-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI ASIA OPEN: Fed Bostic Still Sees Two 25Bp Cuts in '24

- MNI US Employment Insight, Jan'24: Hawkish But Less So Than First Met The Eye

- MNI FED: Bostic ('24): Fed Can Let Restrictive Policy Continue To Work In "Orderly" Process

- MNI SECURITY: Biden "Working With Israeli Govt" To "Significantly Get Out Of Gaza"

- MNI White House: Funding Agreement "Moves US Closer To Preventing Govt Shutdown"

- NY Fed 1Y and 3Y Inflation Expectations At Lows Since 2020

Tsys Off Midday Highs, 10Y Yield Back Over 4%, Limited React to Bostic

- Still bid, Treasury futures continue to scale off midday highs after the bell (TYH4 +7.5 at 111-30.5, 10Y yield 4.0096%, -.0361). Block sales helped get things rolling, in addition to flurry of late rate lock selling as corporate supply resumes ($15.9B total for Monday).

- No significant reaction to latest Atlanta Fed Bostic comments, says "Fed is in a very strong position right now, can let restrictive policy continue to work to slow inflation", still sees two 25bp rate cuts this year.

- Projected rate cuts for early 2024 have gained slightly: January 2024 cumulative -1.1bp at 5.318%, March 2024 chance of rate cut -62% w/ cumulative of -16.6bp at 5.163%, May 2024 chance of cut 90.9% vs. -86.8% this morning, cumulative -39.4bp at 4.935%. Fed terminal at 5.3275% in Jan'24.

- Current TYH4 at 112-02 (+11), well inside technicals: resistance at 112-19 (High Jan 4) vs. 111-06+ support (Low Jan 05). Curves flatter: 3M10Y -5.565 at -140.036, 2Y10Y -1.167 at -34.875. 10Y yield holding just below 4% at 3.9945% (-.0512).

- Cross asset roundup: crude remains weaker/off lows (WTI -2.81 at 71.00), Gold weaker -18.27 at 2027.18., S&P Eminis near highs +58.0 at 4792.75.

- Market focus remains on CPI/PPI inflation measures this Thursday/Friday respectively.

NEWS

US Employment Insight, Jan'24 (MNI): Hawkish But Less So Than First Met The Eye

We have just published and e-mailed to subscribers the MNI Employment Insight, a review of MNI's analysis for Friday's payrolls report and wider data, plus views from 18 analysts.

FED (MNI): Bostic ('24): Fed Can Let Restrictive Policy Continue To Work In "Orderly" Process

Atlanta Fed’s Bostic (’24 voter), speaking in Atlanta without a livestream or prepared remarks, hasn't had a notably market impact in early Q&A. Recall last month he indicated he sees two cuts this year starting in the second half of the year, which he reiterates today.

SECURITY (MNI): Biden "Working With Israeli Govt" To "Significantly Get Out Of Gaza"

US President Joe Biden, speaking at a political event in South Carolina, has announced in ad hoc remarks that he's, "been quietly working with the Israeli government to get them to reduce and significantly get out of Gaza."

White House (MNI): Funding Agreement "Moves US Closer To Preventing Govt Shutdown"

White House National Security Council Spokesperson John Kirby and Press Secretary Karine Jean-Pierre have briefed reporters en-route to South Carolina where President Biden is scheduled to deliver remarks at a political event.

FRANCE (MNI): Prime Minister Borne Resigns, Will Remain In Place Until Reshuffle

The Elysee has confirmed that French Prime Minister Elisabeth Borne has resigned and will stay on caretaker until a new government is named.

SLOVAKIA (MNI): Former PM Pellegrini To Run For President, Election On 23 March

Former Prime Minister and incumbent Speaker of the National Council Peter Pellegrini will run for the Slovakian presidency as the candidate of the governing coalition.

MIDEAST (MNI): Hezbollah Commander Killed In Airstrike As Tensions Remain Elevated

A number of outlets now reporting that an airstrike in southern Lebanese village of Khirbat Salem has killed senior Hezbollah commander Jawad al-Tawil.

OVERNIGHT DATA

US DATA: 1Y expectations fell to 3.01% in Dec from 3.36% for its lowest since Dec’20. 3Y expectations fell to 2.62% in Dec after three months at 3.0%, poking below the 2.66% in Feb’23 for its lowest since Jun’20.

- The 1Y remains about 40bps above its 2019 average despite falling further on the month, but the 3Y is back in line with its pre-pandemic average.

- 5Y expectations fell 0.2pps to 2.5% for the lowest since March, a series that only started in Jan’22.

- The latest moderation in 3Y and 5Y rates has been at a faster pace than the 5-10Y measure in the U.Mich survey, which has pulled back but only to a still rangebound 2.9%.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 146.61 points (0.39%) at 37612.44

- S&P E-Mini Future up 57 points (1.2%) at 4791.5

- Nasdaq up 292.6 points (2%) at 14816.31

- US 10-Yr yield is down 3.8 bps at 4.0077%

- US Mar 10-Yr futures are up 8.5/32 at 111-31.5

- EURUSD up 0.0007 (0.06%) at 1.095

- USDJPY down 0.4 (-0.28%) at 144.23

- WTI Crude Oil (front-month) down $2.78 (-3.77%) at $71.03

- Gold is down $18.87 (-0.92%) at $2026.56

- European bourses closing levels:

- EuroStoxx 50 up 21.97 points (0.49%) at 4485.48

- FTSE 100 up 4.58 points (0.06%) at 7694.19

- German DAX up 122.26 points (0.74%) at 16716.47

- French CAC 40 up 29.55 points (0.4%) at 7450.24

US TREASURY FUTURES CLOSE

- 3M10Y -3.532, -138.003 (L: -142.011 / H: -132.883)

- 2Y10Y -1.116, -34.824 (L: -35.699 / H: -32.724)

- 2Y30Y -0.101, -18.172 (L: -19.693 / H: -15.495)

- 5Y30Y +1.612, 20.987 (L: 18.201 / H: 22.802)

- Current futures levels:

- Mar 2-Yr futures up 2.375/32 at 102-23.125 (L: 102-18.375 / H: 102-26.625)

- Mar 5-Yr futures up 6.25/32 at 108-5.25 (L: 107-25.75 / H: 108-11.75)

- Mar 10-Yr futures up 8/32 at 111-31 (L: 111-15.5 / H: 112-09)

- Mar 30-Yr futures up 13/32 at 122-14 (L: 121-20 / H: 123-00)

- Mar Ultra futures up 15/32 at 130-1 (L: 128-29 / H: 130-27)

US 10Y FUTURE TECHS: (H4) Corrective Cycle Remains In Play

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-19 High Jan 4

- PRICE: 112-01 @ 1500 ET Jan 08

- SUP 1: 111-06+ Low Jan 05

- SUP 2: 110-25+ 50-day EMA

- SUP 3: 110-16 Low Dec 13

- SUP 4: 109-31+ Low Dec 11 and a key short-term support

Treasuries remain in a short-term corrective cycle. Price is back below the 20-day EMA and the breach of this average last week, does suggest potential for a continuation lower near-term. The next key support to watch is 110-25+, the 50-day EMA. Moving average studies continue to suggest the medium-term trend direction remains up. A recovery would refocus attention on the bull trigger at 113-12, the Dec 27 high.

SOFR FUTURES CLOSE

- Mar 24 -0.010 at 94.920

- Jun 24 +0.005 at 95.345

- Sep 24 +0.015 at 95.740

- Dec 24 +0.025 at 96.090

- Red Pack (Mar 25-Dec 25) +0.025 to +0.030

- Green Pack (Mar 26-Dec 26) +0.015 to +0.025

- Blue Pack (Mar 27-Dec 27) +0.010 to +0.015

- Gold Pack (Mar 28-Dec 28) +0.005 to +0.010

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00153 to 5.33771 (-0.00447 total last wk)

- 3M -0.00352 to 5.32574 (-0.00005 total last wk)

- 6M -0.00857 to 5.18427 (+0.01476 total last wk)

- 12M 10.00669 to 4.84781 (+0.03521 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (-0.01), volume: $1.674T

- Broad General Collateral Rate (BGCR): 5.30% (-0.01), volume: $692B

- Tri-Party General Collateral Rate (TGCR): 5.30% (-0.01), volume: $680B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $84B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $243B

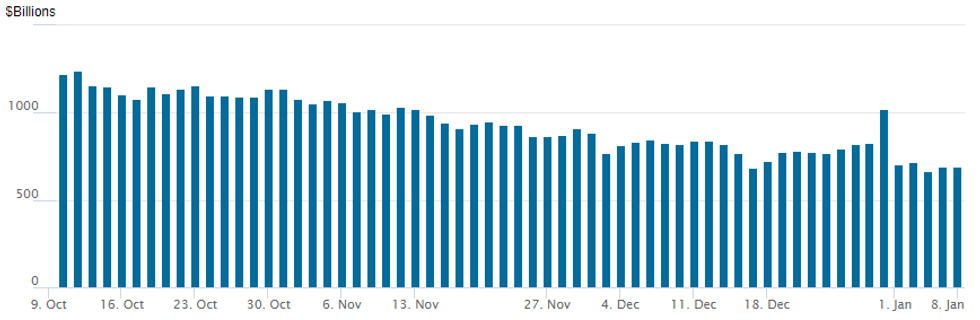

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage recedes to $691.485B vs. $694.478B Friday -- compares to $664.899B on Thursday -- the lowest level since mid-June 2021.

- The number of counterparties falls back to 78, the lowest since April 2022.

PIPELINE: $3.75B Mercedes Benz 5Pt Issuance Launched

- Date $MM Issuer (Priced *, Launch #)

- 1/8 $3.75B #Mercedes Benz 5pt: $700M 2Y +55, $650M 2Y SOFR+67, $800M 3Y +70, $850M 5Y +90, $750M 10Y +100

- 1/8 $2.55B #BPCE $650M 3Y +108, $1B 6NC5 +175, $900M 11NC10 +250

- 1/8 $2B #ANZ Banking Group $1.2B 3Y +63, $800M 3Y SOFR+81

- 1/8 $2B #American Honda $850M 2Y +60, $400M 2Y SOFR+71, $750M 10Y +93

- 1/8 $1.5B *SK Hynix $500M 3Y +145, $1B 5Y +167

- 1/8 $1.4B #Southern California Edison $500M 3Y +75, $900M 10Y +120

- 1/8 $700M #RGA Global Funding 7Y +160

- 1/8 $Benchmark Saudi Arabia 6Y +90, 10Y +110, 30Y +170

- 1/8 $Benchmark Realty Income Group 5Y +95, 10Y +125

- 1/8 $Benchmark National Grid 10Y +142

- 1/8 $Benchmark Principle Life 3Y +90

- Expected Tuesday:

- 1/9 $Benchmark KFW +5Y +45a

EGBs-GILTS CASH CLOSE: Short-End/Belly Retrace Recent Losses

Gilts and Bunds partially recovered Friday's losses in Monday trade, gaining some traction late in the session after a weak start.

- While poor German factory data had little positive impact on core FI, the afternoon rally looked Treasury-led, with 10Y yields pulling back on speculation Fed QT would be tapered soon, and amid a sharp drop in oil prices.

- The short-ends/bellies of the UK and German curves outperformed, following their relative underperformance late last week.

- Periphery spreads tightened modestly as risk assets gained, with SPGBs outperforming. Italy announced a 7/30Y BTP dual-tranche syndication.

- On Tuesday we get German industrial production and Eurozone/Italian labour market data, with supply from the Netherlands, Austria, and the UK, and with Belgium and Italy announcing syndications today.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 2bps at 2.548%, 5-Yr is down 2.7bps at 2.075%, 10-Yr is down 2bps at 2.136%, and 30-Yr is down 1bps at 2.366%.

- UK: The 2-Yr yield is down 2.7bps at 4.215%, 5-Yr is down 2.6bps at 3.73%, 10-Yr is down 1.5bps at 3.772%, and 30-Yr is down 1bps at 4.386%.

- Italian BTP spread down 1.2bps at 168.3bps / Spanish down 1.4bps at 98.1bps

FOREX USD Moderately Softer In Line With Lower US Yields/Bolstered Equity Markets

- US yields extending their post-payrolls reversal lower to start the week, as well as a strong rally for major equity indices have moderately weighed on the USD index, which is seen 0.20% lower as we approach the APAC crossover.

- The softer USD has been most noticeable in a strong turnaround in USDJPY, which after printing as high as 144.92 shortly after the open, briefly traded below Friday’s worst levels to print 143.66. The pair is only down 0.34%, having recovered back above 144.00, however, the trend outlook remains bearish and recent gains appear to be a correction. The move lower from Friday’s high means that resistance around the 50-day EMA - at 145.32 - is intact for now.

- The price action helped prop EURUSD back toward the post-payrolls high on Friday at 1.0998 - which marks the interim resistance in the pair, while markets focus on 1.2770 in GBPUSD. In emerging markets, currencies have been outperforming, aiding MXN, HUF to lead the charge as positioning is eagerly monitored ahead of Thursday's key US CPI print.

- Across G10, intra-day fx adjustments have been contained overall, perhaps with the key data later in the week sapping momentum somewhat. NOK scans as the worst performer, taking its cues from WTI crude futures ( -3.8%) heading for their lowest close since Jan. 2 as demand pessimism sweeps the market.

- Tokyo Core CPI will cross overnight before Australia retail sales for November. Swiss currency reserves will be published in European hours on Tuesday, alongside German industrial production and European unemployment figures. US and Canadian trade balance data is also scheduled.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/01/2024 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/01/2024 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 09/01/2024 | 0030/1130 | ** |  | AU | Retail Trade |

| 09/01/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 09/01/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 09/01/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 09/01/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 09/01/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 09/01/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/01/2024 | 1100/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/01/2024 | 1330/0830 | * |  | CA | Building Permits |

| 09/01/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 09/01/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 09/01/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/01/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/01/2024 | 1700/1200 |  | US | Fed Vice Chair Michael Barr | |

| 09/01/2024 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.