-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Focus on Inflation by September

EXECUTIVE SUMMARY

- MNI: Fed Mester: Faster Hikes If Inflation Not Slowing By Sept

- MNI: Fed Sees ‘Growth Recession’ As Best Case—Ex-Officials

- MNI INTERVIEW: Treasury Market Reform Efforts To Ramp Up-Liang

- MNI: Erdogan Says Turkey Opposes Finland And Sweden Joining NATO

- MESTER FAVORS RAISING RATES BY 50 BPS AT NEXT TWO FED MEETINGS, Bbg

- MN FED KASHKARI:`INFLATION IS MUCH TOO HIGH' .. IF SUPPLY IMPROVES, WON'T NEED TO DAMP DEMAND AS MUCH, Bbg

US

FED: Federal Reserve Bank of Cleveland President Loretta Mester signaled 50bp interest rate increases may be appropriate at least until September unless inflation shows clear signs of slowing, with even larger hikes possible if it doesn't.

- "If by the September FOMC meeting, the monthly readings on inflation provide compelling evidence that inflation is moving down, then the pace of rate increases could slow, but if inflation has failed to moderate, then a faster pace of rate increases may be necessary," she told an European Central Bank virtual forum.

- "Given economic conditions, ongoing increases in the fed funds rate are called for, and unless there are some big surprises, I expect it to be appropriate to raise the policy rate another 50 basis points at each of our next two meetings," she said.

FED: The Federal Reserve has started to acknowledge that an economic soft landing may be hard to pull off, hoping instead for a “growth recession” where the pace of expansion slows down significantly with only a modest rise in the jobless rate, former central bank officials told MNI.

- Fed Chair Jerome Powell appeared to curb his own optimism on the recovery in his latest press conference as he referenced a “softish” landing that doesn’t “materially” boost unemployment.

- “A growth recession is what they’re shooting for,” said William Dudley, ex-president of the New York Fed. “The problem is that they have never been able to pull that off when they’ve had to push up the unemployment rate more than marginally.”

- "The Treasury market is an urgent area because it is important that it function well even in a stressful time," she said. "The Treasury market is the most liquid, deep market in the world and we want to keep it that way."

- Liang suggested reform efforts will not be so strict to solve for previous shocks that could overburden markets in more normal times. "We're not trying to only prevent the last global financial crisis, or only March 2020, but to the extent both of those events told us something about how the system doesn’t work well under stress, you should fix it."

EUROPE

TURKEY/SWEDEN/FINLAND: Turkish President Recep Erdogan has said today that Turkey opposes the NATO membership plans of Finland and Sweden.

- Reuters quotes Erdogan: '...Scandinavian countries are guesthouses for terrorist organisations.'

- It is understood that Turkey's objection is the alleged support of Kurdish militant groups the PKK and YPG, designated as terrorist organisations by Ankara.

- Erdogan continued: 'They [terrorists] are even members of the parliament in some countries. It is not possible for us to be in favour.'

- The Nordic NATO applications are expected imminently and have been welcomed by the US, the UK, who have both provided interim security assurances. NATO Secretary General Jens Stoltenberg, and US Secretary of Defence Lloyd Austin have promised a 'smooth and swift' accession process.

- The NATO constitution reads: 'The Treaty states that NATO membership is open to any “European state in a position to further the principles of this Treaty and to contribute to the security of the North Atlantic area”. It states that any decision on enlargement must be made “by unanimous agreement”.

- If Turkey refuses to ratify accession it could critically damage Nordic aspirations, although Erdogan may be using the veto power to extract concessions from the US. In particular relief from US sanctions on Turkey over the purchase of Russian missile defence systems.

US TSYS: Risk-On AS Mkt Takes Adaptive Fed Seriously?

FI markets traded weaker after the bell -- 30Y Bond around upper half of the week's range but well off Thursday's highs. Little react to morning data (import prices lower than exp at +0.0%; U/Mich sentiment 59.1 vs 64 est, "lowest reading since 2013").

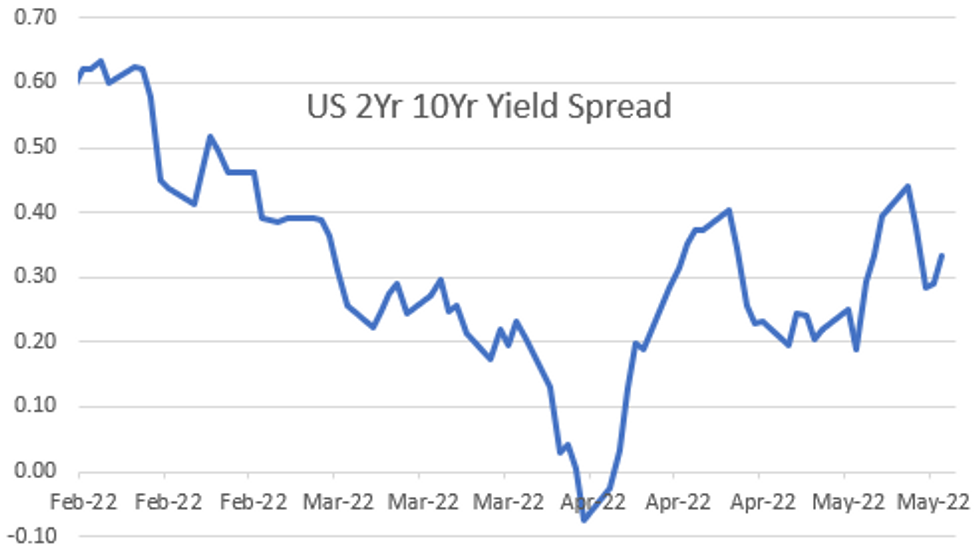

- Tsy 30Y Bond futures holding to narrow channel on the way down (30YY taps 3.0959 high vs. 2.9531% early Thu), curves bear steepening: 2s10s +5.017 at 33.449, 5s10s +2.367 at 4.881.

- Rates under pressure w/ focus back on Fed policy after Fed Chair Powell said he's prepared to consider larger than 50bp hikes in Marketplace interview late Thu (after downplaying 75bp moves at his press conference last week), as the committee adapts to "incoming data and the evolving outlook".

- Not that the correlation is a factor these days, but Equities did have a nice rebound on the day, SPX emini futures +99.0 at 4026.25.

- Commodities: WTI Crude Oil (front-month) holding strong +4.05 at $110.18; Gold weaker at $1807.95 -13.77.

- Next Monday Data Calendar:

- Empire Manufacturing (24.6, 15) at 0830ET

- NY Fed Williams moderated discussion, no text at 0855ET

- US Tsy $45B 13W, $42B 26W bill auctions at 1130ET

- Net Long-term TIC Flows ($141.7B, --) Net TIC Flows ($162.6B, --) at 1600ET

OVERNIGHT DATA

- US APR IMPORT PRICES +0.0%

- US APR EXPORT PRICES +0.6%; NON-AG +0.5%; AGRICULTURE +1.1%

- MICHIGAN PRELIM. MAY CONSUMER SENTIMENT AT 59.1; EST. 64 - bbg

- MICHIGAN PRELIM. MAY CONSUMER SENTIMENT AT 59.1; EST. 64 - bbg

- From the survey: "These declines were broad based--for current economic conditions as well as consumer expectations, and visible across income, age, education, geography, and political affiliation"

- "Consumers' assessment of their current financial situation relative to a year ago is at its lowest reading since 2013"

- "Buying conditions for durables reached its lowest reading since the question began appearing on the monthly surveys in 1978"

- From the survey: "These declines were broad based--for current economic conditions as well as consumer expectations, and visible across income, age, education, geography, and political affiliation"

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 377.17 points (1.19%) at 32109.53

- S&P E-Mini Future up 83.5 points (2.13%) at 4010.75

- Nasdaq up 403.2 points (3.5%) at 11775.19

- US 10-Yr yield is up 8.7 bps at 2.9349%

- US Jun 10Y are down 27/32 at 119-5

- EURUSD up 0.0024 (0.23%) at 1.0404

- USDJPY up 0.98 (0.76%) at 129.31

- WTI Crude Oil (front-month) up $4.22 (3.98%) at $110.34

- Gold is down $13.29 (-0.73%) at $1808.52

- EuroStoxx 50 up 89.99 points (2.49%) at 3703.42

- FTSE 100 up 184.81 points (2.56%) at 7418.15

- German DAX up 288.29 points (2.1%) at 14027.93

- French CAC 40 up 156.42 points (2.52%) at 6362.68

US TSY FUTURES CLOSE

- 3M10Y +1.395, 190.325 (L: 187.672 / H: 196.874)

- 2Y10Y +4.992, 33.424 (L: 26.641 / H: 33.631)

- 2Y30Y +4.278, 49.282 (L: 39.922 / H: 49.488)

- 5Y30Y +1.311, 20.397 (L: 15.007 / H: 21.601)

- Current futures levels:

- Jun 2Y down 4.25/32 at 105-21.75 (L: 105-19.625 / H: 105-24)

- Jun 5Y down 15.5/32 at 112-30.25 (L: 112-26.75 / H: 113-08)

- Jun 10Y down 27/32 at 119-05 (L: 119-03 / H: 119-23.5)

- Jun 30Y down 1-29/32 at 139-01 (L: 138-28 / H: 140-20)

- Jun Ultra 30Y down 3-20/32 at 155-08 (L: 155-05 / H: 158-03)

US 10Y FUTURES TECH: (M2) Corrective Cycle

- RES 4: 122-12+ High Apr 4

- RES 3: 121-11+ 50-day EMA

- RES 2: 121-09 High Apr 14

- RES 1: 120-01/120-18+ High Apr 28 / High Apr 27

- PRICE: 119-13+ @ 11:17 BST May 13

- SUP 1: 118-03+/117-08+ Low May 11 / Low May 9 and a bear trigger

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-11+ 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

The primary downtrend in Treasuries remains intact, however a corrective (bullish) cycle has been established this week and suggests potential for short-term gains. The contract has traded above the 20-day EMA and this opens 120-18+, the Apr 27 high. This level represents an important short-term resistance where a break would signal scope for a stronger retracement. Key support and the bear trigger is unchanged at 117-08+.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.010 at 98.165

- Sep 22 -0.070 at 97.375

- Dec 22 -0.090 at 96.895

- Mar 23 -0.10 at 96.750

- Red Pack (Jun 23-Mar 24) -0.095 to -0.085

- Green Pack (Jun 24-Mar 25) -0.105 to -0.09

- Blue Pack (Jun 25-Mar 26) -0.13 to -0.105

- Gold Pack (Jun 26-Mar 27) -0.135 to -0.13

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00115 to 0.82571% (+0.00714/wk)

- 1M +0.01200 to 0.88671% (+0.04457/wk)

- 3M +0.03242 to 1.44371% (+0.04185/wk) * / **

- 6M +0.03614 to 1.99500% (+0.03043/wk)

- 12M +0.02228 to 2.65214% (-0.04257/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.44371% on 5/13/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $81B

- Daily Overnight Bank Funding Rate: 0.82% volume: $275B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $922B

- Broad General Collateral Rate (BGCR): 0.80%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $345B

- (rate, volume levels reflect prior session)

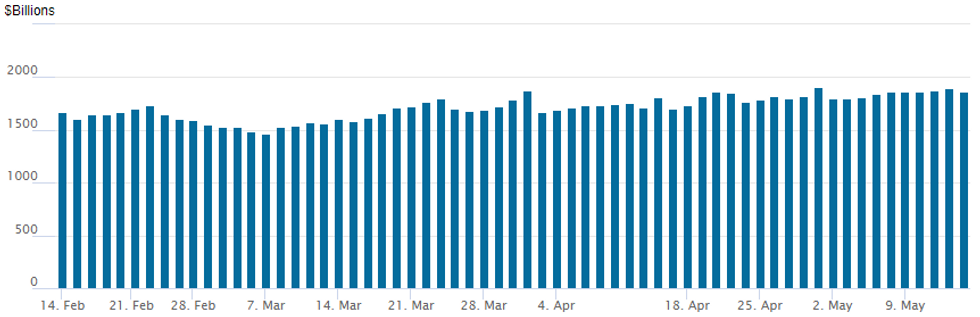

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage currently 1,865.287B w/ 86 counterparties vs. prior session's 1,900.069B (all-time high of $1,906.802B on Friday, March 29, 2022).

EGBs-GILTS CASH CLOSE: Week-Long Yield Drop Comes To An End

European yields reversed higher to end the week following a 4-day drop, with periphery EGB spreads consolidating their recent narrowing.

- In a fairly quiet session in terms of flows and headlines (in contrast to the rest of the week), bond weakness mirrored a relief rally in equities that gained steam as Friday's session went on, with the Eurostoxx and FTSE erasing the week's losses.

- Gilts underperformed German counterparts at the short end, though were roughly flat to Bunds further out the curve.

- End-2022 rate hike pricing change this week: -13bp for BoE, -6bp for ECB.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 1.6bps at 0.063%, 5-Yr is up 3.2bps at 0.546%, 10-Yr is up 4.9bps at 0.889%, and 30-Yr is up 5.5bps at 1.075%.

- UK: The 2-Yr yield is up 5bps at 1.225%, 5-Yr is up 5.5bps at 1.355%, 10-Yr is up 5.4bps at 1.715%, and 30-Yr is up 5.6bps at 1.977%.

- Italian BTP spread down 2.1bps at 185.1bps / Greek down 3.6bps at 248.4bps

FOREX: Markets Reverse Course, But Price Action Looks Corrective in Nature

- Markets across equity, fixed income and foreign exchange markets bounced Friday, with sentiment underpinned well into the close and helping the likes of CAD, AUD, NOK and SEK make solid gains against the greenback. There was no prime news catalyst or headline to drive the reversal in fortunes, with short-covering and profit-taking the most likely culprit as the E-mini S&P ripped back above the 4,000 level.

- Focus going forward turns to the longevity of the move, with traders watching for smoother sentiment in stock markets before the likes of EUR/USD and GBP/USD can discount further cycle lows going forward (both of which touched multi-year lows early Friday, before bouncing).

- For the USD Index, the losses look fleeting, with the corrective pullback helping alleviate some of the technically overbought conditions evident on the longer-term chart. Fedspeak came and went, with Mester and Kashkari providing few new details and continuing to indicate another 50bps of tightening at the June FOMC meeting.

- In the coming week, focus turns to Chinese retail sales and industrial production data, UK jobs & inflation numbers and appearances from BoE's Bailey, Fed's Powell and ECB's Lagarde.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 16/05/2022 | 0820/1020 |  | EU | ECB Panetta Speech at Digital Euro Event | |

| 16/05/2022 | 0840/1040 |  | EU | ECB Panetta & Lane in Discussion on Digital Euro | |

| 16/05/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/05/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 16/05/2022 | 1255/0855 |  | US | New York Fed's John Williams | |

| 16/05/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 16/05/2022 | 1400/1500 |  | UK | BOE TSC to discuss May MPR | |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 16/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 16/05/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.