-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

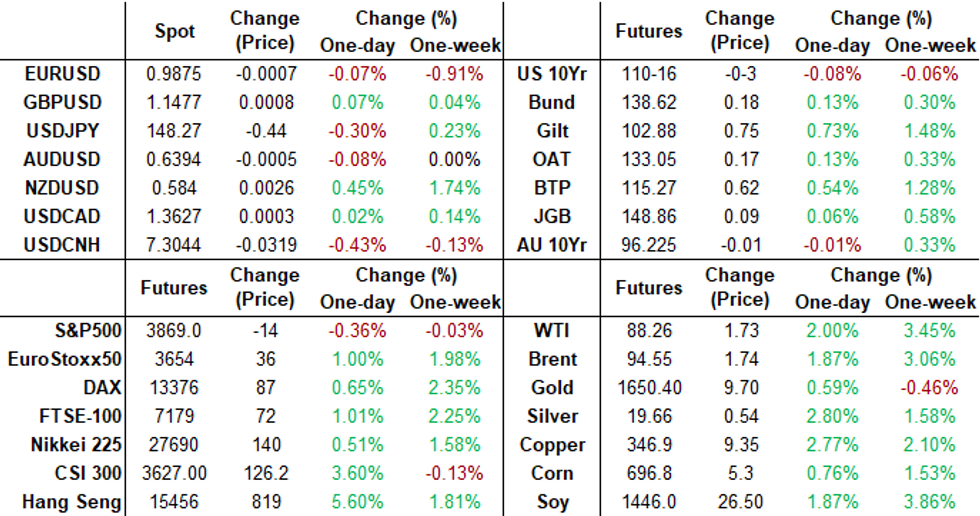

Free AccessMNI ASIA MARKETS ANALYSIS: Strong JOLTS Dampens Dec Step-Down

HIGHLIGHTS

- BIDEN ENDORSED FED PIVOT TO TIGHTEN THIS YR: BERNSTEIN, Bbg

- Saudi Arabia, U.S. on High Alert After Warning of Imminent Iranian Attack -- WSJ

- ECB'S NAGEL: STILL A LONG WAY ON RATE HIKES, Bbg

US TSYS: Low Mkt Conviction Ahead Nov FOMC

Tsys currently mixed after a strong start and ongoing debate over step-down to a 50bp hike in December as data cools. Little new in WSJ's Fed watcher Timiraos article overnight.- Support evaporates after midmorning JOLTS data (job openings rise unexpectedly to 10.717M vs. 9.75M est (above prior 10.053M) showed labor market remains tight - dampening speculation over step-down to 50bp hike at Dec FOMC.

- Lack of strong convictions over forward policy evident in market swings ahead Wednesday's FOMC at 1400ET and Chair Powell's presser at 1430ET. Friday sees latest employment data for October.

- Case in point: Bonds had started to bounce off midday lows following misinterpreted BBG headline: BIDEN HAS ENDORSED FED'S POLICY PIVOT: BERNSTEIN (Jared Berstein, sits on the White House Council of Economic Advisers).

- Since the Fed is in blackout ahead Wed's FOMC, there has been no mention of a policy pivot which spurred confusion until Bbg ran correction: BIDEN ENDORSED FED PIVOT TO TIGHTEN THIS YR, Bbg. Tsys receded again despite the continued use of "PIVOT" in the statement.

- At the moment: 2-Yr yield is up 6.2bps at 4.5447%, 5-Yr is up 3.9bps at 4.267%, 10-Yr is up 1.3bps at 4.0606%, and 30-Yr is down 4bps at 4.1235%.

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00428 to 3.05886% (-0.00500/wk)

- 1M +0.03671 to 3.84157% (+0.07386/wk)

- 3M -0.00058 to 4.45971% (+0.02014/wk) * / **

- 6M +0.00271 to 4.91857% (-0.01229/wk)

- 12M -0.00286 to 5.44543% (+0.07643/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.46029% on 10/31/22

- Daily Effective Fed Funds Rate: 3.08% volume: $82B

- Daily Overnight Bank Funding Rate: 3.06% volume: $249B

- Secured Overnight Financing Rate (SOFR): 3.05%, $1.075T

- Broad General Collateral Rate (BGCR): 3.00%, $414B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $386B

- (rate, volume levels reflect prior session)

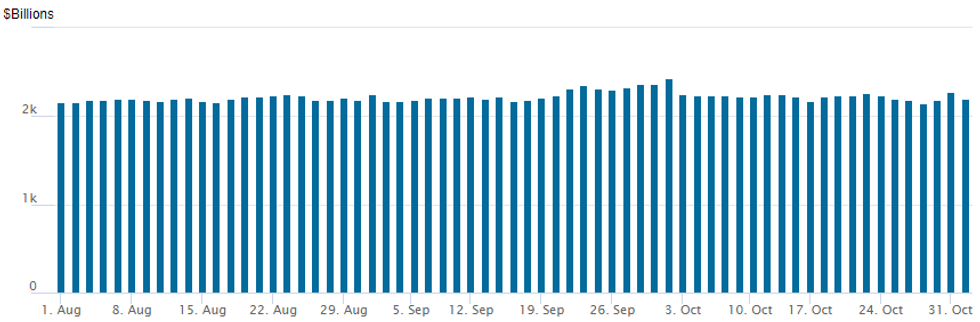

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage fell to $2,200.5109B w/ 102 counterparties vs. $2,275.459B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EURODOLLAR/SOFR/TREASURY OPTIONS SUMMARY

Mixed two-way trade on net as better upside call volume in early trade gave way to better put and put spread buying as support for underlying futures evaporated post JOLTS.

- SOFR Options:

- Block, 10,000 SFRM3 94.25/95.00 put spds, 25.5 ref 95.035

- Block, 40,000 SFRH3 94.0/95.00 put spds, 17.5

- Block, 4,000 SFRG3 94.75/95.00 2x1 put spds, 0.75

- Block, 13,440 SFRH3 94.62/94.75/94.87/95.00 put condors, 2.5 net ref 95.04

- Block, 10,000 short Mar 95.25/95.50 put spds, 8.0 ref 95.84

- +3,000 SFRZ2 95.37/95.56 1x2 call spds 4.75-5.0

- Block, 8,000 SFRM3 95.25/95.62/96.00 call trees, 2.0 net ref 95.16

- Eurodollar Options:

- over 5,600 Dec 95.06/95.25/95.43 call flys

- over 5,600 Dec 95.06/95.25/95.43 call flys

- Treasury Options:

- 3,000 TYZ2 113.5 calls 12 ref 110-17.5

- 2,750 TYZ2 109.5/TYH3 107.5 put spds, 26 net/Dec roll out and down

- Block, 10,000 TYZ2 112.5 calls, 28 ref 110-22.5 just over 19k on screen

- -6,000 TYF 117 calls, 9

- 3,500 TYZ 106/107 put spds, 5

- over 16,000 TYZ 107 puts from 8-9

- Block, 7,500 TYZ2 108.5/110 put spds, 20 ref 111-18.5

- 4,000 wk2 30Y 117/119/121 put flys

- 2,400 FVZ 108.25/109/111 broken call flys

- Block, 5,000 TYZ 110 puts, 36 ref 111-13

- Block, 5,000 TYZ 107/110 put spds, 34 ref 111-05.5

- over 10,300 TYZ2 112.75 calls, 24-26 ref 110-24.5 to -31

EGBs-GILTS CASH CLOSE: Short-End Gilts Rally As BoE QT Begins

Short-end Gilt yields fell sharply Tuesday in a bull steepening move on the UK curve. The German curve twist flattened, with periphery spreads slightly tighter.

- Yields fell sharply across the board on the open, but reversed from session lows after midday when a high US job openings figure dealt a late hawkish twist to Wednesday's Fed decision.

- German yields sustained their rise, though Gilts rallied toward the close after the BoE sold short-dated instruments in its first QT operation.

- All attention turns to the Fed decision Wednesday, though one eye remains on the BoE (and its likely 75bp hike) Thursday - our preview ("Downside Risks To 75bp") went out this afternoon.

CLOSING YIELDS / 10-YR PERIPHERY EGB SPREADS TO GERMANY:

- Germany: The 2-Yr yield is up 0.5bps at 1.941%, 5-Yr is down 2.2bps at 1.983%, 10-Yr is down 1.1bps at 2.131%, and 30-Yr is up 0.5bps at 2.14%.

- UK: The 2-Yr yield is down 14.8bps at 3.185%, 5-Yr is down 12.7bps at 3.504%, 10-Yr is down 4.6bps at 3.47%, and 30-Yr is down 2.2bps at 3.586%.

- Italian BTP spread down 2.7bps at 213.1bps / Spanish down 0.1bps at 108.2bps

EGB Options: Euro Rate Upside Features

Tuesday's Europe rates / bond options flow included:

- ERM3 99.00/99.125cs, bought for 0.25 in 20k

- ERM3 97.25/97.50/97.75c ladder with ERM3 97.25/97.50/97.875c ladder, bought for half in 4k

- OEZ2 117,25/114,75 put spread 2.2k sold at 10

- RXZ2 144/146 call spread 3.9k sold at 16.5

FOREX: Greenback Erases Early Losses, EURUSD Approaches Support

- Despite the US Dollar showing early signs of weakness on Tuesday, a large rise in Jolts job openings and firm ISM Manufacturing data in the US provided solid impetus for a greenback recovery in the latter half of Tuesday trade.

- The USD index had fallen roughly 0.75%, making new marginal lows for the week before recovering and extending gains on the data. There was one brief dip for the greenback (of around 35 pips) on a misinterpreted headline over Biden endorsing the Fed’s pivot, however, USD strength immediately resumed.

- EURUSD has settled back below the 0.99 handle and support to watch is 0.9830, the former bear channel resistance, which was broken last week.

- Technically, trend conditions remain bullish and the recent pullback is considered corrective. It is worth noting that there are some large option expiries between 0.99 and 1.00 which may limit the pairs downside at this juncture, especially given the proximity to the FOMC and US jobs data later this week.

- Showing similar underperformance to the Euro is AUD, following the RBA meeting overnight and being weighed on by softer equity indices. The Reserve Bank of Australia raised rates 25bp to 2.85%, warning inflation will peak at "around" 8% later this year as it cut its growth forecasts out to 2024. Despite holding up for much of the session, AUDUSD crashed back below 0.64 following the US data, trading to within close proximity of initial support at 0.6368, the Oct 31 low.

- Interestingly, AUDNZD traded at the lowest level since May 25, trading within 4 pips of noted support at 1.0922.

- In emerging markets, the Brazilian Real continued to outperform after an election victory for Former President Lula. Most recent rhetoric suggests that President Bolsonaro intends there to be a peaceful transition which continues to underpin BRL strength. USDBRL (-1.42%) has now breached support at 5.1121, the Oct 4 low.

- Final PMI releases in Europe on Wednesday as well as ADP employment data in the US. However, all focus will be on the November FOMC decision and Chair Powell’s press conference.

Expiries for Nov02 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9700(E1.1bln), $0.9725(E702mln), $0.9800(E1.3bln), $0.9820-25(E702mln), $0.9850-70(E1.1bln), $0.9900(E862mln), $1.0000(E2.4bln)

- USD/JPY: Y150.00($1.0bln)

- GBP/USD: $1.2000-22(Gbp1.3bln)

- EUR/JPY: Y141.10(E738mln)

- AUD/USD: $0.6720(A$1.2bln)

- NZD/USD: $0.6175(N$713mln)

- USD/CNY: Cny7.2500($715mln)

Late Equity Roundup: Consumer Discretionary Underperform

Stocks hold moderately weaker by the bell, narrow range since reversing support after latest JOLTS data shows labor market remains tight - dampening speculation over step-down to 50bp hike at Dec FOMC. Consumer Discretionary and Communication Services sectors underperforming late. SPX eminis currently trading -9.5 (-0.24%) at 3874; DJIA -28.54 (-0.09%) at 32706.85; Nasdaq - 65.6 (-0.6%) at 10923.09.

- SPX leading/lagging sectors: Laggers: Consumer Discretionary (-1.27) and Communication Services (-1.25%) sectors underperformed while Information Technology recovered slightly (-0.50%). Google -3.76%, Netflix -1.58%. Leaders: Energy sector (+1.34%) w/oil&gas shares outperforming equipment and servicer names. Financials (+0.51%) and Real Estate (+0.29%) follow.

- Dow Industrials Leaders/Laggers: Goldman Sachs (GS) +3.15 at 347.66, Caterpillar (CAT) +2.28 at 218.74, Chevron (CVX) +2.24 at 183.14. Laggers: United Health (UNH) -7.49 at 547.66, Microsoft (MSFT) -3.66 at 228.47, Apple (AAPL) -2.65 at 150.65

E-MINI S&P (Z2): Uptrend Remains Intact

- RES 4: 4100.00 Round number resistance

- RES 3: 4023.44 61.8% retracement of the Aug 16 - Oct 13 downleg

- RES 2: 3981.25 High Sep 14

- RES 1: 3928.00 Intraday high

- PRICE: 3869.5 @ 1515ET Nov 1

- SUP 1: 3757.50/3641.50 Low Oct 27 / 21

- SUP 2: 3590.50/3502.00 Low Oct 17 / 13 and the bear trigger

- SUP 3: 3491.13 50.0% retracement of the 2020 - 2022 bull cycle

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis trend condition remains bullish and Friday’s resumption of the short-term uptrend has reinforced current conditions. Last week’s climb resulted in a break of 3820.00, Oct 5 high. Furthermore, price is again above the 50-day EMA, at 3836.32. Sights are on 3981.25 next, the Sep 14 high. On the downside, key short-term support has been defined at 3641.50, the Oct 21 low. Initial firm support to watch is at 3757.50, the Oct 27 low.

Commodities Drop Portends Further Declines In ISM Prices

Plenty of attention on the drop in ISM Manufacturing Prices which in October posted the lowest reading since May 2020, at 46.6 vs 51.7 in September and and 53.0 in October (and 87.1 as recently as March).

- Then again, this subindex simply tends to track commodity prices - which are falling from recent peaks at a rapid clip.

- The CRB raw industrials index is falling at the fastest 6-month % rate since the global financial crisis.

- Absent a rebound in commodity prices, further falls in PMI Prices in months ahead are to be expected (the drop in commod prices already is consistent w ISM Prices falling below 40).

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/11/2022 | 0001/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 02/11/2022 | 0030/1130 | ** |  | AU | Lending Finance Details |

| 02/11/2022 | 0030/1130 | * |  | AU | Building Approvals |

| 02/11/2022 | 0700/0800 | ** |  | DE | Trade Balance |

| 02/11/2022 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0845/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0855/0955 | ** |  | DE | Unemployment |

| 02/11/2022 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/11/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/11/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/11/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 02/11/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 02/11/2022 | 1515/1115 |  | CA | BOC director Ron Morrow speaks on payments supervision | |

| 02/11/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 03/11/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.