-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Tsys Drift Lower Ahead CPI/PPI

- MNI US: Schumer Says "World Is Watching" As Congress Gridlocked Over Supplemental Security Package

- CHINA SAYS RUSSIANS SHOWED ENTHUSIASM ON UKRAINE PEACE TALKS, Bbg

- BMO CEO SEES FED, BOC CUTTING RATES BY 100 BPS BY END OF 2024, Bbg

- India’s Plans to Double Coal Production Ignore Climate Threat, Bbg

cropfilter_vintageloyaltyshopping_cartdelete

US Tsys in Holding Pattern Ahead CPI/PPI

- Tsys remain mildly weaker after the bell, near the top end of a narrow range after another quiet data session with markets in a holding pattern ahead CPI/PPI on Thursday/Friday.

- Little reaction in rates following this morning's lower than expected Trade Balance (-$63.2B vs -$64.9B est). Rates appeared to follow EGBs as they drifted off lows following a number of EUR IG supply unwinds.

- Projected rate cuts for early 2024 recovered slightly after unwinding Mon's gains: January 2024 cumulative -1.1bp at 5.318%, March 2024 chance of rate cut -62.0% vs. -57.2% this morning w/ cumulative of -16.6bp at 5.163%, May 2024 chance of cut 86.8% vs. 85.6% this morning, cumulative -38.3bp at 4.946%. Fed terminal at 5.3275% in Jan'24.

- Current TYH4 at 111-29 (-4.5), well inside technicals: Treasuries remain in a short-term corrective cycle. Price has traded through the 20-day EMA and the breach of this average, does suggest potential for a continuation lower near-term. The next key support lies at 110-25+, the 50-day EMA. Moving average studies continue to suggest the medium-term trend direction is up. A recovery would refocus attention on the bull trigger at 113-12, the Dec 27 high.

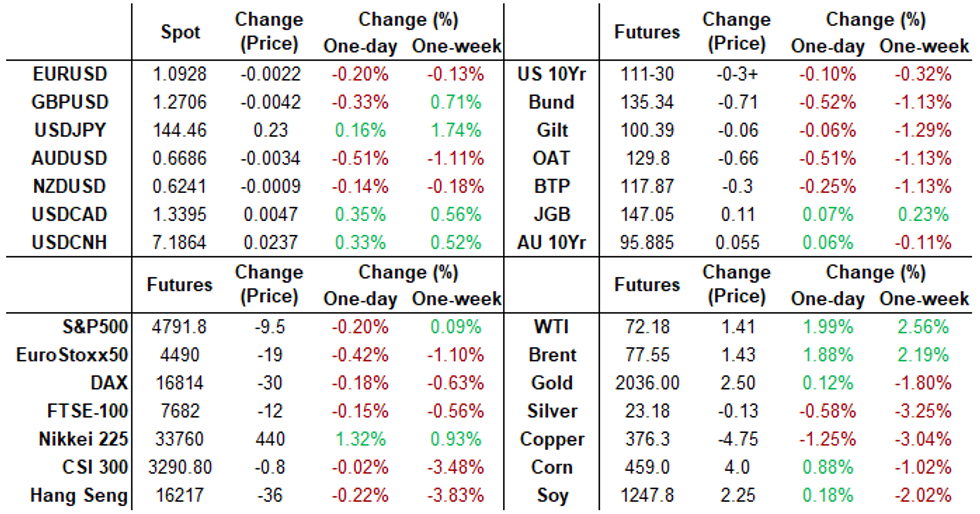

- Cross asset roundup: WTI Crude Oil (front-month) up $1.4 (1.98%) at $72.16; Gold is up $0.73 (0.04%) at $2028.82; S&P E-Mini Futures down 13 points (-0.27%) at 4787.5.

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00218 to 5.33553 (-0.00371/wk)

- 3M -0.00230 to 5.32344 (-0.00582/wk)

- 6M -0.01110 to 5.17317 (-0.01967/wk)

- 12M -0.02729 to 4.82052 (-0.03398/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.658T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $672B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $661B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $86B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $253B

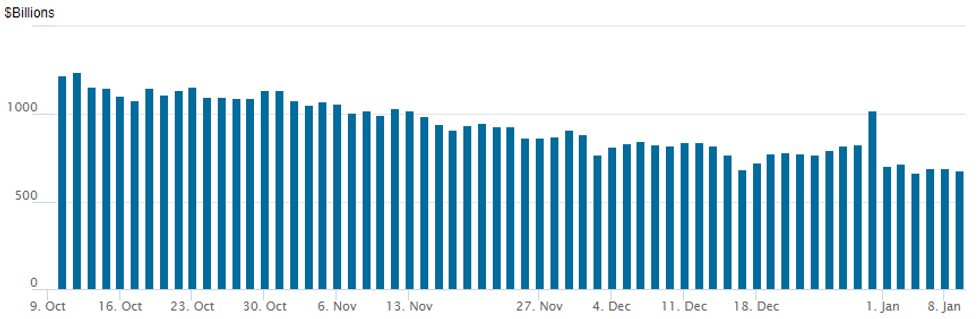

FED REVERSE REPO OPERATION, Counterparties Fall to Early Jan 2022 Lows

NY Federal Reserve/MNI

- RRP usage recedes to $676.050B vs. $691.485B Monday, compares to $664.899B on Thursday, January 4 -- the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties falls to 72 -- the lowest since January 5, 2022.

- Morgan Stanley economists’ "base case is the Fed begins taper in September by $10bn per month for Treasury securities (from a current max runoff of $60bn per month) as the RRP depletes, with an eventual end to QT in February 2025."

SOFR/TREASURY OPTION SUMMARY

Decent overnight option volumes continued through the NY session, more paired as put interest returned following Monday's more one-sided call structure/rate cut positioning. Underlying futures remain mildly weaker after the bell, near session highs after another quiet data session, markets in holding pattern ahead CPI/PPI on Thursday/Friday. Projected rate cuts for early 2024 recovered slightly after unwinding Mon's gains: January 2024 cumulative -1.1bp at 5.318%, March 2024 chance of rate cut -62.0% vs. -57.2% this morning w/ cumulative of -16.6bp at 5.163%, May 2024 chance of cut 86.8% vs. 85.6% this morning, cumulative -38.3bp at 4.946%. Fed terminal at 5.3275% in Jan'24.

- SOFR Options: Reminder, Jan options, including midcurves, expire Friday

- +4,000 SFRZ4 98.00/99.00 1x2 call spds 1.75

- +5,000 SFRU4 95.75/95.87 call spds 1.5 over SFRU4 94.62 puts vs. 95.735/0.14%

- +20,000 SFRH4 95.06/95.12 call spds, 0.75

- -7,000 SFRJ4 95.00/95.75 call spds, 5.25

- over +20,000 SFRH4 94.68/94.81/94.93/95.00 broken put condors

- Block, 13,300 SFRU5 94.50/95.00 2x1 put spds, 4.0 net ref 95.718

- +5,000 SFRM5 96.75/97.12 call spds 2.5 over SFRM5 94.87 puts

- Block +15,000 0QF4 96.12/96.25 put spreads, 2.25

- +8,000 2QJ4 96.00 puts, 5.5

- Block, 2,500 SFRM4 95.25/95.75/96.25 call flys, 9.0 ref 95.335

- Block, 6,000 94.93/95.18/95.50/95.62 broken put condors, .25

- 5,200 0QH4 96.12/96.75 2x3 call spds ref 96.355

- 4,000 SFRH4 95.00/95.12/95.25/95.37 call condors ref 94.905

- 5,200 SFRZ4 94.75/95.75 2x1 put spds

- 2,000 SFRM4 95.50/96.00 call spds vs. SFRMf 94.50/94.75 put spds ref 95.32

- 8,000 SFRM4 95.50/95.87 call spds vs. SFRM4 94.62/94.87 put spds ref 95.325

- 30,000 SFRG4 94.75/94.87/94.93/95.00 broken put condors

- 2,000 SFRG4 95.00/95.12 call spds vs. 0QH4 96.56/96.68 call spds

- over 8,700 SFRM4 95.50 calls ref 95.315/0.38%

- 15,000 SFRH4 94.87/95.00/95.12 call flys ref 94.90 to -.905

- 2,000 SFRM4 94.93/95.18/95.50/95.62 broken put condors ref 95.315

- 6,000 SFRH4 94.75/94.87/94.93/95.00 broken put condors ref 94.905 to -.90

- 4,000 SFRM4 94.62/95.00/95.37/95.50 broken put condors ref 95.32

- 4,000 SFRM4 94.50/95.00/95.37/95.50 broken put condors ref 95.33 to -.325

- Treasury Options:

- 1,100 USH4 118 puts vs. 132 calls on 1x2 ratio

- 2,500 wk2 TY 109/109.75/110.5 put trees vs. wk3 TY 109.25/109.75/110.25 put trees

EGBs-GILTS CASH CLOSE: Bunds Underperform Amid Heavy Supply

Gilts outperformed Bunds Tuesday, as heavy supply took centre stage.

- Supply weighed for most of the morning. Tuesday marked the largest-ever day for European primary market debt issuance (BBG pointed out at least E47bln including corporate paper), including syndications from Italy and Belgium.

- Following syndication pricings, and amid a pullback in oil prices, core EGBs regained ground in mid-afternoon briefly amid some futures block buying but eventually faded toward the cash close.

- The German curve bear flattened on the day, with the UK's twist steepening slightly (20Y Gilt supply was well-received). After a weak start, periphery spreads narrowed by a couple of basis points.

- An uneventful session for data: weak German industrial production data had been telegraphed by Monday's poor factory orders report, while below-expected Eurozone and Italian unemployment rates had little impact.

- ECB's Villeroy speaks after the close, with Wednesday bringing central banker appearances including ECB's Schnabel and Guindos, and BOE's Bailey.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6.2bps at 2.61%, 5-Yr is up 6.1bps at 2.136%, 10-Yr is up 5.2bps at 2.188%, and 30-Yr is up 5bps at 2.416%.

- UK: The 2-Yr yield is down 0.4bps at 4.211%, 5-Yr is down 0.3bps at 3.727%, 10-Yr is up 1bps at 3.782%, and 30-Yr is up 0.5bps at 4.391%.

- Italian BTP spread down 2.1bps at 166.2bps / Greek down 2.6bps at 113.1bps

EGB Options: Sonia Upside Plays Soar Tuesday

Tuesday's Europe rates/bond options flow included:

- RXG4 138.50c, bought for 16 in 3k.

- ERK4 96.62/96.50/96.25p fly, bought for -0.5 in 4k

- SFIM4 95.45/95.55/95.65/95.75c condor, bought for 1 in 1k and 8.5k

- SFIM4 95.35/95.45/95.55c fly bought for 1 and 1.25 in upward of 50k

- SFIK4 95.30/95.45/95.60c fly, bought for 2 in 5k

FOREX Greenback On Firmer Footing, Notable AUD Weakness

- The greenback strengthened on Tuesday, with the USD index (+0.35%) erasing the prior day’s losses and edging into positive territory on the week. An empty data docket points to the moves being brushed off as short-term positioning adjustments as we approach the key US inflation data later this week.

- AUD steadily faded lower on Thursday, largely ignoring the mid-session rebound for major equity indices, with the moves more generally reflecting the poor backdrop for industrial metals (DCE-listed iron ore futures hit multi-week and YTD lows today). Notably, AUDNZD has broken lower, trading the lowest level since Dec13 and the Fed's dovish pivot. 1.0656 marks the downside level to watch from here.

- Shakier sentiment from China is also key focus, and while expectations are building for fresh policy support from the PBOC (Nomura see PBOC as cutting lending rates as soon as Monday), the anticipated support has failed to prop or reverse the pullback off Dec28's 0.6871 in AUDUSD.

- 0.6678 and $0.6641 provide weak intraday support, but clearance here would place the pair at the lowest level since the Mid-Dec rally. More broadly, the formation of a golden cross in DMA space (50- rising above the 200-dma) should prove positive if the current pullback is confirmed as corrective in nature.

- In similar vein, the Swiss Franc is also populating the bottom-end of the G10 table, with the persistent slide in EURCHF and USDCHF stalling at the beginning of 2024. Weakness in CHF comes despite the firmer-than-expected Dec CPI release earlier this week.

- Australian CPI is the key data release on Wednesday, with potential comments from Bank of England Governor Andrew Bailey and a 10-yr treasury auction the only other notable risk events for the rest of the session.

FX Expiries for Jan10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0890-00(E889mln), $1.0915-25(E1.4bln), $1.0970-71(E972mln), $1.0985(E2.3bln)

- USD/JPY: Y143.50-55($831mln), Y144.00-05($1.7bln), Y144.50($622mln), Y145.00($1.9bln)

- EUR/JPY: Y156.00(E720mln)

- USD/CAD: C$1.3400($646mln), C$1.3435($556mln)

- USD/CNY: Cny7.1713($530mln)

Late Equity Roundup: IT, Communication Services Outperform

- Stocks trading mixed after the bell, off lows with Nasdaq outperforming. At the moment: DJIA is down 180.26 points (-0.48%) at 37503.11, S&P E-Mini futures down 8.75 points (-0.18%) at 4792.5, Nasdaq up 11.6 points (0.1%) at 14854.96.

- Leading gainers: Information Technology and Communication Services outperformed in the second half, semiconductor makers buoyed the former: Nvidia +3%, Advanced Micro Devices +2.22%, Enphase +1.59%. Interactive media/entertainment shares continued to support Communication Services: Match Group +2.35%, Google +1.22%, Live Nation Entertainment +1.04%.

- Laggers: Energy and Materials sector stocks underperformed, energy and equipment servicer shares continued to weigh on the former: Schlumberger -3.36%, Baker Hughes -2.54%, Haliburton -2.33%,. Metals/mining shares weighed on the Materials sector: Newmont -3.83%, Steel Dynamics -3.2%, Nucor -2.65%.

- Reminder, banks lead the next quarterly earnings cycle that starts next week Friday with BlackRock, Bank of America, Wells Fargo, JPMorgan, Citigroup and Bank of NY Mellon.

E-MINI S&P TECHS: (H4) Trend Outlook Remains Bullish

- RES 4: 4915.11 1.236 proj of Nov 10 - Dec 1 - 7 price swing

- RES 3: 4900.00 Round number resistance

- RES 2: 4854.75 1.00 proj of Nov 10 - Dec 1 - 7 price swing

- RES 1: 4841.50 High Dec 28 and the bull trigger

- PRICE: 4796.50 @ 1215 ET Jan 09

- SUP 1: 4702.00 Low Jan 05

- SUP 2: 4695.69 2.0% 10-dma Envelope

- SUP 3: 4656.580 50-day EMA

- SUP 4: 4594.00 Low Nov 30

The recent move lower in S&P E-Minis appears to have been a correction. Support at the 20-day EMA of 4750.67 has been pierced. A clear break of this average would strengthen a short-term bearish threat and expose 4695.69, the lower band of a MA envelope. A move through this support would expose the 50-day EMA, at 4656.58. For bulls, a resumption of gains would expose key resistance and the bull trigger at 4841.50, the Dec 28 high.

COMMODITIES Crude Futures Bounce On Reduced Libya Flows And Middle East Tensions

- Crude is holding most of its gains on the day, as reduced flows out of Libya and risks from Middle East tensions bolster prices. The WTI prompt time spread briefly flipped into backwardation for the first time since November, driven by the additional strength on the prompt month.

- Global consumption of liquid fuels is expected to be 102.46m b/d in 2024, according to the EIA’s January Short-Term Energy Outlook. This is revised up from 102.34m b/d in December’s report.

- A total of 21 oil tankers carrying a combined 2.5m mt, or 19.8m bbl of CPC Blend have been unable to depart from the Black Sea after loading due to adverse weather, according to Bloomberg.

- WTI is +2.0% at $72.19, unwinding some of yesterday’s slide to lift away from support at $69.28 (Jan 3 low) closer to resistance at $74.85 (50-day EMA).

- Brent is +1.9% at $77.57, lifting away from support at $74.79 (Jan 3 low) nearer resistance at $79.41 (Jan 4 high).

- Gold is +0.06% at $2029.24, fairing well considering the strengtheing in the USD index throughout the session. It holds narrow ranges and doesn’t test support at $2012.0 (50-day EMA) seen as part of the trend bear leg extension.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/01/2024 | 0030/1130 | *** |  | AU | CPI Inflation Monthly |

| 10/01/2024 | 0700/0800 | *** |  | NO | CPI Norway |

| 10/01/2024 | 0700/0800 | ** |  | SE | Retail Sales |

| 10/01/2024 | 0700/0800 | ** |  | SE | Private Sector Production m/m |

| 10/01/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 10/01/2024 | 0800/0900 |  | EU | ECB's De Guindos speech at Spain Investor Day | |

| 10/01/2024 | 0900/1000 | * |  | IT | Retail Sales |

| 10/01/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/01/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/01/2024 | - | *** |  | CN | Money Supply |

| 10/01/2024 | - | *** |  | CN | New Loans |

| 10/01/2024 | - | *** |  | CN | Social Financing |

| 10/01/2024 | 1415/1415 |  | UK | Treasury Select Hearing on FSR | |

| 10/01/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 10/01/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/01/2024 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/01/2024 | 2015/1515 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.