-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Bostic Base Case Still 2 Cuts in '24

- MNI FED: Bostic Sees 2 Fed Cuts In '24, Wants QT Long As Possible

- MNI BIS: Central Banks Should Beware Of Chasing Higher R-Star- BIS

US

FED (MNI): Bostic Sees 2 Fed Cuts In '24, Wants QT Long As Possible: Atlanta Federal Reserve President Raphael Bostic said Monday his base case remains for two rate cuts this year, likely starting in the third quarter, and does not anticipate reductions at back-to-back meetings, adding he would like quantitative tightening to continue at the current pace for as long as possible.

- Bostic said risks to the outlook appear balanced but flagged some concern that the start of rate cuts could unleash a fresh wave of demand and pent-up exuberance.

- "We have some time to make sure that we get to 2%," Bostic told reporters on a conference call. "We are not seeing degradation in the labor market," he said, noting price pressures are still widespread and broader than preferred. "A lot of it will depend on sort of what the response looks like and how things play out," he said about the pace of rate cuts in the second half of the year.

NEWS

BIS (MNI): Central Banks Should Beware Of Chasing Higher R-Star- BIS: Central banks should be cautious about recent evidence that natural interest rates have climbed following the pandemic and instead look to more concrete observed inflation evidence, a Bank for International Settlements paper published Monday says.

US (MNI): House Vote On FY24 Package Expected As Soon As Wednesday: Congressional leaders yesterday unveiled aUSD$435 billion package of Fiscal Year 2024 spending bills: Agriculture, Energy, MilitaryCon-VA, Commerce, Interior, and Transportation. A House vote is expected on Wednesday with the Senate to follow. The package is expected to pass ahead of Friday’s deadline.

US (MNI): SCOTUS Rules That States Cannot Bar Trump For 2024 Ballot: The United States Supreme Court has ruled unanimously that states cannot unilaterally bar former President Donald Trump for the 2024 presidential election ballot, clearing another potential obstacle for Trump re-election bid.

EU (MNI): Croatian Prime Minister Calls For Spring General Election: Wires reporting that Croatian Prime Minister Andrej Plenković has called for general election, "this spring," and confirming that the Sabor - the Croatian Parliament - is to be dissolved, "no later than March 22."

US TSYS Weaker/Narrow Range Ahead Powell Policy Testimony, Employ Data

- Treasury futures holding weaker after the bell, narrow range since midmorning. No obvious headline driver as Treasury futures scaled back a portion of Friday's rally amid cautious trade ahead Fed Chairman Powell's policy testimony to Congress Wed-Thu, Jobs report Friday.

- Atlanta Federal Reserve President Raphael Bostic said his base case remains for two rate cuts this year, likely starting in the third quarter, and does not anticipate reductions at back-to-back meetings, adding he would like quantitative tightening to continue at the current pace for as long as possible.

- No data Monday, ongoing corporate bond issuance (over $21B) generated some pressure via rate-lock hedging.

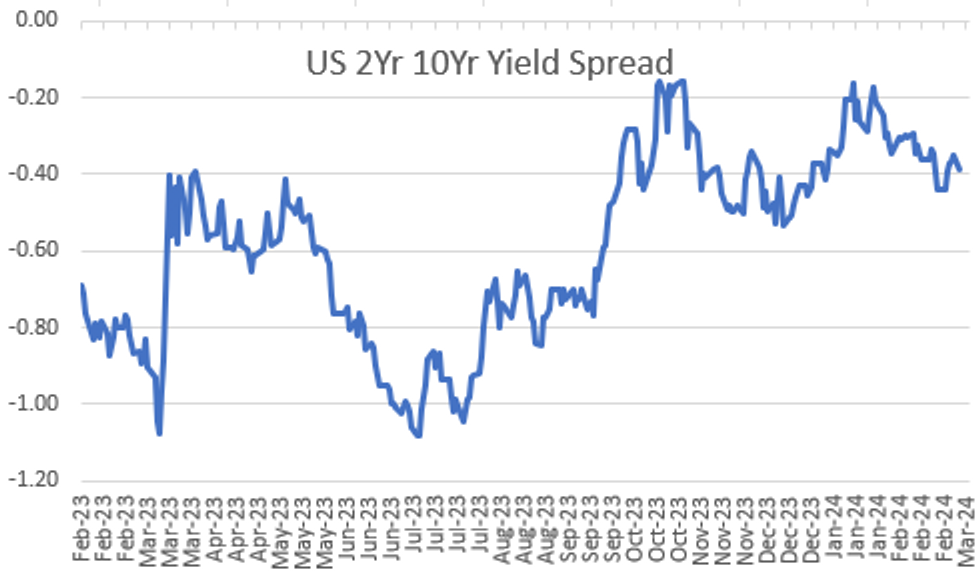

- Tsy Jun'24 10Y futures mark 110-21 low (-12) are currently at 110-24.5 on the screen. 10Y yield 4.2327 high. Curves flatter flatter 2s10s -3.950 at -39.102. Initial technical support at 110-05+/109-25+ (Low Mar 1 / Low Feb 23).

- Look ahead: Tuesday data calendar includes S&P Final PMIs, ISM Services, Factory Orders.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 57.03 points (-0.15%) at 39029.44

- S&P E-Mini Future up 2.75 points (0.05%) at 5148.75

- Nasdaq down 21.5 points (-0.1%) at 16252.55

- US 10-Yr yield is up 3.3 bps at 4.2131%

- US Jun 10-Yr futures are down 8.5/32 at 110-24.5

- EURUSD up 0.0022 (0.2%) at 1.086

- USDJPY up 0.38 (0.25%) at 150.5

- WTI Crude Oil (front-month) down $1.17 (-1.46%) at $78.80

- Gold is up $34.95 (1.68%) at $2117.87

- European bourses closing levels:

- EuroStoxx 50 up 18.06 points (0.37%) at 4912.92

- FTSE 100 down 42.17 points (-0.55%) at 7640.33

- German DAX down 18.9 points (-0.11%) at 17716.17

- French CAC 40 up 22.24 points (0.28%) at 7956.41

US TREASURY FUTURES CLOSE

- 3M10Y +2.885, -117.4 (L: -121.394 / H: -114.918)

- 2Y10Y -3.926, -39.078 (L: -39.286 / H: -34.653)

- 2Y30Y -5.075, -25.356 (L: -25.772 / H: -19.477)

- 5Y30Y -2.537, 14.423 (L: 14.053 / H: 17.793)

- Current futures levels:

- Jun 2-Yr futures down 4.875/32 at 102-14 (L: 102-13.375 / H: 102-18.875)

- Jun 5-Yr futures down 7/32 at 107-4.75 (L: 107-02.75 / H: 107-11.75)

- Jun 10-Yr futures down 8.5/32 at 110-24.5 (L: 110-21 / H: 111-01)

- Jun 30-Yr futures down 12/32 at 119-21 (L: 119-05 / H: 120-00)

- Jun Ultra futures down 15/32 at 128-13 (L: 127-23 / H: 128-27)

US 10Y FUTURE TECHS: (M4) Resistance At The 50-Day EMA Remains Intact

- RES 4: 111-24+ High Feb 13

- RES 3: 111-11+ 38.2% retracement of the Feb 1 - 23 bear leg

- RES 2: 111-06+ 50-day EMA

- RES 1: 111-01/111-02 High Mar 4 / Feb 1

- PRICE: 110-24 @ 11:23 GMT Mar 4

- SUP 1: 110-05+/109-25+ Low Mar 1 / Low Feb 23

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 108-19+ 61.8% of the Oct 19 - Dec 27 bull phase

- SUP 4: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

The trend direction in Treasuries is unchanged and remains down. Last week’s gains are - for now - considered corrective. The 20-day EMA has been breached, however, resistance at the 50-day EMA at 111-06+, remains intact. A clear break of this EMA is required to signal a possible reversal. On the downside, the bear trigger has been defined at 109-25+, the Feb 23 low. A breach would resume the downtrend and open 109-14+, the Nov 28 low.

SOFR FUTURES CLOSE

- Mar 24 -0.018 at 94.688

- Jun 24 -0.055 at 94.905

- Sep 24 -0.075 at 95.205

- Dec 24 -0.085 at 95.520

- Red Pack (Mar 25-Dec 25) -0.085 to -0.06

- Green Pack (Mar 26-Dec 26) -0.045 to -0.03

- Blue Pack (Mar 27-Dec 27) -0.025 to -0.025

- Gold Pack (Mar 28-Dec 28) -0.02 to -0.02

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00136 to 5.32126 (-0.00151 total last wk)

- 3M -0.00736 to 5.32376 (+0.00055 total last wk)

- 6M -0.02184 to 5.24547 (-0.00620 total last wk)

- 12M -0.04115 to 5.01539 (-0.01589 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.783T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $684B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $671B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $84B

- Daily Overnight Bank Funding Rate: 5.31% (-0.01), volume: $270B

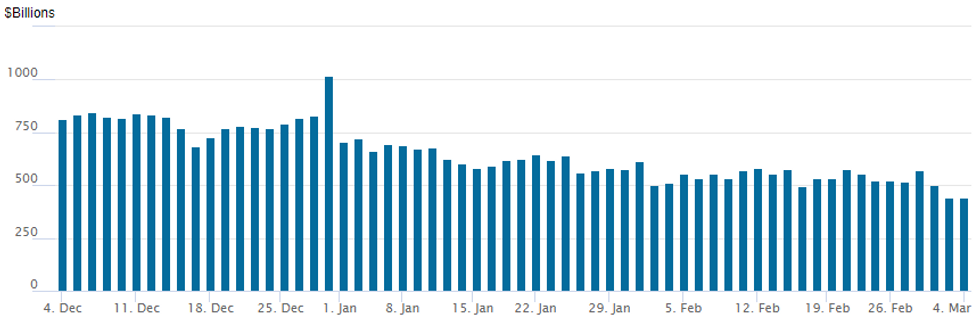

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage falls to new lowest level since May 2021: $439.793B vs. $441.265B Friday. Compares to prior low of $493.065B on February 15 -- was the lowest since early June 2021 .

- Meanwhile, the latest number of counterparties inches back up to 75 from 73 Friday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE $17B Corporate Debt Issuance Kicks Off March

Near $17B corporate debt has issued/will price Monday, but market is still waiting for John Deere and Credit Agricole to launch., EBRD and EIB issuance rolled to Tuesday.- Date $MM Issuer (Priced *, Launch #)

- 3/4 $3.875B #Roche $875B 5Y +58, $750M 7Y +68, $1.25B 10Y +77, $1B 30Y +87

- 3/4 $3B #Keurig $750M 3Y +75, $350M 3Y SOFR+88, $750M 5Y +90, $500M 7Y +100, $650M 10Y +110

- 3/4 $2B #Newmont Corp $1B 2Y +70, $1B 10Y +117

- 3/4 $1.3B #American Tower $650M 5Y +107, $650M 10Y +132

- 3/4 $1.25B #CBA (Commonwealth Bank of Australia) 10Y +162

- 3/4 $1.2B #Entergy Louisiana $500M 10Y +115, $700M 30Y +135

- 3/4 $1B #Chubb 10Y +82

- 3/4 $1B #Dell International 10Y +120

- 3/4 $750M #Element Fleet 3Y +125

- 3/4 $600M #Sixth St Lending Partners 5Y +255

- 3/4 $1B USA Compression Partners 5NC2 7.25%a

- 3/4 $Benchmark John Deere 2Y +37.5, 2Y SOFR+44, 3Y +50, 7Y +70

- 3/4 $Benchmark Credit Agricole 3Y +100a, 3Y SOFR, 10Y +140a

- 3/4 $Benchmark State of Montenegro 7Y investor calls

- 3/4 $Benchmark Al Rajhi Bank 5Y Sukuk investor calls

- Expected to issue Tuesday:

- 3/4 $1B EBRD 10Y SOFR +53a

- 3/5 $Benchmark EIB 3Y SOFR+28a

FOREX Cross/JPY Strengthening Towards Cycle Highs Amid Higher US Yields

- Pressure on US treasury futures has been weighing on the Japanese Yen to start the week, with markets turning their focus to a speech by Fed Chair Powell this week. USDJPY has risen 0.27% as we approach the APAC crossover, crossing back above 150.52, with the year’s highs just 40 pips away at 150.89.

- Moderate outperformance for sterling sees GBPJPY (+0.59%) edging closer to last week’s highs of 191.32, also representing the highest level for the cross since 2015.

- NZDJPY underwent a corrective pullback last week, shedding ~2% off the cycle high of 93.45 and pushing the RSI well back below the overbought technical condition. Nonetheless, the trend condition remains positive, and positioning dynamics point to continued gains in the cross.

- CFTC reports since the turn of the year show continued evidence of the NZD net position improving (coinciding with building expectations that the RBNZ policy cycle may not be at its peak), while the JPY position deteriorates.

- Elsewhere, the Swiss Franc reversed some very moderate strength in the aftermath of above-estimate CPI data. The brief EURCHF dip to 0.9572 proved short-lived, with some single currency strength assisting the reversal back above the 0.96 handle.

- Data overnight includes Tokyo CPI and China’s Caixin Services PMI. Focus then turns to US ISM Services PMI. Later in the week, centra bank decisions from Canada and the ECB are highlights, as well as the US employment report.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/03/2024 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 05/03/2024 | 0030/1130 |  | AU | Balance of Payments: Current Account | |

| 05/03/2024 | 0100/0900 |  | CN | National People's Congress opens | |

| 05/03/2024 | 0745/0845 | * |  | FR | Industrial Production |

| 05/03/2024 | 0900/1000 | *** |  | IT | GDP (f) |

| 05/03/2024 | 1000/1100 | ** |  | EU | PPI |

| 05/03/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/03/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 05/03/2024 | 1500/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/03/2024 | 1500/1000 | ** |  | US | Factory New Orders |

| 05/03/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 05/03/2024 | 1700/1200 |  | US | Fed Governor Michael Barr | |

| 05/03/2024 | 2030/1530 |  | US | Fed Governor Michael Barr |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.