-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Back to Pricing 50Bp Rate Cuts By Year End

- MNI INTERVIEW: Labor Cracks To Drive Fed Cuts- Staffing Group

- MNI FED BRIEF: Fed's Kashkari Favors Wait And See Policy Approach

- MNI BRIEF: ISM Expects Sluggish Growth, Sticky Services Prices

- MNI INTERVIEW: BOC Can Move Far Once Rate Cuts Begin- Devlin

- MNI US DATA: Core CPI At 4.0% and Supercore At 6.5% Over Six Months

US TSYS Retail Sales Miss, April Down-Revisions Outshines In-Line CPI

- Treasuries remain well bid after the bell, not far off this morning's post-Retail Sales (and down-revisions to prior release) and CPI data highs. While 10Y Tsy yield fell to 4.3361% this morning - the lowest level since of prior to the "hot" CPI on April 10, S&P Eminis are back at levels not seen since April 1 this morning.

- Supercore CPI at a still hot but broadly as expected 0.42% M/M (and with its large 0.19pp contribution from vehicle insurance that isn’t reflected in PCE).

- US retail sales had their poorest performance in 3 months in April, with weakness evident across the board, partially reversing March's strong gains. Overall retail sales were flat (+0.4% expected), pulling back from +0.6% in March, while ex-auto/gas sales were -0.1% (+0.2% expected) vs +0.7% in March. Each represented the poorest outturn in 3 months.

- In-turn, short end rate cut pricing now projects two 25bp rate cuts by year end (Sep & Dec).

- Trying to keep things in perspective, Minneapolis Fed President Neel Kashkari said the Federal Reserve should keep monetary policy on hold for now given uncertainty about how tight policy actually is and against a backdrop of inflation that has fallen from its peaks but is still too high.

- Look ahead to Thursday's data calendar: Weekly Claims, Build Permits and more Fed Speak.

US

US INTERVIEW (MNI): Labor Cracks To Drive Fed Cuts- Staffing Group: The U.S. job market is weakening under pressure from the Federal Reserve’s high interest rates and the resulting slack will allow policymakers to cut borrowing costs twice this year, American Staffing Association Chief Economist Noah Yasif told MNI.

- “We're projecting the first cut to come towards the tail end of the summer, then we’re also looking at one towards the end of the year,” he said in an interview, adding that if conditions warrant the second move could be a 50-basis point cut.

- That would still keep that 75 basis points of cuts officials projected in their last Summary of Economic Projections in March. Since then, additional hot inflation data has raised doubts about the Fed's rate cut timeline.

FED BRIEF (MNI): Fed's Kashkari Favors Wait And See Policy Approach: The Federal Reserve should keep monetary policy on hold for now given uncertainty about how tight policy actually is and against a backdrop of inflation that has fallen from its peaks but is still too high, Minneapolis Fed President Neel Kashkari said Wednesday.

- “We probably need to sit here for a while longer until we figure out where underlying inflation is headed before we jump to any conclusions,” Kashkari said during a fireside chat in North Dakota. “The big question on my mind is how restrictive is policy now? It seems like there’s more resilience in the economy than I had expected.”

NEWS

US BRIEF (MNI): ISM Expects Sluggish Growth, Sticky Services Prices: The U.S. economy will continue to softly expand for the rest of 2024 with expectations for little manufacturing price increases but continuing inflation in services, America's purchasing and supply executives said in the Institute for Supply Management Spring 2024 semiannual economic forecast.

- "I still feel that we are in an expansion cycle but it's definitely weak," manufacturing chief Tim Fiore told reporters on a call. Manufacturing survey respondents expect a year-over-year, net-average prices increase of 1.9% for 2024. With respondents reporting price increases of 1.6% through April 2024, prices are projected to increase slightly for the rest of the year. Manufacturing employment is expected to increase 0.3% in 2024.

BOC INTERVIEW (MNI): BOC Can Move Far Once Rate Cuts Begin- Devlin: Canada needs to wait a bit to lower interest rates but will likely move farther than the market expects to blunt an economic slowdown according to Ed Devlin, an investor who has presented at central bank policy workshops.

- Strength in the latest jobs report and the need to wrestle down inflation expectations make it less likely Governor Tiff Macklem will cut the 5% rate at the next meeting in June according to the founder of Devlin Capital and a former Pimco bond manager. Employment rose the fastest since the start of last year in April, though that gain lagged population growth fueled by immigration and kept the jobless rate a percentage point higher than a year ago.

US (MNI): Biden On CPI Report: "We Will Build 2m New Homes": US President Joe Biden has issued a statement on today's CPI report, touting that inflation has fallen, "more than 60% from its peak," and that, "core inflation fell to its lowest level in three years," but stressing that "prices are still too high."

US (MNI): Trump Accepts 27 June Debate w/Biden: The first major event of the 2024 presidential election season has seemingly been agreed to with former President Donald Trump accepting the offer of a televised debate with President Joe Biden to take place at 2100ET (0200BST, 0300CET) on 27 June, hosted by CNN in Atlanta, Georgia. Trump reportedly told Fox News' Brooke Singman that “I’ll be there” and says he’s “looking forward to being in beautiful Atlanta.”

SLOVAKIA (MNI): Fico FB Account: PM 'In Life-Threatening Condition': PM Robert Fico's Facebook account posts the following update: "[Fico] was shot multiple times and is currently in a life-threatening condition. At this moment, he is being transported by helicopter to Banská Bystrica, because it would take too long to get to Bratislava due to the necessity of an acute intervention. The next few hours will decide."

ISRAEL (MNI): Netanyahu-Rafah Op Is Responsible Step-By-Step Action, Will Take Weeks: In an interview with CNBC, PM Benjamin Netanyahu, when asked if he would conduct a full-scale invasion of Rafah, states that the operation 'is a responsible, step-by-step action'. Says that his is 'committed to getting all hostages back', but acknowledges the Rafah operation 'will take weeks'.

OVERNIGHT DATA

US DATA (MNI): Core CPI At 4.0% and Supercore At 6.5% Over Six Months: The almost completely in-line core CPI print of 0.29% M/M doesn’t yield any real surprises in latest trends.

- The three-month rate eased four tenths to 4.1% annualized whilst the six-month increased two tenths to 4.0% for its third consecutive month above the Y/Y (of 3.61%).

- The same is also true for supercore CPI at a still hot but broadly as expected 0.42% M/M (and with its large 0.19pp contribution from vehicle insurance that isn’t reflected in PCE).

- The three-month rate eased from a huge 8.2% to 6.3% in April as the 0.85% from January dropped out, but the six-month accelerates four tenth to 6.5% annualized.

US DATA (MNI): "Control Group" Drop Highlights Softest Retail Sales Report In 3 Months: US retail sales had their poorest performance in 3 months in April, with weakness evident across the board, partially reversing March's strong gains.

- Overall retail sales were flat (+0.4% expected), pulling back from +0.6% in March, while ex-auto/gas sales were -0.1% (+0.2% expected) vs +0.7% in March. Each represented the poorest outturn in 3 months.

- The "control group" contracted by 0.3% M/M (+0.1% expected, and after +1.0% in March), the 3rd flat/negative reading in the past 4 months.

- The prior (March) figures also incorporate downward revisions across all major subcategories.

US DATA (MNI): Second Weekly Decline In Mortgage Rate Sees Minimal Reaction: MBA composite applications ticked up 0.5% in the week to May 10 having bounced 2.6% the week prior after two consecutive declines.

- The largely unchanged week saw conflicting drivers with purchase applications resuming declines with -1.7% whilst refis increased 4.7%.

- There was little composite reaction to the 30Y conforming mortgage rate falling another ~10bps on the week to 7.08% having peaked at 7.29% in late April having averaged 7% through Feb-early April.

- US NY FED EMPIRE STATE MFG INDEX -15.6 MAY

- US NY FED EMPIRE MFG NEW ORDERS -16.5 MAY

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -6.4 MAY

- US NY FED EMPIRE MFG PRICES PAID INDEX 28.3 MAY

CANADA DATA (MNI): April Housing Starts Fall Again Despite Need For Construction: Canada seasonally adjusted starts -1% MOM to 240K units after -7% in March. 6M moving average -2.2% to 244K units from -1.6% in March.

Declines driven by multi-unit starts, particularly in Ontario, but single-detached starts also fell. "We continue to see last year's challenging borrowing conditions reflected in multi-unit housing starts numbers. We expect to see continued downward pressure," said Bob Dugan, CMHC's chief economist.

- CANADIAN MAR MANUFACTURING SALES -2.1% MOM

- CANADA MAR FACTORY INVENTORIES +0.0%; INVENTORY-SALES RATIO 1.73

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 344.77 points (0.87%) at 39900.78

- S&P E-Mini Future up 62.75 points (1.19%) at 5332

- Nasdaq up 231.6 points (1.4%) at 16743.73

- US 10-Yr yield is down 8.6 bps at 4.3536%

- US Jun 10-Yr futures are up 19.5/32 at 109-22.5

- EURUSD up 0.0062 (0.57%) at 1.0881

- USDJPY down 1.44 (-0.92%) at 154.96

- WTI Crude Oil (front-month) up $0.78 (1%) at $78.81

- Gold is up $29.09 (1.23%) at $2387.28

- European bourses closing levels:

- EuroStoxx 50 up 20.61 points (0.41%) at 5100.9

- FTSE 100 up 17.67 points (0.21%) at 8445.8

- German DAX up 152.94 points (0.82%) at 18869.36

- French CAC 40 up 14.19 points (0.17%) at 8239.99

US TREASURY FUTURES CLOSE

- 3M10Y -9.807, -106.091 (L: -107.383 / H: -96.806)

- 2Y10Y -0.541, -38.277 (L: -39.687 / H: -36.412)

- 2Y30Y +0.999, -22.226 (L: -24.44 / H: -18.857)

- 5Y30Y +2.741, 15.582 (L: 12.009 / H: 20.346)

- Current futures levels:

- Jun 2-Yr futures up 5/32 at 101-28.125 (L: 101-22.5 / H: 101-29.625)

- Jun 5-Yr futures up 13.5/32 at 106-8.25 (L: 105-25.25 / H: 106-11.25)

- Jun 10-Yr futures up 19/32 at 109-22 (L: 109-00.5 / H: 109-26.5)

- Jun 30-Yr futures up 1-07/32 at 118-0 (L: 116-24 / H: 118-08)

- Jun Ultra futures up 1-21/32 at 125-6 (L: 123-12 / H: 125-14)

US 10Y FUTURE TECHS: (M4) Trades Through Channel Resistance

- RES 4: 110-16 50.0% retracement of the Feb 1 - Apr 25 bear leg

- RES 3: 110-06 High Apr 4

- RES 2: 109-22+ 38.2% retracement of the Feb 1 - Apr 25 bear leg

- RES 1: 109-09+ High May 3 and a key resistance

- PRICE: 109-08 @ 11:18 BST May 15

- SUP 1: 108-15 Low May 14

- SUP 2: 108-06 Low May 3

- SUP 3: 107-25 Low May 2

- SUP 4: 1074-04 Low Apr 25 and a key support

Treasuries have recovered from yesterday’s low and the contract is trading higher today. Price has moved through resistance at 108-27, the top of a bear channel drawn from the Feb 1 high. A clear break of 109-09+, the May 3 high, would reinforce the bullish importance of the channel break and signal scope for an extension higher near-term. This would open 109-22+, a Fibonacci retracement. Initial support is at 108-15, yesterday’s low.

SOFR FUTURES CLOSE

- Jun 24 +0.008 at 94.703

- Sep 24 +0.045 at 94.930

- Dec 24 +0.080 at 95.195

- Mar 25 +0.10 at 95.465

- Red Pack (Jun 25-Mar 26) +0.125 to +0.135

- Green Pack (Jun 26-Mar 27) +0.120 to +0.130

- Blue Pack (Jun 27-Mar 28) +0.095 to +0.105

- Gold Pack (Jun 28-Mar 29) +0.080 to +0.090

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00091 to 5.32055 (+0.00068/wk)

- 3M +0.00263 to 5.32933 (+0.00735/wk)

- 6M +0.00218 to 5.29573 (+0.01142/wk)

- 12M -0.00182 to 5.15640 (+0.01747/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.838T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $736B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $713B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $76B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $265B

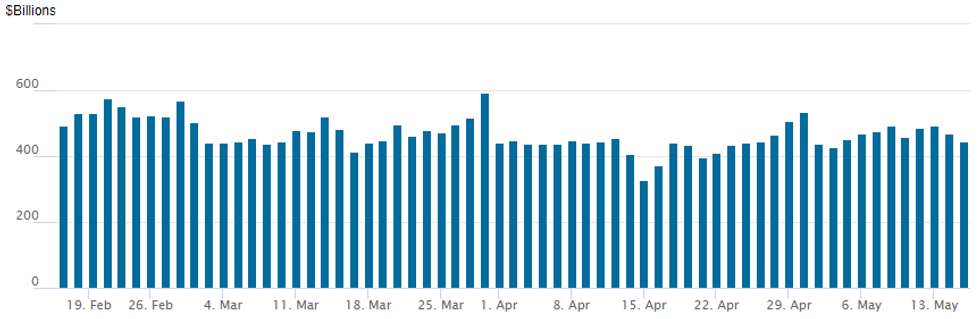

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage falls to $443.779B from $468.344B prior; number of counterparties 74. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $3.5B Goldman Sachs 2Pt, $2.5B BP Capital Mkts 3Pt Debt Launched

- Date $MM Issuer (Priced *, Launch #)

- 5/15 $3.5B #Goldman Sachs $2.65B 3NC2 +68, $850M 3NC2 SOFR+75

- 5/15 $2.5B #BP Capital Mkts Am $750M 3.5Y +50, $750M 5.5Y +62.5, $1B 10.5Y +87.5

- 5/15 $1.65B #MPLX 10Y +130

- 5/15 $Benchmark Citizens Financial investor calls

EGBs-GILTS CASH CLOSE: Bull Flattening Rally On US CPI Relief

EGBs and Gilts joined Treasuries in a broad-based bull flattening rally Wednesday as US data came in on the soft side of expectations.

- Core European instruments had already gotten off to a strong start, attributed to overnight reports that China could enact significant stimulus via government purchases of unsold homes. Eurozone prelim Q1 GDP data was as expected and had little impact.

- US core CPI was in line with median consensus but on the low side on an unrounded basis with unworrying details; the US retail sales report was the weakest in 3 months.

- Central bank easing expectations increased, with implied 2024 ECB cuts up 7bp on the day to 74bp, and BoE 5bp to 61bp.

- But the main impact was further down the curve, with yields from 5-year through 30-year down double digits in both the UK and Germany.

- Periphery EGB spreads tightened, led by BTPs, as risk appetite picked up on the US data miss.

- Thursday's highlights include BoE's Greene and a slew of ECB speakers (de Cos, Nagel, Villeroy, Centeno, Panetta, and Guindos presenting the semi-annual ECB Financial Stability Review).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 9.2bps at 2.895%, 5-Yr is down 12.1bps at 2.457%, 10-Yr is down 12.6bps at 2.422%, and 30-Yr is down 10.8bps at 2.572%.

- UK: The 2-Yr yield is down 7.8bps at 4.244%, 5-Yr is down 9.9bps at 3.95%, 10-Yr is down 10.7bps at 4.066%, and 30-Yr is down 10.9bps at 4.543%.

- Italian BTP spread down 2.9bps at 131.3bps / Spanish down 1.3bps at 77.2bps

FOREX Broad Greenback Weakness Prevails Post US CPI, NZD Surges 1.25%

- The greenback traded in a volatile manner on Wednesday as markets digested the latest inflation data from the US and the USD index has maintained a downward bias throughout the session. Softer-than-expected data sees the DXY down 0.65%, lower for a third consecutive session and at the lowest level since the prior inflation print on April 10. The index has also breached below the 50-dma, intersecting today at 104.77, weighed by US yields 10bp lower on the day and major equity indices surging.

- This risk on tone of the session has been underpinned by China easing rhetoric picking up, with risk proxy currencies being the main beneficiary. This has particularly benefited the New Zealand dollar, which alongside Scandinavian FX, stands as the best performer in G10, rising around 1.25% against the greenback.

- USDJPY is also 1% lower on Wednesday, helped back below the 155.00 mark by lower core yields. Today’s selloff should snap a three-day winning streak for the pair and leave 156.74, the May 14 high and 157.00, a Fibonacci retracement as the key short-term levels on the topside as markets continue to weigh the MoF’s potential intervention plans versus the underlying drivers of central bank policy and yield differentials.

- The preliminary reading of first quarter growth data in Japan is due overnight, which precedes Australian. In the US, jobless claims, Philly Fed and industrial production will cross Thursday, however, markets will likely be more concerned with comments from Fed officials following the latest inflation report.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2024 | 2350/0850 | *** |  | JP | Japan GDP 1st Estimate |

| 16/05/2024 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 16/05/2024 | 0430/1330 | ** |  | JP | Industrial Production |

| 16/05/2024 | 0600/0800 | ** |  | NO | Norway GDP |

| 16/05/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/05/2024 | 1100/1200 |  | UK | BOE's Greene Speech at Make UK on Labour Market | |

| 16/05/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 16/05/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/05/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/05/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/05/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/05/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2024 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/05/2024 | 1430/1030 |  | US | Philadelphia Fed's Pat Harker | |

| 16/05/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/05/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 16/05/2024 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2024 | 1950/1550 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.