-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Case for Soft Landing Grows

EXECUTIVE SUMMARY

- MNI US Inflation Insight, Jan'23: Cementing February Downshift

- MNI INTERVIEW: CPI Rent Passthrough May Be Longer - Detmeister

- MNI FED: BNP Lowers Feb Hike View To 25bp, Still Sees 5.25% Terminal And 2024 Cuts

- MNI POLICY: BOE Mortgage Support Would Ease Collateral Squeeze

- MNI: Growing Chinese Savings Seen Hard To Boost Consumption

- MNI US-CHINA: Biden To Push Kishida And Rutte On Semiconductor Export Controls

US

US: CPI inflation was for once in line with expectations in December as core CPI accelerated only modestly on the month across major components, although with some potentially more constructive details.

- Some uncertainty over implications for core PCE (Jan 27), with a better understanding after PPI (Jan 18).

- The market sees a downshift to a 25bp hike on Feb 1 as locked in, consistent with most of the 20 analysts reviewed below, with a terminal ~4.9% before 50bps of cuts to year-end and deeper cuts into 2024.

- The perceived February downshift has been helped by FOMC commentary calling for a steadier path to higher rates in order to give flexibility going ahead. That flexibility could in turn open the door to pausing after March (getting closer to being priced) if inflation data continues to moderate.

- Core PCE, inflation expectations and notably the ECI for Q4 (Jan 31) are still to come. They would likely have to be particularly strong to see renewed expectations of a 50bp hike but along with changes in financial conditions will determine the degree of Feb 1 FOMC hawkishness. For more see MNI Policy main wire at 0714ET.

- "Rents were very strong and it's a bit of a concern for the next two or three months, maybe even into the early part of the summer," he said in an interview. "We're seeing inflation clearly slowing not only here but average hourly earnings is suggesting that as well and the Atlanta Fed wage tracker ticked down too."

- Detmeister said CPI rents don't change the long run inflation outlook even though the passthrough from market rents to the CPI could be longer than previously anticipated. For more see MNI Policy main wire at 1132ET.

- While they think the underlying details of the Dec inflation report still point to "inflation persistence which will ultimately have to be addressed more forcefully through policy channels", "such a downshift [in rates] buys time for policymakers by pushing the hawk-dove debate over the final destination of the fed funds rate into Q2 2023."

- They still see a 5.00-5.25% terminal rate, but reached in May vs their previous view of March.

- BNP doesn't expect the Fed to be cutting by end-2023, but sees 200bp of cuts in 2024.

- Japan and the Netherlands are key chips producers and both have expressed reservations to Biden administration plans to enact export controls designed to throttle China's access to high-tech chips and restrain military development.

- The White House said in a statement that "cooperation on... critical technologies" will be on the agenda, and President Biden will be joined by US Trade Representative Katherine Tai at a working lunch with Prime Minister Kishida today.

UK

BOE: Tumbling UK house prices are set to prompt a squeeze on borrowing by small firms which rely on property for collateral, potentially raising questions for the Bank of England about whether it should take macroprudential measures to support mortgage lending even as it continues to tighten monetary policy.

- With the Office for Budget Responsibility forecasting a 9% fall in house prices over two years as the BOE hikes rates, firms' borrowing constraints will bite, driving down on jobs, investment and ultimately hitting demand. (See MNI POLICY: BOE Points To 4% Peak At Most, Then Rate Cuts) In the past, the BOE has used various measures to support housing at difficult times, including providing cheap funding for banks to provide mortgages via schemes such as Funding for Lending. For more see MNI Policy main wire at 0955ET.

ASIA

CHINA: Chinese households could add to last year’s historically high savings in 2023 should pessimism over future income and house prices continue, despite official hopes that the Covid reopening will spur a consumption boom, advisors and economists told MNI, saying policymakers were likely to lower interest rates and to accelerate fiscal spending to bolster confidence.

- Households’ bank deposits jumped by a record CNY17.84 trillion in 2022, making total outstanding household savings equivalent to almost 100% of gross domestic product, the highest ratio ever, as loans to households increased only by CNY3.83 trillion, a record low pace, PBOC data shows.

- Since only CNY1.5 trillion of last year’s roughly CNY7 trillion excess savings resulted from weak consumption, the prospects of a boost to consumption this year are relatively limited, said Zhu He, senior fellow at the China Finance 40 Forum. The other CNY5.5 trillion in excess savings came as house buying declined in a weak property market, he said, adding that further declines in property transactions would feed continued fast increase in savings, if not at the same pace as in 2022. For more see MNI Policy main wire at 0623ET.

US TSYS: Latest Sentiment Data Underscores Case for Soft Landing

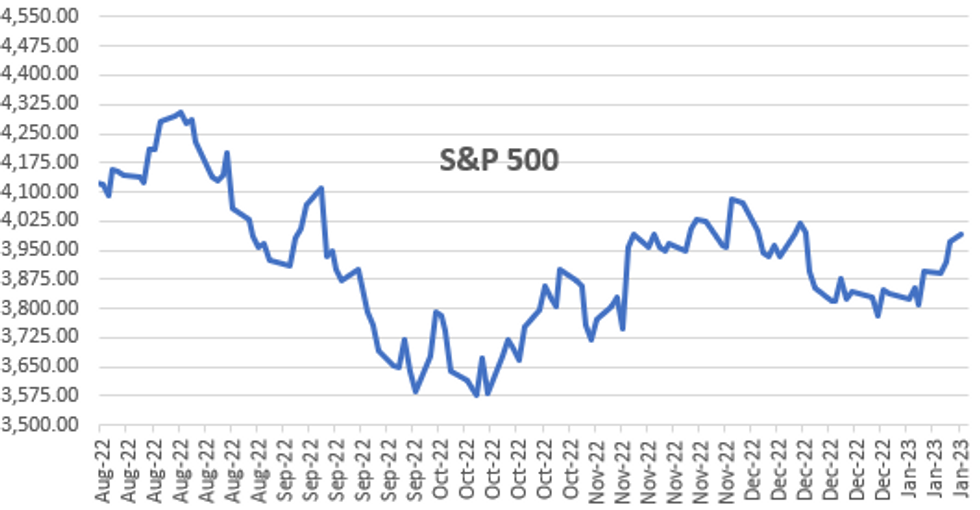

While equities continue to drift higher after better than expected UofM sentiment, rates have gradually receded, trading near late session lows after the bell.

- UoM data climbed from 59.7 prior to 64.6 (60.7 est) underscoring the case for a soft landing for the economy as sentiment hit its highest lvl since Apr'22, while 1Y inflation exp recedes to lowest lvl since Apr 2021 at 4.0% vs. 4.3% exp (4.4% prior).

- At the margin it suggests growing headwinds to input prices but only after a string of solidly negative readings, averaging -0.4% M/M through Jun-Nov during which period core goods inflation has fallen notably.

- Earlier data showed surprising strength for import prices, rising 0.4% M/M (cons -0.9%) and with a broadly similar sized upside surprise for ex-petroleum prices at 0.8% M/M (cons -0.3%).

- Limited react to Tsy Sec Yellen comments on debt ceiling: next Thu, Jan 19, US outstanding debt "is projected to reach the statutory limit. Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting," she said.

- Decent first half trade died down in the second half w/ US markets closed for Dr Martin Luther King Jr Day. Limited docket for Tuesday while equity earnings resume: Goldman Sachs and Morgan Stanley expected to announce before the NY open. Data picks up in earnest on Wednesday January 18 with Retail Sales, PPI, Business Inventories, Net TIC flow.

OVERNIGHT DATA

- US DEC IMPORT PRICES +0.4%

- US DEC EXPORT PRICES -2.6%; NON-AG -2.7%; AGRICULTURE -2.4%

- Surprising strength on the month for import prices, rising 0.4% M/M (cons -0.9%) and with a broadly similar sized upside surprise for ex-petroleum prices at 0.8% M/M (cons -0.3%).

- At the margin it suggests growing headwinds to input prices but only after a string of solidly negative readings, averaging -0.4% M/M through Jun-Nov during which period core goods inflation has fallen notably.

- In Y/Y terms, prior USD strength continues to point to a sizeable moderation in ex-petroleum import price growth.

- UMICH JAN PRELIM CONS SENTIMENT 64.6 (60.7 EXP., 59.7 PRIOR)

- UMICH JAN PRELIM CURR CONDITIONS 68.6 (60.0 EXP., 59.4 PRIOR)

- UMICH JAN PRELIM EXPECTATIONS 62.0 (59.0 EXP., 59.9 PRIOR)

- UMICH JAN PRELIM 1Y INFL EXPECTATIONS 4.0% (4.3% EXP., 4.4% PRIOR)

- UMICH JAN PRELIM 5-10Y INFL EXPECT 3.0% (2.9% EXP., 2.9% PRIOR)

- The improvement was consistent with 1Y ahead inflation expectation surprisingly slowing from 4.4% to 4.0% (cons 4.3%), its lowest since Apr'21. Declines are likely supported by recent sizeable declines in gasoline prices.

- 5-10Y expectations meanwhile surprisingly increased a tenth to 3.0% "again staying within the narrow 2.9-3.1% range for 17 of the last 18 months". Still potential for revisions in the final release.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 39.7 points (0.12%) at 34248.18

- S&P E-Mini Future up 5.5 points (0.14%) at 4010.75

- Nasdaq up 36.2 points (0.3%) at 11043.78

- US 10-Yr yield is up 6.9 bps at 3.509%

- US Mar 10-Yr futures are down 14.5/32 at 114-25

- EURUSD down 0.0024 (-0.22%) at 1.0829

- USDJPY down 1.4 (-1.08%) at 127.83

- WTI Crude Oil (front-month) up $1.45 (1.85%) at $79.73

- Gold is up $23.39 (1.23%) at $1920.70

- EuroStoxx 50 up 24.12 points (0.58%) at 4150.8

- FTSE 100 up 50.03 points (0.64%) at 7844.07

- German DAX up 28.22 points (0.19%) at 15086.52

- French CAC 40 up 47.82 points (0.69%) at 7023.5

US TSY FUTURES CLOSE

- 3M10Y +4.027, -112.194 (L: -121.646 / H: -111.417)

- 2Y10Y -2.244, -72.944 (L: -73.495 / H: -66.576)

- 2Y30Y -4.06, -61.259 (L: -61.861 / H: -51.698)

- 5Y30Y -2.507, 1.263 (L: 0.817 / H: 7.781)

- Current futures levels:

- Mar 2-Yr futures down 5.75/32 at 102-28.375 (L: 102-28.375 / H: 103-04.125)

- Mar 5-Yr futures down 11/32 at 109-14 (L: 109-13.75 / H: 109-30.75)

- Mar 10-Yr futures down 14.5/32 at 114-25 (L: 114-24.5 / H: 115-15.5)

- Mar 30-Yr futures down 21/32 at 130-0 (L: 129-27 / H: 131-10)

- Mar Ultra futures down 1-3/32 at 142-0 (L: 141-26 / H: 143-23)

US 10YR FUTURE TECHS: (H3) Testing The Bull Trigger

- RES 4: 116-00 Round number resistance

- RES 3: 115-28 2.0% 10-dma env

- RES 2: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 low

- RES 1: 115-15+ Intraday high

- PRICE: 115-07.5 @ 1100ET Jan 13

- SUP 1: 113-28/15+ 20- and 50-day EMA values

- SUP 2: 112-18+/111-28 Low Jan 5 / Low Dec 30 and the bear trigger

- SUP 3: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

Treasury futures firmed Thursday and the contract maintains a bullish tone. Price has pierced resistance at 115-11+, high Dec 13. A clear break of this hurdle would strengthen bullish conditions and pave the way for a climb towards 115-26, a Fibonacci projection. Price has recently cleared the 100-dma and this reinforces the bullish theme. On the downside, initial support lies at 113-23+, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Mar 23 -0.005 at 94.960

- Jun 23 -0.035 at 94.870

- Sep 23 -0.075 at 94.980

- Dec 23 -0.115 at 95.340

- Red Pack (Mar 24-Dec 24) -0.12 to -0.09

- Green Pack (Mar 25-Dec 25) -0.075 to -0.05

- Blue Pack (Mar 26-Dec 26) -0.055 to -0.05

- Gold Pack (Mar 27-Dec 27) -0.045 to -0.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 4.31371% (+0.00028/wk)

- 1M -0.00457 to 4.45443% (+0.05286/wk)

- 3M -0.03728 to 4.79243% (-0.01743/wk)*/**

- 6M -0.02857 to 5.10114% (-0.09586/wk)

- 12M -0.05214 to 5.35700% (-0.20197/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $107B

- Daily Overnight Bank Funding Rate: 4.32% volume: $286B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.108T

- Broad General Collateral Rate (BGCR): 4.27%, $447B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $414B

- (rate, volume levels reflect prior session)

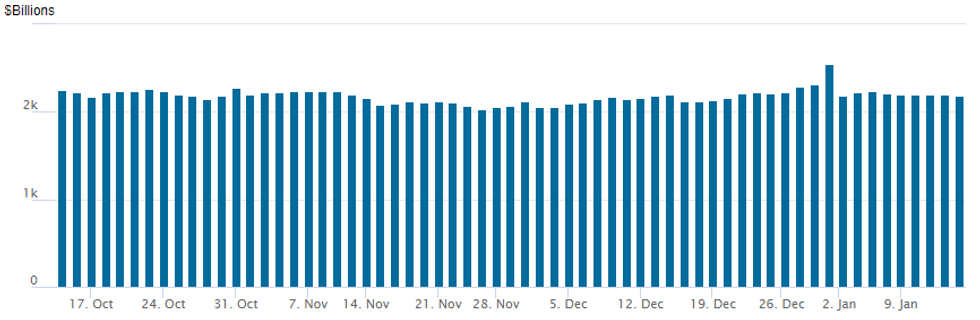

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,179.781B w/ 103 counterparties vs. prior session's $2.202.989B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

No new issuance Thursday-Friday as earning cycle gets underway; total $63.9B priced on week, $158.675B for month of January so far.

EGBs-GILTS CASH CLOSE: Yields Reverse Higher, But Weekly Gains Hold

Bund and Gilt yields bounced from early session lows to finish mostly higher on the session Friday, but still lower on the week (10Y Gilt down 10bp, Bund 4bp).

- The UK and German curves flattened, with 5Y Gilts and 2Y Schatz underperforming on each, respectively. Yields pushed through the session highs toward the cash close, completing the reversal from the morning's intraday lows (10Y Bund up 7+bp and Gilt 10+bp from lows).

- There was no evident fundamental driver of the morning reversal, though notably ECB terminal hike pricing bounced from session lows as well (last +143bp in further hikes priced vs this morning's low below +137bp), suggesting perhaps the dovish rally in the past couple of days may have gone a little too far for now. The stronger-than-expected UK Nov GDP data out this morning helped set a cautious tone as well.

- Combined with BTP spreads re-widening after touching a fresh post-April 2022 low, it certainly had the feel of a profit-taking session.

- January's round of TLTRO repayments was not a market mover, with very limited (E62.7bln) takeup vs expectations.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.4bps at 2.593%, 5-Yr is up 2.3bps at 2.202%, 10-Yr is up 0.9bps at 2.168%, and 30-Yr is up 2.5bps at 2.134%.

- UK: The 2-Yr yield is up 5.1bps at 3.489%, 5-Yr is up 6.6bps at 3.305%, 10-Yr is up 3.2bps at 3.366%, and 30-Yr is up 3bps at 3.724%.

- Italian BTP spread up 0.2bps at 184.3bps / Spanish up 1.2bps at 99.8bps

FOREX: Japanese Yen Continues Powerful Upswing

- Despite a more benign session for currencies in the aftermath of the US CPI print on Thursday in which the USD index remained close to unchanged, the Japanese Yen continued its significant appreciation to rise a further 1.10% against the greenback.

- USDJPY had a clean break from late last night through the bear trigger at 129.52 and the sustained weakness has seen the pair test down and briefly pierce the next support of 127.53, the May 31, 2022 low.

- With moving average studies in a bear mode condition and a bearish price sequence highlighting a clear downtrend, further weakness is likely. Note that the 50- and 200-dmas are on the cusp of forming a bearish death cross.

- With more contained ranges across the rest of G10 currencies, the only notable move is further strengthening of the Chinese Yuan. USDCNH continues to gravitate to fresh cycle lows and is now trading at the lowest levels since July 2022, amid the same positive factors of lower US yields and the relaxation of Chinas covid restrictions.

- MLK Day in the US on Monday and so Chinese growth data kicks off the docket during Tuesday’s APAC session before UK employment figures and Canadian CPI. Focus then quickly turns to the BOJ on Wednesday.

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/01/2023 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/01/2023 | 1400/0900 | * |  | CA | CREA Existing Home Sales |

| 16/01/2023 | 1530/1030 | ** |  | CA | BOC Business Outlook Survey |

| 17/01/2023 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 17/01/2023 | 0200/1000 | *** |  | CN | Retail Sales |

| 17/01/2023 | 0200/1000 | *** |  | CN | Industrial Output |

| 17/01/2023 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 17/01/2023 | 0700/0700 | *** |  | UK | Labour Market Survey |

| 17/01/2023 | 0700/0800 | *** |  | DE | HICP (f) |

| 17/01/2023 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Conditions Index |

| 17/01/2023 | 1000/1100 | *** |  | DE | ZEW Current Expectations Index |

| 17/01/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/01/2023 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/01/2023 | 1315/0815 | ** |  | CA | CMHC Housing Starts |

| 17/01/2023 | 1330/0830 | *** |  | CA | CPI |

| 17/01/2023 | 1330/0830 | ** |  | US | Empire State Manufacturing Survey |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 17/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 17/01/2023 | 2000/1500 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.