flys, 7.5 ref 95.295

- 5,000 SFRH3 95.62 vs. EDH3 95.37 call spds

- +5,000 SFRJ 95.31/95.43 call spds, 2.0 (covers March FOMC)

- +5,000 SFRU 95.00/95.50/96.00 call flys, 13.5

- 1,500 SFRH3 95.25/95.37 1x2 call spds ref 95.155

- Block, 2,500 OQH3 95.75/96.00 put spds, 7.5 vs. 96.20/0.10%

- Block/screen, +16,200 SFRG3 95.12/95.18/95.25 put trees, 1.25-1.5, ref 95.16-.15

- 4,000 SFRZ3 95.00 puts, 12.0 ref 95.705

- Block, 1,900 SFRU3 94.75/95.00/95.25 put trees, 4.0 ref 95.315

- Block, 5,000 SFRH4 93.00/94.00 put spds, 2.5 vs. 96.195/0.05%

- over 8,500 SFRU3 95.50 calls, ref 95.345

- Block, total 7,500 SFRH3 95.12/95.37 call spds, 8.0 ref 95.17

- 1,450 SFRG3 94.93/95.00/95.06/95.12 put condors ref 95.175

- Block, 5,000 SFRH3 95.00/95.06/95.18/95.25 put condors, 3.25 ref 95.17

- Eurodollar Options:

- over 9,000 EDM3 94.75 puts, 7.0 ref 94.92

- Treasury Options:

- 3,000 TYH3 117.5 calls, 20 ref 115-05.5

- 3,500 TYH3 116 calls, 47 ref 115-05

- 5,000 wk3 TY 114/114.75 2x1 put spds, 3 net ref 115-05 (expire next Fri)

- 5,000 TYG3 112 puts, 3 ref 115-00.5 -02.5

- +5,000 USH3 121/123/125/127 put condors, 18

- 2,000 USG3 127/127.5/128.5 broken put flys ref 130-14

- 2,100 TYG3 114.25/115 2x1 put spds ref 115-09

- 4,000 wk3 TY 112.75/113.75 put spds ref 115-07.5

- 30,000 TYG 111/112 put spds ref 115-04

- 2,000 TYG3 112.75/113.75 put spds, ref 115-03.5

EGBs-GILTS CASH CLOSE: Yields Reverse Higher, But Weekly Gains Hold

Bund and Gilt yields bounced from early session lows to finish mostly higher on the session Friday, but still lower on the week (10Y Gilt down 10bp, Bund 4bp).

- The UK and German curves flattened, with 5Y Gilts and 2Y Schatz underperforming on each, respectively. Yields pushed through the session highs toward the cash close, completing the reversal from the morning's intraday lows (10Y Bund up 7+bp and Gilt 10+bp from lows).

- There was no evident fundamental driver of the morning reversal, though notably ECB terminal hike pricing bounced from session lows as well (last +143bp in further hikes priced vs this morning's low below +137bp), suggesting perhaps the dovish rally in the past couple of days may have gone a little too far for now. The stronger-than-expected UK Nov GDP data out this morning helped set a cautious tone as well.

- Combined with BTP spreads re-widening after touching a fresh post-April 2022 low, it certainly had the feel of a profit-taking session.

- January's round of TLTRO repayments was not a market mover, with very limited (E62.7bln) takeup vs expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.4bps at 2.593%, 5-Yr is up 2.3bps at 2.202%, 10-Yr is up 0.9bps at 2.168%, and 30-Yr is up 2.5bps at 2.134%.

- UK: The 2-Yr yield is up 5.1bps at 3.489%, 5-Yr is up 6.6bps at 3.305%, 10-Yr is up 3.2bps at 3.366%, and 30-Yr is up 3bps at 3.724%.

- Italian BTP spread up 0.2bps at 184.3bps / Spanish up 1.2bps at 99.8bps

EGB Options: Straddles And Strangles Highlight Friday's Euribor Trades

Friday's Europe rates / bond options flow included:

- DUG3 105.80/105.60ps, sold at 5.25 in 10k

- RXG3 136.5/134.5/133p fly sold at 20.5 in 4k

- ERH3 97.12/97.25/97.37c fly, bought for 1.5 in 10k

- ERJ3 96.75/97.00cs, bought for 5.75 in 5k

- ERU3 96.62^ sold vs buying the 97.00c, net sold at 44.5 and 44 in 48.5k

- ERU3 96.62^ vs ERM3 97.00/96.37^^, sold the straddle at 39.5 in 40k

FOREX: Japanese Yen Continues Powerful Upswing

- Despite a more benign session for currencies in the aftermath of the US CPI print on Thursday in which the USD index remained close to unchanged, the Japanese Yen continued its significant appreciation to rise a further 1.10% against the greenback.

- USDJPY had a clean break from late last night through the bear trigger at 129.52 and the sustained weakness has seen the pair test down and briefly pierce the next support of 127.53, the May 31, 2022 low.

- With moving average studies in a bear mode condition and a bearish price sequence highlighting a clear downtrend, further weakness is likely. Note that the 50- and 200-dmas are on the cusp of forming a bearish death cross.

- With more contained ranges across the rest of G10 currencies, the only notable move is further strengthening of the Chinese Yuan. USDCNH continues to gravitate to fresh cycle lows and is now trading at the lowest levels since July 2022, amid the same positive factors of lower US yields and the relaxation of Chinas covid restrictions.

- MLK Day in the US on Monday and so Chinese growth data kicks off the docket during Tuesday’s APAC session before UK employment figures and Canadian CPI. Focus then quickly turns to the BOJ on Wednesday.

FX: Expiries for Jan16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0550(E1.5bln), $1.0865(E688mln), $1.0900(E529mln), $1.0950(E2.1bln)

- USD/CNY: Cny6.9500($1.4bln)

Late Equity Roundup: Consumer Discretionary, Financials Outperform

Well off pre-open lows (tied to mixed bank earnings), major indexes trading trading in the green late Friday, initial support after UofM consumer confidence data underscores case for a soft landing for the economy (64.6 (cons 60.7) in the prelim Jan report. SPX eminis currently trades +7.25 (0.18%) at 4010.75; DJIA +56.5 (0.17%) at 34248.18; Nasdaq +42.2 (0.4%) at 11043.78.

- SPX leading/lagging sectors: Consumer Discretionary (+0.64%) and Financials (+0.54%) outpaced Health Care sector (+.30%) in the second half. Internet and direct marketing stocks lead Discretionary sector (AMZN +2.96%, ETSY +2.21%) while banks lead Financials after trading weaker earlier: Wells Fargo (WFC) +2.94%, JPM (+2.59%), BAC (+2.0%), Citi (+1.83%).

- Laggers: Industrials (-0.53%), Real Estate (-0.41%) and Utilities (-0.28%), airlines weighing on the former (DAL -3.93%, FDX -1.59%).

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +3.16 at 373.10, Caterpillar (CAT) +1.85 at 256.92, Travelers (TRV) +1.35 at 193.34. Laggers: Big reversal for United Health that had gained over +12.0 following earnings beat trades -2.08 at 493.59 in late trade, Boeing (BA) -1.17 at 213.15, JNJ -0.85at 173.15.

E-MINI S&P (H3): Short-Term Conditions Remain Bullish

- RES 4: 4194.25 High Sep 13

- RES 3: 4180.00 High Dec 13 and the bull trigger

- RES 2: 4043.00 High Dec 15

- RES 1: 4021.50 High Jan 12

- PRICE: 3995.00 @ 1100ET Jan 13

- SUP 1: 3891.50 Low Jan 10

- SUP 2: 3788.50/78.45 Low Dec 22 / 61.8% of Oct 13-Dec 13 uptrend

- SUP 3: 3735.00 Low Nov 3

- SUP 4: 3670.00 76.4% retracement of the Oct 13 - Dec 13 uptrend

S&P E-Minis traded higher Thursday. The contract has this week cleared resistance at the 50-day EMA and this has strengthened the short-term bullish condition. Price has also traded above the 4000.00 handle to open 4043.00, the Dec 15 high. Key support and the bear trigger has been defined at 3788.50, the Dec 22 low. A reversal lower and a break of this support would resume bearish activity. Today’s pullback is considered corrective.

COMMODITIES: Crude Oil Eyes Bull Trigger and Gold Surges With Golden Cross

- Crude oil sees a seventh day of gains although despite that a survey of shale drillers in the US say prices remain too low to output materially with WTI at $89/bbl needed to boost output by “a lot” (although just $64/bbl to be profitable). WTI is up 8% on the week to nearly draw level ytd.

- Earlier, Exxon announced it’s preparing to start up its $1.2B Texas refinery expansion, beginning the 250bpd expansion by Jan 31.

- WTI is +1.6% at $79.67, next eyeing the bull trigger at $81.50 (Jan 3 high).

- Brent is +1.2% at $85.04, next eyeing key resistance at $87.00 (Jan 3 high).

- Gold is +1.2% at $1920.5, perhaps helped by technical developments with relatively limited further USD index depreciation and Treasury yields rebounding. Instead, a golden cross with the 50-dayMA exceeding the 200-day MA for the first time since Feb’22 appears to have driven trade. Two resistance levels cleared today, next lies $1934.4 (Apr 25, 2022 high).

- Weekly moves: WTI +8%, Brent +8.3%, Gold +2.9%, US nat gas -7.8%, EU TTF -6.8%

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/01/2023 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/01/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 16/01/2023 | 1530/1030 | ** |  | CA | BOC Business Outlook Survey |

| 17/01/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 17/01/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 17/01/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 17/01/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 17/01/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 17/01/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 17/01/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 17/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/01/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/01/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 17/01/2023 | 1330/0830 | *** |  | CA | CPI |

| 17/01/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/01/2023 | 2000/1500 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.