-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: MN Fed Kashkari: Start of Very Strong Recovery

EXECUTIVE SUMMARY

- MNI: Fed Looking At 12-Month, Flexible Taper - Ex-Officials

- MNI: Rosengren Wants Capital Buffer, Rejects Digital Currency

- MNI BRIEF: Dallas Fed Kashkari Sees Inflation Easing, Labor Supply Pickup

- KASHKARI: U.S. HOPEFULLY AT START OF A VERY STRONG RECOVERY; however ECONOMY IS STILL IN A DEEP HOLE, 7M JOBS SHORT Bbg

- BOSTON FED ROSENGREN: SEES 7% AS `GOOD ESTIMATE' OF U.S. GDP THIS YEAR, Bbg

- U.S. ENERGY CHIEF: ANY STRATEGIC OIL RESERVE SALE TO BE LIMITED; GRANHOLM DISCUSSES PLAN TO SELL OIL RESERVE TO PAY FOR INFRAST, Bbg

OVERNIGHT DATA

US MAY PERSONAL INCOME -2.0%; NOM PCE +0.0%

US MAY PCE PRICE INDEX +0.4%; +3.9% Y/Y

US MAY CORE PCE PRICE INDEX +0.5%; +3.4% Y/Y

US MAY UNROUNDED PCE PRICE INDEX +0.449%; CORE +0.481%

MICHIGAN JUNE FINAL CONSUMER SENTIMENT AT 85.5; EST. 86.5

MICHIGAN 1-YR INFLATION EXPECTATIONS AT 4.2%, VS 4% PRELIM.

US DATA: Quicktake: Morgan Stanley on June Employment

Morgan Stanley economists estimate payrolls for June will rise by +620k next week Friday vs. +559k for May (+600k private payrolls vs. +492k prior), citing increased recruitment efforts and compensation by employers to "draw people back into employment."- We expect labor force participation increased from 61.61% to 61.66% which, together with our forecast for payrolls, lowered the unemployment rate from 5.8% to 5.5%.

- Elevated job openings and quits point towards strong demand for workers relative to supply, which we expect supported the bargaining power of current and prospective workers, resulting in a 0.3%M rise in average hourly earnings.

- This would raise the year-over-year rate from 2.0% to 3.6% off of a low base in June 2020. We expect the average workweek ticked up 0.1 hours/week to 35.0 hours/week.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 283.43 points (0.83%) at 34423.67

- S&P E-Mini Future up 18.75 points (0.44%) at 4267

- Nasdaq up 8.6 points (0.1%) at 14362.97

- US 10-Yr yield is up 3.7 bps at 1.5292%

- US Sep 10Y are down 8.5/32 at 131-29

- EURUSD up 0.0003 (0.03%) at 1.1933

- USDJPY down 0.06 (-0.05%) at 110.85

- WTI Crude Oil (front-month) up $0.62 (0.85%) at $74.07

- Gold is up $3.15 (0.18%) at $1777.26

European bourses closing levels:

- EuroStoxx 50 down 1.77 points (-0.04%) at 4120.66

- FTSE 100 up 26.1 points (0.37%) at 7136.07

- German DAX up 18.74 points (0.12%) at 15607.97

- French CAC 40 down 8.28 points (-0.12%) at 6622.87

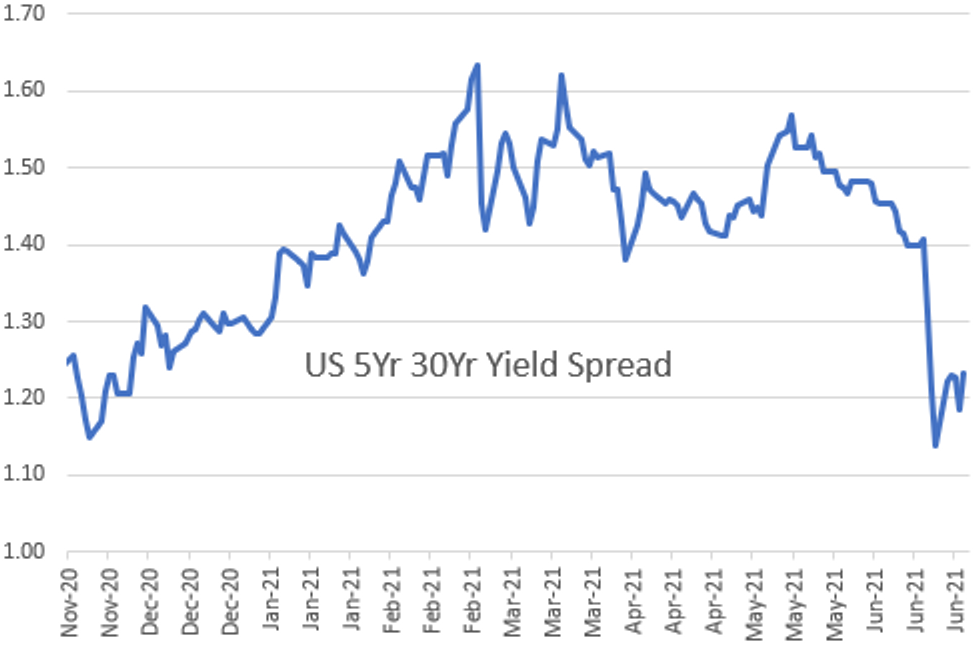

US TSY SUMMARY: 5s30s Back Near Week Highs

Yield curves bent steeper Friday as 30Y Bonds extended session lows in late trade -- USU1 low of 158-18 back to level just before the FOMC annc last Wed. 5s30s Yield curve well off Mon's 107.7 low to 124.236 high. 10YY has climbed to 1.54% after holding near 1.49-.50% over the last week.- No headline driver as Bonds, Gilts and Bunds all came under pressure early in the session -- and gaining momentum through late trade.

- Not a lot of conviction from traders as they awaited more Fed-speak:

- KASHKARI: U.S. HOPEFULLY AT START OF A VERY STRONG RECOVERY; however ECONOMY IS STILL IN A DEEP HOLE, 7M JOBS SHORT Bbg

- BOSTON FED ROSENGREN: SEES 7% AS `GOOD ESTIMATE' OF U.S. GDP THIS YEAR, Bbg

- Focus turns to next week's employment report (+695k est vs. +559k prior). Sources did report real$ buying 7s, fast $ buying 10s after this morning's PCE.

- The 2-Yr yield is unchanged at 0.2681%, 5-Yr is up 1.3bps at 0.9263%, 10-Yr is up 3.6bps at 1.5275%, and 30-Yr is up 6bps at 2.1577%.

US TSY FUTURES CLOSE

- 3M10Y +4.233, 147.848 (L: 142.418 / H: 149.211)

- 2Y10Y +3.726, 125.916 (L: 120.967 / H: 127.279)

- 2Y30Y +6.174, 188.978 (L: 180.836 / H: 190.505)

- 5Y30Y +4.891, 123.192 (L: 116.775 / H: 124.236)

- Current futures levels:

- Sep 2Y steady at at 110-3.75 (L: 110-03.375 / H: 110-04.375)

- Sep 5Y down 3/32 at 123-6.75 (L: 123-05 / H: 123-11.25)

- Sep 10Y down 9/32 at 131-28.5 (L: 131-24.5 / H: 132-08.5)

- Sep 30Y down 1-4/32 at 158-26 (L: 158-18 / H: 160-05)

- Sep Ultra 30Y down 2-18/32 at 189-5 (L: 188-19 / H: 192-04)

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.855

- Dec 21 steady at 99.785

- Mar 22 +0.005 at 99.790

- Jun 22 steady at 99.710

- Red Pack (Sep 22-Jun 23) -0.02 to steady

- Green Pack (Sep 23-Jun 24) -0.03 to -0.02

- Blue Pack (Sep 24-Jun 25) -0.035 to -0.03

- Gold Pack (Sep 25-Jun 26) -0.045 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest Settles

- O/N -0.00162 at 0.08338% (+0.00288/wk)

- 1 Month +0.00113 to 0.09613% (+0.00513/wk)

- 3 Month +0.00000 to 0.14600% (+0.01112/wk) ** (New Record Low: 0.11800% on 6/14)

- 6 Month +0.00025 to 0.16550% (+0.00925/wk)

- 1 Year +0.00162 to 0.24925% (+0.00912/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $74B

- Daily Overnight Bank Funding Rate: 0.08% volume: $266B

- Secured Overnight Financing Rate (SOFR): 0.05%, $868B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $326B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $24.332B submission

- Next scheduled purchases:

- Mon 6/28 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 6/29 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 6/30 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

- Thu 7/1 1100-1120ET: Tsy 22.5Y-30Y, appr $2.025B

FED: Repo and Reverse Repo Operations

NY Fed reverse repo usage drops to $770.830B from 73 counterparties Friday, compares to Thursday's record high of $813.573B.

MONTH-END EXTENSION: PRELIMINARY Barclays/Bbg Extension Estimates for US

PRELIMINARY forecast summary compared to avg increase for prior year and same time in 2020. TIPS 0.01Y; US Gov infl-linked -0.4Y.

| Indices | Estimate | 1Y Avg Incr | Last Year |

| US Tsys | 0.08 | 0.09 | 0.09 |

| Agencies | 0.11 | 0.04 | 0.06 |

| Credit | 0.05 | 0.12 | 0.09 |

| Govt/Credit | 0.07 | 0.10 | 0.09 |

| MBS | 0.11 | 0.06 | 0.08 |

| Aggregate | 0.08 | 0.09 | 0.09 |

| Long Gov/Cr | 0.07 | 0.09 | 0.12 |

| Iterm Credit | 0.07 | 0.10 | 0.10 |

| Interm Gov | 0.09 | 0.08 | 0.07 |

| Interm Gov/Cr | 0.08 | 0.09 | 0.08 |

| High Yield | 0.07 | 0.11 | 0.09 |

PIPELINE: Issuance Evaporates Ahead Weekend

$3.8B Priced Thursday, $27.4B total for week- Date $MM Issuer (Priced *, Launch #)

- 06/24 $1.8B *Centene Corp 7Y +2.45%

- 06/24 $1.5B *Enbridge $1B 12Y +105, $00M 30Y +130

- 06/24 $500M *Athene Global Funding 5Y +72

EGB/GILTS SUMMARY - Curve steepening going into the weekend

Main price action flow for EGBs and other Global bonds have been to unwind most of the week flattening bias.

- US, UK and Germany 5/30s are moving higher, likely catching flattening position.

- Desk unwind going into the weekend.

- German 5/30s now trade above the week high.

- BTP still under performing against its peers, pushing the BTP/Bund spread 3bps wider, and the spread now trades at widest levels since 8th June.

- The weakness in BTP has also helped the Bund lower.

- Support for the Futures contract comes at 150.11 Low Low Jun 8 and key near-term support

- Gilts are taking their cue from EGBs and similar price action and in particular, curve play, with UK bear steepening.

- UK 5/30s is just short of the week high at 90.569, now at 90.00.

- No sovereign rating for today

FOREX: Greenback Recoups Losses Approaching The Close

- In similar price action over the past three days, dollar indices spent the US trading hours unwinding the moves from earlier in the session.

- Dollar weakness across the board was the main feature of early trade on Friday, before the greenback staged a solid recovery approaching the close to end the day in very marginal positive territory, however, still roughly 0.5% lower on the week.

- Kiwi and Aussie had been the best performing G10 currencies, with risk sentiment boosted by tentative US bipartisan infrastructure agreement. However, tracking the USD, both currency pairs gave up all of their gains.

- GBPUSD continued to underperform following yesterday's BOE statement, losing 0.25% with the Canadian dollar marginally outperforming, rising 0.21%. Notable extension of weakness in the Turkish Lira with USDTRY rising another 0.85% on Friday to close higher on the week.

- Cable remains vulnerable after trading through the 100-DMA, reinforcing current bearish conditions. Scope is seen for an extension lower towards 1.3717, Apr 14 low, the bear trigger remains at 1.3787.

- Very little data due on Monday as markets will eagerly await the US Employment Figures later in the week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.