-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

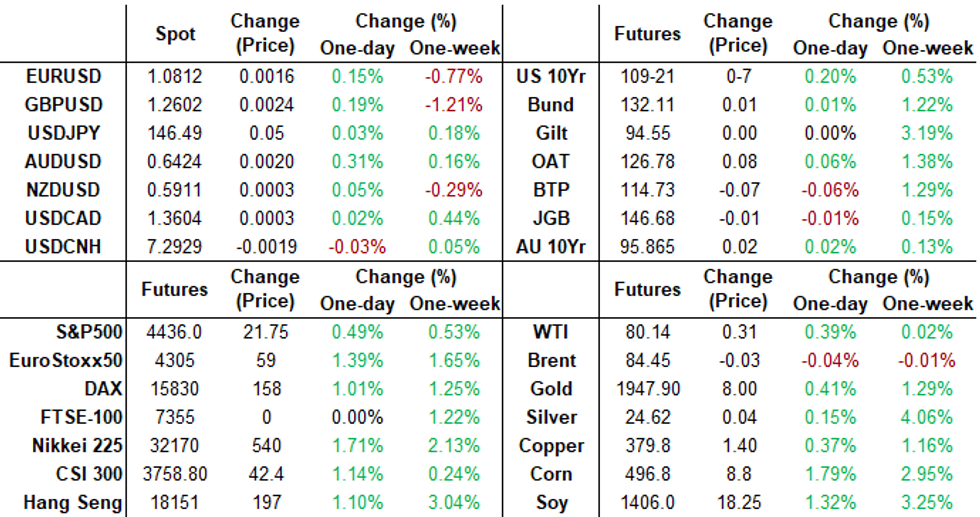

Free AccessMNI ASIA MARKETS ANALYSIS: Tsy Supply Anchors Short End

- MNI US-CHINA: US-China Establish Working Group And Export Control Info Exchange

- MNI US: Judge Sets March 4 Date For Trump Federal Election Interference Trial

- ECB'S NAGEL: WILL WAIT FOR DATA BEFORE TAKING NEXT DECISION, Bbg

- Erdogan Plans to Meet Putin Next Week to Discuss Grain Deal, Bbg

Key Links: US Treasury Auction Schedule / MNI GLOBAL WEEK AHEAD - NBH Rate Decision, German Inflation & US Jobs

US TSYS Position Squaring Ahead Friday's August Employment data

- Tsy futures look to finish the session near the top end of the range after see-sawing off overnight lows by midmorning. No data or headline driver, FI markets worked off last weeks lows with focus on this Friday's August employment report.

- Pre-auction short selling on ample Treasury supply kept the front end anchored.

- Tsy futures steady after the $45B 2Y note auction (91282CHV6) traded through: 5.024% high yield vs. 5.030% WI; 2.94x bid-to-cover vs. 2.86x prior.

- Little reaction to the day's second note auction comes out on the screws: $46B 5Y note auction (91282CHX2): 4.400% high yield vs. 4.400% WI; 2.54x bid-to-cover vs. 2.60x in the prior month.

- Treasury wraps up supply tomorrow with Tsy $36B 7Y Notes (91282CHW4).

- Heavy overall volumes as Sep/Dec Treasury futures roll continued apace, percentage complete over 80% in late trade.

- Looking ahead to Tuesday's data: FHFA House Price Index at 0900ET, JOLTS Job Openings and Conf. Board Consumer Confidence at 1000ET.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00482 to 5.33365 (+.01456 total last wk)

- 3M +0.01355 to 5.41744 (+0.02072 total last wk)

- 6M +0.02548 to 5.49279 (+0.02277 total last wk)

- 12M +0.05466 to 5.46632 (+0.02828 total last wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $103B

- Daily Overnight Bank Funding Rate: 5.31% volume: $261B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.344T

- Broad General Collateral Rate (BGCR): 5.28%, $550B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $543B

- (rate, volume levels reflect prior session)

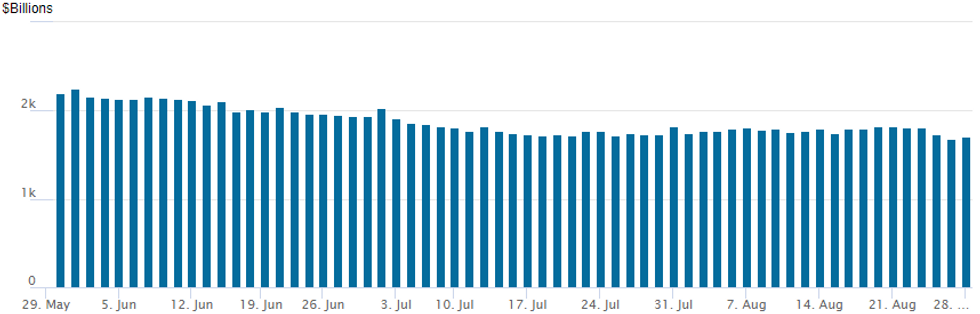

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation bounces to $1,708.605B w/97 counterparties, compared to $1,687.379B in the prior session - the lowest since early April 2022. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

SOFR/TRASURY OPTION SUMMARY

Generally quiet start to the week with London closed for bank holiday Monday. SOFR and Treasury options saw better downside put trade Monday. Rate hike projections through year end inched higher: Sep 20 FOMC is 22.8% w/ implied rate change of +5.7bp to 5.386%. November cumulative of +16.8bp at 5.496, December cumulative of 16.0bp at 5.489%. Fed terminal climbs to 5.49% in Nov'23.

- SOFR Options:

- 6,500 SFRZ3 97.68 calls, .75

- 6,100 SFRZ3 97.62 calls, 1.25

- +2,000 SFRZ3 94.56/94.62/94.75/94.81 put condors, 2.0

- +2,500 SFRM3 97.00/97.50 call spds, 3.0

- -3,500 2QZ3 95.50 puts, 9.5-9.0

- -3,000 0QV3 95.75/96.00 put spds 2.0 over 2QV3 96.25/96.50 put spds

- +2,000 SFRZ3 95.25/95.50 call spds

- 2,000 SFRF4 94.18/94.37/94.56 put flys

- 2,000 0QV3 95.00/95.25 put spds vs. 2QV3 95.37/95.62 put spds

- Treasury Options:

- -5,000 TYX3 108/112 strangles 100-101

- -4,000 USV3 112/116 put spds, 18

- +5,000 wk1 TY 122 calls, 14

- over 10,900 TYV3 111.5 calls, 17 last

- over 3,600 TYV3 108.5 puts, 21 last

- over 6,500 FVV3 106 puts, 30 last

- over 3,700 FVX3 106 calls, 56.5-57

EGB Curves Bear Flatten Peripherals Outperform

Bund futures -15, major German cash benchmarks 1.5-3.5bp cheaper late in the day as the curve bear flattens.

- Hawkish musings from ECB’s Lagarde (late Friday) & Holzmann allowed the front end of the curve to provide the weak point throughout the session.

- Bund futures had a look below Friday’s low, but bears couldn’t make the move stick, running out of steam without forcing a test of key technical support.

- Comments from Bundesbank President Nagel, playing down the need for pre-commitment at the ECB’s Sep meeting, helped Bunds to recover further from lows.

- We then topped out again, with firmer natural gas and oil prices helping cap any rallies.

- News of Germany mandating banks for a tap of its Aug-53 line helped the 5s30s German curve away from session flats, although it wasn’t a complete surprise, with some desks flagging the potential for such a move given already detailed German issuance intentions.

- EU supply didn’t provide any notable headwinds for the market, seeing smooth enough, although not impressive, digestion.

- Most EGB curves saw a bear flattening move, akin to Germany.

- A bid in equities and slightly tighter CDS indices seemed to facilitate some light peripheral spread tightening vs. Bunds, while 10-Year core/semi-core was little changed vs. German 10s.

- Liquidity was thinned by a holiday in London.

FOREX: Bounce in Equities Tips USD/JPY to New Cycle High

- After a more muted start to the day's trade, activity and price action picked up through the NY crossover, with a solid start for US equity markets helping tip USD/JPY to a new cycle high at 146.68. European markets and US futures got off to to a strong start, with US traders following on with strong buying evident from the off via a multi-week high reading for the NYSE Tick index at the open.

- The modest risk-on backdrop pressured JPY to the bottom of the G10 pile, while SEK recovered alongside comments from Riksbank's Floden, who talked up the prospect of the Riksbank holding rates at high levels for an extended period, and stressed his conviction that the SEK would strengthen over time. SEK's outperformance ran counter to a poorer NOK, tipping NOK/SEK away from an early multi-week high of 1.0378.

- Data releases pick up on Tuesday, with the release of JOLTS job openings data as well as the August consumer confidence figure. Markets expecting consumer confidence to fade by 1 point to 116.00. RBA's Bullock is set to speak as well as Fed's Barr, while the Bank of Finland hold a press conference on monetary policy.

Expiries for Aug29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0725-35(E1.0bln), $1.0800(E1.9bln), $1.0825-30(E560mln), $1.0855-65(E550mln), $1.0950-55(E1.4bln)

- USD/JPY: Y145.00($699mln), Y147.00-10($1.4bln)

- GBP/USD: $1.2700-20(Gbp646mln)

- AUD/USD: $0.6400(A$1.3bln)

Late Equity Roundup: Holding Early Gains

- Stocks are holding modest gains in late Monday trade, a quiet start to the week with London out for a bank holiday. Currently, S&P E-Mini futures are up 20.5 points (0.46%) at 4434.75, Nasdaq up 89.1 points (0.7%) at 13679.6, DJIA up 158.05 points (0.46%) at 34505.08.

- Leading gainers: Real Estate, Communication Services and Industrials/Materials sectors outperformed Monday, management and development shares supporting the former with CBRE Group +2.1%, CoStar Group +1.65%.

- Media and telecom shares led Communication Services with Warner Bros +3.1%, Charter Communication +2.86%, Paramount +1.9%. Meanwhile Materials led by metals/mining and industrial shares: 3M +5.16%, Newmont +1.9%, Freeport McMoRan +1.5%.

- Laggers: Utilities, Health Care and Consumer Discretionary lagged the modest rally. Gas companies weighed on Utilities sector: ATO -0.95%, AES Energy -0.8%. Health Care: Pharmaceuticals lagged equipment and services: Bio-Techne Corp -3.27%, JNJ -1.65% and Merck -1.3%. Meanwhile Tesla receded 0.55% after making strong gains late last week, weighed on autos sector.

E-MINI S&P TECHS: (U3) Key Resistance Remains Intact

- RES 4: 4593.50/4634.50 High Aug 2 / Jul 27 and key resistance

- RES 3: 4560.75 High Aug 4

- RES 2: 4517.75 High Aug 15

- RES 1: 4504.75 Former bull channel base drawn from Mar 13

- PRICE: 4426 50 @ 14:30 ET Aug 28

- SUP 1: 4350.00 Low Aug 18 and a bear trigger

- SUP 2: 4344.28 38.2% retracement of the Mar 13 - Jul 27 bull cycle

- SUP 3: 4305.75 Low Jun 8

- SUP 4: 4254.62 50.0% retracement of the Mar 13 - Jul 27 bull cycle

A sharp sell-off on Aug 24 in the E-mini S&P contract reinforces a bearish theme and signals the end of the Aug 18 - 24 corrective bounce. Short-term gains are considered corrective and attention is on support at 4350.00, the Aug 18 low and bear trigger. A break would confirm a resumption of the current bear cycle. Resistance to watch is 4504.75 - the base of a bull channel, drawn from the Mar 13 low - that was breached on Aug 16.

COMMODITIES

- WTI Crude Oil (front-month) up $0.31 (0.39%) at $80.13

- Gold is up $5.31 (0.28%) at $1920.21

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Period | Flag | Country | Release | Prior | Consensus | |

| 29/08/2023 | 2301/0001 | * | Aug |  | UK | BRC Shop Price Index m/m | -0.1 | -- | % |

| 29/08/2023 | 2301/0001 | * | Aug |  | UK | BRC Shop Price Index y/y | 7.6 | -- | % |

| 29/08/2023 | 0600/0800 | * | Aug |  | DE | GFK Consumer Climate | -25.2 | -- | |

| 29/08/2023 | 0600/0800 | *** | Q2 |  | SE | GDP q/q | 0.6 | -1.2 | % |

| 29/08/2023 | 0600/0800 | *** | Q2 |  | SE | GDP y/y | 0.8 | -1.1 | % |

| 29/08/2023 | 0600/0800 | ** | Jul |  | SE | Retail Sales y/y | -4.4 | -- | % |

| 29/08/2023 | 0600/0800 | * | Aug |  | DE | GFK Consumer Climate | -24.4 | -24.5 | |

| 29/08/2023 | 0645/0845 | ** | Aug |  | FR | Consumer Sentiment | 85 | 85 | |

| 29/08/2023 | 1255/0855 | ** | 26-Aug |  | US | Redbook Retail Sales y/y (month) | -- | -- | % |

| 29/08/2023 | 1255/0855 | ** | 26-Aug |  | US | Redbook Retail Sales y/y (week) | 2.9 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | Case-Shiller Home Price Index | 305.15 | -- | |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | FHFA Home Price Index m/m | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | Prior Revised HPI % Chge mm SA | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Q2 |  | US | FHFA Quarterly Home Prices q/q | 0.5 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | FHFA Home Price Index m/m | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Jun |  | US | Prior Revised HPI % Chge mm SA | 0.7 | -- | % |

| 29/08/2023 | 1300/0900 | ** | Q2 |  | US | FHFA Quarterly Home Prices q/q | 0.5 | -- | % |

| 29/08/2023 | 1400/1000 | *** | Aug |  | US | Conference Board Confidence | 117.0 | 116.4 | |

| 29/08/2023 | 1400/1000 | *** | Aug |  | US | Previous Consumer Confidence Index Revised | 110.1 | -- | |

| 29/08/2023 | 1400/1000 | ** | Jun |  | US | JOLTS job openings level | 9582 | -- | (k) |

| 29/08/2023 | 1400/1000 | ** | Jun |  | US | JOLTS quits rate | 3.6 | -- | % |

| 29/08/2023 | 1430/1030 | ** | Aug |  | US | Dallas Fed services index | -4.2 | -- | |

| 29/08/2023 | 1530/1130 | * | 01-Sep |  | US | Bid to Cover Ratio | -- | -- | |

| 29/08/2023 | 1700/1300 | ** | Aug |  | US | Bid to Cover Ratio | -- | -- |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.