-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY177.8 Bln via OMO Wednesday

MNI ASIA MARKETS ANALYSIS - Skip Talk Helps Treasuries Extend Rally And USD Pare Gains

- Treasuries build on an overnight rally after Jefferson and Harker supported skipping a June hike, following earlier volatility after a large miss for the MNI Chicago PMI before a beat for JOLTS job openings.

- That Fed rhetoric saw the USD index pare gains but it had offered equities less of a boost whilst crude oil saw a further slide on demand concerns ahead of the weekend OPEC meeting.

- Ahead, US debt deal proceedings are expected to get underway at 1915ET before a final vote circa 0815ET.

US TSYS: Firmly Richer As Fedspeak and Weak PMIs Offset JOLTS Beat

- Cash Tsys have surged today, technically led by the 3Y at typing whilst the 2Y remains off post-Chicago PMI highs but all other major benchmark tenors push new session highs heading towards the close.

- There has been sizeable volatility through the session after a sizeable downside miss for the MNI Chicago PMI, higher than expected JOLTS job openings and then Jefferson (voter) and Harker (’23 voter) supporting skipping a June hike. They add to the overnight bid on external factors from softer Eurozone core inflation implications and China PMIs.

- 2YY -7.4bps at 4.376%, 5YY -8.0bps at 3.727%, 10YY -6.7bps at 3.620%, 30YY -5.5bps at 3.836%.

- TYU3 trades 17 ticks higher as it climbs to session highs of 114-18, nearer resistance at the 20-day EMA of 114-29+ and ultimately 115-07+ (50-day EMA). Volumes have soared, currently approaching 1.7M cumulative.

- Ahead, a debate on the debt deal bill should begin at 1915ET with a final vote expected circa 2015ET.

- Tomorrow sees a swathe of data including ADP, ISM mfg, final ULCs/productivity for Q1, Challenger job cuts and weekly initial claims, all before Friday’s payrolls report.

US STIR: June FOMC Pricing Bears The Brunt Of Skip Rhetoric

- The combination of a sizeable downside miss for the MNI Chicago PMI, higher than expected JOLTS job openings and then Jefferson (voter) and Harker (’23 voter) supporting skipping a June hike has seen decent swings in Fed rate expectations.

- The latter weighed most heavily, especially for June OIS pricing with most of the day's 7.5bp decline coming after Jefferson/Harker, to leave just +8bp priced, whilst it no longer fully prices a hike come July with +20bp (-5.5bps on the day).

- Aside from that particularly heavy decline in June pricing, subsequent meeting expectations have seen a slightly larger retracement but are still 2-3bps lower than pre-PMI levels for down -5.5-6.5bps on the day after earlier spillover from softer European core inflation and China PMIs.

- Two days left until the media blackout starts Fri midnight, currently with just a repeat appearance from Harker scheduled tomorrow.

EGBs-GILTS CASH CLOSE: Soft EZ Inflation Sparks Rally

European curves leaned bull steeper Wednesday, with central bank hike prospects dented and curve short ends/bellies boosted by softer than expected inflation data.

- The initial dovish signal sent by German state-level (NRW) May CPI carried on through a soft French May flash inflation reading, boosting EGBs. A strong Italian print dented Bunds only briefly before they pushed to fresh session highs.

- The afternoon saw some consolidation, with the national German print in line with updated estimates, and strong US jobs opening data offsetting a very weak MNI Chicago PMI.

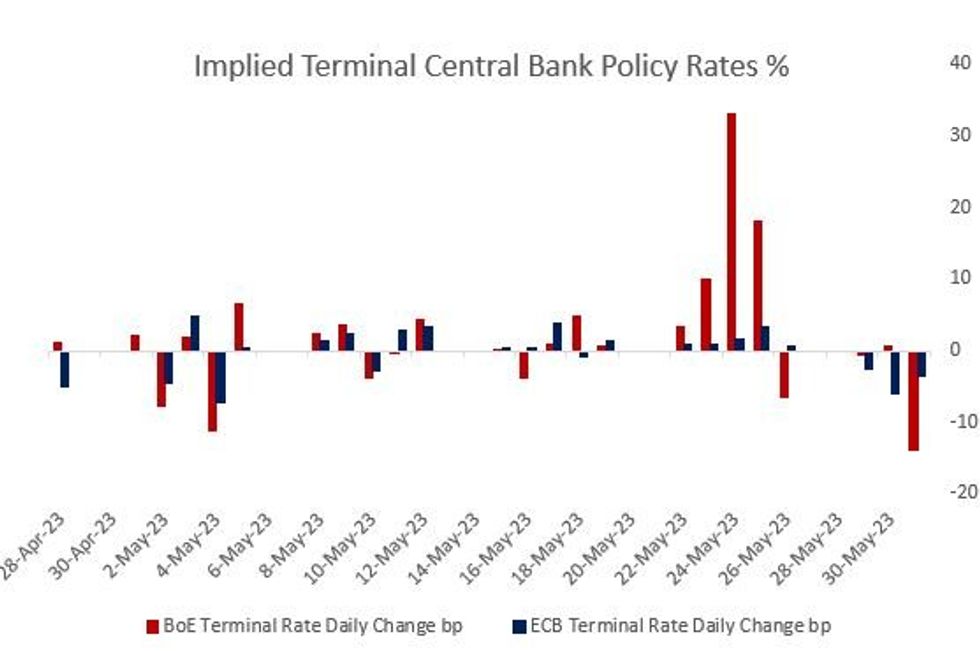

- Bull flattening turned to bull steepening by session's end. Gilts outperformed Bunds, with BoE hike pricing pulling back sharply vs the huge rises in the past few sessions (peak -13bp on the day; ECB -3bp). Periphery spreads traded mixed.

- Central bank speakers (including ECB's Villeroy/de Guindos, and BoE's Mann) had little impact, being overshadowed by the inflation data.

- Thursday sees the eurozone May prelim inflation print, with final PMIs also eyed.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 6.5bps at 2.719%, 5-Yr is down 7.8bps at 2.278%, 10-Yr is down 6bps at 2.282%, and 30-Yr is down 3.8bps at 2.461%.

- UK: The 2-Yr yield is down 10bps at 4.335%, 5-Yr is down 11bps at 4.101%, 10-Yr is down 6.4bps at 4.183%, and 30-Yr is down 6.9bps at 4.515%.

- Italian BTP spread down 1bps at 179.9bps / Greek up 3.7bps at 149.5bps

EU STIR: Soft Eurozone Inflation Continue To Weigh On BoE/ECB Hike Pricing

Bunds and Gilts have fully bounced back after an initial US Treasury-led drop on the strong US job openings data.

- While Fed hike pricing is higher for the next two meetings (by 2bp Jun and 4bp Jul respectively), that hasn't translated across the Atlantic, where Jun/Jul hike pricing has been steady.

- If anything ECB/BoE terminal expectations have dipped a little in the past hour with he softer-than-expected overall eurozone May prelim inflation prints continuing to dampen tightening fervour. On the day:

- BoE terminal Bank Rate pricing -14bp to 5.41% (91bp of further hikes left in the cycle) - 3bp lower than pre-JOLTS/Chicago PMI.

- ECB terminal depo Rate pricing -3.6bp to 3.73% (48bp of further hikes left in the cycle)

EU OPTIONS: Mixed Rates Structures Wednesday Amid Mostly Soft Eurozone CPI Data

Wednesday's Europe rates / bond options flow included:

- DUN3 105.30/105.00/104.70/104.30p condor, sold at 3 and 3.25 in 10k

- ERQ3 96.37/96.50/96.62c fly. Bought for 1 in 6k

- ERU3 96.00/95.75/95.50p fly, bought for 2.75 in 6.5k

- ERN3 96.25/96.375/96.50 c fly with ERQ3 96.25/96.375/96.50 c fly, bought the strip for 3.75 in 4.25k

FOREX: USD Index Paring Gains Following Fed Skip Rhetoric, Euro Weakness Prevails

- Early price action across currency markets on Wednesday assisted the USD Index to new multi-month highs on the final trading day of May. However, late comments from Fed’s Jefferson and Harker seemingly advocating for a Fed pause in June have taken the shine off the greenback in late US trade.

- Worth noting that the DXY turnaround has coincided with the index briefly testing resistance at the 76.4% retracement for the March - April downleg, crossing at 104.68. Progress through here would open the best levels since early March for the index.

- Softer European CPI prints over the past two days continue to place downward pressure on the single currency. EURUSD plumbed fresh lows as the European session came to an end and technical indicators continue to point to short-term downside momentum extending. Immediate levels to watch are 1.0631 and 1.0608, the March 20 and 17 lows respectively. Below here would open the March lows at 1.0516.

- The lower yields have also assisted EURJPY lower, with the pair currently down 0.95% approaching the APAC crossover, having broken a cluster of old lows between 148.72/85. This may prompt some further pressure on the pair which has come into focus following this week’s sharp turnaround from the 151 handle. Overall, the EURJPY move is considered corrective for now, with the 50-day EMA, which intersects at 147.43, remaining intact and a key support.

- EURGBP (-0.75%) has printed another fresh 2023 low Wednesday, marking a fourth consecutive session of lowers lows. The 14day RSI for the cross is on the cusp of becoming technically oversold for the first time since March 2021 - and bearish developments in the moving-average space also signal short-term downside momentum: the 50- and 200-dmas are on the verge of forming a death cross (50-dma < 200-dma).

- Focus shifts to German retail sales on Thursday morning before the final manufacturing PMI reads for May. Attention will then be on the Eurozone Flash estimate of CPI which is expected to come in at 6.3% Y/y. This will be the final read before the June 15 ECB meeting. US ADP and the ISM Manufacturing PMI highlight the docket before Friday’s key employment report.

EUR/GBP: Cross Plumbs New YTD Lows, Nearing Technically Oversold

- A fourth consecutive session of lower lows for EUR/GBP as the cross continues to push to new YTD lows. 0.8600 now marks the 2023 low as rate differentials really come into play - ECB implied pricing rolled over alongside the soft French, German inflation prints today - contrasting with the stickier inflation outlook for the UK.

- The 14d RSI for the cross is on the cusp of becoming technically oversold for the first time since March 2021 - and bearish developments in the DMA space also signal short-term downside momentum: the 50- and 200-dmas are on the verge of forming a death cross (50-dma < 200-dma).

- Housing data will be eyed tomorrow morning for any additional evidence of higher mortgage costs feeding through to the UK economy. Property transaction data released today showed a sharp slowdown in residential housing transactions - falling 25% in April.

FX OPTIONS: Expiries for Jun01 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0670-85(E757mln), $1.0700(E2.0bln), $1.0725-35(E2.3bln), $1.0770(E1.1bln)

- USD/JPY: Y139.00($501mln)

- GBP/USD: $1.2390-00(Gbp583mln)

- EUR/GBP: Gbp0.8800-10(E723mln)

- USD/CNY: Cny7.0500($968mln)

US STOCKS: Only Limited Boost From June Skip Talk, Banks And Energy Stocks Lead Losses

- Talk of skipping a June hike from two FOMC voters helped ESM3 lift further off lows that had been seen after the JOLTS report, a slide that continued despite real yields reversing their initial jump higher on the release.

- Currently at 4190 off an earlier low of 4174, the move sees the contract pull back after yesterday coming just shy of testing resistance at the medium-term bull trigger of 4244 (Feb 2 high), but for now it doesn’t support at the 20-day EMA of 4165.17 after which lies 4114 (May 24 low).

- The S&P e-mini trades broadly inline with the Nasdaq e-mini, both at -0.6% on the day, whilst SPX is led lower by energy (-2.0%) as WTI comes under further pressure, consumer discretionary (-1.4%), and industrials and financials (-1.3%).

- Financials mask larger underperformance for banks, currently underperforming with -2.1%, whilst the separate KBW index shows regionals in particular suffering (KRX -3.5%, BKX -2.4%) after the FDIC said that the number of lenders with weaknesses increased in Q1.

COMMODITIES: Crude Oil Slides Further, Brent Earlier Nearly Opened Key Support

- Crude oil has fallen further today, hindered by weak demand from China (not helped by softer than expected official PMIs overnight) and an on net stronger dollar even after some depreciation seen after two FOMC officials supported skipping in June.

- OPEC+ meet this weekend to decide their latest production quotas as the group weighs up it's tumbling crude exports in May against weak Chinese demand that has sub-$70/bbl Brent in its headlights after already claiming WTI this week.

- In the US, EIA monthly oil data showed crude oil output rising to 12.696mbpd for its highest since Mar’20.

- WTI is -2.0% at $68.07 off a low of $67.03 that breached yesterday’s $69.02 and came close to $66.46 (76.4% of the May 4-24 rally).

- Brent is -1.1% at $72.71, off a low of $71.39 that breached $73.2 (May 30 low) and came close to $71.28 (May 4 low) after which lies a key support at $70.10 (Mar 20 low).

- Most active strikes in the COQ3 today have been $85/bbl calls, but are followed by $70/bbl puts and with some sizeable plays at $65/bbl and $60/bbl puts

- Gold is +0.3% at $1965.64 having earlier poked above the 50-day EMA at $1971.3 in a move that could next open key short-term resistance at $1985.3 (May 24 high).

FED: Is The FOMC Getting Worried About Shelter Prices Again?

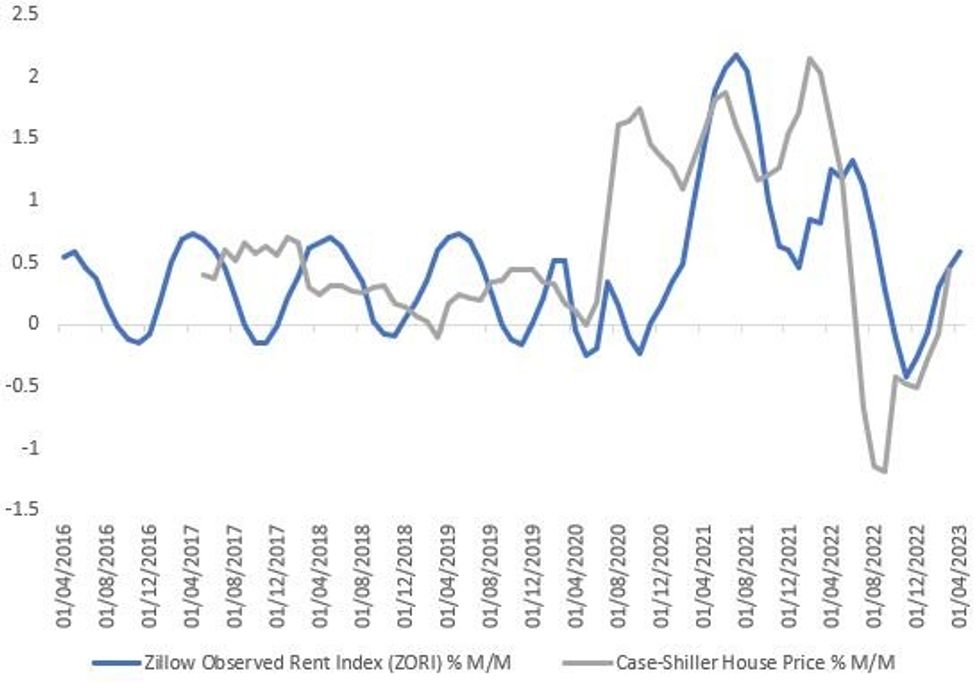

Speeches today by Gov Bowman (here), and last week by Gov Waller (here) highlighted concern that one of the key pillars of the FOMC's disinflation narrative - a softening housing market - may not be playing out quite as well as expected.

- Granted, those Governors are the most hawkish two members on the Board - but Bowman summed up the concern by saying "while we expect lower rents will eventually be reflected in inflation data as new leases make their way into the calculations, the residential real estate market appears to be rebounding, with home prices leveling out recently, which has implications for our fight to lower inflation."

- Powell last year said higher mortgage rates would help "reset" the housing market. And since Powell laid out the "three buckets" approach to the projected 2023 inflation moderation, softer goods and shelter prices have been taken almost for granted, with ex-housing services expected to be the toughest to tame.

- So it has proven so far - Powell barely discussed shelter prices at the May FOMC press conference, and the May meeting minutes showed no concern over a potential stubbornness in rents (saying that participants saw the lower prices for newly-signed leases continuing to feed into lower measured housing service inflation).

- By some measures, the housing market is bottoming sequentially, with Zillow showing observed rents +0.6% in April (highest since last August), with Case-Shiller house prices +0.5% in Mar (highest since May 2022), potentially suggesting softness is past the worst.

- The housing disinflation narrative is unlikely to change quickly, but it's clearly on the minds of some senior Fed officials - at least the concern that the shelter component can't be taken for granted in H2, which if not translating into further hikes, would play into the "higher for longer" theme.

Source: Zillow, Case-Shiller, MNI

Source: Zillow, Case-Shiller, MNI

Reverse Repo Uptake Pushes Higher, Wells Fargo See Down To $1.5T Come Year-End

- RRP uptake increased $54B today to $2.255T, its highest since May 23.

- The number of counterparties remained elevated at 107.

- Wells Fargo estimate balances could drop to $1.5T by year-end once the Treasury begins rebuilding its cash account at the Fed.

- They note that the replenishment of the Treasury General Account combined with continued quantitative tightening should drain about $1.1T of excess liquidity (defined as RRP plus bank reserves) through year-end.

- Bank reserves are expected to drop from $3.25T to $2.75T whilst they estimate $600B of RRP cash could move to T-bills through year-end.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/05/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 31/05/2023 | 1230/0830 | *** |  | CA | GDP - Canadian Economic Accounts |

| 31/05/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/05/2023 | 1230/0830 | *** |  | CA | CA GDP by Industry and GDP Canadian Economic Accounts Combined |

| 31/05/2023 | 1230/1430 |  | EU | ECB Lagarde Q&A at Generation Euro Students' Awards | |

| 31/05/2023 | 1250/0850 |  | US | Boston Fed's Susan Collins | |

| 31/05/2023 | 1250/0850 |  | US | Fed Governor Miki Bowman | |

| 31/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 31/05/2023 | 1315/1415 |  | UK | BOE Mann Panellist at Pictet Family Forum | |

| 31/05/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 31/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 31/05/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 31/05/2023 | 1730/1330 |  | US | Philadelphia Fed's Pat Harker | |

| 31/05/2023 | 1730/1330 |  | US | Fed Governor Philip Jefferson | |

| 31/05/2023 | 1800/1400 |  | US | Fed Beige Book | |

| 01/06/2023 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/06/2023 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 01/06/2023 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/06/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 01/06/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/06/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/06/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/06/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/06/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 01/06/2023 | 0930/1130 |  | EU | ECB Lagarde Speech at German Savings Banks Conference | |

| 01/06/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/06/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 01/06/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 01/06/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/06/2023 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 01/06/2023 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/06/2023 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/06/2023 | 1400/1000 | * |  | US | Construction Spending |

| 01/06/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 01/06/2023 | 1500/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 01/06/2023 | 1700/1300 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.