-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Dec Flash Services PMI Pickup

- MNI INTERVIEW: Fed Could Cut Rates As Early As March-Hoenig

- MNI INTERVIEW: Fed Could Cut More Than SEP Anticipates-Evans

- MNI FED BRIEF: Williams-Fed Not Thinking About Rate Cuts-CNBC

- MNI FED: Williams Comments Not Far Off What Powell Said On Cuts (But Context Matters)Matters)

- MNI BOC BRIEF: BOC Gov Speech Highlights- Opens Door To Cut Debate

- MNI Industrial Production Growth Disappoints Despite Autos Boost

- MNI Dec Flash PMIs: Services Underpin Slight Pickup In Year-End Activity

US

INTERVIEW (MNI): Fed Could Cut Rates As Early As March-Hoenig

- The Federal Reserve could cut interest rates in the next few months if inflation continues to fall, former Kansas City Fed President Thomas Hoenig told MNI, adding that the central bank’s pivot is premature and risks undermining progress in reducing price pressures.

- “If inflation comes down, March is not out of the realm of possibility at all. If it doesn’t come down further they may postpone it,” Hoenig said in an interview. Chair Powell not only refrained from pushing back against dovish market expectations this week but if anything embraced them, implying that the Fed may not be cautious in the way it reduces borrowing costs despite recent high inflation, he said.

FED INTERVIEW (MNI): Fed Could Cut More Than SEP Anticipates-Evans

The Federal Reserve might need to cut interest rates by more than officials indicated this week in the December SEP because holding steady amid further expected drops in inflation would make policy more restrictive, former Chicago Fed President Charles Evans told MNI.

NEWS

FED BRIEF (MNI): Williams-Fed Not Thinking About Rate Cuts-CNBC

Federal Reserve officials are not actively considering interest rate cuts despite a dovish Fed decision this week that was seen in financial markets as the opening salvo of an eventual easing cycle for monetary policy, New York Fed President John Williams said Friday.

FED (MNI): Williams Comments Not Far Off What Powell Said On Cuts (But Context Matters)

While of course the context (a dovish speaker seemingly marched out to push back against market repricing) is the key here to the hawkish market reaction to NY Fed Pres Williams' comments on CNBC, what he said about the rate cut discussion/non-discussion is actually not too far removed from what Powell said Wednesday.

BOC BRIEF (MNI): BOC Gov Speech Highlights- Opens Door To Cut Debate

Highlights of Bank of Canada Governor Tiff Macklem's speech Friday in Toronto. "We expect growth and jobs to be picking up later next year, and inflation will be getting close to the 2% target. And once Governing Council is assured that we are clearly on a path back to price stability, we will be considering whether and when we can lower our policy interest rate."

US (MNI): Risk Of Government Shutdown In 2024 High, As Congress Winds Down 2023

As Congress wraps up 2023, observers are starting to look more closely as the next looming government funding crisis. The House of Representatives returns to session on January 9. This timeline, if adhered to, provides 10 days to legislate and reconcile the first four FY24 bills before hitting the first shutdown deadline (Agriculture, Energy and Water, MilCon-VA and THUD).

US (MNI): US-Mexico Border Talks To Continue Through Weekend

Senator Kyrsten Sinema (I-AZ) has confirmed to reporters that talks taking place on US-Mexico border policy between Senate negotiators and the White House will resume again this afternoon, following a 90 minutes session attended by Homeland Security Secretary Alejandro Mayorkas this morning.

SECURITY (MNI): Hapag-Lloyd Adds To Shipping Firms Suspending Red Sea Activities:

Wires reporting Germany's Hapag-Lloyd - the world's fifth largest shipping firm - have confirmed that they are suspending their Red Sea operations until at least 18 Dec due to security concerns arising from an uptick in aerial attacks on their ships from Houthi rebels in Yemen.

EU (MNI): EUCO Finishes As Leaders Gear Up For Jan Summit On Ukraine Funding:

The European Council has published its conclusionsfollowing the 14-15 Dec leaders' summit in Brussels. In line with headlines that have emerged over the past 24 hours, the document confirms the approval of the EU starting accession talks with Ukraine and Moldova.

POLAND (MNI): EU Commissioner-'Will Take Time' For Rule Of Law Reforms To Unlock Funds:

Reuters reporting comments from European Commissioner for Justice Didier Reynders stating that the new Polish gov't will need 'some time' to enact the requisite reforms to the country's judiciary that would see currently-frozen EU funding released.

US TSYS Markets Roundup: NY Fed Williams Pushed Back on Rate Hike Projections

- Treasury futures looking mixed after the bell, the short end weaker after NY Fed President Williams pushed back on the markets dovish response to Wednesday's steady FOMC rate announcement.

- NY Fed Williams posited markets may have reacted to Wed's FOMC announcement "more strongly than forecasts show". Williams' comments on CNBC were actually not too far removed from what Powell said Wednesday.

- Futures held mixed levels after S&P Flash PMIs, long end still bid vs. weaker 2s-10s after lower than expected Manufacturing PMI (48.2 vs. 49.5 est, 49.4 prior) while Services and Composites come out stronger than expected: 51.3 vs 50.7 est and 551.0 vs. 50.5 est respectively.

- TYH4 112-15 (-1.5) at the moment, curves flatter (2Y10Y -7.342 at -54.296. Tsy 10Y futures still well within technical levels: resistance at 112-28.5 (1.618 proj of the Oct 19 - Nov 3 - Nov 13 price swing). Initial support well below at 111-09+ (High Dec 7 and a recent breakout level).

- Given the curve flattening, projected rate cuts for early 2024 consolidated vs. Thursday highs: January 2024 cumulative -3bp at 5.302%, March 2024 chance of rate cut -64.9% vs. -81.9% late Thursday w/ cumulative of -19.2bp at 5.14%, May 2024 chances -64.9% after fully pricing in the first full cut yesterday with cumulative -40.7bp at 4.926%, while June'24 slipped to -89% vs. -96.9%, cumulative -62.9bp at 4.703%. Fed terminal at 5.33% in Feb'24.

- Monday Data Calendar: Chicago Fed Goolsbee interview on CNBC at 0830, New York Fed Services Business Activity at 0830, NAHB Housing Market Index at 1000, while the US Tsy will auction $75B 13W, $68B 26W bills at 1130ET.

OVERNIGHT DATA

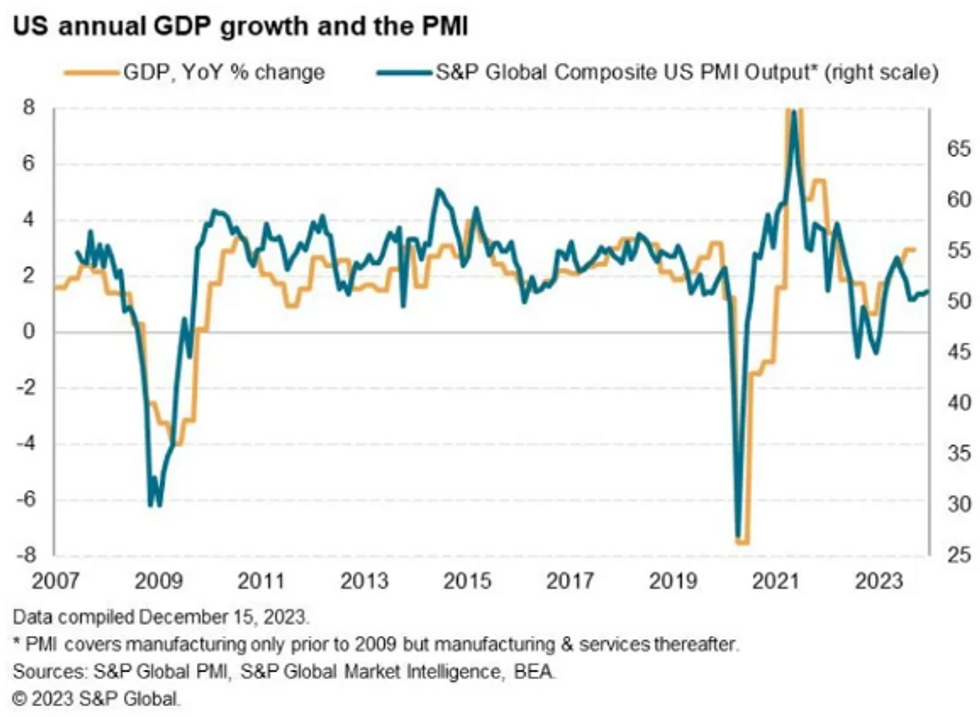

US DATA: US flash PMI readings for December came in mixed, with manufacturing unexpectedly decelerating sharply to 48.2 (vs 49.5 expected, 49.4 prior), but services unexpectedly accelerating to 51.3 (vs 50.7 expected, 50.8 prior).

- Reflecting the split readings, the Composite index rose to a 5-month high 51.0 (50.5 expected, 50.7 prior), as services rose to a 5-month high but manufacturing fell to a 4-month low.

- From the S&P Global report: "The quicker upturn in output was supported by the sharpest increase in new orders since July. Nonetheless, rates of expansion remained historically subdued as firms continued to highlight challenges stimulating demand. Growth was driven by the service sector, as manufacturers registered a further downturn in new orders and a renewed drop in production."

- Indeed, services sectors saw the joint-highest rise in new business in 6 months ("looser financial conditions" were noted as a factor), though manufacturers saw a quicker drop in new orders.

- The release notes input prices rose to a 3-month high, but a softer prices charged reading vs November.

- There was a "renewed upturn in hiring" with a 3-month high in employment, focused on the service sector, with manufacturers shedding jobs for a 3rd straight month.

- Export orders were subdued for both manufacturers and service providers.

- Overall the report suggests "weak GDP growth in the fourth quarter", with the selling prices index remaining "sticky but at a level which is indicative of CPI running only modestly above 2%.

US DATA: Industrial production missed expectations in November, growing by 0.2% M/M (0.3% expected), with a downward revision to October (-0.9% vs -0.6% initially reported) casting it in an even poorer light.

- The November growth figure nonetheless represented a 4-month high.

- November's readings were fully expected to reflect a rebound in auto production due to the return to work by striking autoworkers - this indeed played out with a 7.1% rise in motor vehicles and parts production.

- Manufacturing production grew by 0.3% (0.5% expected, -0.8% prior - a -0.1pp revision) - but ex- motor vehicles/parts, manufacturing shrank by -0.2%.

- Outside of manufacturing, IP was mixed, with Mining output rebounding to +0.3% from -1.1% in October, and Utilities contracting for the 3rd consecutive month, at -0.4%.

- Capacity utilization meanwhile ticked 0.1pp higher to 78.8% (0.3pp below expectations, but October had been revised 0.2pp lower).

- Overall industrial production remains fairly sluggish, down 0.4% Y/Y. IP/manufacturing remains a fairly limited drag on growth, and is not at concerning utilization levels insofar as inflationary pressures are concerned.

- US NY FED EMPIRE STATE MFG INDEX -14.5 DEC

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -8.4 DEC

- US NY FED EMPIRE MFG PRICES PAID INDEX 16.7 DEC

- US NY FED EMPIRE MFG NEW ORDERS -11.3 DEC

- CANADA OCT WHOLESALE SALES +0.8%; EX-AUTOS -0.4%

- CANADA OCT WHOLESALES EX-PETROLEUM/OILSEED/GRAIN -0.5%

- OCT WHOLESALE INVENTORIES +0.3%: STATISTICS CANADA

- CANADIAN HOLDINGS OF FOREIGN SECURITIES -8.2B CAD IN OCT

- FOREIGN HOLDINGS OF CANADA SECURITIES -15.8B CAD IN OCT

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 23.16 points (-0.06%) at 37226.23

- S&P E-Mini Future down 6.5 points (-0.14%) at 4767.5

- Nasdaq up 47.2 points (0.3%) at 14809.73

- US 10-Yr yield is down 1.5 bps at 3.9054%

- US Mar 10-Yr futures are up 0.5/32 at 112-17

- EURUSD down 0.0086 (-0.78%) at 1.0907

- USDJPY up 0.19 (0.13%) at 142.08

- WTI Crude Oil (front-month) down $0.12 (-0.17%) at $71.46

- Gold is down $16.68 (-0.82%) at $2019.78

- European bourses closing levels:

- EuroStoxx 50 up 10.28 points (0.23%) at 4549.44

- FTSE 100 down 72.62 points (-0.95%) at 7576.36

- German DAX down 0.79 points (0%) at 16751.44

- French CAC 40 up 21.06 points (0.28%) at 7596.91

US TREASURY FUTURES CLOSE

- 3M10Y -1.891, -148.576 (L: -150.401 / H: -143.19)

- 2Y10Y -7.854, -54.808 (L: -55.252 / H: -44.778)

- 2Y30Y -9.505, -44.982 (L: -45.364 / H: -31.755)

- 5Y30Y -3.959, 8.981 (L: 8.619 / H: 16.616)

- Current futures levels:

- Mar 2-Yr futures down 4.125/32 at 102-22 (L: 102-20.125 / H: 102-28.25)

- Mar 5-Yr futures down 1.25/32 at 108-13.5 (L: 108-05 / H: 108-20)

- Mar 10-Yr futures up 0.5/32 at 112-17 (L: 112-04 / H: 112-24)

- Mar 30-Yr futures up 21/32 at 124-3 (L: 123-01 / H: 124-09)

- Mar Ultra futures up 32/32 at 133-21 (L: 132-03 / H: 133-25)

US 10Y FUTURE TECHS: (H4) Impulsive Bull Rally

- RES 4: 114-06 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12+ 1.764 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 1: 112-28+ 1.618 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- PRICE: 112-19 @ 11:13 GMT Dec 15

- SUP 1: 111-09+ High Dec 7 and a recent breakout level

- SUP 2: 110-09+ 20-day EMA

- SUP 3: 109-31+ Low Dec 11 and key short-term support

- SUP 4: 109-16 50-day EMA

Treasuries rallied sharply higher this week. Resistance at 111-09+, the Dec 7 high, has been cleared. This confirms a resumption of the uptrend and an extension of the price sequence of higher highs and higher lows. Sights are on 112-28+ next and 113-12+, Fibonacci projection points. On the downside, key short-term support has been defined at 109-31+, the Dec 11 low. First support is at 111-09+, the Dec 7 high.

SOFR FUTURES CLOSE

- Current White pack (Dec 23-Sep 24):

- Dec 23 -0.005 at 94.628

- Mar 24 -0.045 at 94.920

- Jun 24 -0.080 at 95.325

- Sep 24 -0.085 at 95.720

- Red Pack (Dec 24-Sep 25) -0.08 to -0.025

- Green Pack (Dec 25-Sep 26) -0.005 to +0.020

- Blue Pack (Dec 26-Sep 27) +0.030 to +0.045

- Gold Pack (Dec 27-Sep 28) +0.045 to +0.055

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00250 to 5.35575 (-0.00428/wk)

- 3M -0.01375 to 5.36399 (-0.00205/wk)

- 6M -0.07394 to 5.21986 (-0.07225/wk)

- 12M -0.15681 to 4.85795 (-0.16217/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.695T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $627B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $616B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $108B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $267B

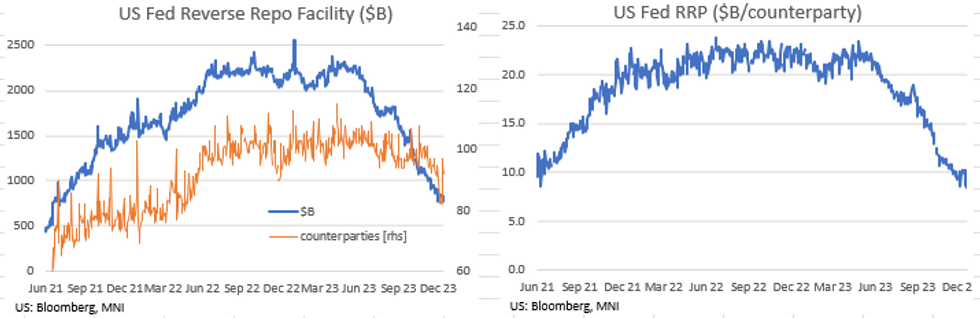

RRP USAGE Tumbles to Lowest Level Since Mid-June 2021

- RRP usage falls to the lowest level since mid-June 2021 this afternoon: $683.254B from -- $769.436B in the prior session and well below $768.543B on December 1.

- The number of counterparties has fallen to 82 from 92 in the prior session.

EGBs-GILTS CASH CLOSE: Weak Eurozone PMIs Provide Boost Into The Weekend

The UK and German curves bull flattened Friday to close out a very strong week for European bonds.

- Unexpectedly weak German and French December flash PMIs saw core/semi-core EGBs soar early in the session. UK Services PMI beat consensus, but the negative impulse on Gilts was fleeting.

- An unexpected pushback against Fed rate cut speculation by New York Fed President Williams saw EGBs and Gilts pull away from the session's best levels in the afternoon in sympathy with Treasuries.

- But the momentum begun by the Fed's dovish communications midweek and the PMIs saw core FI enjoy a strong close, with UK and German yields down roughly the same magnitude on the day.

- The BOE announced in Q1 2024 it would move from APF sales with equal sizes across maturity buckets, to a higher weight on shorter-maturity sales (by way of equal sizes in terms of initial proceeds when the instruments were purchased). Market reaction was limited.

- 10Y Gilts closed their 2nd best week of the year, falling 35.4bp.

- Periphery EGB spreads were mostly wider, with the exception of Greece which had underperformed in previous sessions.

- Next week kicks off with German IFO data and multiple ECB officials appearing, including Schnabel and Lane.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 6.3bps at 2.504%, 5-Yr is down 8bps at 1.999%, 10-Yr is down 10.3bps at 2.016%, and 30-Yr is down 11.2bps at 2.215%.

- UK: The 2-Yr yield is down 7.2bps at 4.29%, 5-Yr is down 8.1bps at 3.736%, 10-Yr is down 10.2bps at 3.687%, and 30-Yr is down 13.4bps at 4.16%.

- Italian BTP spread up 3.4bps at 170.7bps / Greek down 0.8bps at 116bps

FOREX Greenback Recovers As Initial Fed Speak Leans Relatively Hawkish

- On Friday, the dollar index has recovered around 0.6% of its substantial losses this week. The first speaker since the FOMC meeting, Fed’s Williams, stated we aren’t really talking abut rate cuts right now and that it is premature to really be thinking about timing of monetary easing.

- Greenback strength was broad based but has only put a small dent in the larger post-fed adjustment with the DXY sitting well over a percent below pre-FOMC levels. In particular, the Euro has been the main victim on Friday, with some weaker than expected PMIs for France, Germany and the EU all weighing throughout European trade.

- EURUSD is down 0.85% and has spent the late session oscillating around the 1.09 mark. The EURUSD recovery this week is a bullish development and signals the end of the recent corrective pullback between Nov 29 - Dec 8. The continuation higher suggests scope for a test of key short-term resistance at 1.1017, the Nov 29 high and a bull trigger. Moving average studies are in a bull-mode position, highlighting an uptrend. Key support has been defined at 1.0724, the Dec 8 low.

- At the other end of the G10 leaderboard, the Norwegian krone is the best performer with EURNOK down another 1.35%. The surprise rate hike and overall firmer price action for oil continues to support the NOK’s recovery.

- Just German IFO on Monday’s docket before the focus turns to Tuesday’s Bank of Japan meeting and Canadian CPI.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/12/2023 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 18/12/2023 | 1030/1030 |  | UK | BOE's Broadbent speech at London Business School | |

| 18/12/2023 | 1330/1430 |  | EU | ECB Schnabel Lectures On EU Fiscal Policy And Governance | |

| 18/12/2023 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 18/12/2023 | 1500/1600 |  | EU | ECB Lane Chairs Panel on EMU Reforms | |

| 18/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/12/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.