-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI ASIA OPEN: April Empire State Mfg Index Surprise

EXECUTIVE SUMMARY

US: Volatile Empire Mfg Survey Surges, Far Less So Six Months Out

- The Empire State mfg index was far stronger than expected in April as it bounced from -24.6 to +10.8 (cons -18.0).

- It maintains its particularly volatile recent history, with a standard deviation of nearly 20pts since 2021, although the upside surprise does leave it at the highest since Jul’22.

- The six-month ahead measure meanwhile saw a much smaller increase, up from +2.9 to +6.6 but remaining off the most recent high of +14.7 from Feb.

- Mixed prices: Prices paid fell from 41.9 to 33.0 a joint low with January for the lowest since Nov’20, although prices received saw no further moderation, ticking up from 22.9 to 23.7

US

FED: The Federal Reserve sees little need to adjust the terms of its balance sheet reduction plan or its USD2.3 trillion overnight reverse repurchase facility, despite criticism that its 4.8% yield drains deposits from banks and hastens a return to reserve scarcity.

- Hundreds of billions of dollars of bank deposits have poured into money market mutual funds since March in search of higher returns and safety from banking turmoil. The ON RRP facility is used daily by 40% of money market fund investments, and some argue rising take-up poses a financial stability risk at a time when regional banks are still trying to stanch an outflow of deposits.

- Stubbornly high usage of ON RRP also means QT is draining bank reserves at a faster-than-expected clip ahead of a potential U.S. default as the deadline for the debt ceiling looms, reigniting fears the Treasury market could seize up as it did in 2019, or worse. Reserve balances shrank just over USD1 trillion last year to around USD3 trillion before the collapse of Silicon Valley Bank prompted emergency lending actions that re-expanded the balance sheet. Reserves are projected to bottom out in 2026 at a minimally efficient USD2.4 trillion shortly after QT concludes. For more see MNI Policy main wire at 0828ET.

FED: In giving an update to a speech from Mar 30, Richmond Fed's Barkin ('24 voter) says he's reassured by what he's seeing in the bank sector.

- The comments are, however, similar to remarks more recently on Apr 12 that he was encouraged by bank resilience in the Richmond Fed district. Barkin adds though that he never wants to declare victory on potential bank strain whilst the US must continually earn its dollar reserve currency status.

- It compares with other most recent FOMC commentary from Gov Waller saying it's unclear the extent that bank strains will weigh on activity.

BIS: BIS Chief Agustin Carstens laid out a grim scenario for central banks including higher-for-longer interest rates that risk more financial turmoil and a clash with indebted governments, while in the long run policymakers must step back from a long era of naively chasing economic growth.

- "The longer inflation lasts, the more likely is a shift to a high-inflation regime," he said. "Interest rates may need to stay higher and for longer than previously thought." it will be important to ensure that the tightening path consistent with lower inflation is not compromised by the immediate needs of the financial sector and not to succumb to "financial dominance," he said Monday in a speech at New York's Columbia University.

- After a time when monetary and fiscal policy supported each other to pull economies out of the pandemic, they seem poised for conflict as high interest rates pinch budgets, he said. Governments will also feel pain from QE losses, and central banks face "material" pressure to become complacent on inflation or raise price targets, he said. For more see MNI Policy main wire at 1220ET.

US: Senate Majority Leader Chuck Schumer (D-NY) has given a press conference to respond to House Speaker Kevin McCarthy's (R-CA) speech at the New York Stock Exchange earlier today.

- Schumer: "One thing is clear from this morning's theater at the [NYSE]… Speaker McCarthy continues to bumble our country towards a catastrophic default which would cause the economy to crash, cause monumental jobs losses, and drastically raise costs for the American people."

- Schumer: "He went all the way to Wall Street and gave us no more details. No more facts. No new information at all. I'll be blunt, if Speaker McCarthy continues in this direction we are headed to default."

- Schumer: "The main way we have avoided default in the past is to reject brinksmanship and hostage taking and instead work together in a bipartisan way."

- Schumer says McCarthy invoked President Reagan, arguing that "Ronald Reagan was never as reckless as Speaker McCarthy is being. Ronald Reagan said: 'Debt ceiling brinksmanship threatens the holders of government bonds and those who relay on social security and veterans benefits. The United States has a special responsibility to itself, and the world, to meet its obligations.'"

US TSYS: Holding Narrow Range Near Lows, NY MFG Index Surprise

- Treasury futures are holding a narrow range since late morning, near session lows in the aftermath of a surprising reaction to Empire State Manufacturing index release.

- The April data was far stronger than expected, bouncing from -24.6 to +10.8 (cons -18.0). The manufacturing index maintains its particularly volatile recent history, with a standard deviation of nearly 20pts since 2021, although the upside surprise does leave it at the highest since Jul’22.

- Following a period of two way trade, Treasury futures extended lows into late morning trade, front month 10Y futures breached 50-day EMA technical support of 114-14 to mark a session low of 114-09.

- Attention turned to 114-15, the 50-day EMA and 114-07, the Mar 29, 30 low. Clearance of this support zone would strengthen any developing bearish threat and expose 113.23, a Fibonacci retracement. The move lower - for now - is considered corrective.

- No breakthrough on debt ceiling: Sen Schumer maintains that House Speaker McCarthy hasn't yet presented a budget or formal list of Republican priorities which the White House has stated is a condition of negotiations.

- Look ahead: Building Permits, Housing Starts and Fed Speak Tuesday, Atlanta Fed Pres Bostic interview on CNBC at 1100ET followed by Fed Gov Bowman discussion on digital currency, text, moderated Q&A at 1300ET.

OVERNIGHT DATA

- US NY FED EMPIRE STATE MFG INDEX 10.8 APR

- US NY FED EMPIRE MFG NEW ORDERS 25.1 APR

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -8.0 APR

- US NY FED EMPIRE MFG PRICES PAID INDEX 33.0 APR

- US NAHB HOUSING MARKET INDEX 45 IN APR

- US NAHB APR SINGLE FAMILY SALES INDEX 51; NEXT 6-MO 50

- FOREIGN HOLDINGS OF CANADA SECURITIES +4.6B CAD IN FEB

- CANADIAN HOLDINGS OF FOREIGN SECURITIES -1.6B CAD IN FEB

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 53.96 points (0.16%) at 33939.71

- S&P E-Mini Future up 4.5 points (0.11%) at 4168

- Nasdaq up 8.7 points (0.1%) at 12131.51

- US 10-Yr yield is up 7.6 bps at 3.5889%

- US Jun 10-Yr futures are down 16.5/32 at 114-11

- EURUSD down 0.0064 (-0.58%) at 1.0929

- USDJPY up 0.62 (0.46%) at 134.41

- WTI Crude Oil (front-month) down $1.62 (-1.96%) at $80.91

- Gold is down $8.95 (-0.45%) at $1995.29

- EuroStoxx 50 down 23.14 points (-0.53%) at 4367.61

- FTSE 100 up 7.6 points (0.1%) at 7879.51

- German DAX down 17.97 points (-0.11%) at 15789.53

- French CAC 40 down 21.43 points (-0.29%) at 7498.18

US TREASURY FUTURES CLOSE

- 3M10Y +5.929, -154.114 (L: -165.086 / H: -152.64)

- 2Y10Y -0.443, -59.684 (L: -62.121 / H: -58.741)

- 2Y30Y -1.268, -38.313 (L: -41.441 / H: -37.038)

- 5Y30Y -1.569, 11.004 (L: 9.637 / H: 12.995)

- Current futures levels:

- Jun 2-Yr futures down 4.875/32 at 102-31.375 (L: 102-29.875 / H: 103-04.625)

- Jun 5-Yr futures down 11.25/32 at 109-3.75 (L: 109-01.75 / H: 109-17)

- Jun 10-Yr futures down 16/32 at 114-11.5 (L: 114-09 / H: 114-31)

- Jun 30-Yr futures down 1-0/32 at 129-23 (L: 129-20 / H: 130-31)

- Jun Ultra futures down 1-17/32 at 138-21 (L: 138-14 / H: 140-15)

US 10Y FUTURE TECHS: Bear Cycle Extends

- RES 4: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 116-30 High Apr 5 / 6

- RES 1: 116-08 High Apr 12

- PRICE: 114-11 @ 1440ET Apr 17

- SUP 1: 114-09 Low Apr 17

- SUP 2: 114-07 Low Mar 29 and 30 and a key support

- SUP 3: 113-26 Low Mar 22

- SUP 4: 113-23 50.0% retracement of the Mar 3 - 24 bull run

Treasury futures are trading lower, extending last week’s bear cycle that resulted in a break of the 20-day EMA at 115-05. Attention is on 114-15, the 50-day EMA and 114-07, the Mar 29, 30 low. Clearance of this support zone would strengthen any developing bearish threat and expose 113.23, a Fibonacci retracement. The move lower - for now - is considered corrective. A break of 116-08, the Apr 12 high, would be seen as a bullish development.

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02439 to 4.91745

- 3M +0.04597 to 5.02785

- 6M +0.07806 to 5.02108

- 12M +0.11400 to 4.79827

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00600 to 4.80871%

- 1M -0.00814 to 4.95129%

- 3M +0.00329 to 5.26500% */**

- 6M +0.08957 to 5.39486%

- 12M +0.14786 to 5.42000%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $113B

- Daily Overnight Bank Funding Rate: 4.82% volume: $280B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.312T

- Broad General Collateral Rate (BGCR): 4.77%, $524B

- Tri-Party General Collateral Rate (TGCR): 4.77%, $516B

- (rate, volume levels reflect prior session)

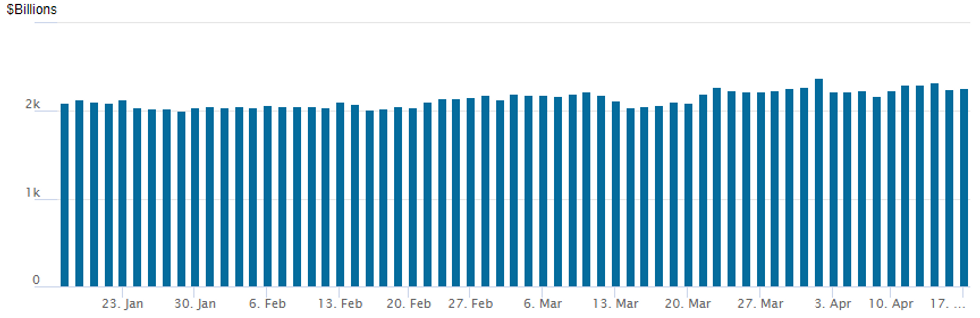

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,256.845B w/ 102 counterparties, compares to prior $2,253.786B. All-time record high of $2,553.716B reached December 30, 2022; high usage for 2023: $2,375.171B on Friday March 31, 2023

PIPELINE: $3.75B Wells Fargo, $2.5B Mars Inc Launched

- $9.35B to price Monday, foreign banks rolled to Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 04/17 $3.75B #Wells Fargo 11NC10 +180

- 04/17 $2.5B #Mars Inc $1B 5Y +87, $500M 8Y +105, $1B 10Y +117

- 04/17 $1.5B #Taqa $500M +5Y +80, $1B 10Y +110

- 04/17 $1.1B #Cargill $600M 3Y +65, $500M 10Y +120

- 04/17 $500M *Kookmin Bank 5Y +95

- 04/17 $Benchmark Banco BTG (Brazilian bank) investor calls

- Rolled to Tuesday's order of business:

- 04/18 $Benchmark European Inv Bank (EIB) 7Y SOFR+41a

- 04/18 $Benchmark Ontario Teachers Union 5Y SOFR+80a

- 04/18 $Benchmark ADB 5Y SOFR+38a

- 04/18 $Benchmark JBIC 3Y SOFR+50a

EGBs-GILTS CASH CLOSE: Curves Steepen With Short-End Anchored

European curves twist steepened Monday, with short-end German and UK instruments remaining relatively anchored.

- Rate hike expectations in Europe lagged US counterparts (Fed funds peak +6bp vs flat for ECB and BoE), with few major catalysts in Europe in the session.

- The weakness in longer-dated Bunds and Gilts mirrored that of Treasuries, which took their cue from stronger-than-expected US data, and a heavy supply slate for the week.

- This meant UK and German 10Y yields rose for the 6th consecutive session.

- Periphery EGB spreads tightened slightly on the Bund move, despite weakness in equities / broader risk-off.

- After a quiet session for European data, things pick up Tuesday with UK labour market data and German ZEW. ECB's Centeno is set to speak.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.2bps at 2.879%, 5-Yr is up 2.2bps at 2.495%, 10-Yr is up 3.3bps at 2.473%, and 30-Yr is up 4.4bps at 2.551%.

- UK: The 2-Yr yield is down 0.5bps at 3.613%, 5-Yr is up 0.3bps at 3.511%, 10-Yr is up 2.4bps at 3.691%, and 30-Yr is up 2.5bps at 4.046%.

- Italian BTP spread down 2.6bps at 183.1bps / Spanish down 1.2bps at 102.5bps

FOREX: USD Extends On Friday Recovery Following Stronger US Data

- An impressive US Empire Manufacturing reading (+10.8 vs. Exp. -18.0) remains the initial trigger for the extension of US dollar strength to start the week. Additionally, shakier financial earnings on Monday (Charles Schwab, State Street) have underpinned the greenback’s resolve. Despite a late recovery for equities, the USD index is maintaining a 0.55% advance.

- Most G10 pairs display an expression of USD strength, as EUR/USD, GBP/USD fall between 0.3-0.6% and USD/JPY rallied to an April high of 134.57 amid the higher US yields.

- Overall, GBP/USD is extending the corrective pullback posted Friday and 1.2345, which marks the next major support, has held so far. If broken, this opens the 1.0% lower 10-dma envelope at 1.2318 - a level crossing ~1.8% below recent highs. The technical indicator has held prices since mid-March - so a show below could mark a more protracted correction in the short-term.

- For the USD index, 102.522 marks the 76.4% retracement for the April dollar downleg, of which a break above would open 103.058.

- The RBA minutes kick off Tuesday’s calendar, followed by China Q1 GDP and March monthly activity indicators. The consensus looks for improvement across the board relative to previous outcomes, as the economy emerged from lockdowns late last year. UK unemployment, German ZEW and Canadian CPI are all scheduled throughout the day.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/04/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 18/04/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 18/04/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 18/04/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 18/04/2023 | 0200/1000 | *** |  | CN | GDP |

| 18/04/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 18/04/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 18/04/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 18/04/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 18/04/2023 | 1230/0830 | *** |  | CA | CPI |

| 18/04/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 18/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 18/04/2023 | 1300/1500 |  | EU | ECB Elderson in Basel Committee on Banking Supervision | |

| 18/04/2023 | 1500/1100 |  | CA | BOC Governor testifies to House of Commons committee | |

| 18/04/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 18/04/2023 | 1700/1300 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.