-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN:Bank Jitters Cool Slightly, Softer Mon/Pol Stays

EXECUTIVE SUMMARY

US

FED: The Federal Reserve will likely approve a quarter-point interest rate increase next week as focus shifts from strong economic data to restoring confidence in the banking system, former senior Bank for International Settlements official and ex-New York Fed research director Stephen Cecchetti told MNI.

- The possibility of a half-point hike -- even as strong job and inflation data warrant such a move -- appears out of the question. Pressing ahead with a rate increase after the collapse of Silicon Valley Bank and Signature Bank is a needed signal of Fed confidence in a financial system where the vast majority of firms are in good shape, he said. (See: MNI INTERVIEW: Ex-FDIC's Bair Sees Limited SVB Contagion Risk)

- "I would try to get that message out as broadly, clearly and quickly as possible, and then I would raise interest rates. Does that mean you're probably going to go 25 now instead of 50 and then postpone further increases? Probably yes," Cecchetti said.

- Pausing would be a "very bad signal," said Cecchetti, now a finance professor at Brandeis International Business School. "It would be read that you’re really worried about the financial stability consequences of further interest rate increases and you’re willing to compromise your inflation objective." For more see MNI Policy main wire at 1506ET.

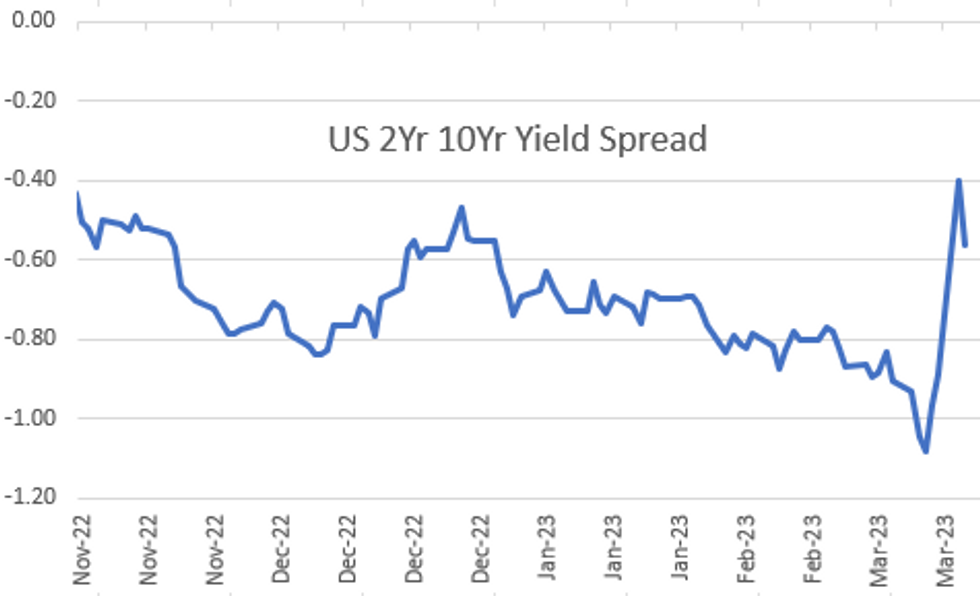

US TSYS: Yield Curves Off Lows, Bonds Weaker

Tsy yield curves have rebounded with Bond futures near lows after the bell, short end rates pare losses: Tsy 2s10s currently -15.988 -57.138, approximately 20bp off session lows.

- Little react to Feb CPI data: Core services ex OER and rent accelerate from 0.36 to 0.50% M/M, highest since September. 0.45% M/M if exclude total rent of shelter for same trend, fastest since Sep.

- Front-month 2Y note trading 103-00 (-13.12), 2Y yield at 4.2253% vs. 3.8367% overnight low (mid-Sep territory) as banking crisis concerns debatably moderated somewhat.

- Implied volatility drifting lower despite skittishness toward any contagion related headlines involving banks, however. Global rates gapped higher overnight after headlines flagged "material weakness" in financial reporting surrounding Credit Suisse - the bid reversed amid questions over how much the CS news has already been absorbed by markets. Latest from CS CEO: "SAYS FIRM SAW CLIENT INFLOWS ON MONDAY".

- Barring additional bank tied headline risk, next focus is on Wednesday's PPI data for February: MoM (0.7%, 0.3%); YoY (6.0%, 5.4%), Retail Sales Advance MoM (3.0%, -0.4%) and TIC flows in the afternoon.

OVERNIGHT DATA

- US FEB CPI 0.4%, CORE 0.5%; CPI Y/Y 6.0%, CORE Y/Y 5.5%

- US FEB ENERGY PRICES -0.6%

- US FEB OWNERS' EQUIVALENT RENT PRICES 0.7%

- US DATA: CPI Unrounded - Feb'23

- A 'small' 0.5% M/M for core CPI (vs cons 0.4)

- Unrounded % M/M (SA): Headline 0.37%; Core: 0.452% (from 0.412%)

- Unrounded % Y/Y (NSA): Headline 6.036%; Core: 5.538% (from 5.583%)

- US DATA: Stronger Underlying Details Than Core Print Suggests: Core services ex OER and rent accelerate from 0.36 to 0.50% M/M, highest since September. 0.45% M/M if exclude total rent of shelter for same trend, fastest since Sep. Both OER and tenants' rents also stronger than analysts had forecast. Main offsetting weakness comes from surprisingly large hit from used cars (-2.7%, fastest decline of post-pandemic surge) vs expectations of flat to a small increase.

- US DATA: But Non-Housing Core Service Increase From Weaker Foundations: However, a large part of the strength behind non-housing core service inflation was airfares jumping 6.4% after -2.2%, at the top end of analyst expectations and adding 0.5pps to core CPI compared to last month.

- Of more note for the Fed will be softer medical care service details. The overall category held at -0.70% after -0.68% M/M, but within that, the professional & hospital services both slowed on the month.

- These carry larger weight in PCE, with professional service prices falling further with -0.32% M/M after -0.09% M/M for the fastest monthly drop since Apr'17.

- US REDBOOK: MAR STORE SALES +2.8% V YR AGO MO

- US REDBOOK: STORE SALES +2.6% WK ENDED MAR 11 V YR AGO WK

- CANADIAN JAN MANUFACTURING SALES +4.1% MOM

- CANADA JAN FACTORY INVENTORIES +0.3%; INVENTORY-SALES RATIO 1.63

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 99.46 points (0.31%) at 31918.12

- S&P E-Mini Future up 32.25 points (0.83%) at 3921

- Nasdaq up 136.6 points (1.2%) at 11325.96

- US 10-Yr yield is up 5.7 bps at 3.6301%

- US Jun 10-Yr futures are down 23.5/32 at 113-29.5

- EURUSD up 0.0008 (0.07%) at 1.0739

- USDJPY up 0.84 (0.63%) at 134.05

- WTI Crude Oil (front-month) down $3.47 (-4.64%) at $71.32

- Gold is down $8.05 (-0.42%) at $1905.62

- EuroStoxx 50 up 82.93 points (2.02%) at 4179.47

- FTSE 100 up 88.48 points (1.17%) at 7637.11

- German DAX up 273.36 points (1.83%) at 15232.83

- French CAC 40 up 130.07 points (1.86%) at 7141.57

US TREASURY FUTURES CLOSE

- 3M10Y +3.749, -120.867 (L: -143.739 / H: -119.221)

- 2Y10Y -16.284, -57.434 (L: -76.331 / H: -36.859)

- 2Y30Y -16.463, -44.108 (L: -67.354 / H: -19.682)

- 5Y30Y -3.154, -2.405 (L: -14.707 / H: 7.299)

- Current futures levels:

- Jun 2-Yr futures down 11.25/32 at 103-1.875 (L: 102-21.125 / H: 103-26.375)

- Jun 5-Yr futures down 18/32 at 108-25 (L: 108-08.25 / H: 109-28.75)

- Jun 10-Yr futures down 23.5/32 at 113-29.5 (L: 113-09 / H: 115-07.5)

- Jun 30-Yr futures down 1-20/32 at 129-29 (L: 129-10 / H: 132-04)

- Jun Ultra futures down 2-15/32 at 139-28 (L: 138-28 / H: 143-01)

US 10YR FUTURE TECHS: Short-Term Outlook Remains Bullish

- RES 4: 116-28+ High Jan 19 and key resistance

- RES 3: 116-08 High Feb 2

- RES 2: 116-00 Round number resistance

- RES 1: 115-13 High Mar 13

- PRICE: 113-17+ @ 16:34 GMT Mar 14

- SUP 1: 113-09 High Mar 14

- SUP 2: 113-01+ 50-day EMA

- SUP 3: 112-21 Low Mar 13

- SUP 4: 112-09+ 20-day EMA

Treasury futures started the week on a firm note and yesterday’s rally marks an extension of last week’s strong impulsive bounce. A number of important Fibonacci retracement points have been cleared and 115-03+, the 76.4% retracement of the bear leg between Feb 2 - Mar 2, has been pierced. A clear breach would open the 116-00 handle. Price is today retracing part of yesterday's rally, initial firm support lies at 113-01+, the 50-day EMA.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.271 at 95.134

- Jun 23 -0.095 at 94.845

- Sep 23 -0.295 at 95.330

- Dec 23 -0.270 at 95.560

- Red Pack (Mar 24-Dec 24) -0.225 to -0.14

- Green Pack (Mar 25-Dec 25) -0.16 to -0.12

- Blue Pack (Mar 26-Dec 26) -0.145 to -0.10

- Gold Pack (Mar 27-Dec 27) -0.10 to -0.08

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00243 to 4.55357% (-0.00357/wk)

- 1M +0.04328 to 4.72771% (-0.07086/wk)

- 3M +0.07471 to 4.94100% (-0.19714/wk)*/**

- 6M -0.08228 to 4.96843% (-0.45986/wk)

- 12M -0.15028 to 4.99229% (-0.74585/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $41B

- Daily Overnight Bank Funding Rate: 4.56% volume: $232B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.148T

- Broad General Collateral Rate (BGCR): 4.52%, $467B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $457B

- (rate, volume levels reflect prior session)

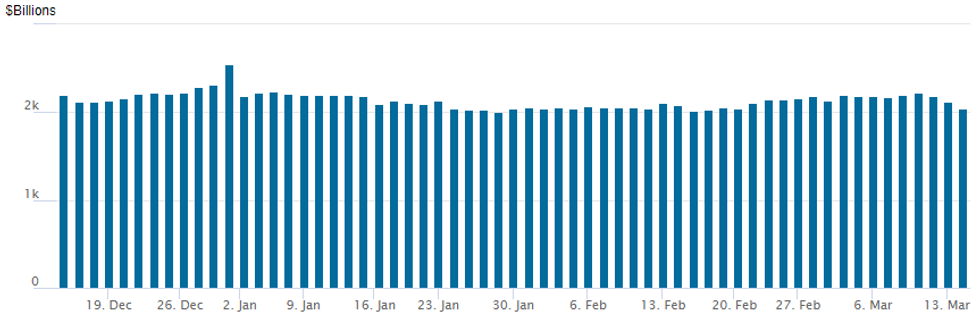

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,042.579B w/ 95 counterparties vs. prior session's $2,126.677B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

No new corporate bond issuance Tuesday, several interested parties remain sidelined due to market volatility tied to Silicone Valley Bank and Signature Bank collapse last Friday.

EGBs-GILTS CASH CLOSE: Yields Continue To Bounce

EGBs and Gilts sold off amid a risk asset relief rally Tuesday, as concerns over US banking stability abated vs the panic of the prior two sessions.

- Risk / swap spreads fell sharply, with periphery EGBs outperforming (10Y BTPs closed 8bp tighter to Bunds) as equities rallied.

- Bunds and Gilts fell to session lows after the highly anticipated US CPI reading was on the strong side, but traded sideways/higher for the rest of the session.

- The German curve bear flattened with Schatz yields up more than 20bp as ECB hike pricing continued to recover ground. A 50bp hike on Thursday is back to 70% probability, vs 30% at Monday's low.

- Expectations for a BoE hike later this month remain uncertain after this morning's mixed jobs data was not enough to sway the MPC in any particular direction: current implied pricing is about 65% for a 25bp hike vs a pause.

- Wednesday's Europe calendar highlight is the UK budget announcement - MNI's preview is here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 20.2bps at 2.892%, 5-Yr is up 18.4bps at 2.512%, 10-Yr is up 16.1bps at 2.42%, and 30-Yr is up 13.4bps at 2.41%.

- UK: The 2-Yr yield is up 11.8bps at 3.481%, 5-Yr is up 11.5bps at 3.392%, 10-Yr is up 11.8bps at 3.488%, and 30-Yr is up 5.9bps at 3.894%.

- Italian BTP spread down 7.9bps at 184.5bps / Greek down 13.1bps at 191.3bps

FOREX: USD Index Unchanged As Markets Stabilise

- As concerns over US banking stability abated compared to the panic of the prior two sessions, the USD index is unchanged as we approach Tuesday’s APAC crossover. Stronger equity markets overall and the lower yields at the front-end of the US curve have weighed on the JPY, whereas risk-tied AUD, NZD and CAD have all outperformed.

- Over the US CPI data, USDJPY (+0.64%) aggressively whipsawed and price action eventually prompted a 134.90 print, an impressive recovery from the 132.29 low. Prices have since moderated back to the 134.00 mark ahead of the close and overall, last Friday’s move lower and Monday’s bearish extension, highlights potential for a deeper corrective pullback.

- The pair has traded below support at 134.22, the 50-day EMA. Traders will continue to monitor a clear break of this average which strengthens a short-term bearish threat and exposes 131.31, a Fibonacci retracement point.

- EURUSD has consolidated recent gains on Tuesday and is hovering just below the most recent highs around 1.0750 in late US trade. Price action has strengthened a short-term bull theme and targets 1.0779 next, a Fibonacci retracement, ahead of Thursday’s ECB rate decision.

- Bank of Japan minutes kick off Wednesday’s docket, followed by Chinese activity data. Later on Wednesday, US PPI, retail sales and empire state manufacturing index data will be in primary focus.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/03/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 15/03/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 15/03/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 15/03/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 15/03/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 15/03/2023 | 0745/0845 | *** |  | FR | HICP (f) |

| 15/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 15/03/2023 | 1000/1100 | ** |  | EU | Industrial Production |

| 15/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/03/2023 | - |  | UK | Chancellor Delivers Spring Budget, OBR Forecasts, Likely DMO Remit | |

| 15/03/2023 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/03/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 15/03/2023 | 1230/0830 | *** |  | US | PPI |

| 15/03/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/03/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/03/2023 | 1400/1000 | * |  | US | Business Inventories |

| 15/03/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 15/03/2023 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.