-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Stock Rout Resumes

- Treasuries look to finish Monday mixed, well off early session highs as 2s-10s reverse course/trade weaker in 2s-10s.

- Initial safe haven/risk off support as global equities continued to sell off (Eminis appr -4.75% on lows), saw curves bull steepen, 2s10s dis-inverted to +1.475 high briefly before finishing at -13.454.

- Wide ranges and heavy volumes (TYU4 >3.2M) as 2s-10s reversed course trades weaker after higher than expected ISM Services data tempered recession fears.

Heavy Volumes, Wide Ranges, ISM Services Cools Recession Cares

- Treasuries are trading mixed after the bell, well off early session highs as short end support evaporated following mildly higher than expected in July at 51.4 (cons 51.0), confirming a return above 50 after what had been the lowest since early in the pandemic. Coupled with firmer underlying details, imminent recession concerns that appeared to have been priced in cooled.

- Heavy volumes (TYU4 >3.6M) and wide ranges (TYU4 113-24.5 low vs 115-03.5 high) on the day. Curves surged steeper overnight with 2s10s dis-inverting for the first time in two years to 1.475 high -- reversed course to -11.637 after the Services data.

- Elsewhere, Services PMI revised down to 55.0 (flash and cons 56.0) for a modest decline from 55.3 in June. Composite PMI revised down to 54.3 (flash 55.0) for a slightly larger decline from 54.8 in June.

- Markets showed little reaction to the Federal Reserve Board's Sr Loan Officer Loan Survey (SLOOS): There was less tightening in lending standards in Q2 than that of Q1 across the board, offering a relative boost to growth. After the Q1 report saw a mixed bag for loan demand, the Q2 report saw a (in some areas sharp) normalization of prior declines.

- Looking ahead to Tuesday: Trade Balance, Tsy 3Y Note Sale, no scheduled Fed speak. Markets watching for VP Harris Democratic nominee's choice of Vice President no later than Tuesday.

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.02464 to 5.32740 (+0.00534 total last wk)

- 3M -0.09532 to 5.13241 (-0.02754 total last wk)

- 6M -0.22197 to 4.78566 (-0.08382 total last wk)

- 12M -0.30351 to 4.29257 (-0.15682 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (+0.00), volume: $2.077T

- Broad General Collateral Rate (BGCR): 5.33% (-0.01), volume: $808B

- Tri-Party General Collateral Rate (TGCR): 5.33% (-0.01), volume: $784B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $89B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $234B

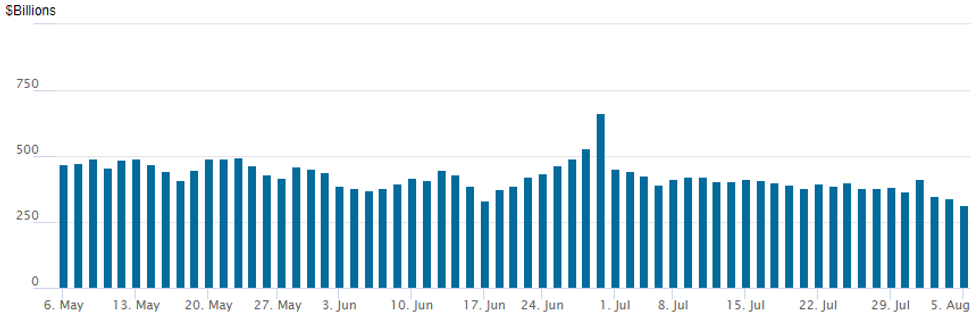

FED Reverse Repo Operation: New Multi-Year Low

NY Federal Reserve/MNI

RRP usage slips to $316.246B -- new lowest level since mid-May 2021 -- vs. $338.473B on Friday. Number of counterparties steady at 63. Prior low of $327.066B marked on Monday, April 15.

SOFR/TEASURY OPTION SUMMARY

SOFR and Treasury option volume remained heavy Monday, leaning towards upside calls even as underlying futures pared/reversed support in the short end/curves twist flatter. Projected rate cut pricing into year end ease vs. early morning levels (*): Sep'24 cumulative -49.9bp (-54.3bp), Nov'24 cumulative -86.5bp (-95.9bp), Dec'24 -118.6bp (-128.1bp).- SOFR Options:

- Block/screen, 15,000 SFRM5 95.50/96.00/96.50 put flys, 10.0 ref 96.73

- -5,000 0QZ4 96.50 calls vs 97.075/0.72% vs 2QZ4 96.75 calls vs. 97.105/0.74%, 16.5 net

- -5,000 SFRX4 95.50/95.62/95.75/95.87 call condors 2.25 ref 96.03

- -10,000 0QZ4 96.25 calls vs 97.075/.80% vs 2QZ4 96.50 calls vs 97.105/0.75%, 18.0 net

- -6,000 SFRZ4 96.25 calls 26.0 vs. 96.09/0.40%

- -5,000 0QU4 97.00/97.25 call spds, 9.0 vs 96.995/0.16%

- +10,000 SFRU4 94.93/95.31 put spds 12.5 ref 95.41

- +10,000 SFRU4 95.37/95.87 call spds 10.0 vs. 95.42/0.27%

- -10,000 0QZ4 96.25/96.75 call spds v 2QZ4 96.37/96.75 call spds, 7.5 net

- -5,000 SFRZ4 95.37/95.50 call spds, 10.5 ref 96.16

- Block, 10,000 0QU4 96.50 puts, 6.0

- Block, 3,450 SFRH5 95.68/95.93 call spds 19.5

- Block, 6,500 SFRU4 95.87/96.25/96.50/96.87 call condors, 1.25

- 9,000 SFRH5 95.75/96.00/96.25 call flys, 3.5 ref 96.595

- 5,000 SFRZ4 95.75/96.25/96.50/97.00 call condors ref 96.06

- 4,700 0QQ4 96.50/96.62/96.75 put trees ref 96.935

- 6,000 SFRU4 95.87/96.25 call spds ref 95.365

- over -15,000 SFRZ4 95.37/96.00 2x3 call spds, 50-47

- 4,600 SFRZ4 96.50/96.62 call spds ref 96..02

- Block, 6,000 SFRU4 95.00/95.12/95.25 put trees ref 95.335

- over 20,000 SFRU4 95.25/95.75/96.00 broken call trees ref 95.345

- 2,000 SFRM5 95.75/96.00/96.25/96.50 call condors vs. 2QM5 96.50/96.75/97.00/97.25 call condors

- 7,500 SFRZ4 95.00/95.50/96.00 put flys, 4.0

- 3,000 SFRU4 95.75 calls ref 95.385 to -.37

- 3,000 SFRU4 95.50/0QU4 97.50 call spds, 2.0

- 4,000 SFRZ4 96.25 calls ref 95.955 to -.97

- Treasury Options:

- 5,000 TYU4 113/114.75 call spds, 49 ref 113-29

- 5,000 TUV4 102.62/103/103.25/103.5 broken put condors ref 103-29.62

- 5,000 TYU4 114/114.75 2x3 call spds ref 114-02.5

- 11,000 TYU4 114.25/114.5 call spds

- Block, 7,500 wk2 TY112.75 / TYU4 114.75 1x2 call spds

- 2,000 TYU4 112/113/114 put flys, 12

- 3,000 TYV4 112.5/113.5 put spds, 11

- 2,000 FVU4 110/111 call spds, 19.5

- 3,900 TYV4 112/113.5/114/115.5 put condors ref 115-12

- 2,600 TYV4 111.5/113.5/114/115.5 broken put condors

- over 12,000 TYU4 115 calls 45 last

- over -15,000 FVU4 109.5/110.5 call spds, 28-27 ref 109-30.5

- 2,000 USU4 118 straddles

- 2,000 TYU4 115.5/116 call spds ref 114-11

- 5,000 TYU4 114.75/115 call spds, 6-7 ref 114-11

- +8,000 wk2 TY 114.25/114.75 call spds vs. 113.75 put 0.0-1 cr

- +10,000 wk2 TY 114.25/114.75 call spds vs. 113.5 puts, 2 net

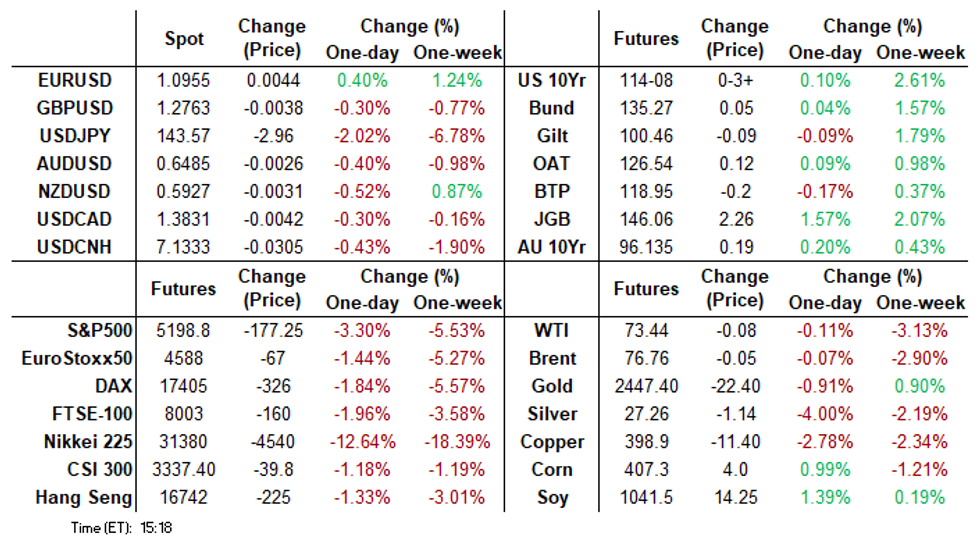

FOREX USDJPY Remains 1.6% Lower Despite Post-ISM Bounce

- Today’s movements in currency markets have been centred around the Japanese Yen, with USDJPY posting an impressive 496 pip range to start the week. The weakness across the Asia-Pac session culminated in a 141.70 low print, a level that was not breached for the remainder of the session despite multiple tests back below 142.00 as equities remained under pressure.

- A stronger-than-expected set of US ISM data helped stabilise risk and as such USDJPY had a solid recovery across the latter half of the session, rising briefly back to 144.89. Given the sharp moves, initial resistance is not seen until 146.66, today’s intraday high. Key support remains at 140.25, the Dec 28 ‘23 low.

- Elsewhere, risk sensitive currencies in G10 are on the back foot, though off session lows. The likes of AUD and NZD are both down around half a percent as we approach the APAC crossover. Bucking the trend, the Euro outperforms which is likely tied to its lofty weighting within the USD index, and notably EURUSD traded above 1.10 today for the first time since January 02.

- The overall risk off tone also weighs on GBP, with civil unrest across the UK likely adding to pessimism towards sterling. Last week’s close back above the July 1 high and notable pivot at 0.8500 marks an important development for EURGBP, cancelling the recent bearish theme and highlighting a potential short-term reversal. The cross rose as high as 0.8620, closely matching initial resistance found at the May 9 high. Above here, 0.8645 the Apr 23 high marks a key resistance for the cross.

- A notable mention in emerging markets, where USDMXN also exhibited sharp volatility. The pair rose to a high of 20.2181 before reversing the best part of 5% across the remainder of the trading day.

- The RBA decision headlines Tuesday’s calendar, where we do not expect a change in rates or statement guidance. US and Canadian trade balance figures headline a quiet docket in North America.

Late Equities Roundup: Back Under Pressure

- Off early session lows, US stocks remain broadly weaker after paring losses into midday. After S&P Eminis falling as much as 4.75% vs. Friday's settlement early Monday, Nasdaq -6.35%, DJIA -3.0%, indexes bounced after higher than expected ISM services data cooled recession concerns somewhat.

- Currently, the DJIA trades down 1099.05 points (-2.77%) at 38639.86, S&P E-Minis down 174.75 points (-3.25%) at 5202, Nasdaq down 653.3 points (-3.9%) at 16125.63.

- Information Technology and Consumer Discretionary sectors continued to underperform in late trade, semiconductor and hardware shares weighing on the former with Intel -7.22%, Nvidia -7.00%, Apple -6.38%. Broadline retailers and auto related stocks weighed on the Consumer Discretionary sector: Bath & Body Works -6.11%, Etsy -5.91%, Tesla -5.24%.

- Conversely, Energy and Industrial sector shares outperformed, oil & gas shares declining the least: Marathon Oil -0.64%, Valero -0.72%, ConocoPhillips -0.80%. Meanwhile, Industrials saw AMETEK +1.56%, Generac +0.43%, Lockheed Martin -0.33%.

- Earnings announcement resume late Monday, include the following: Carlyle Group, Diamondback Energy, Realty Income Corp, CSX Corp, Lucid Group Inc, Simon Property Group, ZoomInfo Technologies, Spirit AeroSystems, Definitive Healthcare, Williams Cos, Hims & Hers Health Inc, Palantir Technologies and Crescent Energy.

E-MINI S&P TECHS: (U4) Bear Cycle Extends

- RES 4: 5721.25 High Jul 16 and Key resistance

- RES 3: 5600.75 High Aug 1

- RES 2: 5494.20 50-day EMA

- RES 1: 5345.50 Intraday high

- PRICE: 5200.00 @ 1519 ET Aug 5

- SUP 1: 5120.00 Intraday low

- SUP 2: 5185 50.76.4% retracement of the Apr 19 - Jul 16 bull leg

- SUP 3: 5092.00 Low May 2

- SUP 4: 5020 Low Apr 19 and a key support

S&P E-Minis traded lower late last week and the contract has started this week’s session on a bearish note as the current sell-off extends. The move lower has also resulted in a break of 5185.50, a Fibonacci retracement. A clear break of this level would signal scope for an extension towards 5092.00 next, the May 2 low. Today’s intraday high of 5345.50 marks initial resistance. The 50-day EMA, a firmer level, is at 5494.20.

COMMODITIES Gold Falls Despite Risk-Off Backdrop, Crude Moderates Losses

- Spot gold is trading 1.5% lower today at $2,406/oz, despite the seemingly favourable risk-off environment.

- Today’s price action saw the yellow metal pierce the first support at $2,405.4/oz, the 20-day EMA, exposing $2,353.2 next, the July 25 low.

- The overall trend structure remains bullish though, with a clear breach of the 50-day EMA at $2,374.4/oz needed to signal scope for a deeper retracement.

- Silver similarly trades poorly, currently down 5.0% at $27.1/oz, with key support at $26.018/oz, the May 2 low.

- The gold/silver ratio thus approached 90 today, a level not seen since Q1 this year.

- Meanwhile, crude markets are ending the day lower, but have moderated losses as better-than-expected US data assuaged some concerns of a looming recession.

- WTI Sep 24 is down 0.6% at $73.1/bbl.

- The increased possibility of another retaliatory Iranian attack on Israel and further escalation in the Middle East could limit downside moves, although the market may need to see tangible supply disruption before it becomes a major driver.

- A bear threat in WTI futures remains present and sights are on the next key support at $72.23, the Jun 4 low. A clear break would open $70.73, the Feb 5 low.

- Key resistance is seen at $78.88, the Aug 1 high.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/08/2024 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 06/08/2024 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 06/08/2024 | 0545/0745 | ** |  | CH | Unemployment |

| 06/08/2024 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/08/2024 | 0630/0830 | ** |  | CH | Retail Sales |

| 06/08/2024 | 0730/0930 | ** |  | EU | S&P Global Final Eurozone Construction PMI |

| 06/08/2024 | 0830/0930 | ** |  | UK | S&P Global/CIPS Construction PMI |

| 06/08/2024 | 0900/1100 | ** |  | EU | Retail Sales |

| 06/08/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 06/08/2024 | 1100/1200 |  | UK | APF Quarterly Report | |

| 06/08/2024 | 1230/0830 | ** |  | US | Trade Balance |

| 06/08/2024 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 06/08/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/08/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/08/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 06/08/2024 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/08/2024 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.