-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Core PPI Slightly Stronger, Not a Hot Read

- MNI BRIEF: Fed Must Hit 2% Before Rethinking Target-Kashkari

- MNI BRIEF: Fed's Waller Says Climate Doesn't Pose Bank Risks

- MNI BOE WATCH: Hikes 25bps, Leaves Door Open To More

- MNI US DATA: Core PPI Inflation Slightly Stronger Than Expected In April

- MNI US DATA: Surprising Rise In Initial Jobless Claims To Highest Since Oct 2021

US

FED: The Federal Reserve must hit 2% inflation before considering any adjustment to the inflation target, Minneapolis Fed President Neel Kashkari said Thursday.

- "It is conceivable that once we get through this inflation period, and we get inflation back down to 2%, we could have a deliberation with, for example, elected leaders in Washington" and ask whether a Fed inflation target of 2.5%, 3% or 1.5% is preferable, he said in Q&A at an event in Michigan. "But we can't change it while we're missing it. Right?"

- Kashkari characterized recent inflation as "pretty darn persistent" and said the Fed will "keep at it for an extended period of time." (See: MNI INTERVIEW: Sticky Prices Could Require More Hikes-Fed Econ)

- "We have to get inflation back down to 2%. The Federal Open Market Committee is united in our commitment to doing that. Once we do that, it'll be an appropriate time to have that conversation," he said. "Just because the Committee picked 2% a decade ago that doesn't mean that we need to live with 2% for the next 50 years, but now's not the time to change."

FED: Climate change does not present a major risk to bank safety or the financial system, and thus does not deserve special attention from the Federal Reserve, Fed Governor Chris Waller said Thursday.

- "Climate change is real, but I do not believe it poses a serious risk to the safety and soundness of large banks or the financial stability of the United States. There is no need for us to focus on one set of risks in a way that crowds out our focus on others," he said in remarks prepared for a conference in Madrid jointed hosted by IE University, Banco de Espana and the St. Louis Fed.

UK

BOE: The Bank of England raised rates by 25 basis points on Thursday, significantly raising its growth forecasts and leaving its guidance unchanged that further tightening would be needed if there were signs of more persistent inflation pressures.

- The seven-to-two vote to lift Bank Rate to 4.5%, with Swathi Dhingra and Silvana Tenreryo voting for no change, was widely expected. Some analysts had speculated the Monetary Policy Committee could tweak its policy wording to raise the hurdle to future hikes or to signal a peak was near but it stuck to the line that if inflation appeared to be sticky it would be ready to tighten again.

- The MPC forecast inflation would fall from 8.2% in the second quarter of this year to 3.4% in the same period of 2024, up sharply from the 1.0% it previously forecast. "We have to stay the course until inflation falls all the way ... to the 2% target,” BOE Governor Andrew Bailey told a press conference. For more, see MNI Policy main wire at 0925ET.

US TSYS: Short End Support Wanes Late, Projected Yr End Rate Cuts Ease

Treasury futures pared gains in the second half, curves bending flatter (2s10s -4.490 at -51.623 vs. -45.947 high) as short end rates reverse course, 2s and 5s trading weaker after the bell.- As such, projected rate cuts for late 2023 have eased slightly. September cumulative -26.9bp (-30.7bp earlier) at 4.800%, November cumulative -52.0bp (-56.1bp earlier) at 4.549%, Dec'23 cumulative -76.5bp (-81.2bp earlier) at 4.304%, while Jan'24 cumulative is running at -100.9bp vs. -105.9bp this morning. Fed Terminal currently at 5.07% in Jun'23 this morning.

- Treasury futures had dipped briefly following the BOE 25bp rate hike this morning , but quickly bounced after regional banks took the focus off the BOE rate hike announcement. Risk-off as PacWest falls 26% following 10Q filing mentions of asset quality, deposit decline and heavy goodwill impairment loss of $1.38B.

- Curves bull steepened following Core PPI inflation in April was on balance close to expected if not slightly stronger, with ex food & energy stronger but weaker when also stripping out trade services.

- Meanwhile, Treasury reacted positively after a decent $21B 30Y auction (912810TR9) trades through with 3.741% high yield vs. 3.755% WI; 2.43x bid-to-cover vs. 2.36x prior month. Indirect take-up 72.43% vs. 69.12% prior; direct bidder take-up 17.36% vs. 19.80% prior; primary dealer take-up 10.21% vs. 11.09%.

OVERNIGHT DATA

- US APR FINAL DEMAND PPI +0.2%, EX FOOD, ENERGY +0.2%

- US APR FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.2%

- US APR FINAL DEMAND PPI Y/Y +2.3%, EX FOOD, ENERGY Y/Y +3.2%

- US APR PPI: FOOD -0.5%; ENERGY +0.8%

- US APR PPI: GOODS +0.2%; SERVICES +0.3%; TRADE SERVICES +0.5%

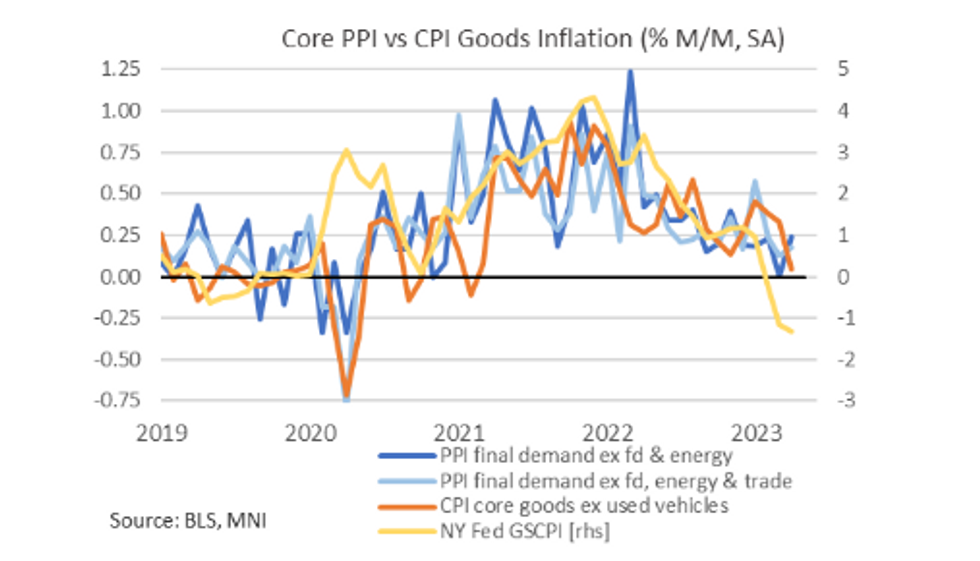

US: Core PPI inflation in April was on balance close to expected if not slightly stronger, with ex food & energy stronger but weaker when also stripping out trade services.

- Ex food & energy increased 0.24% M/M (cons 0.2) after an upward revised 0.0% (initial -0.1)

- Ex food, energy & trade increased 0.18% M/M (cons 0.3) after a minimally upward revised 0.12% (initial 0.07).

- The combination sees a trend moderation in input cost pressures, something seen in yesterday’s CPI core goods ex used autos but not yet fully reflecting the recent sizeable improvement in supply chain pressures with the NY Fed’s GSCPI at levels last seen in late 2008.

- US JOBLESS CLAIMS +22K TO 264K IN MAY 06 WK

- US PREV JOBLESS CLAIMS REVISED TO 242K IN APR 29 WK

- US CONTINUING CLAIMS +0.012M to 1.813M IN APR 29 WK

US: Initial jobless claims surprisingly increased to 264k (cons 245k) in wk to May 6 after an unrevised 242k.

- The data have been volatile in recent weeks but it breaks out of the rough 230-45k range seen since the drift higher in late Feb/early March. It records its highest level since Oct’21 whilst the 4-week average of 245k is also the highest since Nov’21.

- The move came with the level of non-seasonally adjusted claims pushing above levels for typical non-pandemic years, a change from hovering near the higher end in recent weeks.

- Continuing claims offered a slightly better picture on the other hand, only edging to 1813k (cons 1820k) from a downward revised 1801k (initial 1805k).

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 241.81 points (-0.72%) at 33293.28

- S&P E-Mini Future down 9.5 points (-0.23%) at 4143.25

- Nasdaq up 31.3 points (0.3%) at 12339.06

- US 10-Yr yield is down 4.7 bps at 3.3954%

- US Jun 10-Yr futures are up 4.5/32 at 116-1.5

- EURUSD down 0.0066 (-0.6%) at 1.0917

- USDJPY up 0.18 (0.13%) at 134.52

- WTI Crude Oil (front-month) down $1.6 (-2.21%) at $70.95

- Gold is down $15.86 (-0.78%) at $2014.20

- EuroStoxx 50 up 2.99 points (0.07%) at 4309.75

- FTSE 100 down 10.75 points (-0.14%) at 7730.58

- German DAX down 61.32 points (-0.39%) at 15834.91

- French CAC 40 up 20.58 points (0.28%) at 7381.78

TREASURY FUTURES CLOSE

- 3M10Y +2.896, -177.459 (L: -190.646 / H: -176.902)

- 2Y10Y -4.096, -51.229 (L: -51.691 / H: -45.947)

- 2Y30Y -4.292, -16.037 (L: -16.426 / H: -7.832)

- 5Y30Y -1.821, 39.035 (L: 38.622 / H: 45.086)

- Current futures levels:

- Jun 2-Yr futures down 0.75/32 at 103-11.25 (L: 103-09.375 / H: 103-17.125)

- Jun 5-Yr futures up 0.25/32 at 110-15.5 (L: 110-10.5 / H: 110-27.5)

- Jun 10-Yr futures up 4.5/32 at 116-1.5 (L: 115-24 / H: 116-16)

- Jun 30-Yr futures up 26/32 at 131-16 (L: 130-17 / H: 132-08)

- Jun Ultra futures up 1-08/32 at 140-4 (L: 138-26 / H: 141-00)

US 10YR FUTURE TECHS: (M3) Remains Above The 50-Day EMA

- RES 4: 117-29+ High Aug 26 2022 (cont)

- RES 3: 117-01+ High Mar 24 and bull trigger

- RES 2: 117-00 High May 4

- RES 1: 116-16 High May 11

- PRICE: 116-05 @ 16:37 BST May 11

- SUP 1: 115-01+/114-28 Low May 9 / 50-day EMA

- SUP 2: 114-10 Low May 1

- SUP 3: 113-30+ Low Apr 19 and a key support

- SUP 4: 113-26 Low Mar 22

Treasury futures bounced again Thursday, to open a gap with key short-term support at 115-01+, the May 9 low. This level lies ahead of 114-28, the 50-day EMA. A clear break of this average would signal scope for a deeper retracement towards 114-10 initially, May 1 low. For bulls, the extension of Wednesday’s bounce is a positive development. A continuation higher would open key resistance at 117-01+, the Mar 24 high. This is the bull trigger.

SOFR FUTURES CLOSE

- Jun 23 -0.015 at 94.950

- Sep 23 -0.010 at 95.310

- Dec 23 -0.020 at 95.775

- Mar 24 -0.015 at 96.325

- Red Pack (Jun 24-Mar 25) -0.01 to +0.015

- Green Pack (Jun 25-Mar 26) +0.020 to +0.035

- Blue Pack (Jun 26-Mar 27) +0.035 to +0.045

- Gold Pack (Jun 27-Mar 28) +0.050 to +0.055

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00220 to 5.05929 (+.00903/wk)

- 3M -0.01177 to 5.08634 (+.04761/wk)

- 6M -0.02846 to 5.02255 (+.07704/wk)

- 12M -0.06103 to 4.67255 (+.11895/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00142 to 5.06171%

- 1M -0.00057 to 5.10743%

- 3M -0.02172 to 5.32071% */**

- 6M -0.04972 to 5.34871%

- 12M -0.08700 to 5.26586%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.34243% on 5/10/23

- Daily Effective Fed Funds Rate: 5.08% volume: $120B

- Daily Overnight Bank Funding Rate: 5.07% volume: $284B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.410T

- Broad General Collateral Rate (BGCR): 5.02%, $579B

- Tri-Party General Collateral Rate (TGCR): 5.02%, $568B

- (rate, volume levels reflect prior session)

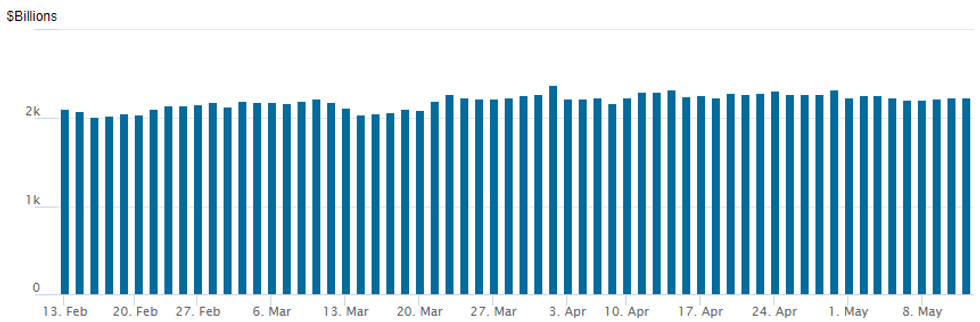

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,242.243B w/ 102 counterparties, compares to prior $2,233.149B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $1.6B EIB 2pt Launched

Looks to be $5.8B total high-grade corporate issuance Thursday.

- Date $MM Issuer (Priced *, Launch #)

- 05/11 $1.6B #Texas Instruments $200M 5Y +76, $200M 10Y +102, $1.2B 40Y +137

- 05/11 $1.5B #BNG Bank 5Y SOFR+45

- 05/11 $1.5B #Mamoura 10.5Y +115a, 30Y +145a

- 05/11 $1.2B #EIDP 3Y +95, 10Y +145

- 05/11 $Benchmark FMC Corp investor calls

- 05/11 $Benchmark BGK Bank (State Dev Bank of Poland) 10Y investor calls

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/05/2023 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 12/05/2023 | 0600/0700 | *** |  | UK | GDP First Estimate |

| 12/05/2023 | 0600/0700 | *** |  | UK | Index of Production |

| 12/05/2023 | 0600/0700 | ** |  | UK | Trade Balance |

| 12/05/2023 | 0600/0700 | ** |  | UK | Index of Services |

| 12/05/2023 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 12/05/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 12/05/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 12/05/2023 | 0700/0900 | *** |  | ES | HICP (f) |

| 12/05/2023 | 0800/1000 |  | EU | ECB de Guindos Lecture at Academia Europea Leadership | |

| 12/05/2023 | 1115/1215 |  | UK | BOE Pill & Shortall Monetary Policy Report National Agency Briefing | |

| 12/05/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 12/05/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 12/05/2023 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/05/2023 | 1820/1420 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.