-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Spotlight Off FOMC as Stocks Tumble

EXECUTIVE SUMMARY

- MNI Fed Preview - Sep 2021: Consider This "Advance Notice"

- Evergrande Contagion Fear or Just a Correction Trigger?

- MNI: Fed's Inflation Credibility Weakening--Weinberg

- US: Gov't To Require Foreign Entrants To Be Double Vaccinated: CNN

US

FED: The September FOMC meeting will set up a taper start in late 2021, increasingly likely in November.

- While details of the FOMC's taper plan may not emerge from this meeting, a taper is likely to include $15B/meeting pace and optionality to adjust at each meeting, opening up the possibility of an end-2022 rate hike.

- Consensus expects the median Fed funds rate 'dot plot' path to remain fairly static at this meeting vs the June projections, setting up hawkish risks.

FED: The Federal Reserve is in danger of allowing a dangerous un-anchoring of price expectations, economists connected with the Fed system told MNI, with ex-Richmond Fed Research Director John Weinberg calling for officials to proclaim more decisively that they will not tolerate persistently high inflation.

- "Rather than saying we have the tools to deal with it if it proves to be persistent, I would have hoped they would have said we have the tools to ensure it's not persistent," Weinberg said in an interview. "The whole point of central bank messaging is to affect expectations or reassure expectations." For more see MNI Policy main wire at 0820ET.

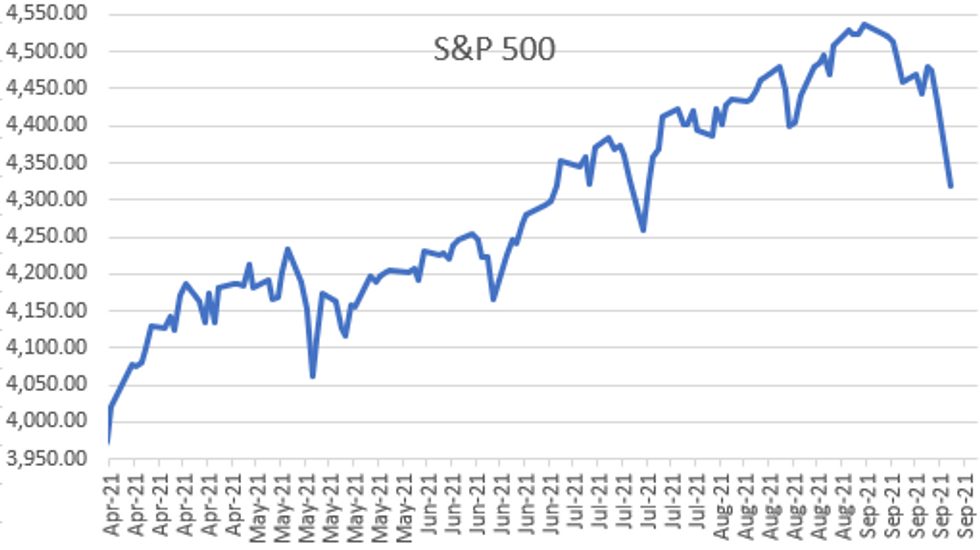

US TSYS: China's Evergrande Real Estate Group Default Fears Roil Markets

The midweek FOMC policy annc out of the limelight as a global equity sell-off underpinned Tsys Monday, rate futures near session highs after the bell as China's Evergrande Real Estate Group default fears roiled markets.- Dec emini futures (ESZ1) were off lows at 4349.5 vs. 4293.75 low after the bell;

- while TYZ1 held just under first resistance of 133-09.5 (20D EMA), after tapping 133-11.5 high. Rather decent volumes on orderly risk-off session, TYZ >1.3M.

- Just a trigger for correction. Barclays analysts wrote the "possible Evergrande default could be a significant drag on the property sector" it's "far from being China's Lehman moment."

- Otherwise -- trade was rather orderly, many accounts squared and pared, plying the sidelines ahead of Wednesday's FOMC policy annc -- no rate change expected, while most Fed watchers estimate a taper annc to come at the November meeting at the earliest.

- Currently, the 2-Yr yield is down 0.8bps at 0.2137%, 5-Yr is down 4.1bps at 0.8195%, 10-Yr is down 5.4bps at 1.3074%, and 30-Yr is down 5.2bps at 1.8471%.

OVERNIGHT DATA

US NAHB HOUSING MARKET INDEX 76 IN SEP

US NAHB SEP SINGLE FAMILY SALES INDEX 82; NEXT 6-MO 81

MARKET SNAPSHOT

Key late session market levels:

- DJIA down 887.08 points (-2.56%) at 33700.2

- S&P E-Mini Future down 115 points (-2.6%) at 4307

- Nasdaq down 464.6 points (-3.1%) at 14579.71

- US 10-Yr yield is down 5.4 bps at 1.3074%

- US Dec 10Y are up 15/32 at 133-8

- EURUSD down 0.0001 (-0.01%) at 1.1724

- USDJPY down 0.56 (-0.51%) at 109.37

- WTI Crude Oil (front-month) down $1.58 (-2.2%) at $70.39

- Gold is up $8.34 (0.48%) at $1762.45

- EuroStoxx 50 down 87.21 points (-2.11%) at 4043.63

- FTSE 100 down 59.73 points (-0.86%) at 6903.91

- German DAX down 358.11 points (-2.31%) at 15132.06

- French CAC 40 down 114.38 points (-1.74%) at 6455.81

US TSY FUTURES CLOSE

- 3M10Y -4.331, 127.524 (L: 126.34 / H: 131.854)

- 2Y10Y -4.602, 108.991 (L: 108.009 / H: 112.933)

- 2Y30Y -4.592, 162.867 (L: 161.935 / H: 167.037)

- 5Y30Y -0.918, 102.494 (L: 101.631 / H: 103.58)

- Current futures levels:

- Dec 2Y up 1/32 at 110-5 (L: 110-04 / H: 110-05)

- Dec 5Y up 7.5/32 at 123-16.5 (L: 123-08.75 / H: 123-18)

- Dec 10Y up 16/32 at 133-9 (L: 132-24 / H: 133-11.5)

- Dec 30Y up 1-10/32 at 163-29 (L: 162-19 / H: 164-06)

- Dec Ultra 30Y up 2-19/32 at 200-08 (L: 197-28 / H: 200-23)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.815

- Mar 22 -0.005 at 99.845

- Jun 22 steady at 99.810

- Sep 22 +0.005 at 99.725

- Red Pack (Dec 22-Sep 23) +0.015 to +0.045

- Green Pack (Dec 23-Sep 24) +0.050 to +0.070

- Blue Pack (Dec 24-Sep 25) +0.070 to +0.075

- Gold Pack (Dec 25-Sep 26) +0.080

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00113 at 0.07188% (-0.00088 total last wk)

- 1 Month +0.00000 to 0.08350% (-0.00038 total last wk)

- 3 Month +0.00150 to 0.12538% (+0.00813 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00025 to 0.15250% (+0.00288 total last wk)

- 1 Year +0.00175 to 0.22613% (+0.00188 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $64B

- Daily Overnight Bank Funding Rate: 0.07% volume: $256B

- Secured Overnight Financing Rate (SOFR): 0.05%, $884B

- Broad General Collateral Rate (BGCR): 0.05%, $371B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $354B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.199B accepted vs. $7.151B submission

- Next scheduled purchases

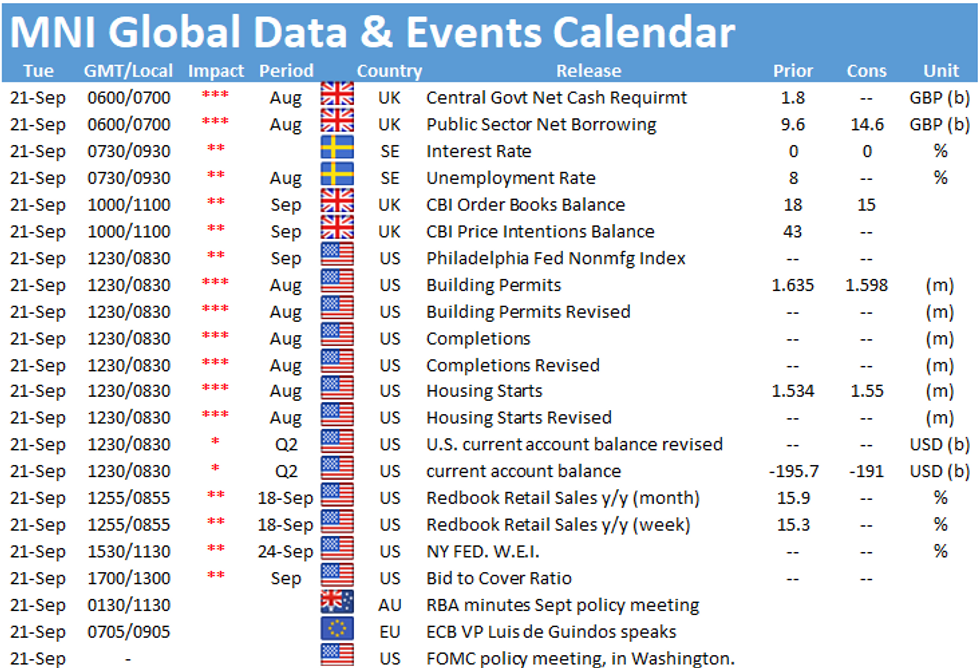

- Tue 9/21 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 9/22 No buy operation scheduled due to FOMC

- Thu 9/23 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 9/24 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

FED: Reverse Repo Operation, Second Consecutive Record High

NY Fed reverse repo usage climbs to new record high of 1,224.289B from 77 counter-parties vs. last Friday's record $1,218.303B. Prior record high was $1,189.616B set Tuesday, Aug 31.

PIPELINE: September Debt Issuance Third Largest for 2021

Last week's $65.71B total high-grade corporate & supra-sovereign debt issuance pushed the running total for September to nearly $163B, making it the third largest month in 2021 (Mar'21: $232.62B; Jan'21: $227.55B) with another two weeks to go.- Total for September last year was $207.82B. No new issuance on tap as yet, expected to be relatively light this week, around $20B as issuers hit the sidelines ahead Wednesday's FOMC annc.

FOREX: Risk Off Prompts Safe Haven Demand

- A shaky start to the week for risk sentiment on the back of China stability concerns prompted strong demand for historically considered safe haven currencies such as JPY and CHF, with the dollar index also marginally firmer for the session ahead of the FOMC decision/statement on Wednesday.

- USDJPY and USDCHF have both fallen a little over half a percent with sharper declines seen in the crosses as commodity/risk tied currencies such as AUD, NZD and CAD all suffered. CADJPY has fallen 1.1% with heavy equity indices and oil prices exacerbating the pairs decline.

- GBP led G10 declines with aforementioned bearish sentiment drivers mostly to blame, however, uncertainties about the Bank of England's monetary policy and surging gas prices may be acting as additional headwinds.

- With EURUSD downside momentum halted at the 1.17 mark, EURGBP broke out of its consolidating trend today, inching higher to work against the bearish technical outlook. Key short-term resistance at 0.8614, Sep 7 high remains intact for now, but initial resistance at 0.8563 has been cleared.

- Markets will turn their focus to Canadian election exit poll results due later today followed by the RBA's Monetary Policy Meeting Minutes.

- Attention then undoubtedly turns to the plethora of central bank meetings starting on Wednesday, including the Fed, BOJ, SNB and BOE.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.