-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: China Shifts To Stimulus Mode

- MNI FED WATCH: Hawkish Skip For June, But Peak Rates Higher

- MNI ECB WATCH: ECB To Hike 25bps With Focus On July, September

- MNI POLICY: BOJ To Keep Yield Curve Control This Year

- Russia Mulls Quitting Ukraine Safe-Corridor Crops Accord - Bloomberg

- China Shifts to Stimulus Mode With Xi’s Options Dwindling - Bloomberg

- Bailey: UK Labour Market Still Very Tight - MNI

NEWS

US

FED (MNI): MNI FED WATCH: Hawkish Skip For June, But Peak Rates Higher

The Federal Reserve is widely expected to leave official borrowing costs unchanged Wednesday for the first time since the pandemic hiking cycle, holding them at 5%-5.25% even as officials are likely to raise their estimates for peak rates in the face of stubbornly high inflation and a very strong labor market.

Politics (BBG): McCarthy’s Deal With Republican Rebels Risks Government Shutdown

The US government faces a greater risk of a shutdown in October following a new budget-cutting deal House Speaker Kevin McCarthy forged to quell a revolt among ultra-conservative Republicans. McCarthy agreed this week to push through the House spending cuts $120 billion deeper than caps set barely two weeks ago as part of a hard-fought compromise the GOP leader reached with President Joe Biden to avert a catastrophic debt default.

Treasury (BBG): Yellen Says Treasury Watching for Disruption From Bill Issuance

US Treasury Secretary Janet Yellen said her department is doing all it can not to disrupt the smooth functioning on fixed-income markets as it works to replenish its coffers via a surge of bill issuance. “It is our obligation to build the Treasury balance up to a safe and appropriate level, but we’ve consulted widely with market participants about what the best way is to do that to minimize the cost to the federal government and to avoid market disruption to the maximum extent possible,” she said Tuesday. Her department will “be careful to see if there are impacts or market disruption.”

Climate (BBG): Texas Seen Breaking Power-Demand Record Amid Intense Heat

Texas’s fragile power grid will be pushed to the brink in coming days as unusually hot weather grips the second-largest US state. Electricity usage is forecast to break the all-time high by the end of the week, the Electric Reliability Council of Texas, or Ercot, warned.

Europe

ECB (MNI): MNI ECB WATCH: ECB To Hike 25bps With Focus On July, September

The European Central Bank is set to raise its key interest rate by 25bps to 3.5% on Thursday and to signal that more hikes are on the way, despite signs of easing inflationary pressures. While June’s Eurosystem staff projections should show inflation converging to the 2% target by the end of the 2025, prompting sources to tell MNI that rates could peak at 3.75%, perhaps in July, but possibly in September, the ECB’s statement is likely to repeat its commitment to a meeting-by-meeting approach and to keeping rates at sufficiently restrictive levels for as long as necessary to meet the price objective.

Russia-Ukraine (BBG) Russia Mulls Quitting Ukraine Safe-Corridor Crops Accord

Russia is considering leaving the deal that allows Ukraine to ship grain exports from Black Sea ports, President Vladimir Putin said at a televised meeting. The Russian leader said that his country had agreed to the deal’s extension several times not in Ukraine’s interests, but for its allies in Africa and South America.

BOE (MNI) Bailey: UK Labour Market Still Very Tight

The latest labour market data showed that the market remained very tight and that recovery in labour supply was very slow, Bank of England Governor Andrew Bailey said Tuesday. Speaking to the House of Lords Economic Affairs Committee Bailey said that while the Bank's central model showed inflation coming back to below target they were "aiming off", anticipating that inflation would be more persistent and one reason was the structural change in the labour market.

BOE (MNI) Dhingra Sees Delayed Hit From Past Tightening

The effects of falling producer price inflation and previous rate hikes will take time to feed through to consumer prices, Bank of England Monetary Policy Committee member Swati Dhingra said Tuesday, as she expressed confidence that inflation would head lower.

BOE (MNI) MPC Newcomer Greene Sees Inflation Persisting

Megan Greene, set to join the Bank of England's Monetary Policy Committee next month, has warned against "stop-start" monetary policy whilst highlighting the risk of higher inflation persisting in evidence to the Treasury Select Committee. Greene, facing MPs in an appointment hearing, said that while inflation would come down from double digits swiftly it would be tougher to get it back to the 2% target and she cited structural weaknesses in the UK, with Brexit fueling low productivity growth.

EU Lending (BBG): Private Lenders in Europe Mull CLOs as Means to Draw Investors

At least three direct lenders are looking at bundling up private credit into collateralized loan obligations as they seek new ways to tap pockets of capital, potentially kick-starting a fledgling European asset class in the process.

Asia/Global

JAPAN (MNI): MNI POLICY: BOJ To Keep Yield Curve Control This Year

There is no prospect that the Bank of Japan will scrap yield curve control this year, because even if policymakers become confident of a virtuous cycle between wage hikes and price rises they would still want to avoid any sharp rise in interest rates, MNI understands.

CHINA (BBG): China Shifts to Stimulus Mode With Xi’s Options Dwindling

(Bloomberg) -- China is ramping up policy stimulus to boost its faltering economy, although soaring debt levels and concerns about financial stability mean the measures are likely to be limited compared with support packages in previous downturns. The People’s Bank of China unexpectedly cut a series of different policy interest rates on Tuesday, paving the way to lower the key lending rate which will be announced on Thursday. After reducing a key short term interest rate that heavily influences interbank liquidity early on Tuesday, the central bank then cut the higher rates which are seen as the ceiling of the corridor, adding to expectations of more easing.

JAPAN Equities (BBG): BlackRock’s Japan ETF Pulls $1 Billion as Nikkei Rally Powers On

Traders are piling into BlackRock’s Japan-focused ETF at the fastest pace in years as the country’s stock market hits multi-decade highs. The iShares MSCI Japan ETF (ticker EWJ) has pulled in roughly $1 billion in June, with the bulk of that coming from a $787 million cash influx last week, the biggest weekly inflow in over five years. The fund — whose top holdings include Toyota Motor Corp., Sony Group Corp., and Mitsubishi UFJ Financial Group Inc. — has gained almost 8% month to date as the country’s economic outlook improves.

DATA

US May CPI As Expected, Keeps Fed On Track For Skip

U.S. core CPI rose 0.436% in May, its sixth consecutive month at 0.4% or higher, but headline cooled to a 0.124% rise from a month earlier, both largely meeting analyst expectations and keeping the Federal Reserve on track to hold interest rates steady at Wednesday's meeting. From a year earlier, headline CPI eased to 4.0%, its lowest since March 2021, while core CPI slowed two-tenths to 5.3%. Shelter was the largest contributor to headline inflation, followed by used cars and trucks, the BLS said. Owners' equivalent rent came in at 0.5%, same as in April and meeting analyst expectations. Core goods prices and core services prices were both steady at 0.6% and 0.4%, respectively.

Strong UK Jobs Market Ups Pressure On BOE

The total number of employed people in the UK rose to 30 million for the first time in May, as another strong set of labour market data increases the pressure on the Bank of England ahead of their June policy meeting. ONS data showed payrolls in May increased by 23,000 to 30 million, coming on top of a strong upward revision of 7,000 to the April figure -- which initially showed a surprise decline of 136,000. The unemployment fell to 3.8% from 3.9% in April and overall employment by the ILO measure rose by 250,000 on a rolling 3 months as workers returned to the workforce. Wages also rose strongly, with average weekly earnings rising to 6.5% and ex-bonuses rising to 7.2%. In part, the strong gains in April reflected the near 10% increases in both minimum and living wages.

US TSYS: Ending A Mixed Session Notably Cheaper Despite Softer CPI Details

- Cash Tsys have seen a significantly mixed session, with a sharp rally on the CPI report before fully reversing the move and them plumbing new lows since March 10 after brief respite ahead of and only shortly after the solid 30Y auction.

- It follows a substantial 26bp increase in 2Y Gilt yields after strong labour data sent BoE rate expectations surging, decent increases in planned T-bill issuance and Russia mulling quitting the safe corridor grain deal for Black Sea ports, plus the PBoC cutting short-term rates ahead of CPI. Clearance of key support for TY helped extend lows.

- Coming on the eve of the FOMC decision, the end result is yields currently 10-11bps higher on the day for 2-7Y tenors, with the 2Y at the high end of its wide 4.49-4.704% range. 10s only modestly outperform with +9.3bps whilst the very long end more clearly outperforms at +5bps after the auction traded through with decent internals.

- TYU3 at 112-24 off a low of 112-20+ easily cleared key support at 112-29+ to open 112-16 (76.4% retrace of Mar 2 – May 4 rally).

- FOMC-dated OIS doesn’t shake off the post-CPI hit for near-term meetings with just +2bps for tomorrow and a cumulative +17bps for July (-5bps since the data) but the Dec’23 has continued to increase to 5.13% for +6bps on the day and just 15bp of cuts from the 5.28% terminal now seen in September.

- Tomorrow sees PPI land with the usual implications for core PCE inflation, before of course the FOMC decision at 1400ET.

EGBs-GILTS CASH CLOSE: UK Short End Crushed On Jobs Data

Stronger-than-expected UK jobs and wage data triggered the biggest selloff in short-dated Gilts in over 8 months Tuesday, with bear flattening in the curve that triggered a similar move in German yields.

- 2Y UK yields rose relentlessly over the day, shrugging off a US inflation report that was largely in line with expectations, and closed up over 26bp (most since Sep 26, 2022)

- Several BoE speakers today (incl Dhingra, Greene) did little to quell the hawkish speculation - Gov Bailey noted “we still think inflation is going to come down but it’s taking a lot longer than expected".

- That "longer than expected" is also the theme of UK rates markets, with BoE peak rates now seen reached in Feb 2024 (vs Dec 2023) and with pricing nearing a 6% handle for the first time since late last year (5.85% peak priced, 135bp from here).

- Eurozone bond / rate action was relatively tame by comparison to the UK, another theme of late. ECB hike pricing edged up marginally on the day, with a 25bp hike this Thursday fully expected - our meeting preview went out today.

- Periphery spreads narrowed, with 10Y BTP at fresh 14-month tights to Bund.

- Wednesday sees UK GDP data and the Federal Reserve decision.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 6bps at 2.974%, 5-Yr is up 5.4bps at 2.475%, 10-Yr is up 3.5bps at 2.423%, and 30-Yr is up 1.4bps at 2.564%.

- UK: The 2-Yr yield is up 26.1bps at 4.897%, 5-Yr is up 18.1bps at 4.528%, 10-Yr is up 9.6bps at 4.434%, and 30-Yr is up 4.3bps at 4.615%.

- Italian BTP spread down 3.7bps at 163.2bps / Greek down 4.4bps at 128.4bps

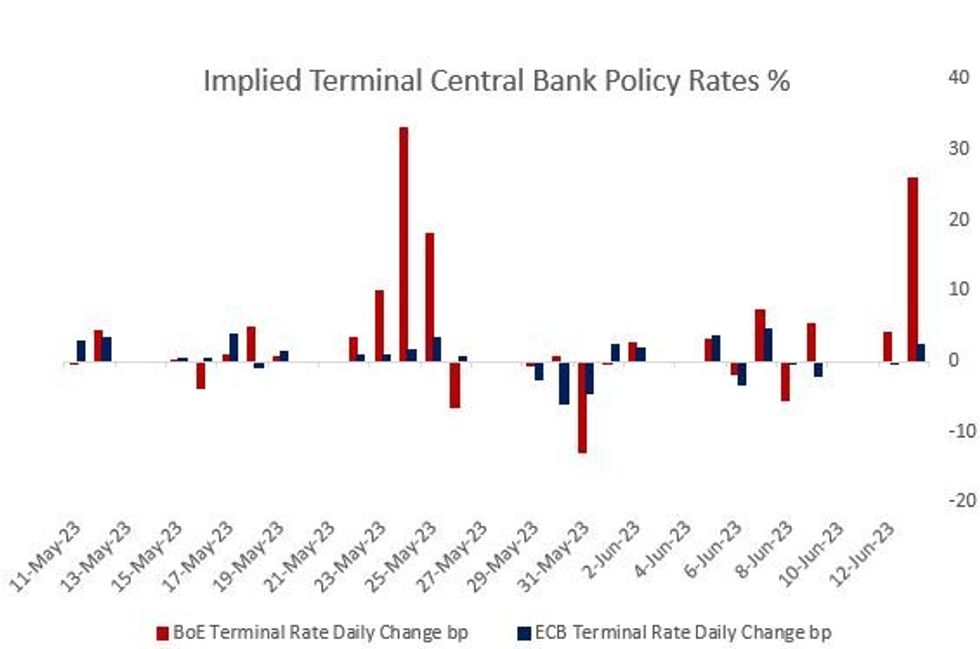

EU STIR: BoE Seen Going Higher For Longer, While ECB Pricing Stagnates

Today's post-UK jobs market price action, and parade of BoE speakers, have effectively added a 25bp hike to the BoE's tightening cycle, now seen peaking in Feb 2024 at 5.85% (up 28bp on the day, and 135bp from current rates).

- That's higher and longer than previously expected - coming into today, the peak was seen arriving in Dec 2023. There's a chance seen of a 50bp hike this month (around 20% implied).

- While an impressive increase, it's not even the biggest single day move of the past month for peak rate pricing, which was the +33bp on May 24 following much stronger-than-expected April CPI data; that was followed up by +18bp on May 25.

- Meanwhile ECB policy is seen as much more predictable and peak hike pricing continues to effectively stand still: +1.5bp today to 3.80%, implying 56bp of further hikes in this cycle, including 96% probability of a quarter point raise this week (as seen in MNI's meeting preview).

FOREX: JPY Under Renewed Pressure Following Core Yield Surge, GBP Buoyed By Domestic Data

- The US inflation report came in largely in line with expectations which looks likely to prompt the Federal Reserve to keep rates unchanged on Wednesday. Despite a sharp reversal higher for US yields, the path of least resistance in currency markets was generally lower for the greenback, with the Japanese Yen performing the worst in G10.

- USDJPY has bounced around 125 pips from the earlier 139.01 lows, reinforcing the bullish technical trend conditions. Attention is on key resistance at the top of a bull channel drawn from the Jan 16 low. The line intersects at 141.30 today. A clear break of this hurdle would reinforce a bullish theme and open 141.61, the Nov 23 2022 high.

- Interestingly, GBPJPY has extended its move back above 175 and looks set to close at its highest level since late 2015.

- The GBP strength comes hot on the heels of stronger-than-expected UK jobs and wage data, which triggered the biggest selloff in short-dated Gilts in over 8 months. GBPUSD has also thrived, bouncing back strongly following yesterday’s underperformance that saw the pair briefly drop as low as 1.2487. Cable is flirting with a close above the 1.2600 mark for just the fifth time this year. A sustained move above this level would expose key resistance at 1.2680, May 10 high. The first support moves up to 1.2468, the 20-day EMA.

- Wednesday sees UK GDP data where the economy is expected to advance +0.2% m/m in April. US PPI data for May will also cross before the focus then quickly shifts to the FOMC decision.

US STOCKS: Gains Stall After Post-CPI Push But Shrug Off Jump In Real Yields

- ESA at 4412.75 has pulled back slightly off session highs and newfound initial resistance at 4423.25 but still sees solid gains after the CPI report helped breach the round 4400 tested prior to the data.

- The continued push higher has opened a string of resistance levels running off projections based on the May 4-19-24 price swing, with 4427.19 (1.618) and 4452.42 (1.764) next ahead.

- The 0.6% increase on the day is decent from a macro perspective considering a 7.5bp increase in 10Y Tsy real yields.

- SPX is also +0.7%, and whilst banks (+1%) and energy (+0.6%) partly bounce back after yesterday’s underperformance, it’s led by materials (+2.3%). The latter is led by metals & mining (+3.8%) as part of sizeable gains for commodity producers generally after iron ore pushed higher overnight.

- Away from SPX, the Nasdaq 100 trades broadly in line whilst the Dow Jones lags with +0.3%, as does the TSX (+0.4%) north of the border despite strong energy gains on the day.

COMMODITIES: Stimulus Hopes Boost Oil, Nat Gas Surges On Norwegian Works

- Crude oil has gained strongly today to unwind yesterday’s slide but no more than that.

- China cutting short-term rates and hopes of further Chinese stimulus have played a role, as seemingly did a rally in Treasuries after the US CPI data although a subsequent sharp reversal of that and yields pushing significantly higher on the day has had a relatively modest impact.

- EU TTF natural gas meanwhile has surged 16% on tight supply concerns as Norway extends the outages at gas plants and fields. Nyhamna gas plant, Ormen Lange and Aasta Hansteen field works were extended until 15 July.

- WTI is +3.1% at $69.2, moving back nearer to resistance at $71.30 (20-day EMA).

- Brent is +3.1% at $74.05, moving back nearer to resistance at $75.59 (20-day EMA).

- Gold is -0.85% at $1941.26 as it moves closer to support at $1932.2 (May 31 low) with notably higher Tsy yields offseting a softer USD index on the day.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/06/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 14/06/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 14/06/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 14/06/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 14/06/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 14/06/2023 | 0600/0800 | *** |  | SE | Inflation Report |

| 14/06/2023 | 0900/1100 | ** |  | EU | Industrial Production |

| 14/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/06/2023 | 1230/0830 | * |  | CA | Household debt-to-income |

| 14/06/2023 | 1230/0830 | *** |  | US | PPI |

| 14/06/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 14/06/2023 | 1800/1400 | *** |  | US | FOMC Statement |

| 15/06/2023 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.