-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Month-End Tailwind For Stocks?

EXECUTIVE SUMMARY

- MNI: Fed Seen Taking Swift Steps To Neutral Rates By Summer

- MNI: Fed Welcomes Softening In Hot Housing Market-Ex-Officials

- US DATA REACT: US GDP Misses But With Caveats

- BIDEN TO ASK CONGRESS FOR $33B IN EMERGENCY FUNDING FOR UKRAINE

US

FED: A half-point interest rate increase next week will set the pace for the Federal Reserve's sprint to neutral policy territory by summer to combat soaring inflation, according to current and former Fed officials.

- Barring a significant shift in the economic outlook, the FOMC will raise the fed funds rate in 50-bp increments, twice as fast as typical, until rates are near 2.0%, the low end of the committee's estimate of neutral. At that point, officials will re-evaluate how much further to hike rates and at what pace, current and ex-officials say.

- "They feel sufficiently behind the curve that they’ll probably be on 50 for a while -- I would guess at least two or three before throttling back," former Fed Vice Chair Alan Blinder told MNI.

- Half-point hikes in May, June and July would take the target rate range to 1.75% to 2.0%. Eleven out of 15 FOMC members see neutral at 2.25% or 2.5% and want rates to get there by December. Investors are currently pricing in another 200 bps of rate increases this year after the quarter-point move in March. For more see MNI Policy main wire at 0735ET.

- While the Fed has hiked by a single quarter-point so far, its words signaling a coming rapid adjustment propelled the average 30-year fixed mortgage rate to 5.10% this week from 3.11% in December, the fastest climb since the early 1980s. Existing and new home sales slid by 2.7% and 8.6%, respectively, even as Census Bureau data showed that, while completions slipped, housing permits and starts continued to move up in March.

- “They’d like to see demand dialed back and supply dialed up and then see where they are, take some pressure off of prices,” said Donald Kohn, former Fed vice chair, in an interview. “It’ll be a more difficult read than usual because, like the rest of the economy, there will be supply and demand issues that need to be interpreted.” For more see MNI Policy main wire at 1444ET.

- Nevertheless, personal consumption was still softer than expected at 2.7% vs 3.5% consensus.

- Countering the implication that domestic demand was softer than expected was a surge in imports that drove the second highest drag from net trade of -3.2pps. That in part was implied by the jump to the new record deficit in March released yesterday, with the surprise here being that it looks to have also been real demand rather than simply a price-driven nominal story.

- These caveats see half of the 0.35% drop in BBDXY on the release reversed whilst front-dated Tsys move back near session highs from prior to the release.

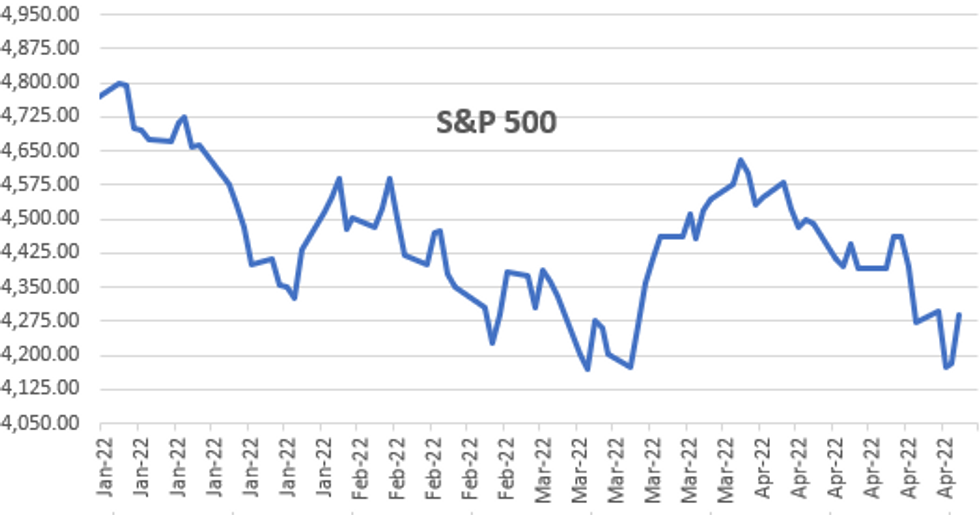

Skittish Ahead Month-End, Stocks Well Bid Ahead Earnings

Skittish markets, FI trading weaker after the bell but well off lows. Curves bear flattening as the short end remains under heavy pressure (2YY +.0466 at 2.6375% vs. 2.6761%H; 30YY -.0103 at 2.9109% vs. 2.9690%H).

- Tsy and Eurodollar futures sold off pre/post-German inflation data that weighed on Bunds ahead the NY open, drew short cover support after GDP shrank -1.4% in Q1 vs. an estimates +1.0%.

- Weakness exacerbated by falling inventories, most notably wholesale trade (mainly motor vehicles) and retail trade (notably, "other" retailers and motor vehicle dealers). These are likely particularly volatile with offsetting swings in subsequent quarters.

- Futures moderated through the second half, inched lower $44B 7Y note auction (91282CEM9) tailed: 2.908% high yield vs. 2.890% WI; 2.41x bid-to-cover vs. 2.44x last month.

- Market also watching continued surge in US$ strength, DXY $ index that climbed to new 5Y high of 103.928.

- As well as stocks as they topped 4300.0 in late trade, awaiting earnings annc's from Apple (AAPL), Western Digital (WDC), Intel (INTC), Amazon (AMZN) after the close.

OVERNIGHT DATA

- US Q1 GDP -1.4%

- U.S. 1Q PERSONAL CONSUMPTION RISES AT 2.7% ANNUAL RATE

- US JOBLESS CLAIMS -5K TO 180K IN APR 23 WK

- US PREV JOBLESS CLAIMS REVISED TO 185K IN APR 16 WK

- US CONTINUING CLAIMS -0.001M to 1.408M IN APR 16 WK

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 635.01 points (1.91%) at 33938.29

- S&P E-Mini Future up 106 points (2.54%) at 4286.5

- Nasdaq up 397.3 points (3.2%) at 12887.01

- US 10-Yr yield is up 1.6 bps at 2.8475%

- US Jun 10Y are down 11.5/32 at 119-14

- EURUSD down 0.0051 (-0.48%) at 1.0506

- USDJPY up 2.48 (1.93%) at 130.91

- WTI Crude Oil (front-month) up $3.29 (3.22%) at $105.31

- Gold is up $8.82 (0.47%) at $1894.96

- EuroStoxx 50 up 42.38 points (1.13%) at 3777.02

- FTSE 100 up 83.58 points (1.13%) at 7509.19

- German DAX up 185.9 points (1.35%) at 13979.84

- French CAC 40 up 62.88 points (0.98%) at 6508.14

US TSY FUTURES CLOSE

- 3M10Y +3.289, 202.65 (L: 193.567 / H: 206.302)

- 2Y10Y -3.101, 20.58 (L: 20.164 / H: 24.622)

- 2Y30Y -5.633, 26.985 (L: 26.64 / H: 34.254)

- 5Y30Y -4.598, 4.349 (L: 2.994 / H: 10.848)

- Current futures levels:

- Jun 2Y down 3.625/32 at 105-16.375 (L: 105-13.875 / H: 105-21.625)

- Jun 5Y down 9/32 at 112-28.25 (L: 112-22.25 / H: 113-09.75)

- Jun 10Y down 11.5/32 at 119-14 (L: 119-06.5 / H: 120-01)

- Jun 30Y down 4/32 at 141-13 (L: 140-12 / H: 141-31)

- Jun Ultra 30Y down 6/32 at 161-20 (L: 159-31 / H: 162-11)

US 10Y FUTURES TECH: (M2) Primary Trend Remains Down

- RES 4: 122-24+ High Apr 27

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09 High Apr 14 and key resistance

- RES 1: 120-17/18+ 20-day EMA / High Apr 27

- PRICE: 119-26 @ 11:11 BST Apr 28

- SUP 1: 118-08 Low Apr 22 and the bear trigger

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

The trend outlook in Treasuries remains bearish and recent gains are considered corrective. Moving average studies are in a bear mode and fresh cycle lows last week confirmed a resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. The focus is on 118-02+ next, a Fibonacci projection. The 20-day EMA is the resistance to watch, at 120-17. It was probed yesterday, but remains intact.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.035 at 98.115

- Sep 22 -0.050 at 97.310

- Dec 22 -0.075 at 96.850

- Mar 23 -0.095 at 96.625

- Red Pack (Jun 23-Mar 24) -0.115 to -0.09

- Green Pack (Jun 24-Mar 25) -0.095 to -0.085

- Blue Pack (Jun 25-Mar 26) -0.085 to -0.065

- Gold Pack (Jun 26-Mar 27) -0.055 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00014 to 0.32500% (-0.00143/wk)

- 1M +0.03629 to 0.80000% (+0.09657/wk)

- 3M +0.04714 to 1.28600% (+0.07239/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.02185 to 1.84814% (+0.02443/wk)

- 12M +0.00500 to 2.54914% (-0.05757/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $78B

- Daily Overnight Bank Funding Rate: 0.32% volume: $262B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $882B

- Broad General Collateral Rate (BGCR): 0.30%, $342B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $330B

- (rate, volume levels reflect prior session)

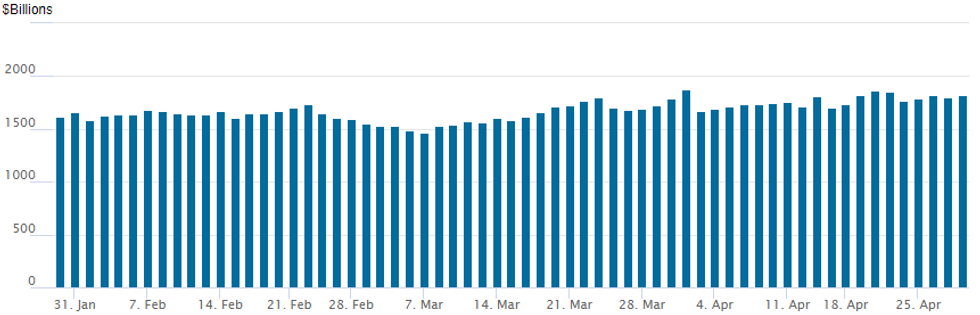

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,818.416B w/ 83 counterparties from prior session 1,803.1623B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $3.5B American Express 3Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 04/28 $3.5B #American Express $2B 2Y +77, $500M 2Y SOFR+72, $1B 7Y +120

- 04/28 $1B #Waste Management 10Y +130

- 04/28 $500M *Korea East/West Power 3Y Green +95

EGBs-GILTS CASH CLOSE: Upside German Inflation Surprise Sets Bearish Tone

Strong German inflation data and a rebound in equities fuelled a core EGB sell-off Thursday, with periphery EGBs also weakening.

- German CPI came in above expectations, pushing Bund yields to session highs, though Spain's missed.

- Gilts outperformed, with direction mainly determined by EGBs and Tsys.

- Periphery spread widening continued: Italy 10Y yields hit highs of 2.743% intersession (+17bp) - highest since Mar 2020 with Bund spread above 184bp, a fresh post-Jun 2020 high; but settled down by day's end.

- Plenty of data yet to come Friday, including French and Italian inflation.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 9.8bps at 0.198%, 5-Yr is up 10.8bps at 0.637%, 10-Yr is up 9.9bps at 0.9%, and 30-Yr is up 7.9bps at 1.053%.

- UK: The 2-Yr yield is up 5.3bps at 1.542%, 5-Yr is up 5.2bps at 1.627%, 10-Yr is up 6.5bps at 1.877%, and 30-Yr is up 7.3bps at 2.01%.

- Italian BTP spread up 4bps at 181.2bps / Greek up 6.4bps at 229.8bps

FOREX: Greenback Marches Higher, USDJPY Extends Advance Above 131.00

- The Dollar Index (DXY +0.65%) is set to extend its winning streak to six trading sessions. The index now boasts an impressive 5.5% advance throughout April with the Japanese yen and Chinese Yuan particular victims on Thursday.

- USDJPY continues to defy gravity and has now rallied over 400 pips from yesterday’s low print below 127.00. With any small risks associated with the Bank of Japan meeting out of the way, market participants were given the green light for the pair to extend its path of least resistance higher.

- Verbal murmurings from MOF officials, combined with weaker US growth data provided only brief price pullbacks, however, USDJPY continued to be very well supported on dips, eventually breaching the 131.00 handle and printing highs at 131.25.

- Technically, the break above 129.40/44 confirms a resumption of the primary uptrend and highlights a bull flag breakout. Next resistance resides at 131.96, 1.00 projection of the Feb 24 - Mar 28 - 31 price swing.

- USDCNH has advanced a further 1.1% on Thursday. Several banks have slashed their yuan forecasts with the currency headed for its biggest monthly decline since China unified its exchange market in 1994.

- The late bounce in major equity indices, as well as firmer crude prices, lent support to the likes of the Canadian dollar, the only G10 currency to appreciate against the dollar on Thursday.

- EURUSD price action confirms an extension of the bearish price sequence of lower lows and lower highs. 1.0494, the Feb 22 2017 low, was breached earlier in the session as the pair continues to narrow the gap to the 2017 lows, residing at 103.41.

- Some more Eurozone inflation data scheduled for Friday before Canadian GDP and US Core PCE Price index figures kick off the North American docket. The week will be rounded off by Michigan sentiment data and the MNI Chicago Business Barometer.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/04/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/04/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/04/2022 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 29/04/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/04/2022 | 0645/0845 | ** |  | FR | PPI |

| 29/04/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/04/2022 | 0800/1000 | ** |  | EU | M3 |

| 29/04/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/04/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/04/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/04/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/04/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/04/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/04/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.